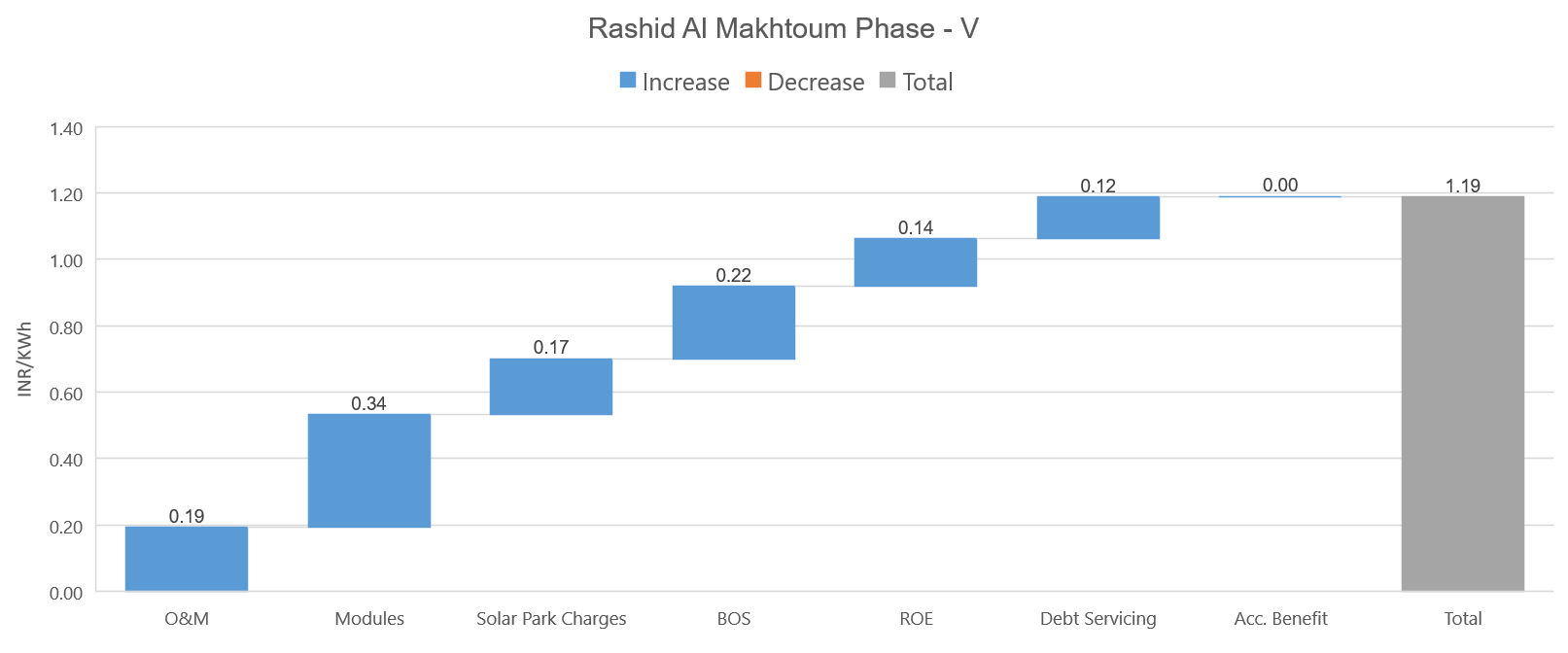

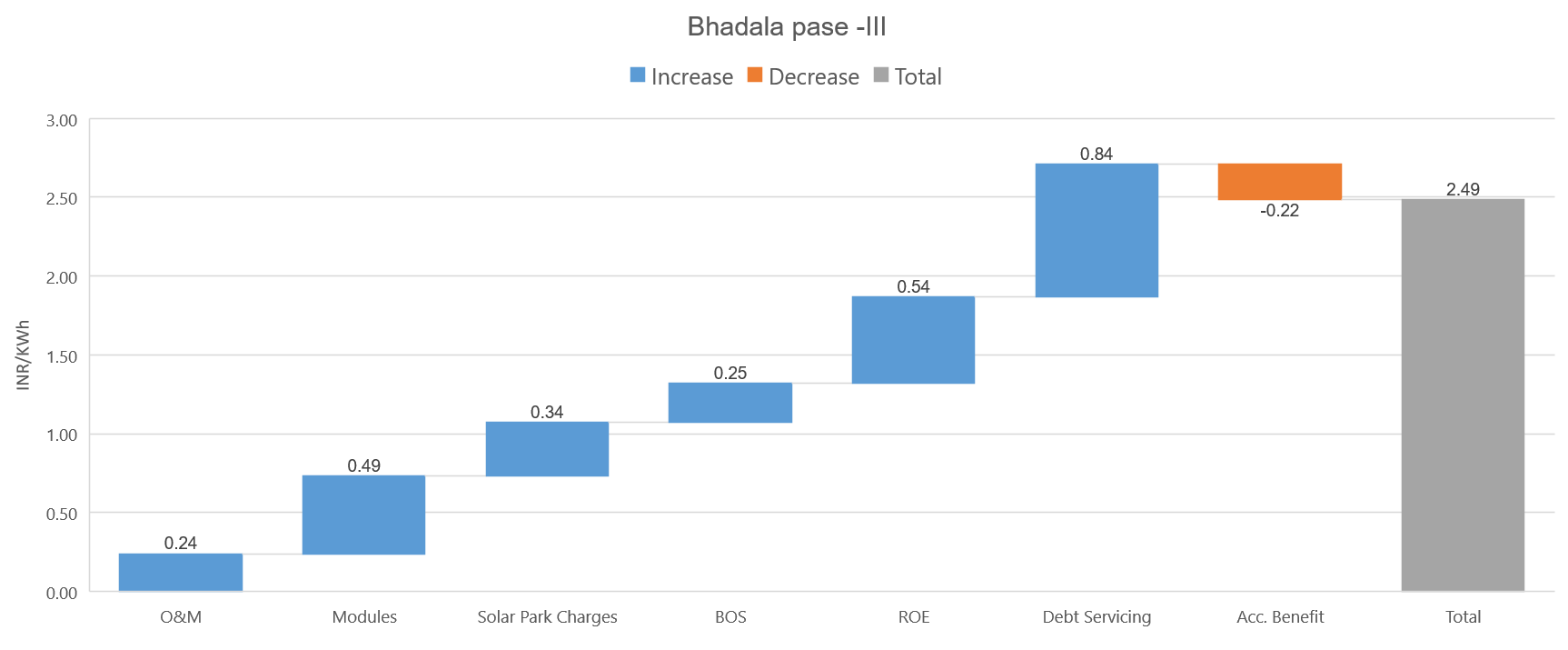

Solar PV tariffs quoted by developers in renewable energy auctions are a composite of a number of underlying determinants. These include the solar resource availability at the project site as well as a number of costs associated with the project. These costs include the cost of solar PV modules, balance of system costs, solar park charges, cost of finance (both debt and equity), and operations and maintenance expenses. A deconstruction of tariffs along these dimensions is useful for identifying the underlying reasons for the magnitude of bids achieved at particular sites. Figure 1 dissects the lowest global solar tariff of USD c 1.7/kWh (INR 1.19/kWh) achieved at the Mohammed bin Rashid al Maktoum solar park Phase V in the UAE in October 2019, and Figure 2 provides a comparison with the lowest tariffs achieved in India (INR 2.44/kWh at Bhadla Solar Park – III in May 2017).

Figure 1: LCOE breakdown for lowest achieved global solar tariff

Figure 2: LCOE breakdown for lowest achieved solar tariff in India

Note: The breakdown of the Bhadla Phase-III Tariff contains a modelling errors of INR 0.05/kWh.

Key findings

- As is evident from the figure above, financing costs are the single biggest differentiator of tariffs achieved in India versus those in the UAE (lowest in the world). Whereas private developers bid for solar projects in India, in the UAE all solar projects are developed by an entity controlled by a sub-sovereign entity (Dubai Electricity & Water Authority) with participation from a private sector investor. As a result, project developers in the UAE have access to low-cost capital, as available to sub-sovereign entities.[1] Table 1 puts this into context:

Table 1: Comparison of financing cost assumptions for solar PV between India and UAE

Cost of long-term debt |

After tax return on equity |

|

Bhadla Phase III (India) |

9% |

