Jain, Abhishek, Wase Khalid, and Shruti Jindal. 2023. Decentralised Renewable Energy Technologies for Sustainable Livelihoods: Market, Viability, and Impact Potential in India. New Delhi: Council on Energy, Environment and Water.

Key stakeholders are now starting to recognise the potential of using decentralised renewable energy (DRE) technologies such as dryers, silk-reeling machines, vertical fodder grow units, and others to transform India’s rural economy. But several questions on their market potential, viability and impact are also emerging. As part of the Powering Livelihoods programme, this study examines and answers these questions that are emerging as the sector is in its nascent stage while also evolving rapidly. The questions from stakeholders such as government officials, philanthropic funders, investors, financiers, think tanks, incubators, entrepreneurs, and users include the following:

DRE livelihood technologies provide a significant opportunity to impact tens of millions of livelihoods across the country. The study recommends that sector stakeholders must extend context-specific support to mainstream DRE livelihoods while appreciating the relative impact potential and the factors guiding the financing, business, and stakeholder engagement models.

India needs to generate 90 million jobs by 2030 (Sankhe et al. 2020). Simultaneously, it needs to rapidly transition its economy to a low-carbon and resilient one, in line with the national commitments on climate action. While deploying large-scale renewables and transitioning to green hydrogen will create more jobs, these will not be sufficient to productively engage the more-than-a-million additional youth reaching employable age every month (Mallapur 2018). We need much more entrepreneurship, livelihood opportunities, and jobs that are economically rewarding, environmentally sustainable, and socially equitable.

One solution to increase livelihood opportunities is to power microenterprises across India through clean energy. Energy-efficient technologies powered by decentralised renewables can help enhance the incomes and resilience of many of India’s more than 60 million microenterprises while fostering climate action (MoMSME 2022). Recognising the unique opportunity that such DRE–based livelihood technologies pose, the Ministry of New and Renewable Energy, Government of India, released a dedicated policy framework titled Framework for Promotion of Decentralised Renewable Energy Livelihood Applications (MNRE 2022).

