The onset of a second wave of COVID-19 and a fresh round of lockdown announcements are a clarion call for power distribution companies (discoms) to brace for another turbulent year. Discoms’ billing and collection operations could once again be disrupted. In this blog, we discuss how the pandemic has exacerbated their dwindling financial and operational performance in the past year, and examine the steps taken by the central government to address the problem. We also outline a five-pronged strategy that discoms and governments can implement to promote financial sustainability and operational efficiency in the power sector and deal effectively with future challenges.

Glossary

Regulatory assets -Previously incurred expenditures that have been deferred and can be recovered from consumers by regulatory authorities in future through tariff revision.

Carrying costs - Interest cost, allowed by the regulator at a specified rate, on the regulatory assets and deferment of their recovery to subsequent years.

Securitisation - Conversion of assets into marketable instruments such as securities to raise capital from investors.

Cross subsidy - It’s a mechanism where some consumer categories are charged a higher tariff than the cost of supply, in order to compensate for lower tariffs for other sets of consumers.

Amortisation - Paying off the debt through periodic payments.

Discoms in dire straits: a quick look at the numbers

According to estimates, the gross debt of discoms across India will rise from INR 4.78 lakh crore in March 2019 to INR 6 lakh crores in March 2022, primarily due to loans availed under the liquidity infusion scheme announced in May 2020 (more on this later). This is nearly 50 per cent higher than the debt levels at the commencement of Ujwal Discoms Assurance Yojana (UDAY) scheme. Further, the discoms’ projected net losses are estimated to be in the tune of INR 90,000 crore in FY 2021. Their financial distress has reverberated across the value chain and hit generation companies (gencos) particularly hard. As of February 2021, they owed gencos as much as INR 90,000 crore. Figure 1 provides an overview of the 10 states with the highest overdues, with Tamil Nadu, Uttar Pradesh, and Rajasthan topping the charts.

Note: Praapti portal accessed on April 12, 2021

What contributed to the rise in financial stress of discoms?

1. Delays or lack of payment of electricity bills

The non-payment of electricity bills by domestic consumers, an issue partly linked to poor billing practices, has plagued discom finances in many states. During the lockdown, payment rates declined further as a result of suspended physical billing and payment collection, especially in Uttar Pradesh, Maharashtra, and Haryana. When the lockdown ended, and consumers suddenly received high cumulative bill amounts, it deepened their distrust in the billing process, This, combined with income losses, led to a further drop in payment rates.

Pending dues from state-level government departments (INR 41,700 crore) are another sticky issue. With the pandemic proving detrimental to states’ finances, things are likely to stay that way.

2. Loss of revenue from high paying consumers

Lower energy demand from high-paying commercial and industrial (C&I) consumers added to discoms’ revenue losses. It also led to a reduction in cross-subsidy inflow from C&I consumers. States like Gujarat, Odisha, Uttarakhand and Himachal have high C&I shares (ranging from 47% to 63%) and have seen a significant drop in demand between April and June 2020. Cross subsidies from C&I consumers supported discoms to the extent of INR 75,000 crore in FY 2019.

3. Absence of tariff hikes

Inadequate tariff hikes resulted in increased regulatory assets and associated carrying costs (see glossary below). Owing to the political economy constraints, states like Tamil Nadu, Telangana, and West Bengal have not witnessed a tariff hike for at least four years. In FY 2021, too, most electricity regulators refrained from hiking consumer tariffs. In fact, among the 22 states that issued tariff orders in FY 21, only 8 witnessed an upward tariff revision.

4. Delays in subsidy disbursals

States like Andhra Pradesh, Chhattisgarh, Karnataka, Punjab, Rajasthan, and Telangana have consistently defaulted on full subsidy payments. These delays are expected to have persisted in FY 2021 and have likely further stretched the short-term working capital requirement of discoms. The tariff subsidy burden on discoms increased by 140 per cent between 2014-2019 and is estimated to be higher than INR 1.16 trillion1 in FY 2020.

What were the measures taken to support the cash-strapped power sector in the first COVID wave?