14% |

Rashid al Maktoum Phase V (UAE) |

2.5% |

5% |

Sources: Johan Lilliestam and Robert Pitz-Paal, Concentrating solar power for less than USD 0.07 per kWh: finally the breakthrough?, Renewable Energy Focus Journal, September 2018; CEEW-CEF market intelligence

- If one factors in the same financing cost assumptions for Bhadla Phase III as for Rashid al Maktoum Phase V, the tariff declines by 36% to INR 1.60/kWh, illustrating the extent to which financing costs impact the tariff.

- Besides lower financing costs, while Indian solar PV developers have to bear costs for leasing land / solar park charges (in case of development in solar parks), developers in the UAE are provided land at concessional rates, which is an added advantage in facilitating the realisation of lower tariffs.[2]

- The imposition of safeguard duties on solar cell and module imports further adds to capital costs of project developers in India. While not applicable to the Bhadla Phase-III, module costs for projects with commissioning deadlines before July 2020 will be higher by at least 15%, which translates into higher tariffs realised in Indian PV auctions.

Recommendations

In order to achieve lower tariffs in India through lower financing costs, it is essential to de-risk the renewables sector. Based on market interactions, offtaker risk, in the form of payment delays to developers and renegotiation risk, is the most significant risk facing developers. Developers factor in higher equity returns and working capital requirements to counteract these risks, which pushes up tariffs. Credible management of offtaker risk could translate into lower tariffs over time.

Do you think lower financing costs is essential to world record low tariffs? Share your views and comments on the above CEF Analysis at [email protected]

References

- [1] IRENA, Renewable Energy Market Analysis GCC, 2019

- [2] Kanika Chawla and Manu Aggarwal, Anatomy of a Solar Tariff (CEEW,2016)