Context

A power purchase agreement (PPA) is a contract where a power generation company (genco) agrees to sell electricity to a distribution company (discom). This buy–sell relationship is governed by key contractual conditions around tenure, tariff, dispatch, billing, and payment.

An important contractual condition is levying of a late payment surcharge (LPS) on the discom for each month it delays payments to the genco beyond the due date. The LPS is typically charged at 1.5 per cent per month1. Levying an LPS has two broad objectives: (a) penalising discoms for the delay in payments, and (b) compensating the genco for its lost time value due to delayed revenue realisation.

In February 2021, the Ministry of Power (MoP) notified the Electricity (Late Payment Surcharge) Rules, 20212. The notification revised the LPS calculation mechanism and introduced a clause to debar the discoms that have defaulted on payments from accessing power exchanges (PX) or grant of short-term open access (STOA). These rules were notified primarily because, despite the mandatory LPS clause and a multi-level payment security mechanism in PPAs, many discoms continue to delay payments to gencos, often for several months.

As of April 2021, discoms’ overdue payments amounted to INR 92,700 crore, including INR 11,296 crore outstanding payments to renewable energy (RE) developers. The states with the highest overdue payments as of April 2021 were Tamil Nadu (INR 13,718 crore), Rajasthan (INR 10,290 crore), Telangana (INR 4,374 crore), and Andhra Pradesh (INR 3,712 crore), which are coincidentally also the most RE-rich states in India3. The delays average about 2–6 months4.

The new rule: a new stick to wield over discoms

In the February 2021 notification, the MoP revised the LPS rate from flat 1.5 per cent (per month) and linked it to the State Bank of India (SBI) marginal cost of funds-based lending rate (MCLR). Now, LPS will be applicable on the overdue payment at the base rate in the first month of default5. However, in successive months (till seven months), the applicable LPS rate will increase by 0.5 per cent for every month of delay with a cap of 3 per cent over the base rate at any time. Based on FY 2021-22 figures, the applicable base rate would be one per cent6 per month with an escalation of 0.5 per cent every month. Additionally, and more importantly, the rule states that if a discom fails to pay the overdue amount after seven months from the due date of an energy bill, it shall be debarred from PXs or grants of short-term open access (STOA) till the dues are paid. The rule further laid down payment adjustment conditions. Payments by discoms will be first adjusted against the applied LPS and thereafter against the monthly charges, starting with the longest overdue bill.

Financial impact of the new rule on discoms

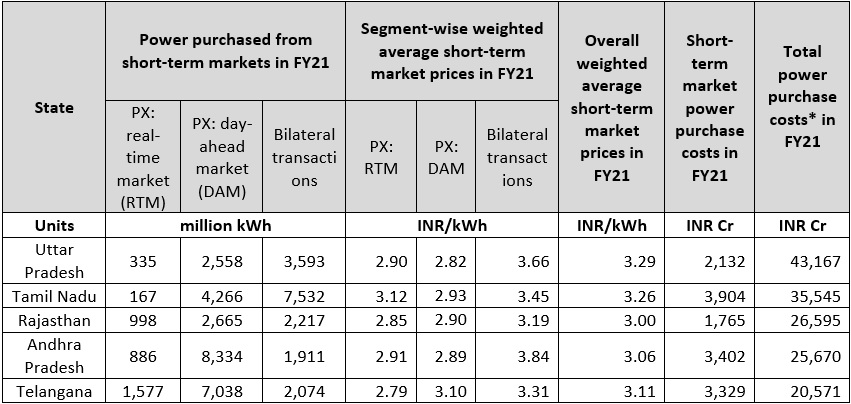

Debarment from PX or STOA is expected to increase the power purchase cost of discoms by prohibiting access to short-term markets. We selected five states with the highest discom overdue payments and calculated the quantum of electricity procured from the short-term market7 (bilateral transactions through traders and PXs, the PX day-ahead market, and the PX real-time market) and average prices for each month in 2020–218,9,10 This helped us estimate the amount each of these states spent to procure power from short-term markets. If debarred, this power would have to be met through long-term purchases (through PPAs either from existing contracted but idle gencos or other non-RE gencos).11

Table 1: State-wise short-term market purchases and prices

Note: Area prices for bilateral transactions and PX day-ahead and real-time markets were the same for the states for every month during FY21. *Projected (not actual) as per discom retail tariff orders for 2020–21.

