Suggested Citation: Sharma, Bharat, Kanika Balani, Shalu Agrawal, Paras Bhattarai, and Rashi Singh. 2023. Improving Discoms’ Financial Viability: Learnings from Uttar Haryana Bijli Vitran Nigam. New Delhi: Council on Energy, Environment and Water.

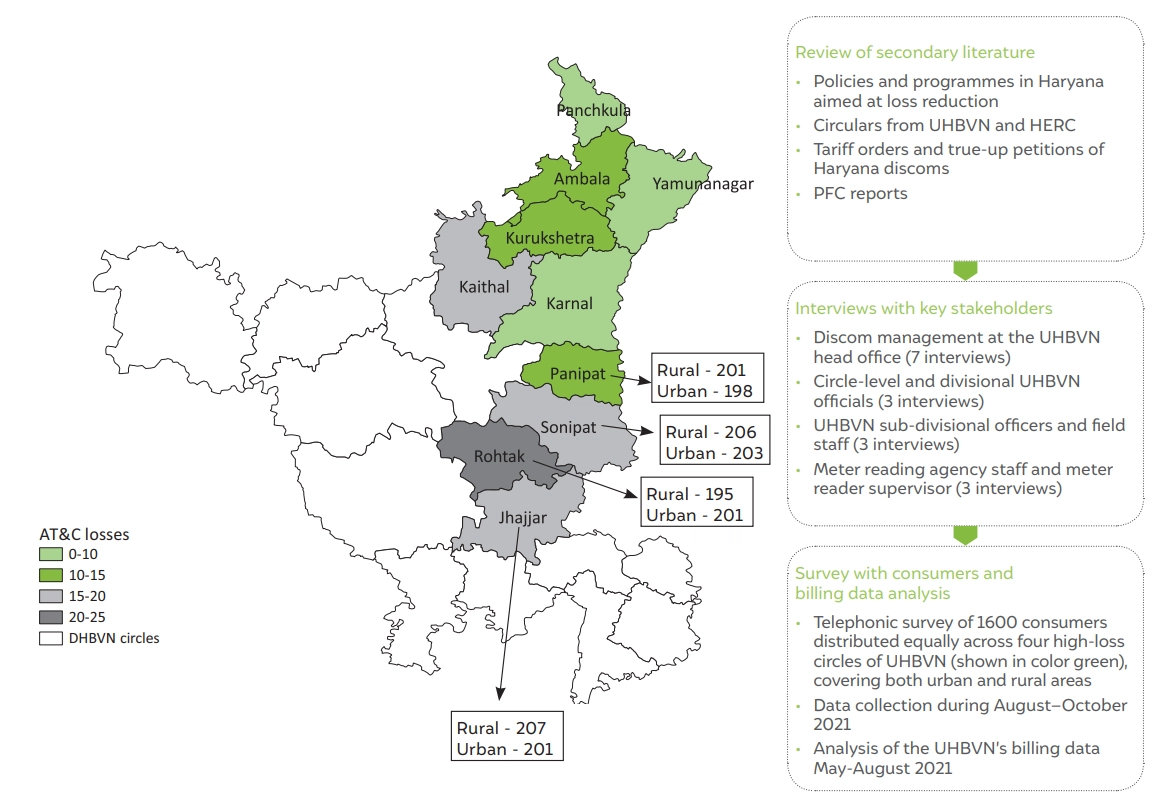

This report presents a detailed case study on the efforts of Uttar Haryana Bijli Vidyut Nigam (UHBVN) towards its financial turnaround and the remaining issues affecting discom’s operation efficiency. The study is the outcome of diverse data sources, including semi-structured interviews with key stakeholders, a primary survey of ~1,600 consumers in four high-loss circles, and a review of policies, regulations, and discom circulars in Haryana. Based on this assessment, the report also recommends measures for UHBVN, and discoms grappling with similar challenges, to reduce losses further.

India’s clean energy transition hinges on a fiscally sound power distribution sector. While the aggregate technical and commercial (AT&C) losses of state discoms have reduced to 22 per cent in Fiscal Year (FY) 2021, the performance varies, with some discoms still reporting losses above 30 per cent (PFC 2022a). However, there are discoms such as Uttar Haryana Bijli Vidyut Nigam (UHBVN), whose AT&C losses were reduced from 34 per cent in FY 2015 to 17 per cent FY 2021. UHBVN has also been consistently ranked among the top 10 state discoms since FY 2019 with an ‘A’ rating (PFC 2021b). In this context, UHBVN provides insightful learnings for discoms still struggling with high losses.

India has made tremendous progress towards a clean energy transition, with 122 GW of installed renewable capacity and near-universal household electrification (Agrawal et al. 2020; PIB 2021). However, achieving India’s recent commitment of a generation fleet comprising 50 per cent non-fossil fuel capacity by 2030 and a net zero economy by 2070 would require a fiscally sound power distribution sector (PIB 2022b). Majority of Indian power distribution companies (discoms) have been reeling from huge losses, with overall aggregate commercial and technical (AT&C) losses being 22 per cent as of fiscal year (FY) 2021 (PFC 2022a). This is despite several financial restructuring schemes, such as Scheme for Financial Restructuring of State Distribution Companies (2012) and Ujjwal Discom Assurance Yojana (2015). High losses impact discoms’ capacity to invest in network and infrastructure upgradation and build the human resource capacity essential for integrating the increasing share of renewables in the energy market as well as improving the quality of supply to consumers.

