Globally, countries are transitioning towards electrifying transportation. The major drivers for the transition are concerns regarding climate change, energy security, and local air pollution caused by the use of internal combustion engine (ICE) based vehicles. For India, the transition to electric mobility could translate into a market opportunity worth USD 206 billion by FY30.1

This is an opportune time to implement measures to help develop the EV ecosystem, as EVs have started making more economic sense than ICEs. Most importantly, the country's EV sector can also contribute to significant local value addition and job creation and drive India's post-COVID-19 recovery. India’s automotive market – one of the largest in the world – contributes about seven to eight per cent to its GDP. In 2017, the sector employed over 1.3 million people in manufacturing and many more in sales, repair, and ancillary services like vehicle insurance.2 The EV sector, given its deep linkages with micro, small, and medium enterprises for vehicle production and opportunities for technological innovations in the coming decade, can be a key driver of this growth.3 The lion's share of this opportunity lies in setting up the supply chain to manufacture and assemble components. CEEW-CEF estimates that this could provide vehicle manufacturers an additional turnover of over USD 177 billion by FY30.

Building such a supply chain and manufacturing capacity is a complex exercise that requires in-depth planning and investments to meet future demand. Mobilising investment flows to develop a robust supply chain would require an understanding of the current landscape, including the value addition of each component and its sourcing; current players; policy levers; and the existing barriers to the development of the ecosystem. Our analysis presents a bird’s-eye view of the EV supply chain, including the state of the sector and the barriers to its development. We conclude with suggestions to develop a robust EV supply chain and spur domestic manufacturing.

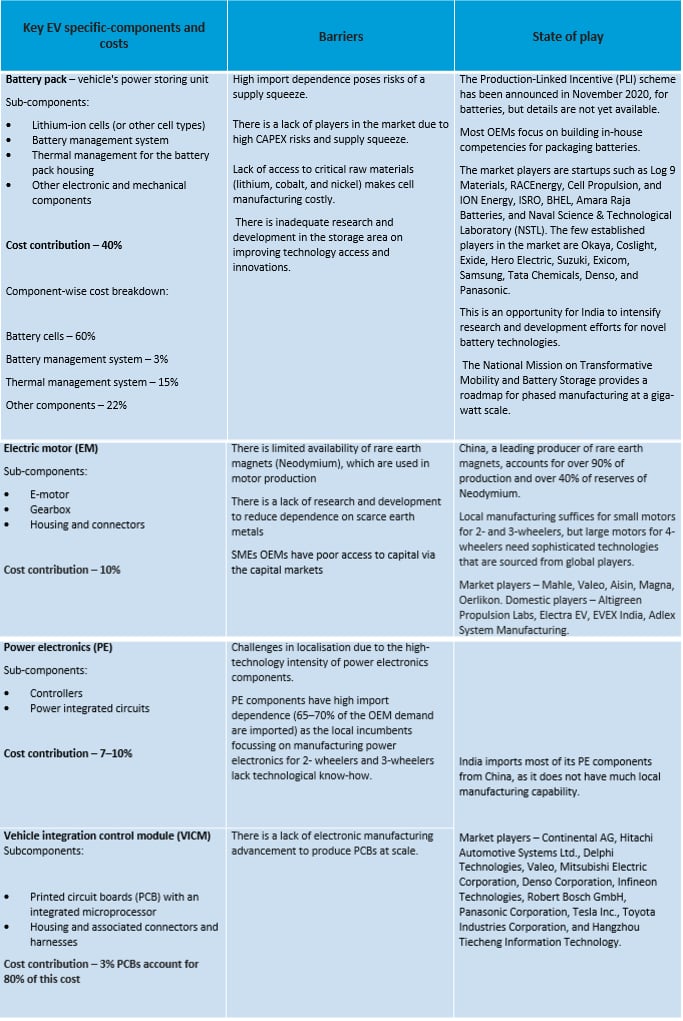

At the apex of the supply chain are the original equipment manufacturers (OEM), who produce and market vehicles. They assemble EVs using components that they produce in-house and partially source from a network of large, medium, and small vendors. These vendors supply critical components, such as car door modules, braking systems, and other EV-specific components.4 In production, EV-specific components make up about 60 to 70 per cent of vehicle component costs, with non-EV-specific components making up the balance. India already has advanced domestic capacities for traditional ICE manufacturing across categories. However, the EV supply chain differs markedly from its ICE counterpart. We present a snapshot of some of its key components, barriers, and state of play in Table 1.

Table 1: The state of the EV-component manufacturing sector

Source: CEEW-CEF analysis

CEEW-CEF proposes a three-pronged approach to address these barriers and holistically support the nascent EV ecosystem. Given that the rate of EV adoption is currently low, measures to boost demand needs to go hand-in-hand with measures that directly promote the manufacturing of EVs themselves.

