Issue Brief

Growing Clean Energy Markets in India with Green Windows

Poonam Sandhu, Sameer Kwatra, Arjun Dutt, Kanika Chawla

January 2020 | Sustainable Finance

Suggested citation: Natural Resources Defense Council and Council on Energy, Environment and Water. 2020. Growing Clean Energy Markets in India with Green Windows. New Delhi: Natural Resources Defense Council and Council on Energy, Environment and Water.

Overview

This issue brief with The Natural Resources Defense Council (NRDC) and supported by Indian Renewable Energy Development Agency (IREDA) describes the Green Window concept, its operationalisation, and market impact in India. It discusses the role of catalytic finance in crowding in private sector capital and thereby accelerating the flow of investment towards financially underserved clean energy markets. The brief also quantifies the impact of catalytic finance in terms of mobilising capital, highlighting the advantages of such financing approaches versus traditional lending. Further, it also outlines primary potential sources of capitalising such financing mechanisms in the Indian context.

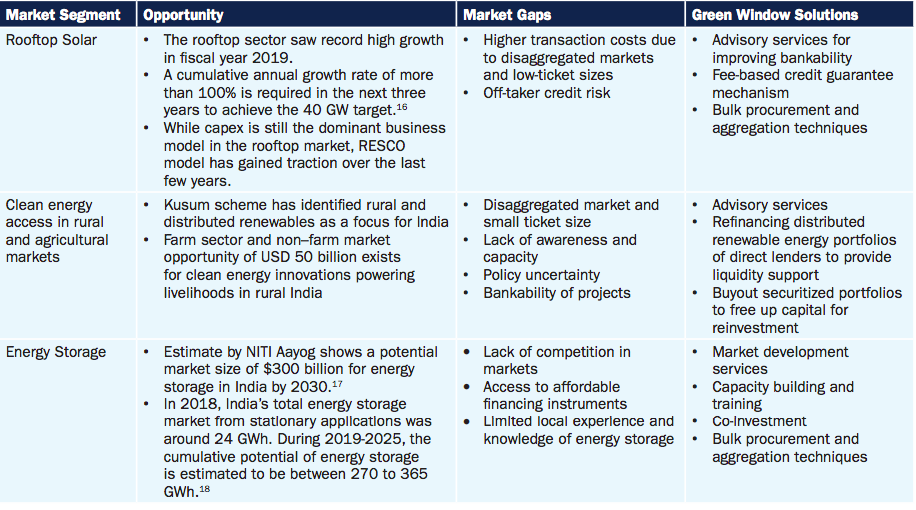

Select clean energy market segments and indicative catalytic solutions that the Green Window can provide

Key highlights

- Green windows, which are institutional clean energy finance solutions, can have a transformative impact in catalysing clean energy investment and spur market growth.

- The approach positions public finance as an activator of greater private investment for mission-defined sectors by using strategies such as risk mitigation, aggregation of small projects to diversify risk and to scale, strategic public-private co-investments, demonstration projects and market development activities.

- Each Green Window will have an expert team with access to a dedicated limited pool of low-cost capital that can be leveraged to attract private investment for clean energy.

- Green Windows can amplify the impact on clean energy markets by expanding clean energy investment, attracting international capital, developing underserved clean energy market segments, providing market developing service, and by helping to meet and exceed India’s climate goals.

- The Green Window can attract more private capital at affordable rates through credit enhancements.

- It can directly invest in clean energy projects— through senior or subordinated debt—in partnership with private investors for new technology projects that private capital would shy away from.

- It can underwrite loans and build portfolios of small distributed energy resources (DER) projects that have high transaction costs relative to their value.

- Based on the needs of the Indian market and learning from global best practices, the Green Window could focus on supporting projects that contribute to low-carbon infrastructure and climate-related goals.

- The key capital providers who could potentially provide capital to Green Windows in India include the Green Climate Funds and other climate funds, development banks, impact investments, philanthropic sources, and recurring public charges for protecting the environment.

- A $50 million commitment for seed funding in a Green Window, in the form of government or public financial institution equity, can mobilize up to $3.2 billion in total investments over 10 years. It can help create a self-sustaining clean energy market in India.

- With this expected investment, for 2019 to 2030, as much as 43 million tons of CO2 can be avoided because of Green Window investments accelerating public and private investment in clean energy.

A $50 million commitment for seed funding in a Green Window, in the form of government or public financial institution equity, can mobilize up to $3.2 billion in total investments over 10 years.