Context

The global net-zero transition has many aspects, including technological advances, climate-resilient infrastructure, regulatory changes, people-centric focus, and access to financing solutions, among others. In 2014, the United Nations Conference on Trade and Development (UNCTAD) had estimated a global requirement of approximately USD 5–7 trillion annually to finance the Sustainable Development Goals (SDGs).1 In a 2023 update, UNCTAD reported an increase in the investment gap across all SDG sectors from USD 2.5 trillion annually in 2015 to USD 4 trillion annually.2 The Global South is going through a phase of full-fledged industrialisation. With comparatively lesser access to finance and a still-maturing green finance market, the directives to reduce emissions put an additional burden on these countries. Thematic bonds are instruments that have the potential to bridge this financing gap.

What are thematic bonds?

Thematic bonds are fixed-income securities issued to finance specific investment themes which target specific SDGs, such as climate change, health, food, education, and access to financial services.3,4 They benefit both investors and issuers in the market:

- For investors, they help in balancing the portfolio risk.

- For issuers, greater investor diversification allows access to new pools of funds; they also gain environmental and social credentials.

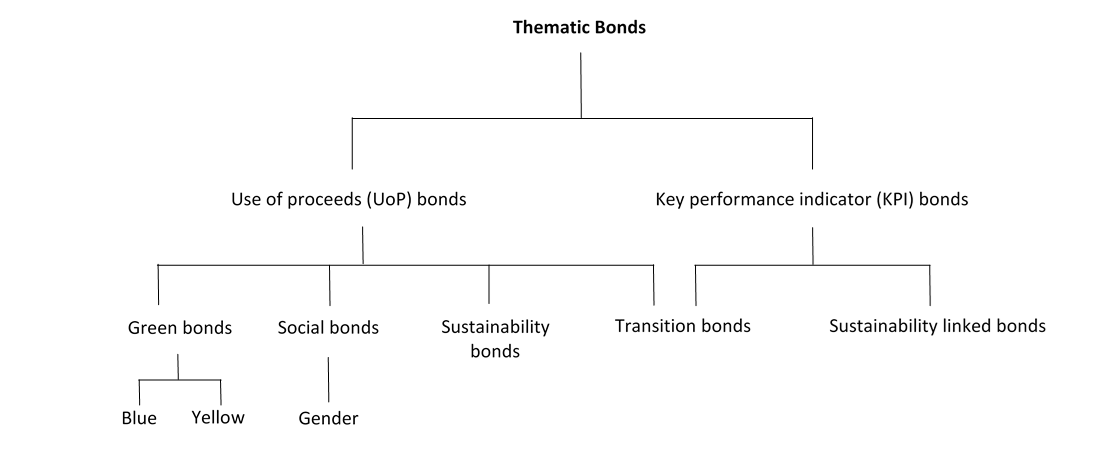

Broadly, thematic bonds are classified into two types: use of proceeds (UoP) and key performance indicator (KPI) bonds.4 UoP bonds are securities earmarked for specific projects designed to generate the intended impacts.4 KPI bonds are required to meet the overarching goals of sustainability and environmental, social, and governance (ESG) objectives but are not tied to any project or specified output like UoP bonds. Moreover, a borrower would generally have to pay higher coupon rates if the KPIs are not met.4

Figure - 1 Classification of thematic bonds

Source: Author’s compilation, based on Organisation for Economic Co-operation and Development,5 Jain,6 World Bank,7 and Asian Development Bank.8

