India’s solar sector is highly import-dependent. However, to reduce the sector’s reliance on imports, the Indian government has introduced various mechanisms to support the growth of domestic manufacturing. Customs duties in various forms have been levied on the import of solar photovoltaic (PV) project components based on recent import trends. The following sections provide the details on the key customs duties that have been implemented in the solar sector.

Tariffs applicable to various solar components

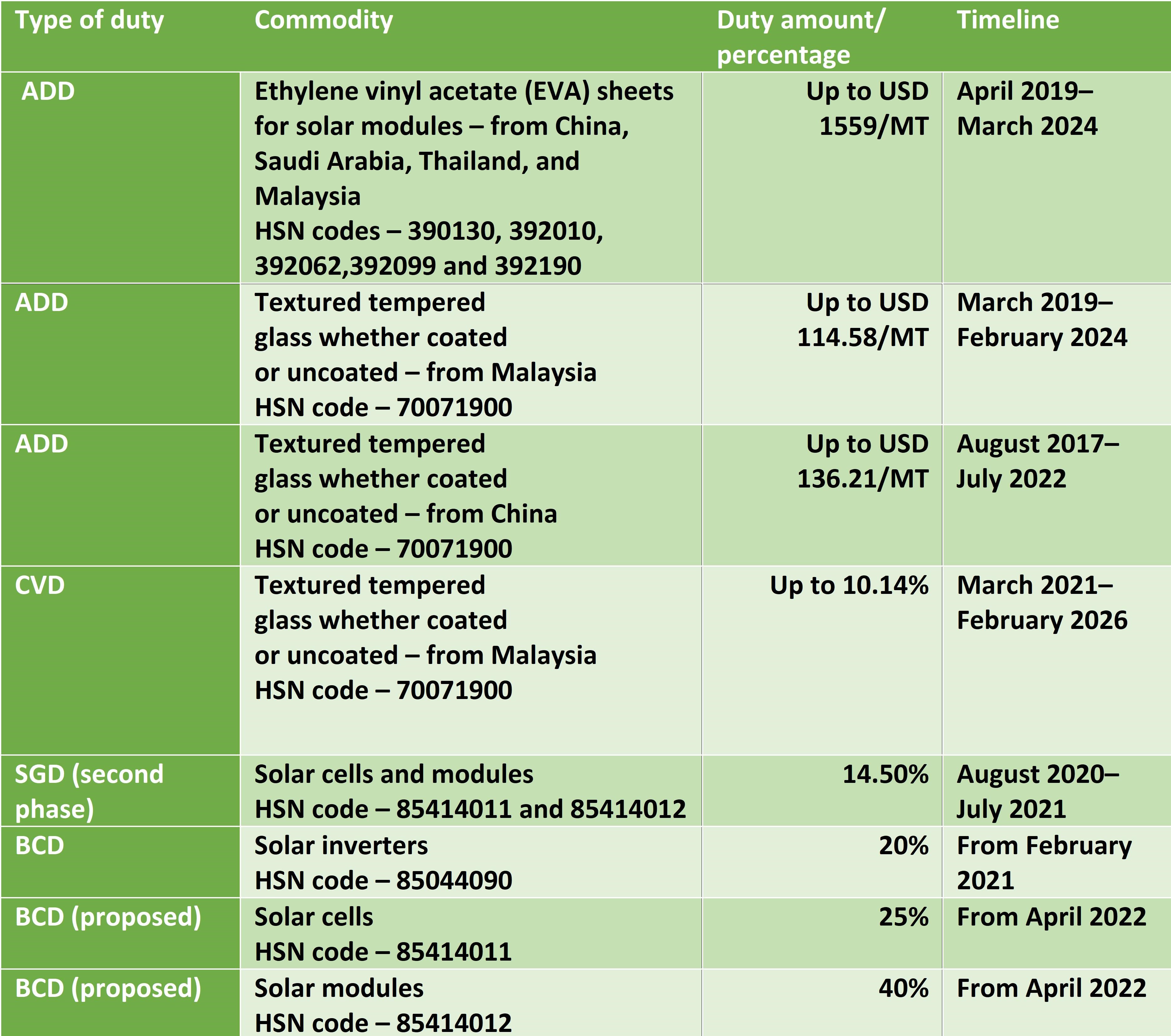

Directorate General of Trade Remedies (DGTR), under the Ministry of Commerce and Industry, is an integrated single-window agency that provides comprehensive and swift trade defence mechanisms in India.1 It conducts anti-dumping, anti-subsidy, and safeguard investigations and provides recommendations to the Ministry of Finance, Government of India (GoI). Table 1 encloses different duty types currently applicable to the solar sector in India.