Source: CEEW-CEF compilation from Central Electricity Regulatory Commission (CERC) monthly market monitoring reports, and calculation of Average Power Purchase Cost (APPC) rate at the national level, CERC (2020–21).

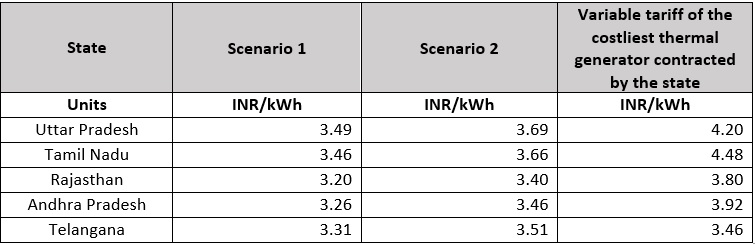

Since a discom is liable to pay fixed charges to a genco (even if it does not procure power from the genco), we constructed two pricing scenarios around variable charges to determine the financial impact in the form of additional power purchase costs. These charges depend directly on the amount of energy dispatched.

Scenario 1: Purchase of power at a variable tariff that is 20 paise higher than the average short-term market price for FY 2020–21

Scenario 2: Purchase of power at a variable tariff that is 40 paise higher than the average short-term market price for FY 2020–21

Table 2: Average power purchase prices under different scenarios

Source: CEEW-CEF analysis and MERIT India. *In the case of Telangana, Scenario 2 assumes power purchase at a variable tariff slightly higher than the variable tariff of the costliest generator.

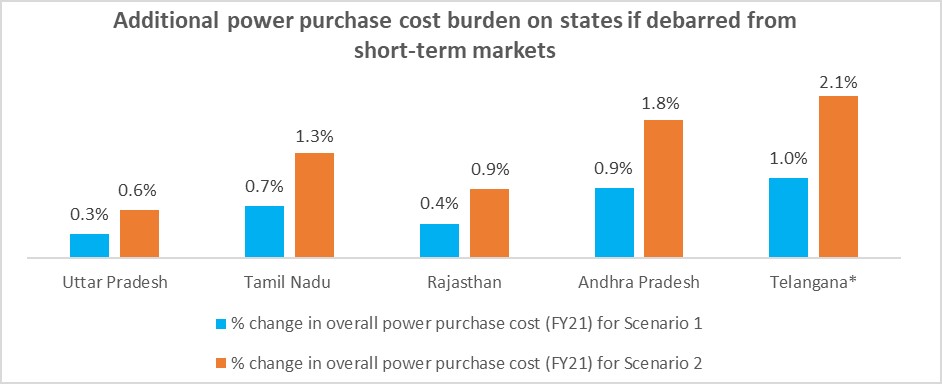

We estimated the financial impact on the overall power purchase cost based on FY21 procurement volumes (Figure 1). Among the selected states, Andhra Pradesh, Tamil Nadu, and Telangana would be the most affected in absolute and percentage change terms in both scenarios. This is primarily because these states rely heavily on PXs12 (particularly, day-ahead market) to avoid paying for costlier power contracted by them. On the other hand, a state like Uttar Pradesh would be moderately affected owing to its lesser dependence on short-term markets.

Figure 1: Additional power purchase cost burden on states under different scenarios

Source: CEEW-CEF analysis. *In the case of Telangana, Scenario 2 assumes power purchase at a variable tariff slightly higher than the variable tariff of the costliest generator.