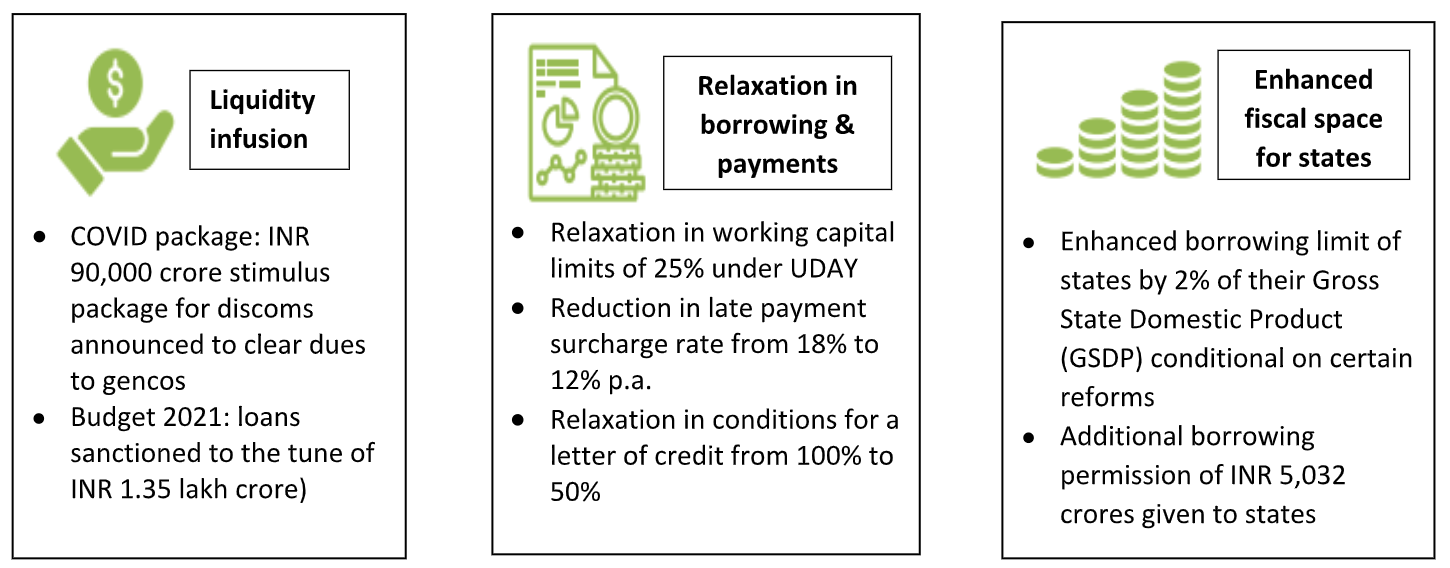

In May 2020, the central government announced the following measures to alleviate the liquidity stress of discoms and state governments.

Source: GoI/MoP response in Rajya Sabha (March 2021); GoI Press Release on Atmanirbhar package for power sector

With the release of INR 46,000 crore as a form of liquidity infusion, gencos’ dues decreased from INR 1,37,000 crore to INR 90,000 crore between December 2020 and February 2021. Further, to enable additional borrowings, seven states have taken steps to reduce revenue gap targets and Aggregate, Technical and Commercial (AT&C) losses; and to initiate pilots on Direct Benefit Transfers (DBT) of electricity subsidies to farmers. However, a grey area in the liquidity infusion scheme is the pass through of interest cost burden. It is unclear whether this will be borne by the discoms or passed on by regulatory authorities to consumers through the annual (or multi-year) tariff exercises.

More recently, the Union Budget for FY 2022 emphasised delicensing the distribution sector and enabling retail competition through private sector participation. As part of its medium-term strategy, the Ministry of Power (MoP) has prepared an INR 3 trillion draft ‘Revamped Reform linked Result-based Distribution Sector Scheme’. While these proposals could be instrumental in transforming the sector in the medium-term, the immediate issues that continue to affect discom finances remain unaddressed, especially the mounting debt situation. Further, after the liquidity infusion made recently by the central government, the discoms’ projected high debt level will be unsustainable and will necessitate another round of debt restructuring - a never ending cycle of entrapment.

