Paper

Investment in Technologies of Today

Increasing Flows of Finance into Developing Countries

Arjun Dutt, Arunabha Ghosh, Gagan Sidhu

May 2022 | International Cooperation, Sustainable Finance

Suggested Citation: Dutt, Arjun, Arunabha Ghosh and Gagan Sidhu. 2022. Investment in technologies of today: the need and ways to increase flows of finance into developing countries. Stockholm+50 background paper series. Stockholm Environment Institute, Stockholm.

Overview

This paper, in collaboration with the Stockholm Environment Institute, analyses the capacity of developing countries’ financial systems to fund the deployment of sustainable technologies consistent with sustainable development trajectories. Highlighting existing constraints, the paper outlines the role of financial instruments and financial regulations in addressing existing bottlenecks to the flow of capital. Building upon the solutions identified, the paper examines the role of both domestic policy and multilateralism in implementing these solutions.

Key Highlights

- ‘Technologies of today’ are those that have demonstrated technological viability and achieved commercially viable deployment in some developed countries. However, they remain at varying levels of commercial viability in developing countries.

- While attracting investments for commercially viable technologies by itself is not challenging, mobilising them at the scale dictated by long-term decarbonisation trajectories is the issue.

Developing countries are disadvantaged in mobilising investments for sustainability

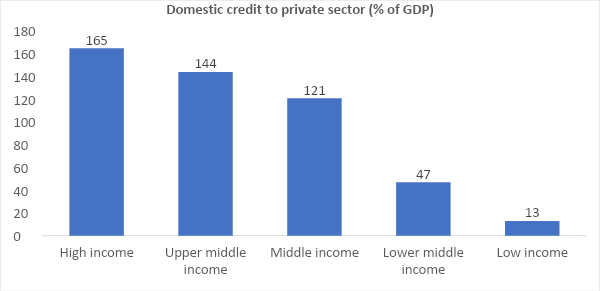

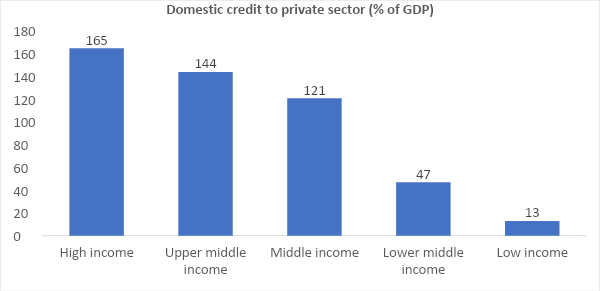

Source: CEEW compilation based on data sourced from World Bank

- In contrast to commercially viable technologies, financially underserved technology segments have not succeeded in attracting the initial large-scale flow of finance.

- Most sampled households (60 per cent) underestimate their AC use on average by 4 hours, while the rest over-estimated usage, typically by 2.5 hours. Most people tend to wrongly estimate their energy consumption, and hence have poor data to optimise their usage.

- For market segments in which policy and regulation are major barriers, instituting supportive policies can unlock the inherent competitiveness of the technology.

- For market segments in which limited track records of technology performance or business models are major barriers, the de-risking of investment opportunities is essential in order to kick-start the flow of finance at scale.

- The end use of investment in what qualifies as sustainable technologies manifests most often in the form of finance for physical infrastructure which is typically majority debt financed. The capacity of domestic financial systems to cater to the debt financing needs of an economy’s sustainability transformation is thus critical.

- The domestic financial systems of developing economies are ill-equipped to support the needs of an economy-wide sustainability transformation. World Bank data indicates that the lower the income level, the greater the disadvantage when it comes to mobilising much needed credit for investment.

- Domestic financial systems of developing countries are also usually not well-equipped to catalyse investment flows in financially underserved segments. Such segments require patient capital, typically drawn from public sources, to underwrite risks and crowd in private capital. Given the weaker state of public finances in developing countries, they have limited capacity to deploy necessary public capital.

Key Recommendations

- Catalytic finance: As many developing countries by themselves do not possess the wherewithal to de-risk financially underserved investment opportunities, the pooling together of risks across countries and their de-risking through a common fund represents one possible solution.

- Financial and fiscal regulation: Private sector investments in low-carbon technologies in developing countries have thus far largely been shaped by sectoral policies and regulations. Financial and fiscal regulation offer other routes to complement sectoral regulation in directing capital flows towards sustainability. Some levers include:

- Institute taxonomies of sustainable activities: This kind of classification system, with specific performance thresholds, establishes a list of sustainable activities. By reducing the risk of greenwashing, it supports the linking of international capital with a credible pipeline of projects. The specific socio-economic contexts of developing countries could also be weaved into taxonomies.

- Mandate corporate sustainability disclosures: While taxonomies facilitate due diligence for sustainability investors at the activity or asset level, corporate climate-related disclosures can do so for investments at the corporate level. Such disclosures may incorporate two basic dimensions – impact of businesses on the climate and impact of climate change on businesses. It could be broadened to environmental, social and governance (ESG) related factors.

- Price externalities associated with unsustainable economic activities: Regulation can also help direct capital flows towards sustainability by penalising the negative externalities associated with unsustainable economic activities. These include carbon pricing initiatives,. sustainability-linked credit ratings, and regulations that mandate pricing environmental and social factors into credit ratings.

- Introduce sustainability-linked lending and investment mandates: Mandates for a minimum allocation of lending portfolios of banks and non-bank financial institutions, pension funds and mutual funds to SDG-compliant activities, could accelerate the shift of investment flows towards sustainability.

- Role of multilateralism: While domestic policies should institutionalise the aforementioned solutions in developing countries, multilateralism could be a key enabler for accelerating capital flows towards sustainability in developing countries in the following ways:

- Bolstering catalytic finance capabilities: Climate finance support provided to developing countries under the UNFCCC could become a means to considerably enhance catalytic finance capabilities. By de-risking investment opportunities for private capital, catalytic finance would, in turn, maximise the impact of climate finance support.

- Harmonising international sustainable financial regulation: Coordination between financial regulators through multilateral forums such as the International Platform on Sustainable Finance (IPSF), Network of Central Banks and Supervisors for Greening the Financial System (NGFS) and the Taskforce on Climate-related Financial Disclosures (TCFD) could facilitate the harmonisation of global sustainable finance regulations.

- Enabling carbon pricing mechanisms: International carbon offsets have played the role of enablers of several carbon pricing initiatives. Among developing countries, obligated entities in South Africa and Colombia are permitted to use certified emission reductions (CERs) for meeting a part of their obligations. The finalisation of the implementation guidelines of Article 6 of the Paris Agreement at COP26 could enable larger-scale trading of credits. These could facilitate the setting up of more carbon pricing initiatives going forward in developing countries.

‘Technologies of today’ are those that have demonstrated technological viability and achieved commercially viable deployment in some developed countries. However, they remain at varying levels of commercial viability in developing countries.