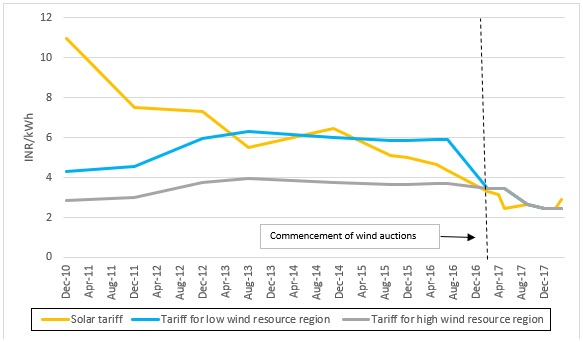

Declining renewable energy (RE) tariffs, driven by favourable policy support and decreasing equipment costs, have facilitated the uptake of renewable power in India, with the lowest realised solar and wind tariffs dipping to around INR 2.44/kWh in 2017 (see Figure 1). However, this downward trend in tariffs has stalled. While the impact of the imposition of safeguard duties on solar module imports in 2018 in driving tariffs up is well understood and easily quantifiable, the prevalence of other equally consequential risks could also be preventing further tariff declines. Delays in payments made by discoms to RE developers, the renegotiation of power purchase agreements (PPAs), and curtailment are three such prominent risks.

Figure 1: Trajectory of RE tariffs in India

Source: CEEW-CEF analysis based on RE auction results, media reports, and CERC tariff orders.

Note: Tariffs for wind before the commencement of competitive auctions were sourced from Central Electricity Regulatory Commission (CERC) orders for RE tariff determination. Tariffs in FY 2012–13 and the first half of calendar year 2014 exclude the impact of accelerated depreciation benefits, as per the prevailing regulation.

The Andhra Pradesh government’s decision to renegotiate RE PPAs drew criticism for the adverse impact it would have on investor sentiment in the sector, including from the central government.[1] Instances such as this have resulted in investors associating higher risk perceptions with the sector. This has in turn led to investors expecting higher returns, and subsequently, factoring in higher tariffs into their bids. On the other hand, extensive payment delays lead to greater working capital requirements and lower returns for equity investors. Similarly, the unexpected curtailment of RE generation adversely impacts project cash flows and equity returns, creating higher working capital requirements. Thus, when investors expect payment delays or curtailment, they factor higher working capital requirements into their tariff bids in order to protect their returns. This subsequently leads to higher tariffs.

Considering the limited data available on the extent of RE curtailment, this note focuses on quantitatively analysing the impact of payment delays, and higher risk perception due to possible renegotiations, on tariffs.

Baseline for risk analysis

To quantify the impact of these factors, the latest solar park bid awarded by Solar Energy Corporation of India (SECI) at the time of writing – INR 2.87/kWh, realised at Dondaicha Solar Park (Maharashtra) in May 2019 – has been chosen as a baseline for establishing returns expectations. The solar park project was chosen for two reasons:

- Data availability – The solar park charges associated with the project are readily available through the relevant request for selection (RfS) document; in contrast, non-solar park projects are characterised by wide variations in land acquisition or leasing costs.

- Suitability for analysis – RE projects with central government entities as offtakers are characterised by minimal payment delays compared to those with state discoms as offtakers. Similarly, investors are likely to have more moderate risk perceptions for projects with central government entities as offtakers, as these entities have better credit profiles and repayment track records than state discoms. Thus, a tariff bid with SECI as the offtaker provides a convenient baseline for analysing the impact of payment delays and higher risk perceptions deriving from the possibility of renegotiation.

It is worthwhile to note that while investors’ risk perceptions vary based on whether the offtaker is a central or state entity, instances such as the Andhra Pradesh renegotiation episode have the potential to adversely impact risk perceptions for all categories of offtakers. This is especially true in the case of foreign investors. Therefore, this note demonstrates the potential adverse impact of heightened risk perceptions in general through an analysis of a PPA tariff with SECI as the offtaker. Further, while the analysis uses solar tariff to quantify the impact of these risks, a similar analysis is also applicable to wind.

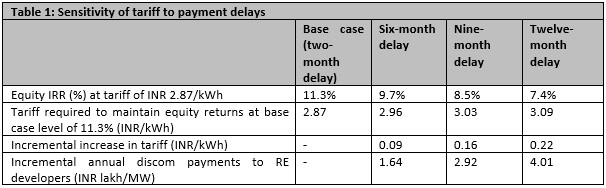

Quantifying the impact of longer payment delay assumptions

Investors will undertake high-risk investments only if they believe that the returns are high enough to compensate for the risks involved. To illustrate how these returns expectations could change, we first established equity investors’ expectations in the base case. The various assumptions pertaining to the analysis are outlined in Table 3. Using a discounted cash flow methodology, we estimated the post-tax equity internal rate of return (IRR) pertaining to the Dondaicha Solar Park tariff to be 11.3 per cent, which is specified in the second column of Table 1.

Payments by discoms to RE developers have sometimes been characterised by long delays. While delays of thirty to sixty days are usually permitted between invoices raised by RE developers and payments by discoms, data reported on the Ministry of Power’s PRAAPTI portal reveals much longer delays in practice. Based on data reported on overdue outstanding amounts to RE developers and billed amount for the past twelve months, an average of around 12 months’ payables remain outstanding to RE developers.[2]

In order to model the impact of payment delays on tariffs, we have factored in working capital requirements equivalent to two months’ electricity sales in the base case, in line with CERC recommendations.[3] If the payment delays extend beyond two months, the higher working capital requirements eat into the returns of equity investors (see Table 2) if the tariff remains unchanged. In order to retain equity returns at the same level as the base case, a considerable increase in tariffs will be required depending on the extent of the payment delay.