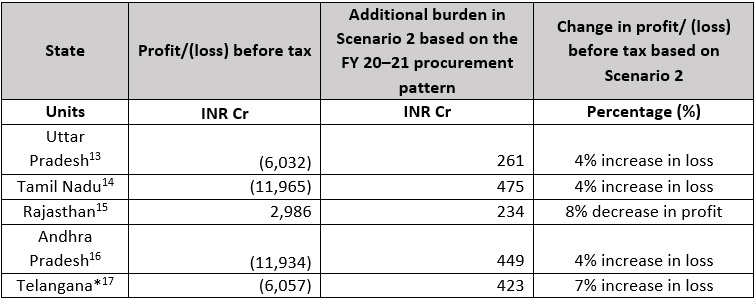

Further, we evaluated the change in profit/loss before tax for state discoms by applying Scenario 2. In the absence of FY21 data, we have used the latest state-wise financial performance data for state discoms. Our analysis showed that the loss-making discoms in Telangana and profit-making ones in Rajasthan will experience the most substantial increasein losses and decrease in profits, respectively.

Table 3: Impact on discoms’ (state-wise) for Scenario 2

Source: CEEW-CEF analysis. *In the case of Telangana, Scenario 2 assumes power purchase at a variable tariff slightly higher than the variable tariff of the costliest generator.

In short, debarment from short-term markets is expected to cause a notable financial burden (over and above the overdue amount) on discoms that are heavily dependent on bilateral transactions and PXs for fulfilling the power demand, especially since PX prices are highly cost-competitive. In recent years, discoms have shifted towards trading on PXs to reduce their overall costs.18 Hence, discoms must evaluate the financial burden of debarment and clear the pending energy bill amount within the stipulated time limit.

In conclusion: will it work?

To reduce payment delays by discoms, the MoP issued an order in June 2019 mandating that they maintain a letter of credit (LC) as part of the payment security mechanism of the PPA.19 However, the Hon Andhra Pradesh High Court20 questioned the authority of the MoP and Ministry of New and Renewable Energy (MNRE) to affect the bilateral relationship between a discom and a genco by enforcing PPA terms and suspended the order.

With the Electricity (Late Payment Surcharge) Rules, 2021, the MoP has tried a different approach by notifying rules that may supersede the payment terms of a typical PPA. The clause debarring defaulting discoms from the PXs or STOA after a seven-month payment delay can potentially mitigate delay in payments considerably. If successfully implemented, the defaulting discoms might not be allowed access to PXs or STOA starting September 2021.

However, the following questions need to be addressed for the successful implementation of the rule:

- The rules conflict with the CERC Tariff Regulations 2021 (amended in February 2021). They mandate adjusting the discom’s payment first against the LPS and then against the principal amount of an energy bill, while the CERC regulations allow otherwise.21 Will these regulations need to be amended to enforce the new rules?

- The institutional framework to support the rules needs to be outlined. Currently, there is no clarity on the role of various institutions in implementing the rules. The roles of the national and regional despatch centres, PXs, CERC, gencos, and discoms in operationalising the rules need to be outlined clearly so that the regulation can be effectively implemented.

- An implementation agency that debars a discom’s access to PXs or grant of STOA would require written acknowledgement from both the discom and the genco regarding the delay in payments. Experience has shown that gencos typically shy away from the same to avoid the risk of affecting their relationship with discoms. A mechanism to ensure continual information flow on payments needs to be operationalised to circumvent this challenge.

- A genco-discom relationship has an imbalance in bargaining power, most of which lies with the discom. Since, unlike other contracts, a genco cannot easily terminate its PPA, it keeps tolerating unfair delays in payment. Will Ministry of Power’s recent proposal to allow a genco to sell power over PXs or to other discoms/consumers in case of a seven-month delay equalise the bargaining power and make the discoms pay in time?22

References

- [1]CERC, “Statement of Objects & Reasons,” March 2019, https://cercind.gov.in/2019/regulation/SOR145.pdf.

- [2]Ministry of Power, “Electricity (Late Payment Surcharge) Rules, 2021”, February 2021, https://powermin.gov.in/sites/default/files/webform/notices/LPS_rules_Notification_dated_22_2_2021.pdf.