Although discoms have been making several efforts to reduce losses, it will be helpful for them to learn from some discoms that have managed to achieve a financial turnaround. In this context, Uttar Haryana Bijli Vitran Nigam (UHBVN) offers an insightful case study for discoms to draw upon. The UHBVN has not only reduced its AT&C losses by half (34 per cent to 17 per cent) between FY 2015 and FY 2021, but it has also consistently ranked among the top 10 discoms since FY 2019, with an ‘A’ rating and a negative revenue gap (PFC 2021b).

This policy brief unpacks the factors that enabled UHBVN’s financial turnaround and also reflects on the sticky issues that need redressal to improve the discom’s operational efficiency further. The study draws on diverse data sources, including semi-structured interviews with key stakeholders, a primary survey of ~1,600 consumers in four high-loss making circles of the UHBVN, and a review of policies, regulations, and discom circulars in Haryana (Figure ES1).

Figure ES1 Multi-pronged data collection method for assessment

Source: Authors’ compilation

An in-depth assessment of UHBVN’s journey through FY 2015–FY 2021, along with a review of tariff orders, discom circulars, and stakeholder discussions reveals that several combined systematic and targeted interventions contributed to the UHBVN’s improved finances and operational efficiency. These are discussed below.

Billing efficiency improved from 69.4% in FY 2015 to 82.8% in FY 2021

Collection efficiency increased from 95% in FY 2015 to 100.8% in FY 2021

Average cost of supply and Average Revenue Realised (ACS-ARR) gap dropped from INR 1.1 per unit in FY 2016 to INR 0 in FY 2018

In addition to the above-mentioned interventions, interviews with key informants reveal the major role of the leadership and support provided by political executives, UHBVN management, and state electricity regulators. For instance, measures such as performance-based incentives, transfer policies,and establishing robust communication channels between the field staff and headquarters have been instrumental in effecting operational reforms towards achieving loss reduction. The Haryana Electricity Regulatory Commission (HERC) has also been stringent in monitoring UHBVN performance and compliance with directives – for instance, the replacement of electromechanical or faulty meters.

The central government’s UDAY also unlocked discom capital for investment in infrastructure augmentation and improvement in service delivery. The overall impact of these efforts in improving the supply and service experience of consumers can be seen in the level of consumer satisfaction and complaint resolution: more than 70 per cent of the respondents in our survey, who had filed complaints in the past one year (FY2021) prior to the survey, were satisfied with the complaint resolution process. Also, 70 per cent of them had already had their complaints resolved.

Notwithstanding the significant improvements observed in UHBVN’s performance, any further loss reduction would require greater targeted efforts, especially focussed on rural domestic consumers. Our assessment of four high-loss circles in UHBVN through a consumer survey and stakeholder interviews indicates some persistent issues that require redressal. Here, we summarise key recommendations for the UHBVN. These would also be useful for discoms grappling with similar challenges.

This can be combined with a targeted GoDigital campaign designed specifically for areas with low penetration of online payments and low revenue recovery. The campaign can build on the existing momentum of digital bill payments. Considering the Revamped Distribution Sector Scheme (RDSS), UHBVN can potentially utilise such a campaign to increase consumer awareness of the benefits of shifting to prepaid smart meters and spread information regarding the utility of their smart meter mobile application.

Overall, our findings confirm that there are no silver bullets for improving the financial health of discoms. A suite of systematic interventions, concerted efforts for community engagement, and decisive leadership is what transformed UHBVN from a high-loss discom to a financially healthy one. While each discom will have a unique transition journey, by documenting lessons from UHBVN, we hope to offer salient insights for interested policymakers, discoms, and actors working towards the transformation of the power distribution sector in India.

According to the recently released “Report on Performance of Power Utilities – 2021-22”, the total accumulated losses of the state discoms was INR 5,74,220 crore at the end of FY2022.

As per the latest PFC report, losses of power utilities in Tamil Nadu, Uttar Pradesh, Rajasthan and Madhya Pradesh constitute around 61 per cent of the total accumulated losses of state discoms in FY2022.

Aggregate Technical and Commercial (AT&C) losses is a key metric to ascertain the financial health and performance of the discom. Since FY2016, AT&C losses of state discoms have reduced from 24.84 per cent to 16.51 per cent in FY2022. During this period, discoms in Haryana, Maharashtra, Assam, West Bengal, and Rajasthan have improved their financial performance and brought their AT&C losses well below 20 per cent.

Discoms continue to face financial stress due to operational inefficiencies leading to low billing and collection efficiency. Billing efficiency is the proportion of energy that has been billed (both metered and unmetered sales) to consumers w.r.t. the energy supplied to an area. Collection efficiency is the proportion of the amount that has been collected from consumers w.r.t. amount billed. While discoms have been able to improve collection efficiency, billing efficiency remains a hard nut to crack. Low billing efficiency is an outcome of both technical and non-technical losses. The former results from gaps in the quality of power distribution infrastructure, whereas the latter is an outcome of improper energy accounting due to gaps in metering and billing.

In 2020, the Ministry of Power launched the Revamped Distribution Sector Scheme to support discoms in loss reduction through the upgradation of distribution infrastructure and replace 250 million conventional meters with smart prepaid meters across states by FY2025. Smart prepaid metering would be helpful in curbing inefficiencies in billing, ensuring timely revenue recovery and enhancing consumer control over their consumption. However, as the recent CEEW study on smart meters suggests, extensive consumer engagement, building capabilities for data analysis and state-specific regulations on smart prepaid meters would be essential for leveraging smart prepaid meters for the improved financial health of discoms and enhanced consumer experience.

How can India Scale Up Electricity Demand-side Management?

Assessing the Value of Offshore Wind for India’s Power System in 2030

Making India’s Advanced Metering Infrastructure Resilient

Enabling a Consumer-centric Smart Metering Transition in India