Source: CEEW-CEF analysis

If investors factor in the prevailing average payment delays (~12 months) into their solar tariff bids, it would translate into considerably higher payments to RE developers relative to the base case for India’s discoms. Assuming 25 GW of solar projects are contracted annually over the next ten years for India to meet its 2030 solar deployment ambitions, a six-month payment delay could add INR 10,250 crore to the expenditure of India’s debt-laden discoms over the lifetime of each year’s capacity addition.[4] Further, each additional three-month delay could add INR 7,400 crore to this payment burden.

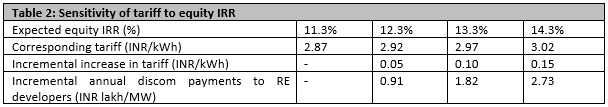

Quantifying the impact of higher risk perception due to renegotiation

If higher risk perceptions due to renegotiation are factored in by equity investors into their tariff bids at RE auctions, they would subsequently expect higher returns. While the cost of debt could also increase with heightened risk perception, we have assumed it to remain constant throughout the analysis in order to focus on the impact of changes in equity investors’ returns expectations.

Source: CEEW-CEF analysis

Table 2 depicts the extent of the increment in tariffs for a range of return expectations. Specifically, every 100-basis point increment in expected equity IRR could add INR 0.05/kWh to the tariff. This translates into higher annual discom payments to the tune of INR 91,000 per MW of contracted solar PV capacity. India is targeting 25 GW of solar projects to be contracted annually over the next ten years as it races to meet its 2030 solar deployment ambitions.[5] Each 100-basis point increment in the expected equity IRR resulting from an enhanced risk perception due to PPA renegotiation could add INR 5,700 crore to the expenditure of India’s debt-laden discoms over the lifetime of each year’s capacity addition.[6]

While the analysis presented above indicates the extent to which enhanced risk perceptions due to renegotiation could impact tariffs under various scenarios, CEEW Centre for Energy Finance is working on a more rigorous quantification of the risks impacting RE investments.

Lower uncertainty to achieve lower tariffs

It is apparent from the foregoing analysis that uncertainty for investors – be it longer payment delays or a higher risk perception due to possible renegotiations and market uncertainty – could be playing a significant role in propping up RE tariffs. While payment delays and PPA renegotiation are tactics that some discoms resort to for easing the immediate financial burden of payments to RE developers, this approach focusses on short-term financial benefits at the cost of ignoring their long-term financial impact. Strict contract enforcement and timely payments could translate into RE developers lowering their return expectations and working capital assumptions while making tariff bids. Over time, this could facilitate further declines in tariffs. Given that the targeted RE capacity increases dwarf the existing generating capacity, it would be in the discoms’ best interest to weigh out the future implications of their actions.

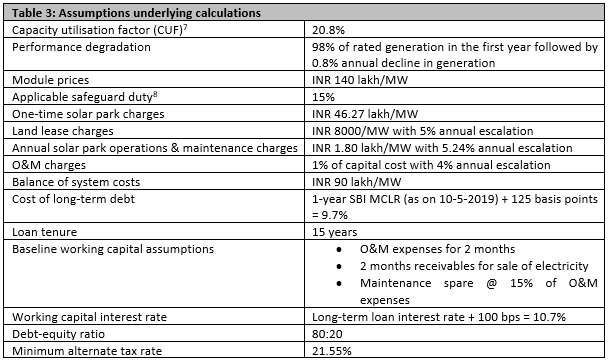

Sources:

Solar Park related charges: RfS document for May 2019 Dondaicha Solar Park auction.

Balance of system costs: CEEW-CEF market intelligence

Baseline working capital assumptions: CERC

Note: Cost of debt and tax rates have been taken as the rates prevailing at the time of the Dondaicha Solar Park bid.

References

- [1] Venkatesh Ganesh, “Centre cautions Andhra Pradesh against revising PPAs”, The Hindu BusinessLine, Sept 21, 2019. https://www.thehindubusinessline.com/economy/centre-cautions-andhra-pradesh-against-revising-ppas/article29475228.ece

- [2] The calculation is based on submissions to the PRAAPTI portal made by participating discoms and may not represent the average delay for the sector as a whole. The calculation assumes a normal payment cycle of one month for invoices raised by RE developers.

- [3] Central Electricity Regulatory Commission (CERC), “Order In the Matter Of Determination of Levelised Generic Tariff for FY 2016–17 under Regulation 8 of the Central Electricity Regulatory Commission”, petition, New Delhi, 2012, 1–244. http://cercind.gov.in/2016/orders/sm_3.pdf.

- [4] Assuming 25-year project lives and the same CUF as used in the analysis.

- [5] Uma Gupta, “India will tender 500 GW renewable capacity by 2028”, PV Magazine, January 8, 2019. https://www.pv-magazine.com/2019/01/08/india-will-tender-500-gw-renewable-capacity-by-2028/

- [6] Assuming 25-year project lives and the same CUF as used in the analysis.

- [7] Assuming 30 per cent overloading on the DC side, based on CEEW-CEF market intelligence.

- [8] The project, awarded in May 2019, has a commissioning timeline of 12 months from the signing of the PPA. Module procurement is expected to occur during the period of 15 per cent safeguard duty (February–July 2020).