Report

Greening India’s Financial Market

How Green Bonds Can Drive Clean Energy Deployment

Arunabha Ghosh, Kanika Chawla, Anjali Jaiswal, Sameer Kwarta, Meredith Connolly, Nehmat Kaur, Bhaskar Deol, Anna Mance, Douglas Smis, Sarah Dougherty, Jeff Schub and Rog Youngs

April 2016 | Sustainable Finance

Suggested citation: Ghosh, Arunabha, Kanika Chawla, Anjali Jaiswal, Sameer Kwarta, Meredith Connolly, Nehmat Kaur, Bhaskar Deol, Anna Mance, Douglas Smis, Sarah Dougherty, Jeff Schub and Rog Youngs. 2016. Greening India’s Financial Market - How Green Bonds Can Drive Clean Energy Deployment. New Delhi; New York: Council on Energy, Environment and Water and Natural Resources Defense Council.

Overview

This report, in collaboration with Natural Resource Defence Council (NRDC) and Indian Renewable Energy Development Agency (IREDA), analyses how green bonds can be an effective vehicle to raise capital for renewable energy projects. Green bonds are an effective vehicle to raise capital for renewable energy projects and help in meeting environmental targets of the investors and climate targets of the Government of India. The report also provides an overview of green bonds in India and various strategies to strengthen India’s market. Further, it recommends roles for government agencies, domestic financiers, industry stakeholders, and clean energy experts that can support the scale-up of green bonds in India.

This report is a part of the India Clean Energy Finance series which also includes Reenergising India’s Solar Energy Market through Financing, A Second Wind for India’s Energy MarketFinancing Mechanisms to Support India’s National Wind Energy Mission, Greening India’s Financial Market: Opportunities for a Green Bank in India.

Key highlights

- India’s aim is to install 175 GW of renewable energy by 2022, which will require an estimated USD 264 billion. Green bonds could support deployment of renewable energy projects by providing broader access to domestic and foreign capital.

- Green bonds provide lower cost and stable funding opportunities for renewable energy projects while offering a similar risk-return profile compared to traditional bonds.

- Within a year of India’s first green bond issuances by public and private banks, three private corporations issued their own green bonds. This demonstrated the market’s quick maturation and diversification into the corporate sector.

- A high level of oversubscription of green bonds in India as compared to non-green issuances showed significant demand and growth opportunity of green bonds to mobilise finance in India.

- Green bonds provide low-cost financing by providing lower interest rates than typical domestic clean energy project financing and by being cost-competitive as compared to other corporate bonds.

- An important policy option to insulate international investors from currency depreciation is to provide dollar-denominated contracts, funded through a national cess (tax).

- Certifying government bonds through an accepted green standard will increase the reach of the issuing government to institutional and even international investors.

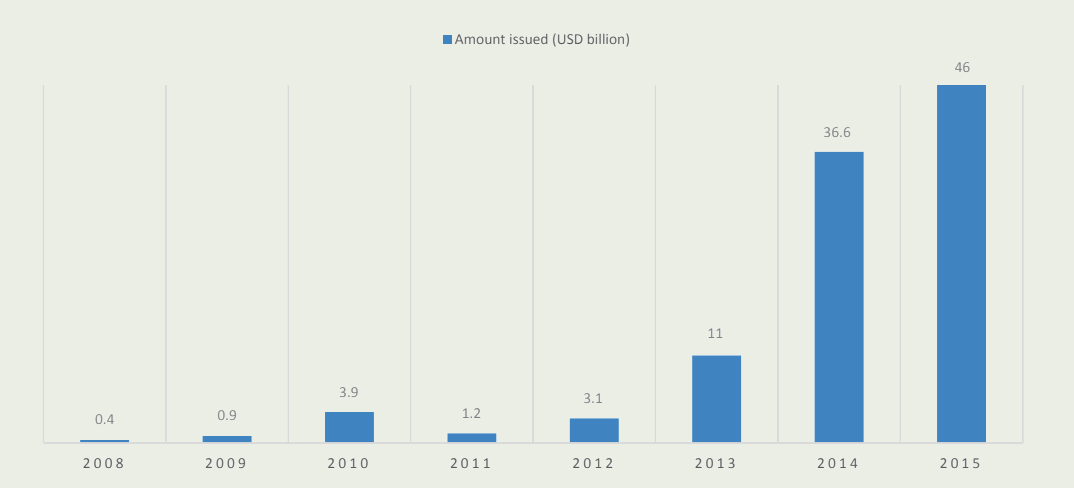

Issuance of Green Bonds Globally

Source: NRDC with data from Climate Bonds Initiative

Key recommendations

- Provide a support mechanism to grow green bonds market in India and internationally, through a Green Bond Market Development Committee and the International Solar Alliance.

- Reduce the cost of capital, stimulate demand from institutional and retail investors, and expand the issue bars to strengthen the green bonds market in India.

- Organise workshops, training content, and webinars on green bonds to increase familiarity and bring in new investors.

- Simplify and standardise the issuance and compliance process to increase transparency and reach to new investors in India and internationally.

- Lead efforts to develop rupee-denominated green bonds that open access to new sets of international investors for India’s clean energy projects. This can be initiated by the Ministry of Finance and Reserve Bank of India.

India’s green bond investments raised INR 79 billion ($1.2 billion) in 2015, which showcased growth in momentum in its debut year.