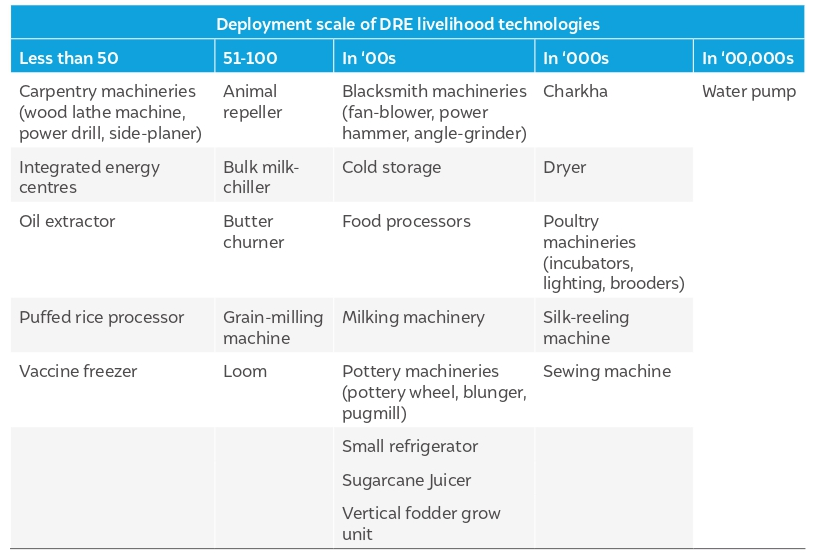

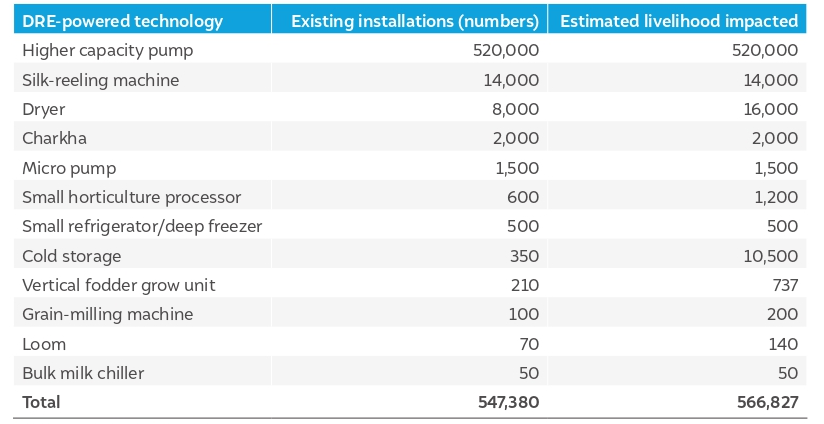

In recent years, many livelihood technologies have emerged that are highly energy efficient and designed to run with DRE sources, from solar-powered looms and charkhas to solarpowered cold storages, solar dryers, and solar-powered vertical fodder grow units (SELCO 2021). While many of these technologies are already being sold commercially, some are being supported via grants and philanthropy to enable adoption among end customers. Others are in development or being tested under technical pilots. Based on our mapping of these technologies, Table ES1 presents the broad landscape of DRE livelihood technologies in the country. The aim is not to be exhaustive but to indicate the broad spectrum of technologies and their commercial maturity.

Source: Authors’ Analysis

Table ES1 Few DRE livelihood technologies have scaled to reach thousands of users

Source: Authors’ compilation

Image: CEEW

Maitree Mahila Mandal Samiti, a dairy and agriculture producer company (PC), employs over 8,000 rural women from Dooni village in Rajasthan. The purchase of solar refrigerators gave them a consistent electricity supply, which helped increase the shelf life of dairy and other perishable products as well as save on electricity bills.

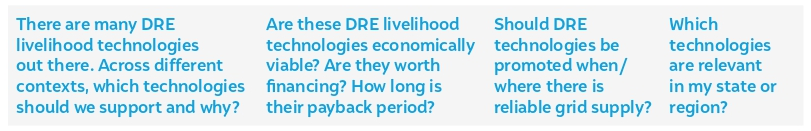

As a rapidly evolving sector that is still in its early stages, stakeholders who are trying to engage, support, or promote these DRE livelihood technologies – including policymakers, bankers, financiers, donor, enterprises, incubators, and development sector professionals – are often confronted with the following questions:

Our report answers these questions. In the process, we propose a framework that can help us navigate the DRE livelihoods landscape, even as technologies and markets evolve over time.

To answer these emerging questions, we use an impact-feasibility framework.

We define impact as the number of livelihoods a DRE livelihood technology can positively impact in a given region. In some ways, it pertains to the ‘scale of impact’.

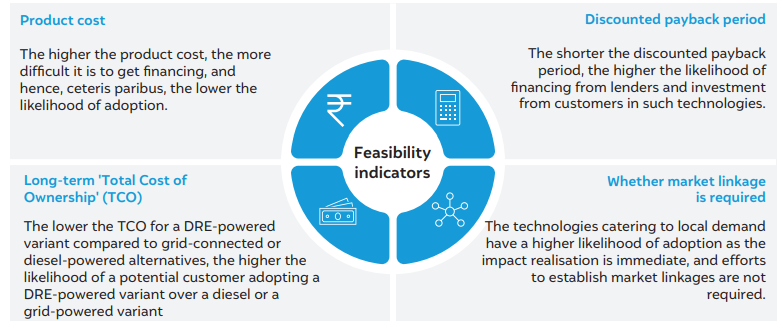

We define feasibility as the likelihood of realising the impact. It is essentially a measure of how feasible it is to realise the impact that the DRE livelihood technology promises. We assess feasibility through a combination of indicators.

Based on this framework, we undertook a comparative assessment of the DRE livelihood technologies that have achieved commercial maturity (in the agriculture and textile sectors). The findings around these 12 commercially-mature technologies are discussed below.

