Suggested citation: Shalu Agrawal, Sunil Mani, Simran Kalra, Bharat Sharma, and Kanika Balani. 2023. Enabling A Consumer-Centric Smart Metering Transition in India: Insights from A Survey of Six States. New Delhi: Council on Energy, Environment and Water

As of February 2023, power distribution companies (discoms) have deployed 5.5 million smart meters in India (NSGM 2023). Under the Revamped Distribution Sector Scheme (RDSS), the aim is to replace 250 million conventional electricity meters with smart prepaid meters by 2025-26. The rapid roll-out of smart meters could present teething issues that could risk consumer trust in the technology.

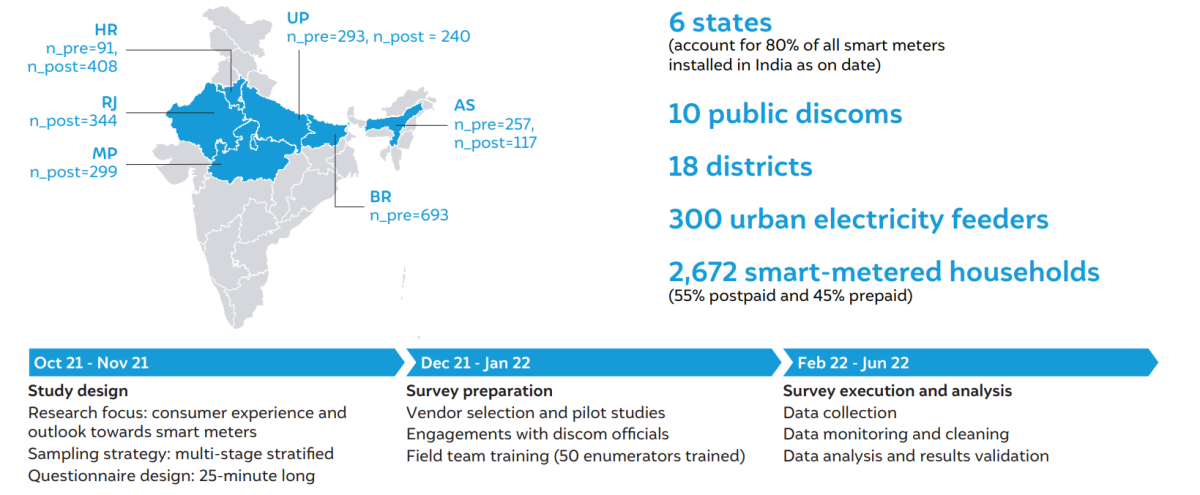

This study presents a granular assessment of consumer perceptions and experience with using smart meters, especially in the prepaid mode. The study, based on an independent survey of ~2,700 urban smart-metered households in six Indian states (Assam, Bihar, Uttar Pradesh, Haryana, Madhya Pradesh, and Rajasthan) provides recommendations to ensure a smooth transition of consumers to a new billing and payments regime through prepaid smart meters.

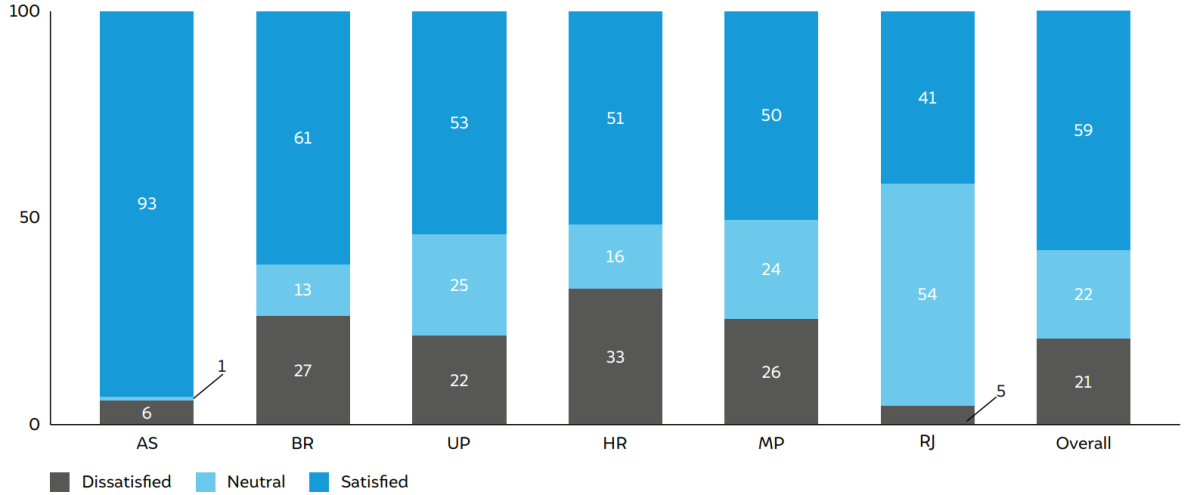

Around 60 per cent of smart meter consumers are satisfied with the technology

Source: Authors’ analysis

In 2020, the Government of India unveiled the Revamped Distribution Sector Scheme (RDSS), focused on the financial turnaround of discoms. One of the scheme’s components aims to replace 250 million conventional electricity meters with smart prepaid meters by 2025–26. The thrust for smart meter deployment is linked to their role in helping power distribution companies (discoms) improve their billing and revenue collection efficiency, while also enabling consumers to track and manage their electricity consumption and expenses.

As of February, 2023, nearly 5.5 million smart meters have been deployed in the country (NSGM 2023).1 Meeting the RDSS’s target would require deployment at a rapid scale (5.6 million smart prepaid meters per month). However, switching to universal smart metering would necessitate a change in consumer behaviour concerning the receipt and payment of electricity bills. This may involve teething issues and the risk of compromising consumer trust in the technology. A granular assessment of consumer perceptions and experience with using smart meters, especially in the prepaid mode, could be instrumental in pre-empting potential bottlenecks and ensuring the smooth transition of consumers to a new billing and payments regime.

To inform a consumer-centric deployment strategy for smart (prepaid) meters, we, the Council on Energy, Environment and Water (CEEW), conducted an independent survey of ~2,700 domestic consumers using smart meters (in the postpaid and prepaid modes). REC Limited (formerly Rural Electrification Corporation), the nodal agency for implementing the RDSS, facilitated the study by supporting engagements with discoms and helped in identifying areas with smart meter installations.

Our survey aimed to capture the consumer experience and perceived benefits of using smart meters, along with the challenges faced, if any. The survey was conducted between March and April 2022. It covered ~1,200 prepaid and ~1,500 postpaid consumers in six Indian states with the highest smart meter deployment – Assam, Bihar, Haryana, Madhya Pradesh (MP), Rajasthan, and Uttar Pradesh (UP) (Figure ES1). The surveyed consumers were sampled from 300 distribution feeders spread across 18 districts and 10 public discoms. We also interviewed relevant discom staff to understand their experiences with managing the new infrastructure.

Notwithstanding the positive outlook of many consumers on smart (prepaid) meters, we encountered several issues that adversely affect the experiences of consumers with smart meters; these problems merit the close attention of discoms.

In view of our findings, we propose the following recommendations.

How can India Scale Up Electricity Demand-side Management?

Improving Discoms’ Financial Viability

Assessing the Value of Offshore Wind for India’s Power System in 2030

Making India’s Advanced Metering Infrastructure Resilient