- [3]PRAAPTI, “Status of Overdues to Gencos by Discoms for March 2021,” https://praapti.in/.

- [4]“CEEW-CEF Market Handbook,” May 2021, https://cef.ceew.in/solutions-factory/market-handbook/2020-21-annual-issue.

- [5]Base rate as defined in the notification: “Base rate of Late Payment Surcharge means the marginal cost of funds-based lending rate for one year of the State Bank of India, as applicable on the 1st April of the financial year in which the period lies, plus, five percent and in the absence of marginal cost of funds-based lending rate, any other arrangement that substitutes it, which the Central Government may, by notification, in the Official Gazette, specify. Provided that if the period of default lies in two or more financial years, the base rate of Late Payment Surcharge shall be calculated separately for the periods falling in different year.”

- [6]The base rate for the first month is 7 per cent (one-year SBI marginal cost-of-fund-based lending rate [SBI MCLR] in 2021) + 5 per cent = 12 per cent per annum or 1 per cent per month; any change in the SBI MCLR will change the base rate.

- [7]Power procurement from short-term market varies daily/monthly/yearly; study period is restricted to FY21.

- [8]CERC, “Monthly Report on Short-term Transactions of Electricity in India,” 2020–21, http://cercind.gov.in/report_MM-2020.html.

- [9]IEX, “Prices” at IEX, 2020–21, https://www.iexindia.com/marketdata/rtm_areaprice.aspx.

- [10]Excluding the deviation settlement mechanism (DSM) market.

- [11]For the analysis, we have assumed that bilateral transactions will not be impacted by the notification.

- [12]Nikhil Sharma, Dhruvak Aggarwal, Prateek Aggarwal, and Karthik Ganesan, “Prioritising Efficiency in India's Wholesale Power Procurement,” CEEW, April 2021, https://www.ceew.in/blogs/prioritising-efficiency-indias-wholesale-power-procurement.

- [13]Uttar Pradesh discoms - PsVVNL, PuVVNL, KESCO, DVVNL, MVVNL, “Annual Report 2018-19”.

- [14]Tamil Nadu discoms - TANGEDCO, “Profit and loss statement as at 31st March 2020,” https://www.tangedco.gov.in/linkpdf/profitandloss2020.pdf.

- [15]Rajasthan discoms - JVVNL, JdVVNL, AVVNL, “Annual Report 2019-20”.

- [16]Andhra Pradesh discoms - APSPDCL, APEPDCL, “Annual Report 2018-19”.

- [17]Telangana discoms - TSNPDCL, TSSPDCL, “Annual Report 2019-20”.

- [18]Nikhil Sharma, Dhruvak Aggarwal, Prateek Aggarwal, and Karthik Ganesan, “Prioritising Efficiency in India's Wholesale Power Procurement,” CEEW, April 2021, https://www.ceew.in/blogs/prioritising-efficiency-indias-wholesale-power-procurement.

- [19]Ministry of Power, “Opening and Maintaining of Adequate Letter of Credit (LC) as Payment Security Mechanism under Power Purchase Agreements by Distribution Licensees -Reg,” June 2019, https://powermin.gov.in/sites/default/files/webform/notices/Opening_and_maintanig_of%20adequate_Letter_of_Credit_as_Payment_Security_Mechanism_under_Power_Purchase_Agreements.pdf

- [20]“Andhra Pradesh High Court Order,” EQmagpro, accessed June 2021, https://www.eqmagpro.com/wp-content/uploads/2021/03/Andhra-Pradesh-High-Court-order-dated-15.03.2021_compressed.pdf.

- [21]CERC, Terms and Conditions of Tariff (Second Amendment) Regulations, February 2021, https://cercind.gov.in/2021/regulation/164-reg.pdf.

- [22]Ministry of Power, “Draft Electricity (Late Payment Surcharge) Amendment Rules, 2021”, August 2021, https://powermin.gov.in/sites/default/files/webform/notices/Seeking_comments_on_Draft_Electricity_Late_Payment_Surcharge_Amendment_Rules_2021.pdf