Suggested Citation: Kuldeep, Neeraj, Selna Saji, and Kanika Chawla. 2018. Scaling Rooftop Solar: Powering India’s Renewable Energy Transition with Households and DISCOMs. New Delhi: Council on Energy, Environment and Water.

The research, in collaboration with the Delhi electricity distribution company (DISCOM), BSES Yamuna (BYPL) proposes three innovative utility-led business models to overcome prevailing market challenges, accelerate deployment of rooftop solar systems in the residential sector and create a conducive environment for households, DISCOMs, and developers. With the trend of decreasing prices of solar systems, and the possible cost reduction with DISCOM involvement in aggregation and facilitation, these three business models can address market challenges and understand the domestic consumer segments.

Households owning rooftop solar systems could save up to 95 percent on their electricity bills and households buying solar electricity from a community solar PV plant via a subscription plan could save up to 35 per cent on their electricity bill. The solar electricity tariffs have declined significantly in recent years making rooftop solar a lucrative investment for commercial and industrial consumers. However, despite a 30 percent government subsidy, only about 400 MW of rooftop solar has been installed by households across the country.

The research proposes three business models – community solar model, on-bill financing, and solar partner model. While the community solar model provides a way for households living in apartment buildings with shared roofs or with no roof access to avail the benefits of a rooftop solar system through a shared system, the solar partner model allows even renters to subscribe to solar energy for shorter periods. Both models benefit from the availability of large roof spaces in public and private buildings, and pass on the benefit to residential consumers.