Anti-dumping duty (ADD)

The ADD, under Sections 9A and 9B of the Indian Customs Tariff Act, 1975 is levied on goods imported at dumped2 prices. ADD restricts biased trading practices and creates an equal-opportunity market for domestic manufacturers. Additionally, it aims to avoid flooding of low-quality equipment and components in the domestic market. The DGTR3 investigates and recommends the imposition of ADD in consonance with the World Trading Organization (WTO) Anti-Dumping Agreement.4 Typically, ADD is country- and company-specific and is applied for a specific period.5

Countervailing duty (CVD)

The CVD, under Section 9 of the Indian Customs Tariff Act, 1975 is levied on goods that receive a subsidy on manufacturing in the production country (exporting country). CVD protects domestic manufacturers by mitigating demand for cheaper imported products with subsidised production. DGTR conducts investigations and recommends the imposition of CVD based on the WTO Agreement on Subsidies and Countervailing Measures6 (SCM Agreement). Typically, CVD is country- and company-specific and is applied for a specific period.7

Safeguard duty (SGD)

The SGD, under Section 8B of the Indian Customs Tariff Act, 1975 is levied on goods that witness a sudden surge in imports that impact domestic manufacturers. Once applicable, SGD will be levied on all imports. However, it does not apply to developing countries that have an import share of less than 3 per cent (collectively, all such developing countries account for less than 9 per cent). The DGTR initiates safeguarding investigations and recommends SGD imposition in line with the WTO Agreement on Safeguards (SG Agreement).8 It is a temporary relief measure that provides domestic manufacturers a grace period to become more competitive vis-a-vis imports.

Basic customs duty (BCD)

The BCD is imposed on imported/exported goods as per the Section 12 of the Customs Act, 1962

at the rates given in First Schedule to Customs Tariff Act, 1975. It raises the government’s revenues, safeguards domestic industries, and regulates the movement of goods. Once notified, BCD is a permanent duty and is applicable on all imports.

Table 1: Various duties applicable to solar components in India

Source: CEEW-CEF analysis from data gathered from the Central Board of Indirect Taxes and Customs (CBIC)

Relevance

The Indian solar PV sector grew tremendously after the launch of the Jawaharlal Nehru National Solar Mission (JNNSM), 2010. As of March 202110, India has a solar installed capacity of 40 GW and aims to install 450 GW by 2030. While the installed solar capacity has grown exponentially, India continues to import critical components of solar PV projects such as solar cells and modules, solar-grade glass, and EVA sheets, particularly from China, Malaysia, Thailand, and Vietnam. Understanding duties can help various stakeholders make informed decisions on their investments.

Who should care?

- Solar developers

- Domestic solar manufacturers

- Investors

- Solar component importers and exporters

References

- [1]Directorate General of Trade Remedies, “About the Department”, https://www.dgtr.gov.in/about-us/about-department.

- [2]Dumped price is defined export of goods by a country to another country at a price lower than its normal value

- [3]DGTR, “Anti-Dumping Procedure – FAQs”, https://www.dgtr.gov.in/faq.

- [4]WTO, “Anti-dumping Agreement”, https://www.wto.org/english/thewto_e/whatis_e/tif_e/agrm8_e.htm.

- [5] A blanket duty may be applied to other companies with imports from same country.

- [6]WTO,” SCM Agreement”, https://www.wto.org/english/tratop_e/scm_e/subs_e.htm.

- [7]A blanket duty may be applied to other companies with imports from same country.

- [8]WTO, “SG Agreement”, https://www.wto.org/english/tratop_e/safeg_e/safeint.htm.

- [10]MNRE, “Physical Progress”, https://mnre.gov.in/the-ministry/physical-progress.