Prong 1: Demand-pull measures

The lack of appropriate financing options hurts demand generation, especially since the upfront purchase cost of EVs is 1.2X–3X higher than that of ICE vehicles. Thus, measures to ease financing, such as giving credit guarantees to lenders, and some business models, like leasing, could help overcome the initial price barriers and generate demand. Such measures are necessary given the consumers’ reluctance to purchase EVs even though in many use cases, like that of two- and three-wheeler fleets, EVs are already cheaper based on life cycle cost. Also, measures such as awareness campaigns highlighting the benefits of EVs over ICE vehicles can promote higher adoption.

Prong 2: Demand-push measures

Regulatory measures could help India create a demand push. It could take a leaf out of the European Union’s policy norms. In the EU, the carbon dioxide (CO2) emission norms based on a fleet’s average vehicle weight for individual manufacturers drove OEMs to electrify the offering or else face fines.7 China also offers some examples of what India could potentially do. Demand in China is driven mainly by fiscal incentives, coupled with the extensive deployment of charging infrastructure, mitigating fears regarding range anxiety. Measures to disincentivise ICE vehicle sales through the implementation of green cess could go a long way in restricting their sales and encouraging consumers to switch to EVs.

Prong 3: Policy support for manufacturing

The ecosystem also needs fiscal support that incentivises the setting up of manufacturing facilities. The incentives are vital given the long gestation period and the enormous amounts of fixed cost investments needed for setting up EV manufacturing facility. The PLI scheme for batteries is a step in the right direction; however, Indian policymakers will need to continue providing calibrated support. The current policy ecosystem for EV manufacturing merely addresses the EV supply chain's challenges from the margins and needs additional measures.

However, the country has an opportunity under the recently announced PLI scheme for the auto sector to provide dedicated incentive support to EV manufacturers over ICE-based manufacturing to make it more competitive to manufacture EVs domestically for the world and the country.8 If rightly designed, such a measure could help attract foreign players to manufacture in the country and boost investments in the sector. Simultaneously, several state EV policies will need alignment to provide appropriate benefits for developing EV manufacturing capacity. Policy support for manufacturing requires a collaborative approach on the part of central and state governments, which addresses the specific barriers that market players face in the EV supply chain.

India's EV demand, though small, has started picking up in recent years; however, the domestic EV supply chain ecosystem continues to be at a nascent stage. The charging up of the EV value chain in line with the country's EV aspirations would need demand creation at scale through both pull and push measures. Also, the manufacturing ecosystem requires significant and consistent policy support. Given the value chains and deep linkages with micro, small, and medium enterprises, such measures will also help drive up jobs, growth, and sustainability for the economy in the decade to come. It is an opportune time for OEMs and policymakers at the central and state levels to collaborate on developing an ecosystem that can bring EV manufacturing from the margins to the mainstream.

References

- [1]CEEW-CEF. 2020.“Financing India’s Transition to Electric Vehicles: A USD 206 Billion Market Opportunity (FY21–FY30).” https://cef.ceew.in/solutions-factory/publications/CEEW-CEF-financing-india-transition-to-electric-vehicles.pdf. Accessed January 18, 2021.

- [2]Asher Vaibhav. 2020. “Automotive Sector Employment in India, FY2013–2017.” https://www.statista.com/statistics/581257/projected-automotive-sector-direct-employment-in-india/ Accessed February 15, 2021.

- [3]CEEW. 2020. “India’s Electric Vehicle Transition: Can Electric Mobility Support India’s Sustainable Economic Recovery Post COVID-19?” https://www.ceew.in/publications/india%E2%80%99s-electric-vehicle-transition-0. Accessed January 18, 2021.

- [4]CEEW-CEF. 2020. “Financing India’s Transition to Electric Vehicles: A USD 206 Billion Market Opportunity (FY21–FY30). https://cef.ceew.in/solutions-factory/publications/CEEW-CEF-financing-india-transition-to-electric-vehicles.pdf. Accessed January 18, 2021.

- [5]ACMA. 2018. “Study on xEV Market and Opportunities for xEV Component Suppliers.” Accessed March 04, 2020.

- [6]Allied Market Research. 2020. “Powered Airborne Vehicles): Global Opportunity Analysis and Industry Forecast, 2019–2026.” https://www.reportlinker.com/p05868957/Power-Electronics-for-Electric-Vehicle-Market-By-Application-and-End-Use-Global-Opportunity-Analysis-and-Industry-Forecast-.html?utm_source=PRN. Accessed March 04, 2020.

- [7]Transport Policy. 2020 “EU: Light-Duty: GHG Emissions.” https://www.transportpolicy.net/standard/eu-light-duty-ghg-emissions/#:~:text=The%20EU%20implemented%20mandatory%20fleet,carbon%20dioxide%2Fkm%20by%202021. Accessed February 11, 2020.