What is carbon pricing?

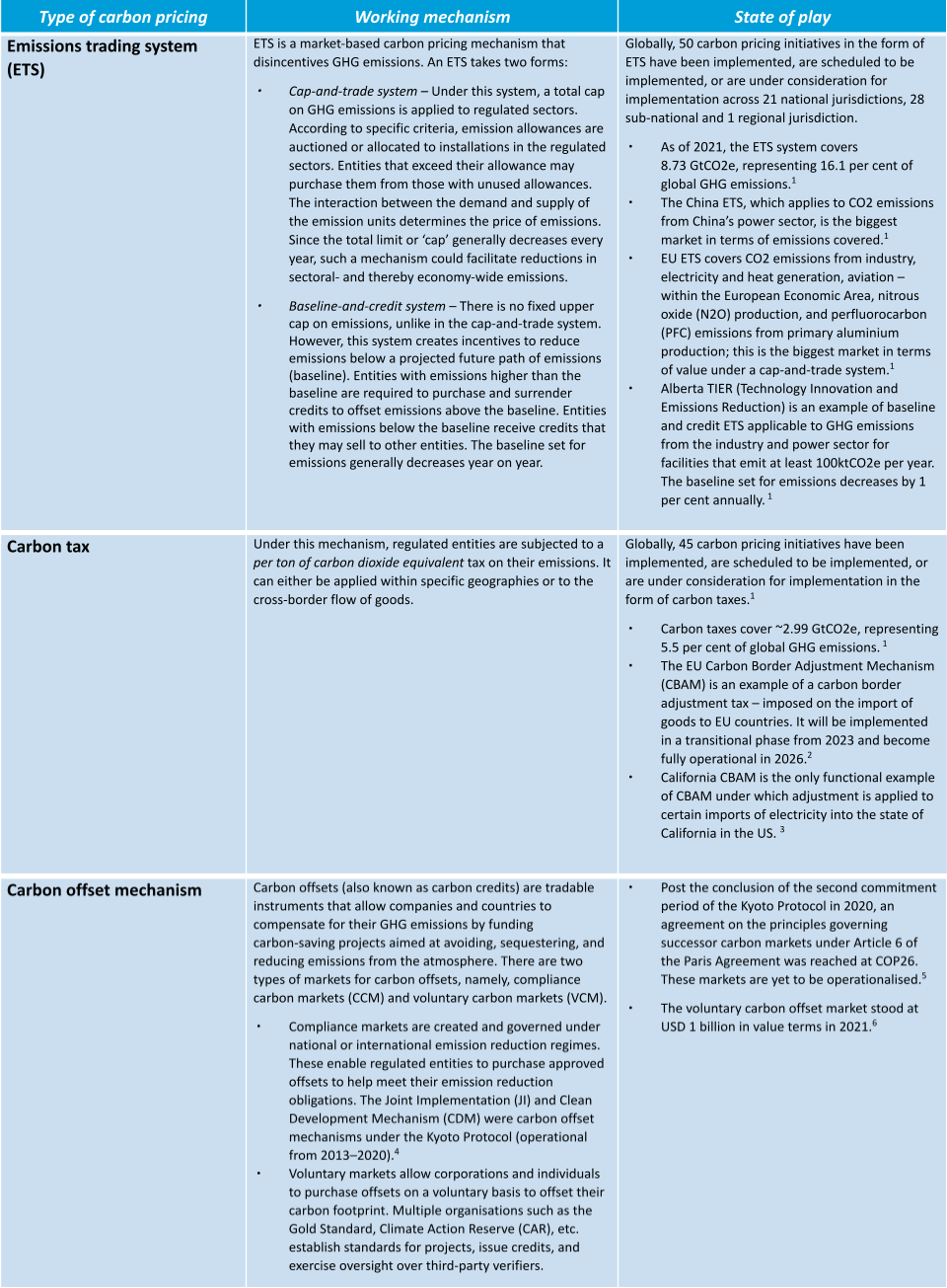

Carbon pricing refers to mechanisms that put a price on greenhouse gas (GHG) emissions. These include those that internalise the costs of and thereby disincentivise, GHG emissions such as carbon taxes and emissions trading systems. These also include carbon offset schemes that enable investors to financially support emission reductions or removal projects and claim the emission savings towards their own decarbonisation efforts. These are described in Table 1 below:

Table 1: Types of carbon pricing

Source: CEEW-CEF compilation based on The World Bank. “Carbon Pricing Dashboard.” https://carbonpricingdashboard.worldbank.org/what-carbon-pricing. Accessed 31st January 2022.

Relevance

Carbon pricing can work as an important policy lever to accelerate economy-wide decarbonisation. Given India’s plans for achieving net-zero emissions by 2070 as announced by the Prime Minister at COP26, policymakers could consider an appropriate form of carbon pricing that sets India on course to meet this objective.7 The relevance of carbon pricing for corporate decarbonisation is explained in the CEF analysis here.

Who should care?

Policymakers

Corporations

Climate change activists

References

- [1] The World Bank. 2021. Carbon Pricing Dashboard – ETS and Carbon Pricing – Map and Data. https://carbonpricingdashboard.worldbank.org/map_data.

- [2] European Commission. 2021. Carbon Border Adjustment Mechanism. https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661.

- [3] ERCST. 2021. “Status of the Border Carbon Adjustments international developments.” https://ercst.org/wp-content/uploads/2021/08/Update-on-developments-in-the-international-jurisdictions-on-the-Border-Carbon-Adjustments.pdf. Accessed 29th March, 2022.

- [4] World Bank. 2021. State and Trends of Carbon Pricing 2021. Washington, DC: World Bank. https://openknowledge.worldbank.org/handle/10986/35620.

- [5] Gold Standard. 2021. “Post-COP26 – Reflections on Article 6 Outcomes.” https://www.goldstandard.org/blog-item/post-cop26-%E2%80%93-reflections-article-6-outcomes.

- [6] Sanchez, Carlos. “Analysing Carbon Offset Markets’ Role in our Journey to a Net-zero World.” https://carlossanchez.eco/blog/carbon-offset-markets/.

- [7] Press Information Bureau – Prime Minister’s Office. 2021. National Statement by Prime Minister Shri Narendra Modi at COP26 Summit in Glasgow. https://pib.gov.in/PressReleasePage.aspx?PRID=1768712.