Figure ES1 Feasibility assessment indicators

Source: Authors’ compilation

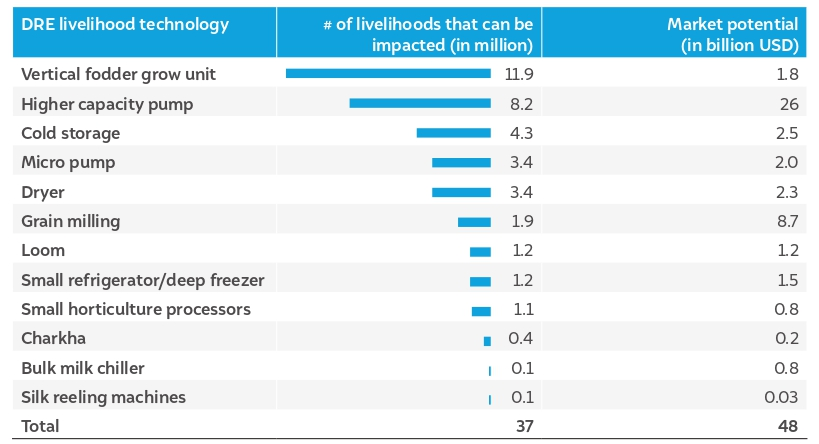

The twelve mature DRE livelihood technologies collectively have the potential to impact 37 million livelihoods This livelihood impact potential translates into a revenue opportunity worth USD 48 billion for enterprises deploying and commercialising such technologies. The number of current deployments of these technologies and associative livelihood impact are also summarised in the Table ES2.

Table ES2 The 12 mature DRE livelihood technologies have already impacted more than 566,000 livelihoods across India

Source: Authors’ compilation

Solar-powered pumps—higher capacity and micro-pumps— have the maximum deployment potential, followed by solar-powered vertical fodder growing units and solar dryers. Collectively, these four technologies alone can impact around 27 million livelihoods. Unsurprisingly, solar pumps are the most mature among these technologies due to the government subsidy programmes supporting them since 2015. We summarise the estimated livelihood potential of each such technology in Table ES3.

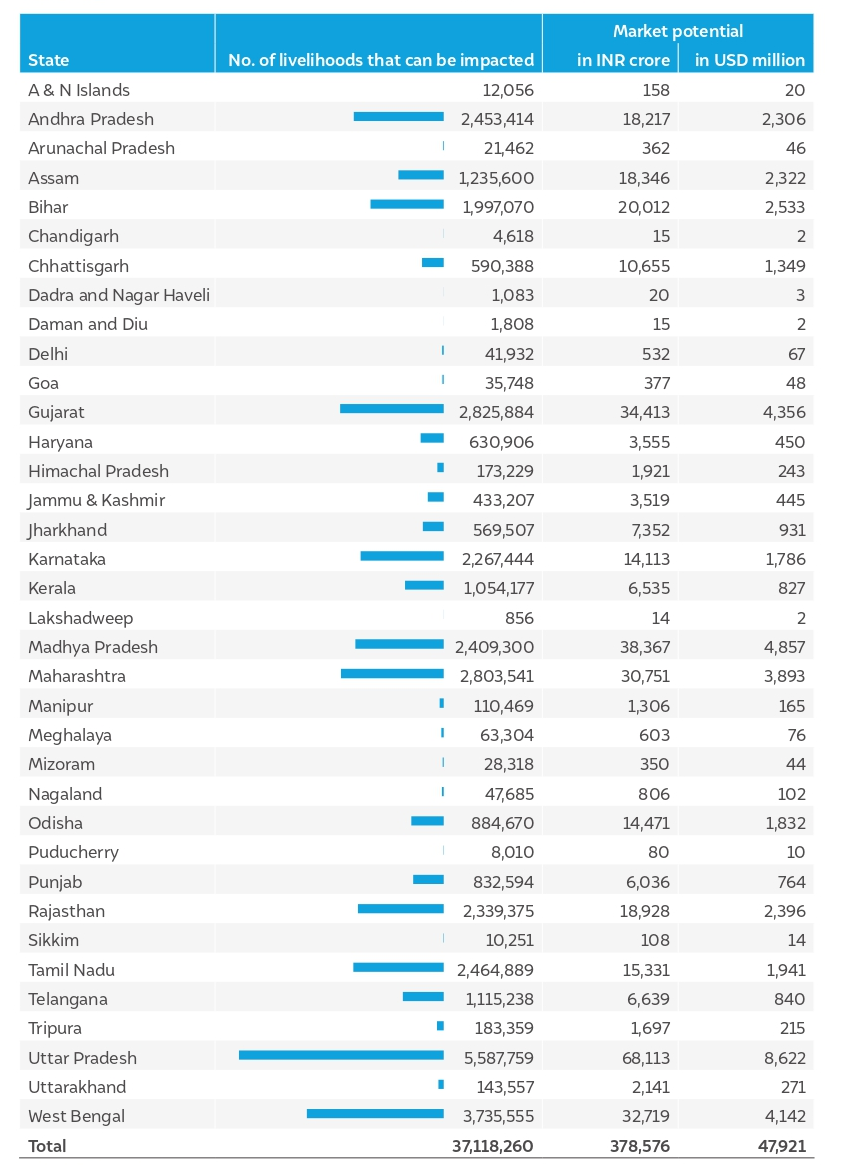

The DRE livelihood technologies have the greatest impact opportunity in Uttar Pradesh, the state with the highest population in the country. It is followed by West Bengal, Bihar, Gujarat, Maharashtra, Madhya Pradesh, and Karnataka. Table ES4 shows the distribution of market potential and livelihood impact potential among Indian states.