Source: CEEW Analysis

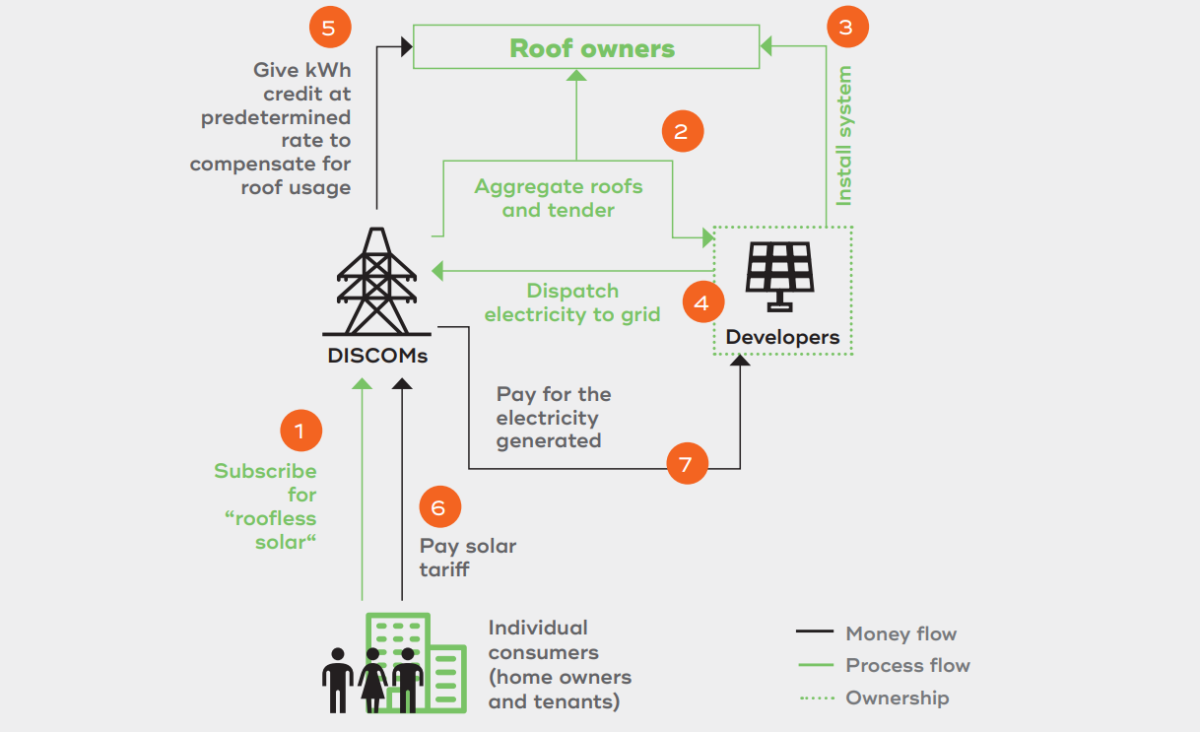

Solar Partners Model

Source: CEEW Analysis

The on-bill financing model, on the other hand, targets consumers with roof access and who need access to easy financing. The combination of the three models extends the rooftop market to all residential consumer segments. The involvement of DISCOMs with well-planned rooftop programmes can eliminate the various market challenges and provide the momentum that the sector currently lacks.