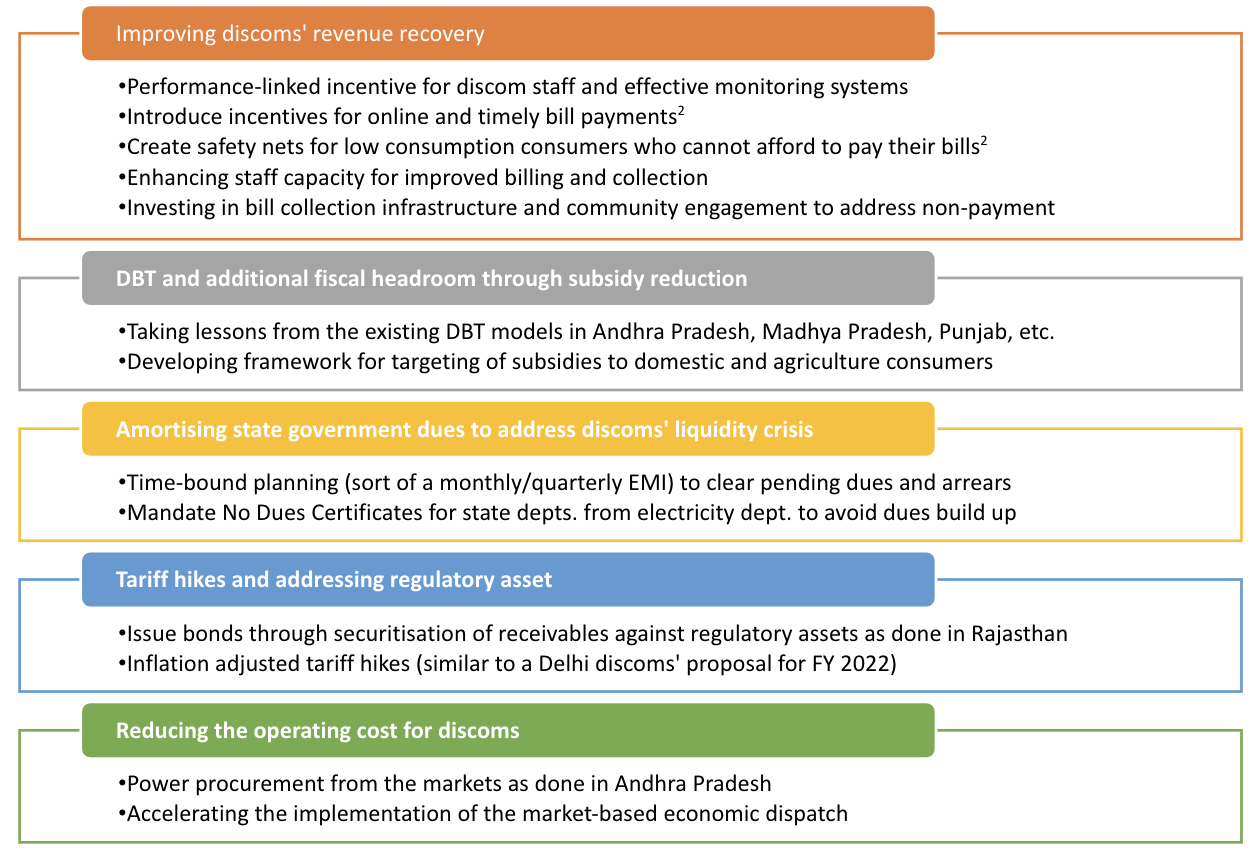

How can we help our discoms recover from the financial strain?

The MoP’s revamped scheme proposes well-intended reforms, and as with all GoI schemes, in good implementation lies the success mantra. A well-designed feedback/learning loop is critical to ensuring that discoms shed their legacy issues and transition smoothly into a new era. We propose five actionable measures that could help the sector address its mammoth debt levels, and become financially sustainable and operationally efficient in the medium term. Implementation will require a collaborative effort by discoms, central and state governments.

Prateek Aggarwal is a Programme Associate, Bharat Sharma is a Research Analyst and Kanika Balani is a Programme Associate at The Council. Send your comments to [email protected].

Read Part 1: Breaking Down India’s Power Demand Recovery after Lockdown: Key Figures and Future Outlook

Read Part 2: How did India’s Renewable Energy Sector Perform During the Year of COVID-19 Lockdown?

Read Part 3: Prioritising Efficiency in India's Wholesale Power Procurement

1Authors’ analysis from State Electricity Regulatory Commission Tariff Orders, PFC reports and State governments budget documents

2We discuss the incentives discoms could provide to consumers, and the support the states could offer as safety nets to low consumption households who cannot afford to pay their bills during the lockdown, in this blog.

Add new comment