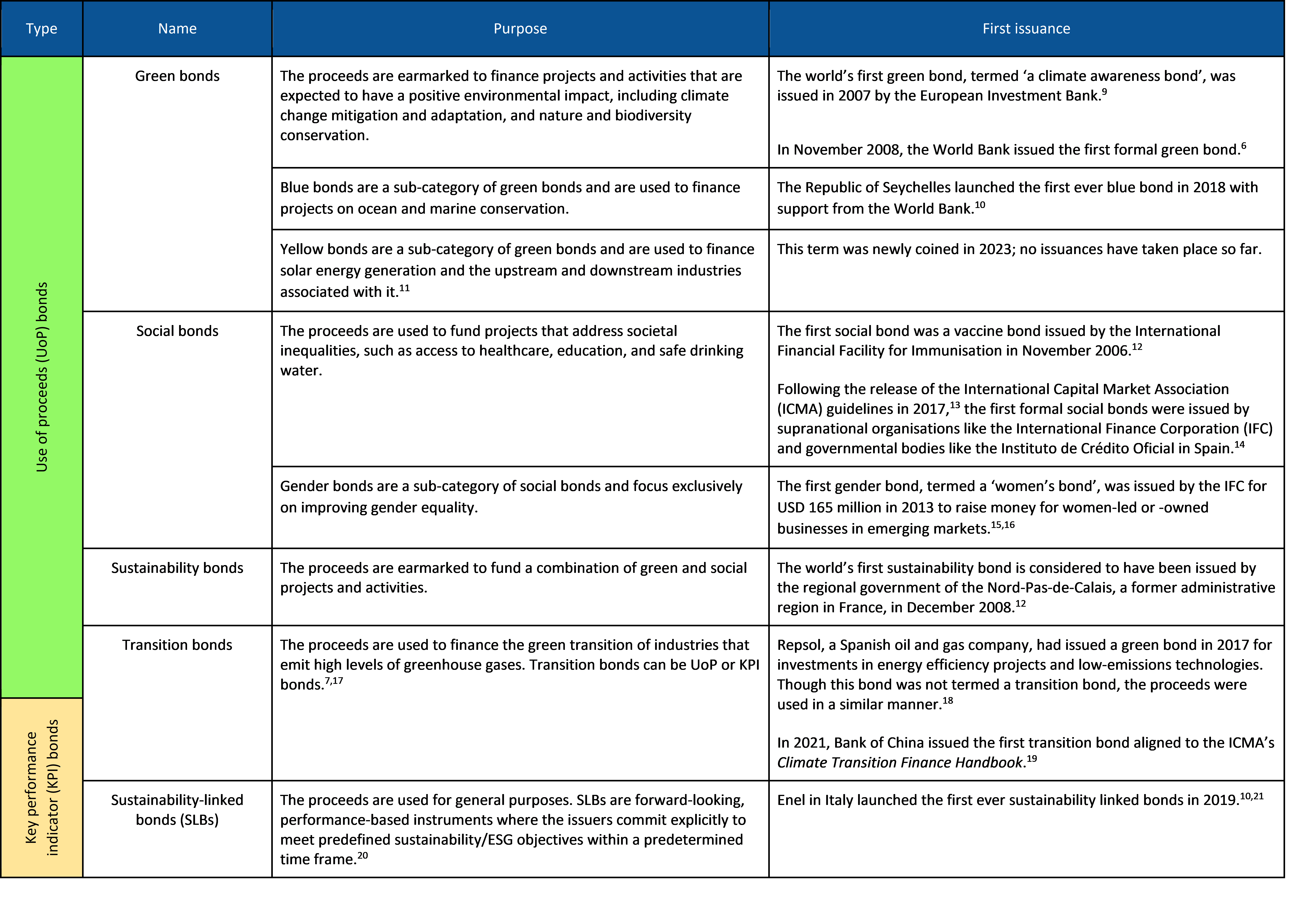

The categorisation and functioning of the various types of bonds are discussed in Table 1.

Table 1: Categorisation and functioning of thematic bonds

Source: CEEW-CEF's compliation

Note: ‘Formal’ denotes a bond instrument which has been formally certified by a third-party verifier.

Thematic bonds are expected to follow the various voluntary bond standards established by the ICMA.3,5.8 In recent years, an increasing number of nations have introduced frameworks for different types of thematic bonds and proceeded with sovereign issuances of these bonds.

Who should care?

- Government agencies and regulatory bodies

- Public welfare associations

- Investors

References

- [1] United Nations Conference on Trade and Development. 2014. “World Investment Report 2014: Investing in the SDGs: An Action Plan.” Accessed September 6, 2023. https://unctad.org/system/files/official-document/wir2014_en.pdf.

- [2] United Nations Conference on Trade and Development. 2023. “World Investment Report 2023: Investing in Sustainable Energy for All.” Accessed September 6, 2023. https://unctad.org/system/files/official-document/wir2023_en.pdf.

- [3] World Bank. 2022. “Sovereign Green, Social and Sustainability Bonds: Unlocking the Potential for Emerging Markets and Developing Economies.” Accessed September 6, 2023. https://thedocs.worldbank.org/en/doc/4de3839b85c57eb958dd207fad132f8e-0340012022/original/WB-GSS-Bonds-Survey-Report.pdf.

- [4] United Nations Economic and Social Commission for Asia and the Pacific. 2021. "An Introduction to Issuing Thematic Bonds." Accessed September 6, 2023. https://www.unescap.org/sites/default/d8files/knowledge-products/Draft%209_An%20Introduction%20To%20Issuing%20Thematic%20Bonds_web.pdf.