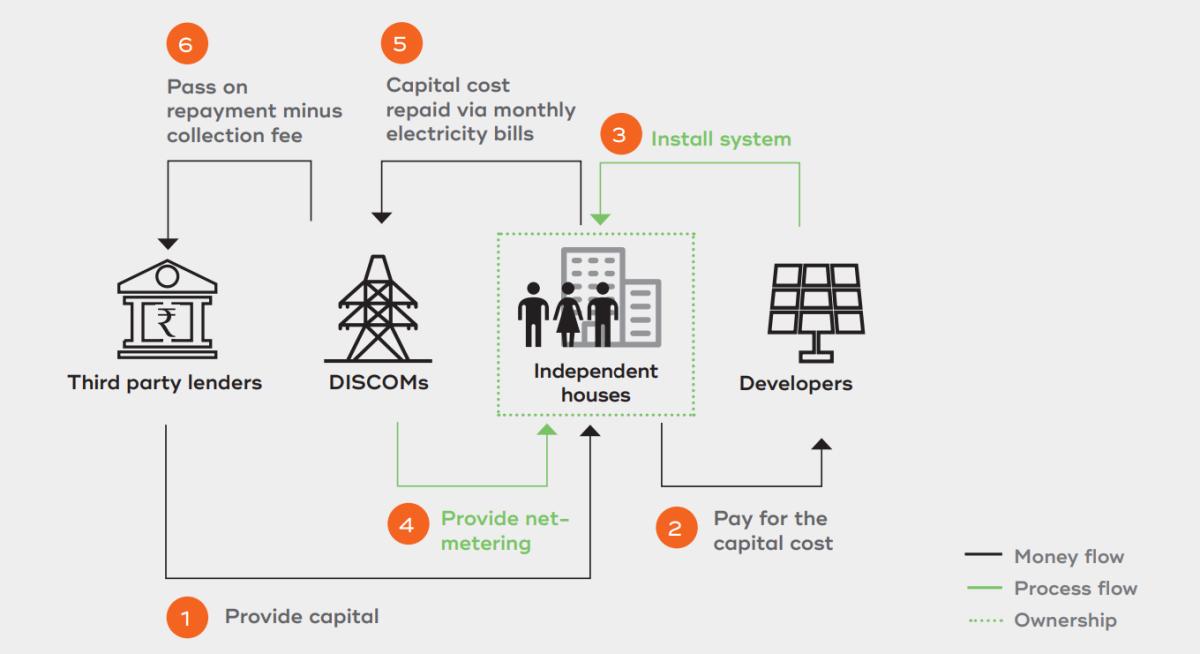

On-bill financing model

Source: CEEW Analysis

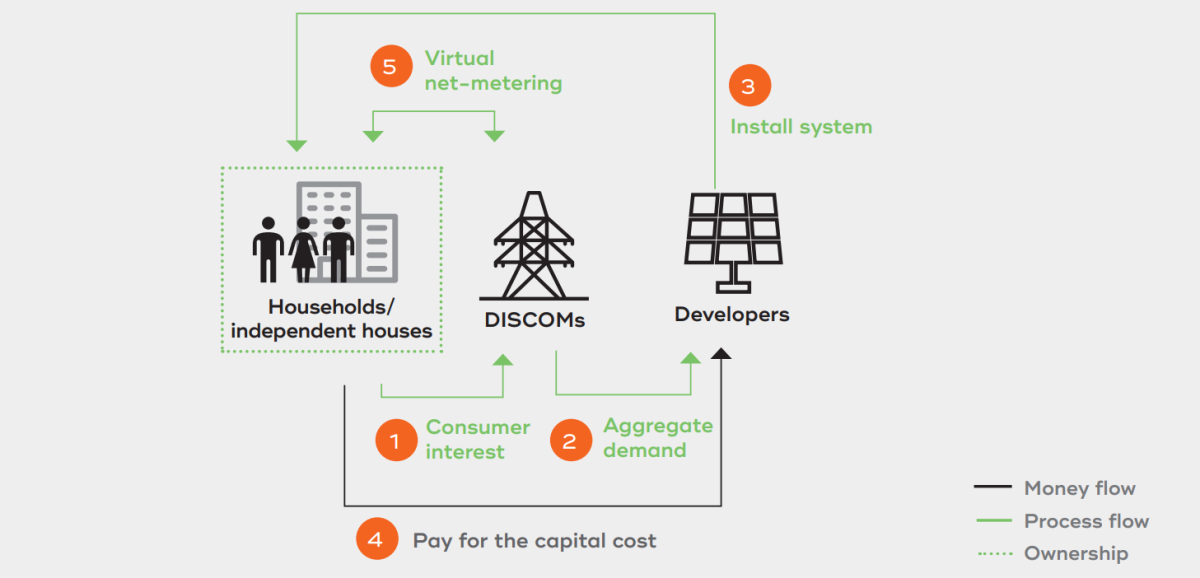

Community solar model

On-bill financing model

Solar partner model

Given the low rate of deployment of rooftop solar in the residential sector in India, it has become imperative to develop innovative business and financial interventions to accelerate its adoption among households. Bringing the utilities to the forefront and incentivising them to take the lead would go a long way in improving the situation. In this context, the Council on Energy, Environment and Water (CEEW) in partnership with the Delhi electricity distribution company (discom), BSES Yamuna Power Limited (BYPL), has developed three innovative utility-led business models that can accelerate the deployment of rooftop solar systems in the residential sector.

Community solar is ideal for consumers who wish to benefit from solar power but do not have access to suitable roof spaces, like households within high-rise and multistory buildings. Through this model, a group of consumers could either own the solar photovoltaic (PV) system jointly or buy the solar electricity from community solar PV plants at a predetermined tariff. Individual consumers can subscribe to a share of the system by one of the two subscription options – upfront payment or subscription fee.

The on-bill financing model allows individual consumers with roof ownership to install rooftop solar systems while not having to pay a huge upfront amount. This is made possible by offering the capital cost as a loan which the consumers would repay through their monthly electricity bill. The average savings achieved through reduced grid electricity consumption or a part of the savings would then be used to make the monthly loan repayment. The repayment collection on the bill with a threat of disconnection on non-payment, reduces the risk of loan default.

Solar partners model mimics the reverse auction model deployed for utility-scale large solar plants. DISCOMs play the role of a demand and supply aggregator. At the supply end, DISCOM aggregate rooftop owners in their license area, tender the capacity through reverse auction and sign power purchase agreements (PPAs) with developers who would install systems on the aggregated rooftop space.

Solar electricity from these rooftop solar plants would be made available to residential consumers through electricity exchange platform. This model allows tenants as well as flat owners (without roof access) to avail solar electricity by paying an annual subscription fee.

