Suggested Citation: Bharadwaj, Kapardhi, Karthik Ganesan, and Neeraj Kuldeep. 2018. Retail Tariffs for Electricity Consumers in Maharashtra: A Forward Looking Assessment. New Delhi: Council on Energy, Environment and Water.

This report estimates the rise in tariffs for electricity consumers in Mumbai and the rest of Maharashtra, and explores the effects of increasing renewable energy penetration on the tariffs.

Estimating the future cost of electricity requires an understanding of the different components that make up an electricity bill, the regulatory procedures and influences that impact the tariff for each of these components, and the market and political forces that affect these tariffs.

The estimates incorporate two scenarios of renewable energy growth, high renewable energy penetration and low renewable energy penetration, and their impact on the cost of procurement.

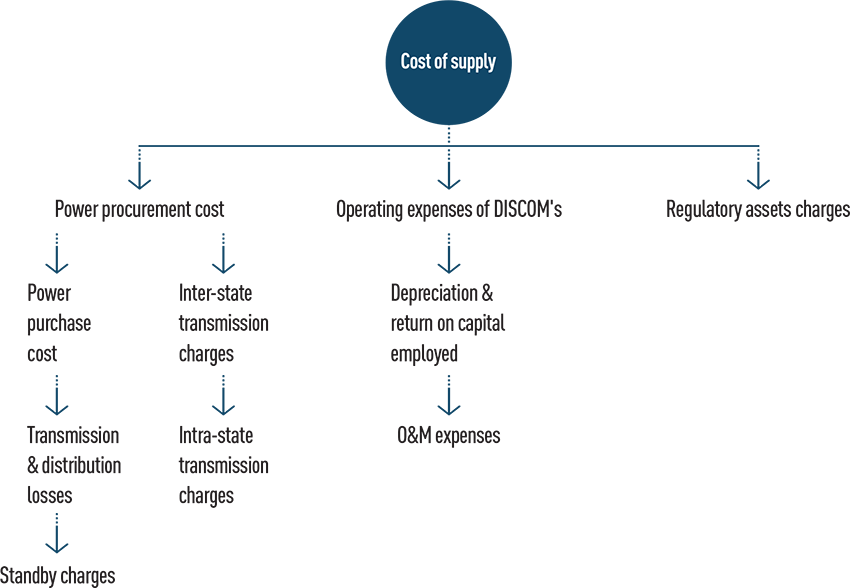

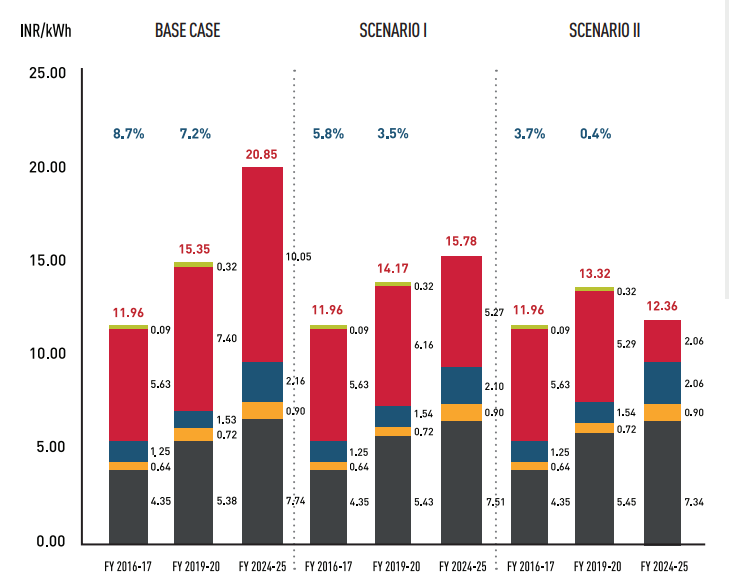

Components of cost of supply for Mumbai DISCOMs and MSEDL*

Source: CEEW Analysis

* Consumers of MSEDCL are not levied standby charges; these are applicable on consumers of Mumbai DISCOMs to ensure uninterrupted supply

Source: Pixabay

Estimating the future cost of electricity requires an understanding of the different components of an electricity bill, the regulatory procedures and influences that impact the tariff for each of these components, and the market and political forces that affect these tariffs. Each component of an electricity bill is determined by a variety of factors. To provide clarity on the make-up of power supply costs, the overall cost is broken down into four parts: power procurement costs, transmission charges, distribution charges, and cross-subsidy charges. Should there be more clarity (in due course) on the specific trends for each part, the forward-looking trends can be fine-tuned accordingly.

The four components of an electricity bill and the factors that influence them are as follows:

This report examines each of these factors in detail. In order to present the relative influence of different factors, this report has considered two scenarios, with varying energy mixes based on RE capacity additions and based on certain expectations regarding changes in cross-subsidy, which is an inherent part of the power sector. The two scenarios-high RE penetration and low RE penetration-are both conservative estimates of planned RE capacity additions, going by the ambitions expressed by the current government. The costs of integration have been arrived at on the basis of discussions with various stakeholders, including MNRE officials, experts on grid integration, and other researchers working on RE-integration costs. Adani Transmission Ltd has acquired the Mumbai business of Reliance Industries (RIL) (TOI, 2017). Any mention of RIL-D hereby refers to the distribution business owned by Adani Transmission Ltd.