Table ES3 The 12 mature DRE livelihood technologies have the potential to impact 37 million livelihoods across India

Source: Authors’ compilation

Table ES4 State-wise distribution of market and impact potential

Source: Authors’ compilation

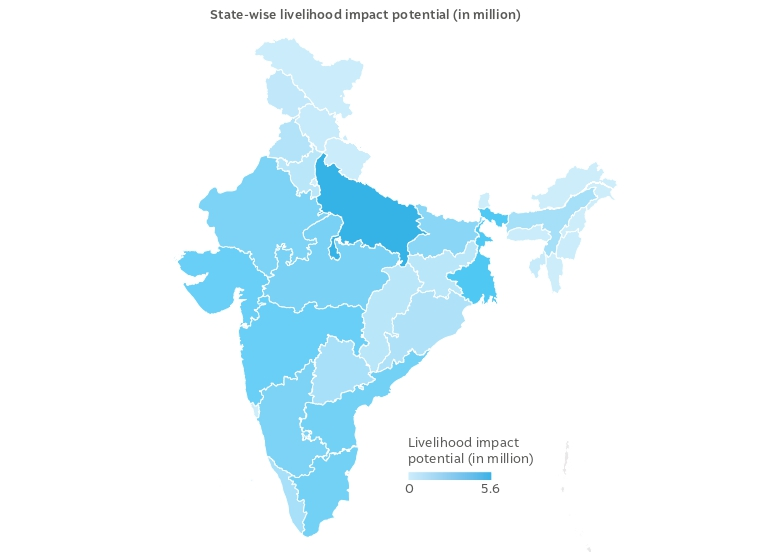

Additionally, the relative market for each DRE livelihood technology varies across states. For example, micro solar pumps have the highest market in West Bengal, whereas solar dryers have the highest market in Maharashtra. The relative impact potential of these DRE livelihood technologies across Indian states is shown in Figure ES2.

Figure ES2 Uttar Pradesh has the greatest impact opportunity for DRE livelihood technologies

Source: Authors’ compilation

Note: State-wise market potential estimates for DRE livelihood technologies is available here

Image: CEEW

Shivraj Singh Chouhan from Kanpur Dehat, Uttar Pradesh, earns a monthly income of INR 5 lakh through drying flowers using solar dryers. He sources flowers from more than 100 farmers to dry them in solar dryers.