- [5] Organisation for Economic Co-operation and Development. 2023. “Green, Social and Sustainability Bonds in Developing Countries: The Case for Increased Donor Coordination.” Accessed September 6, 2023. https://www.oecd.org/dac/green-social-sustainability-bonds-developing-countries-donor-co-ordination.pdf.

- [6] World Bank Group. 2021. “What You Need to Know about IFC’s Green Bonds.” Published December 8, 2021. https://www.worldbank.org/en/news/feature/2021/12/08/what-you-need-to-know-about-ifc-s-green-bonds.

- [7] Jain, Gautam. December 2022. Thematic Bonds: Financing Net-Zero Transition in Emerging Market and Developing Economies. New York: Center on Global Energy Policy. https://www.energypolicy.columbia.edu/wp-content/uploads/2022/12/EM-GreenBonds-CGEP_Report_120622-2.pdf.

- [8] Asian Development Bank. 2021. “Primer on Social Bonds and Recent Developments in Asia.” Accessed September 6, 2023. https://www.adb.org/sites/default/files/publication/677671/social-bonds-recent-developments-asia.pdf.

- [9] European Investment Bank. n.d. "Climate Awareness Bonds.” Accessed September 6, 2023. https://www.eib.org/en/investor-relations/cab/index.htm.

- [10] Macfarlane, Alec. 2021. Financing the Transition to Net Zero. Washington, DC: International Finance Corporation. https://www.ifc.org/en/stories/2021/financing-the-transition-to-net-zero.

- [11] Securities and Exchange Board of India. February 2023. “Securities and Exchange Board of India (Issue and Listing of Non-Convertible Securities) (Amendment) Regulations, 2023.” Gazette notification. Accessed September 6, 2023. https://www.sebi.gov.in/legal/regulations/feb-2023/securities-and-exchange-board-of-india-issue-and-listing-of-non-convertible-securities-amendment-regulations-2023_67798.html.

- [12] Nemoto, Naoko, and Lian Liu, eds. Strengthening Environmental, Social, and Governance Investment under COVID-19. 2022. Tokyo: Asian Development Bank Institute. https://www.adb.org/sites/default/files/publication/792146/strengthening-environmental-social-and-governance-investment-under-covid-19.pdf.

- [13] Financial Services Agency of Japan. 2021. “Social Bond Guidelines.” Accessed September 6, 2023. https://www.fsa.go.jp/en/news/2021/001.pdf.

- [14] Impact Invest Lab. 2018. “The Social Bond Market: Towards a New Asset Class?” Accessed September 6, 2023. https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Public-research-resources/II-LAB2019-02Social-Bonds-130219.pdf.

- [15] Yukhananov, Anna. 2013. “First Women's Bond from World Bank Raises $165 Million.” Updated November 7, 2013. Accessed September 6, 2023. https://www.reuters.com/article/worldbank-women-bond/first-womens-bond-from-world-bank-raises-165-million-idUSL2N0IR1IN20131106.

- [16] Asian Development Bank. 2023. “Gender Bonds: From Incidental to Center Stage.” ADB Briefs No. 243. Accessed September 6, 2023. https://www.adb.org/sites/default/files/publication/861396/adb-brief-243-gender-bonds-incidental-center-stage.pdf.

- [17] International Capital Market Association. 2023. Climate Transition Finance Handbook: Guidance for Issuers. Zurich: International Capital Market Association. https://www.icmagroup.org/assets/documents/Sustainable-finance/2023-updates/Climate-Transition-Finance-Handbook-CTFH-June-2023-220623v2.pdf.

- [18] Repsol Group. n.d. “Green Bonds That Finance Sustainability Projects.” Accessed September 6, 2023. https://www.repsol.com/en/press-room/repsol-news/29/index.cshtml.

- [19] Crédit Agricole. n.d. “Bank of China Issued World’s First ICMA Handbook Linked Transition Bond.” Accessed September 6, 2023. https://www.ca-cib.com/pressroom/news/bank-china-issued-worlds-first-icma-handbook-linked-transition-bond.

- [20] International Capital Market Association. 2023. “Sustainability-Linked Bond Principles: Voluntary Process Guidelines.” Accessed September 6, 2023. https://www.icmagroup.org/assets/documents/Sustainable-finance/2023-updates/Sustainability-Linked-Bond-Principles-June-2023-220623.pdf.

- [21] Enel. n.d. “Sustainability-Linked Bonds.” Accessed September 6, 2023. https://www.enel.com/investors/investing/sustainable-finance/sustainability-linked-finance/sustainability-linked-bonds.