Transmission charges will rise as per the investments made in the overall network (inter-state as well as intra-state). The estimations, however, look at the growth trends projected in the latest Multi Year Tariff (MYT) orders of all four DISCOMs, and the same are projected on transmission charges, looking ahead.

Distribution charges, based on the operating expenses of a DISCOM, are a complex mix of administrative and O&M expenses, capital expenditure, and employee expenses. For the purposes of this study, operating expenses of DISCOMs (distribution charges) have been assumed to constitute a fixed ratio of the overall cost of supply. This represents the upper limit of the range of values seen in the DISCOMs that operate in Delhi.

The cross-subsidy component can have a telling impact on future tariffs. Extensive review of tariff orders provides no insight into the science of cross-subsidy determination. However, policy makers acknowledge that reduction of cross-subsidies (across consumer categories) is one of the major drivers of regulatory reforms. This constitutes a significant assumption in this assessment and is considered in parallel with the scenarios that depict two different energy mixes. The ratio of the average billing rate for a consumer category (ABR) to the overall average cost of supply (ACoS) is an indicator of tariff rationalisation for that category of consumers. Going forward, some rationalisation is expected in both the scenarios.

Apart from standard tariff components, the Mumbai DISCOMs also pay standby charges to Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to ensure reliable and uninterrupted supply to Mumbai consumers. Standby power capacity is equivalent to the largest power generating unit, 500 MW, supplied to Mumbai city. It is essential to have standby power for reliable supply in the event of failure of any generating unit that is supplying to Mumbai.

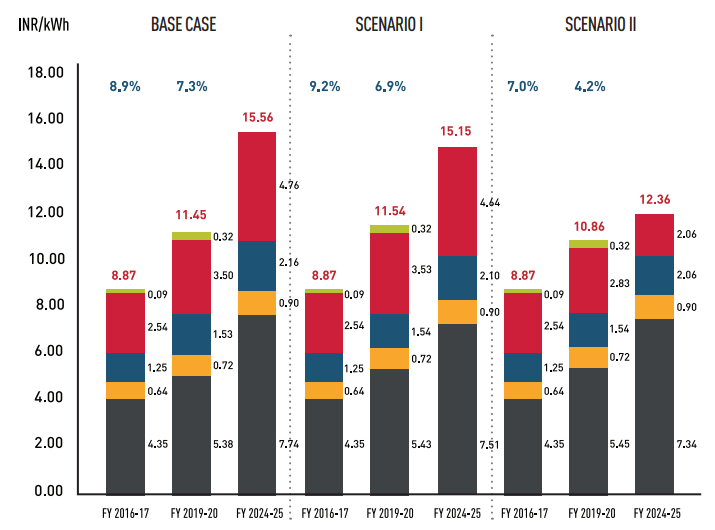

A base case scenario for MSEDCL is considered assuming that the future energy mix will be the same as the current mix and that the cross-subsidy remains the same, going forward. In the case of the Mumbai DISCOMs, a base case was not considered because the cross-subsidy charges are relatively low when compared to those of MSEDCL. There is little difference in the existing energy mix in scenario I, which was the premise for not including a base case for the Mumbai DISCOMs. There is uncertainty about the energy mix and the procurement costs for the Mumbai DISCOMs because of transmission constraints in bringing power into Mumbai (discussed in detail in Chapter 3). Scenario I assumes that the existing energy mix will continue in view of the transmission constraints for Mumbai remaining unresolved. Scenario II assumes that the transmission issues have been resolved, and that the DISCOMs can procure from any power plant in the grid, and as a result, a higher share of RE is envisioned, which is in line with the national ambitions of achieving higher RE penetration.

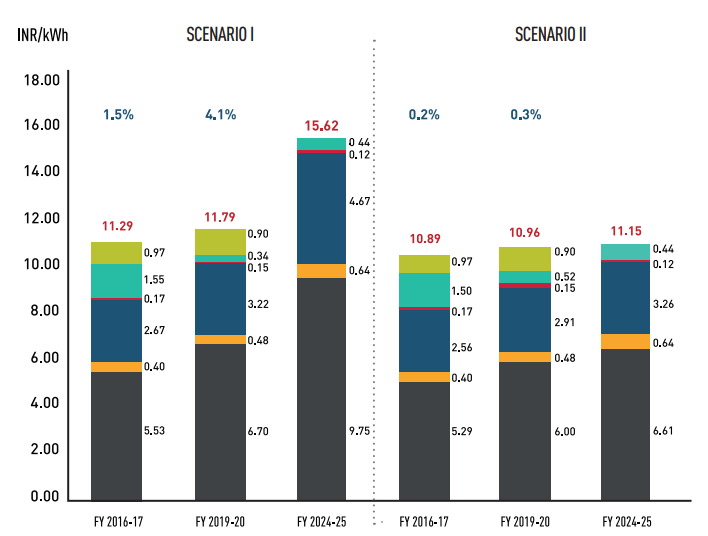

Power procurement costs continue to constitute the largest share of the cost of supply. The illustration below presents the share of components in future tariffs for high tension (HT) commercial and industrial consumers of RIL-D.