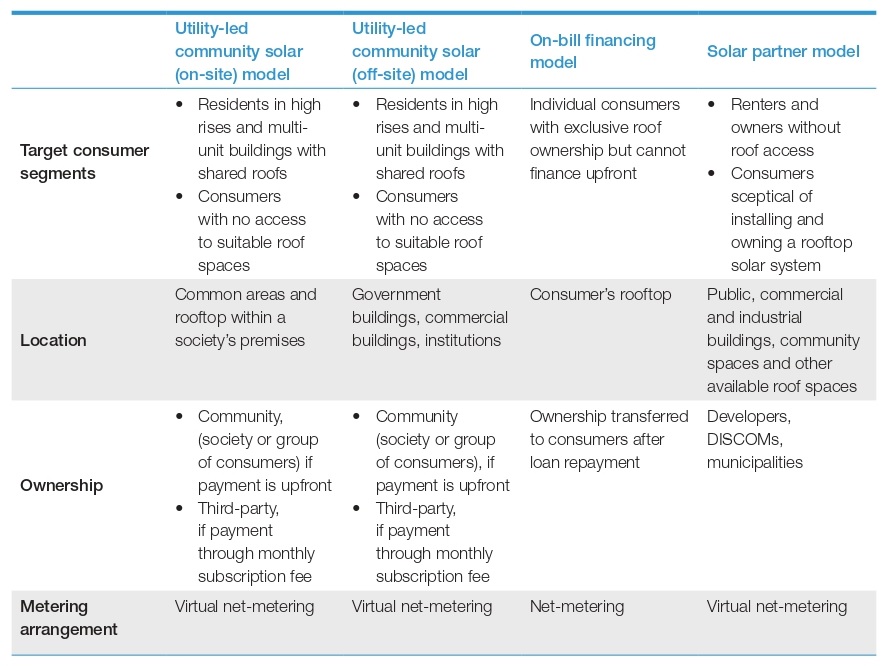

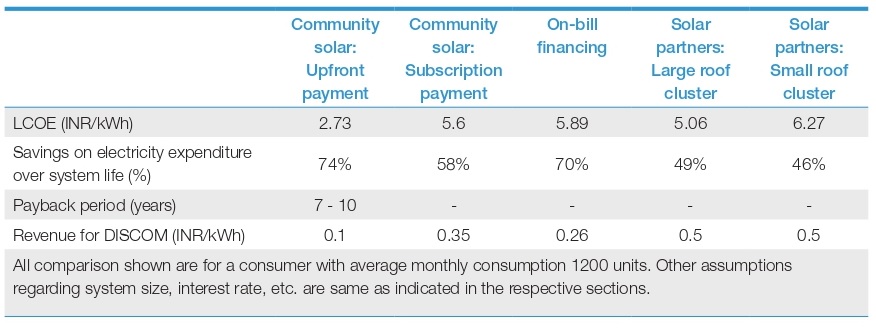

Table 1. Business models at a glance

Source: CEEW

The economic viability of the business models varies with several parameters like consumer consumption slab, system size, ownership and mode of financing. Techno-economic analysis of the models indicate that they could be made financially attractive to consumers who are in the high consumption slabs (>400 units/month) while lower consumption slabs (<400 units/ month) would need customised solar tariff design for it to be feasible. This is mainly because of the 50% subsidy on energy charges given to the domestic consumers under the 400-unit slab in Delhi. For BYPL, this category accounts for 84% of its total domestic consumers.

The solar subscription programme design would be one way to make benefits from solar rooftop system accessible to consumers in the low consumption category. It is possible to develop such programmes under community solar - subscription and solar partners models. This way, a certain proportion of the subscription will be reserved for consumers below the 400-unit slab at a lower tariff which will be adjusted by the higher tariff for the consumers in other slabs.

Table 2 compares the different business models in terms of the different financial parameters that determines its economic viability. Given the results, the DISCOM can choose combinations of two or more of these models and devise deployment strategies tailored to the needs of its domestic consumer segments.

Table 2. The economics at a glance

Source: CEEW analysis

The DISCOMs should initiate rooftop programmes that will address the various market challenges and cater to its consumer segments. Some of the key recommendations based on the business model analysis and stakeholder consultation are:

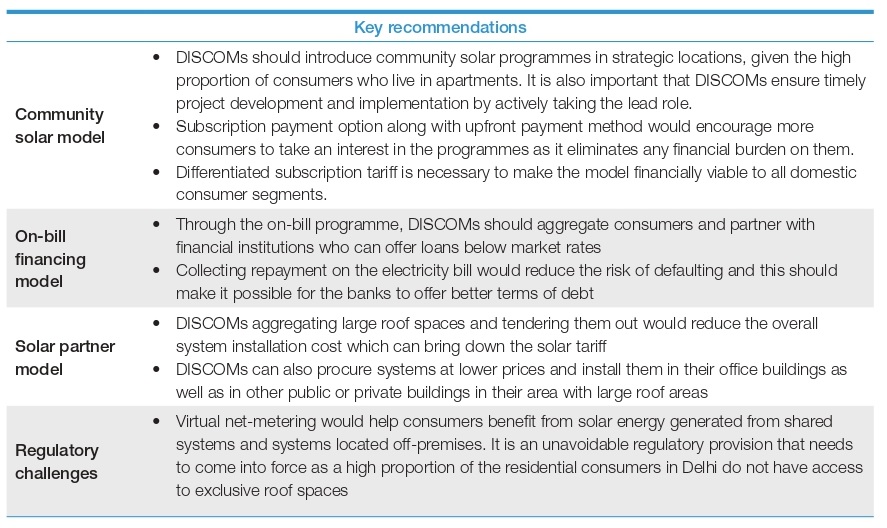

Table 3: Key recommendations at a glance

Source: CEEW Analysi

The DISCOMs should initiate rooftop programmes that will address the various market challenges and cater to its consumer segments. Some of the key recommendations based on the business model analysis and stakeholder consultation are:

Table 3: Key recommendations at a glance

Source: CEEW analysis

BSES Yamuna Power Limited, with its large share of residential consumers, has found that it needs to make innovative business interventions to increase the pace of solar deployment in its license area. Given its consumer mix and the dominant building types in its license area, the community solar model, the on-bill financing model, and the solar partners model are the three business models that could aid the utility in achieving this objective by addressing the market challenges in the sector.

While the community solar model provides a way for households living in apartment buildings with shared roofs or with no roof access to receive the benefits of a RTS system through a shared system, the solar partners model allows even tenants to subscribe to solar energy for shorter periods. Both models benefit from the availability of large roof spaces in public and private buildings and pass on the benefit to residential consumers. The on-bill financing model, on the other hand, targets consumers with roof access and who need access to easy financing. Thus, the combination of the three models extends the rooftop market to all the residential consumer segments.

The business models that are quite feasible for consumers in the higher consumption slabs in the present market conditions will need additional provisions like differentiated solar tariff to ensure that they are feasible for all consumer segments. The current tariff structure for the domestic consumers in Delhi play an important role in determining the economic viability of these business models to different consumer segments. The recent tariff revision and the existing 50 per cent additional subsidy on energy charges for consumers under 400 units slab are two factors that have deemed solar rooftop unattractive for the consumers in those slabs. In the revised tariff structure for the financial year 2018-19, the fixed tariff was increased up to 2 - 5 times while the energy charges were reduced by 11-25 per cent for various slabs. This would help the DISCOMs reduce their losses from consumers switching to solar as they are now able to recover more money through the fixed tariff which the consumers pay irrespective of solar generation. But the reduced energy charges have considerably reduced the savings consumers could have gained with net-metered RTS. Additionally, the 50 per cent energy tariff subsidy reduces the per unit average tariff of the consumers to as low as INR 1.7/kWh (including tax and surcharges) which are incomparable with the rooftop solar tariffs.

Ideally, the involvement of DISCOMs through the business models discussed here should help in bringing considerable system cost reduction. When the DISCOMs undertake consumer and site aggregation, the developers would be able to save on their sales and consumer acquisition cost which should reflect in the final prices. DISCOMs conducting reverse auctions in community solar subscription or solar partners model can also help in realising lowest possible subscription tariffs. Therefore, with the trend of decreasing prices of solar systems and the possible cost reduction that could be achieved through economies of scale and interventions by the utility, the financial attractiveness of the business models will only improve.

Enabling a Circular Economy in India’s Solar Industry

Community Solar for Advancing Power Sector Reforms and the Net-Zero Goals

Mapping India’s Residential Rooftop Solar PotentialA bottom-up assessment using primary data

Promoting the Use of LPG for Household Cooking in Developing Countries