ABR for industrial consumers of RIL-D

Source: CEEW estimates

ABR for commercial consumers of RIL-D

Source: CEEW estimates

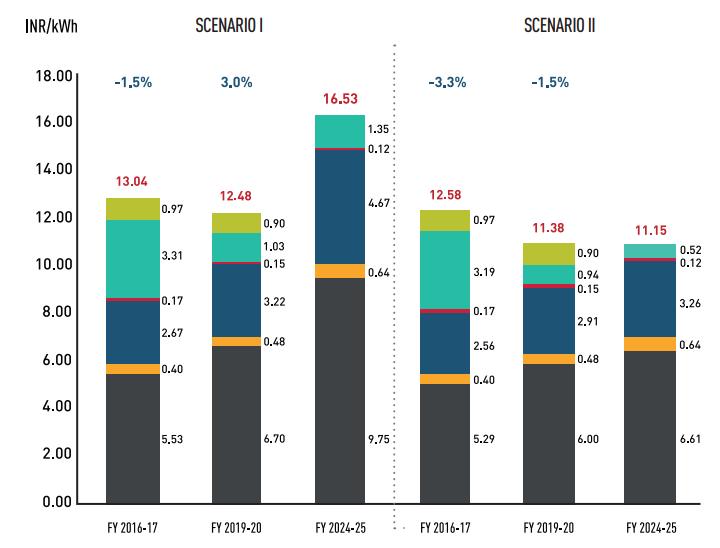

Similarly, the cost of distribution for commercial and industrial consumers of MSEDCL is detailed in the two illustrations below.

ABR for industrial consumers of MSEDCL

Source: CEEW estimations based on indicated assumptions

ABR for commercial consumers of MSEDCL

Source: CEEW estimations based on indicated assumptions

Power procurement cost is dictated by the rate of growth of the energy charges associated with the various sources of electricity. The future tariff for commercial and industrial consumers will depend largely on three main parameters - the energy mix, the cost associated with each source, and cross-subsidy and regulatory asset charges. This is highlighted in two scenarios presented for RIL-D, and in three scenarios presented for MSEDCL. The higher share of renewable power in the overall energy mix limits the growth in power procurement cost, as a portion of costlier coal power is replaced with cheaper renewable power in the future.1 The estimates (for commercial and industrial [C&I] tariff ) in the base case scenario for MSEDCL are at the higher end of the three scenarios considered.

Cross-subsidy will also have a significant impact on the overall tariff for C&I consumers. As per the guidelines from central and state regulators, tariff for C&I consumers is expected to be within +/- 20 per cent of ACoS. Currently, commercial consumers in Maharashtra (excluding Mumbai) are paying as much as 200 per cent over and above ACoS. Rationalisation of crosssubsidy for C&I consumers will take place. However, it is difficult to commit a time frame for the achievement of this goal. This has actually contributed to negative growth in tariff for commercial consumers in scenario II in which rationalisation is happening at a faster pace.

Further, the recovery of the existing regulatory assets will bring down the ACoS. As per the latest tariff filing and approvals from the state regulators in Maharashtra, regulatory assets are expected to be recovered fully in the next three to four years. The creation of new regulatory assets is not envisaged post-2020, which is expected to result in lower tariff for consumers.

Based on the assumptions for each components of an electricity bill, CEEW estimates that the electricity costs for commercial customers of MSEDCL will grow at a CAGR (compound annual growth rate) of 3.3 per cent in the case of the partial rationalisation of cross-subsidy and will increase marginally at a CAGR of 0.2 per cent if cross-subsidy is brought down to 120 per cent from the existing 193 per cent. Similarly, for industrial customers, tariff will rise at an expected CAGR of 6.7 per cent and at a lower CAGR of 4 per cent in case the tariffs are set at 120 per cent of ACoS.

For consumers in Mumbai, for all three DISCOMs, electricity tariff for commercial consumers will increase at an average rate of 2 to 3 per cent. For industrial consumers, tariff will rise at an average rate between 3 per cent and 4 per cent. Further, in the case of 105 per cent rationalisation of tariff and assuming that no new regulatory assets will be created, electricity tariff for both C&I consumers will see a dip.

The following general trends emerged from the study:

Other factors that this study did not consider could also influence electricity prices. These factors are:

How can India Scale Up Electricity Demand-side Management?

Improving Discoms’ Financial Viability

Assessing the Value of Offshore Wind for India’s Power System in 2030

Enabling a Consumer-centric Smart Metering Transition in India

Making India’s Advanced Metering Infrastructure Resilient