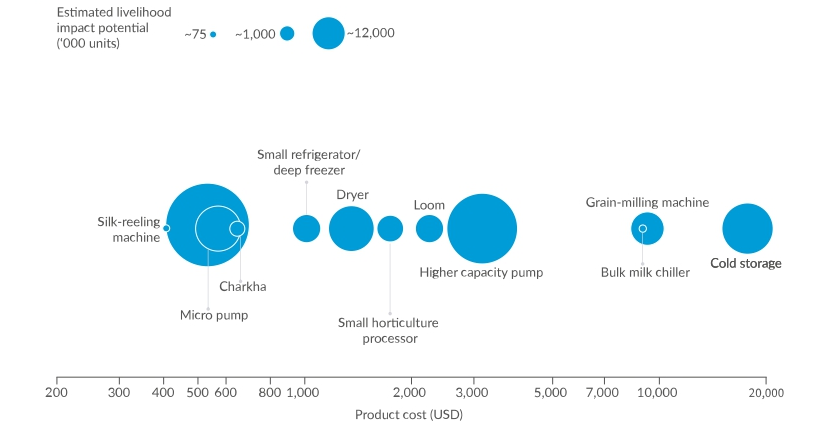

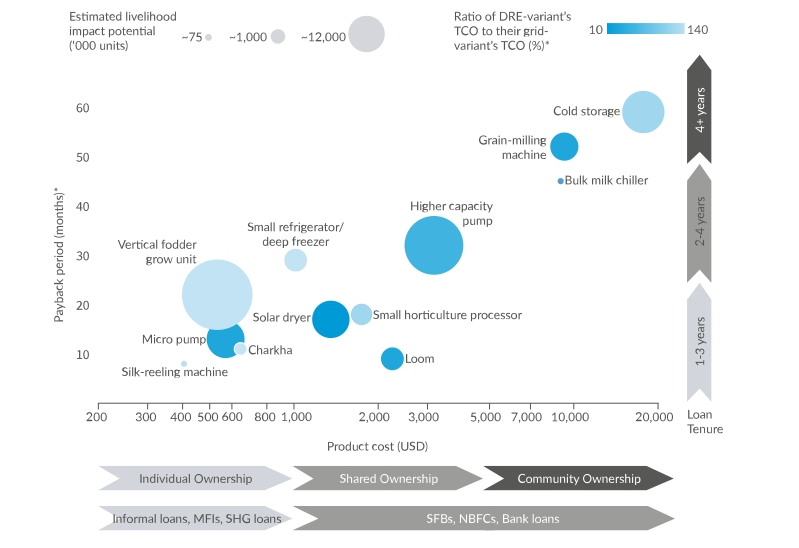

Next, we add our feasibility indicators to the impact potential to understand the relative ease of enabling the adoption of such technologies among potential customers. First, we plot the livelihood impact potential against the typical product cost1 (Figure ES3). Please note that the product-cost axis is in the log scale and that we are considering the product costs of the most popular variants of these technologies. Of course, the product costs vary across product capacities and different manufacturers, but the broader order of magnitude and the relative cost trends among technologies remain, as shown in Figure ES3. Products on the left end of the spectrum, such as solar-powered silk-reeling machines and micro solar pumps, would have a relatively higher likelihood of adoption than those on the other end, such as solar-powered bulk milk chillers and solar-powered cold storages. We understand this is a broad generalisation, and there could be several exceptions; we add nuances as we proceed further in the discussion.

Figure ES3 DRE livelihood technologies cost between INR 25,000 - INR 1,400,000

Source: Authors’ compilation

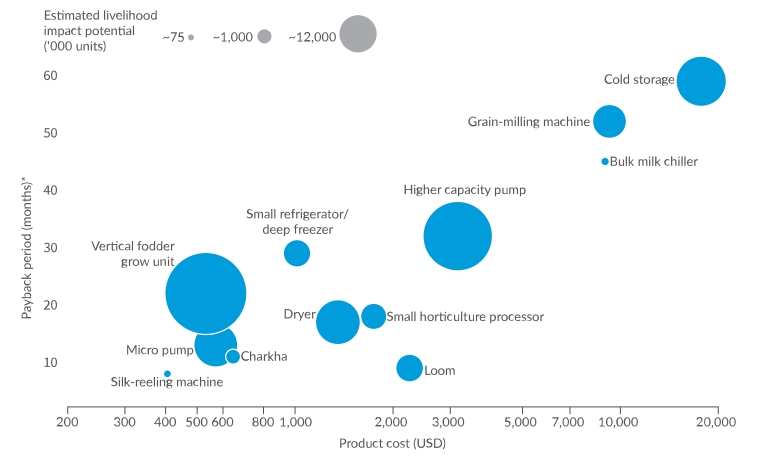

Next, on the same plot, we add another dimension to assess the feasibility aspect – the typical discounted payback periods of the respective DRE livelihood technologies. The relative location of each technology bubble along the Y-axis is now determined by its typical discounted payback period, as shown in Figure ES4. The products lower on the Y-axis, i.e., having shorter discounted payback periods, are more likely to find traction among the end-users and financiers. We also observe a broad positive association between the product’s unit cost and the discounted payback period. Costlier DRE livelihood technologies have longer payback periods. However, there are notable exceptions, such as solar-powered looms and solar-powered small horticulture processors. It is worth noting that the payback periods are estimated based on the typical (median) reported income increase by the end-users of these technologies through impact assessment surveys and customer interviews conducted by CEEW. The income increase itself has significant variation based on the context of use. For instance, solar-powered cold storage used to store potatoes would generate a very different income profile than one used to store high-value commodities such as lemons. So, the payback periods are indicative and used to broadly understand the relative trends across technologies.

Figure ES4 Technologies with shorter payback periods may find more traction among users and financiers

Source: Authors’ compilation

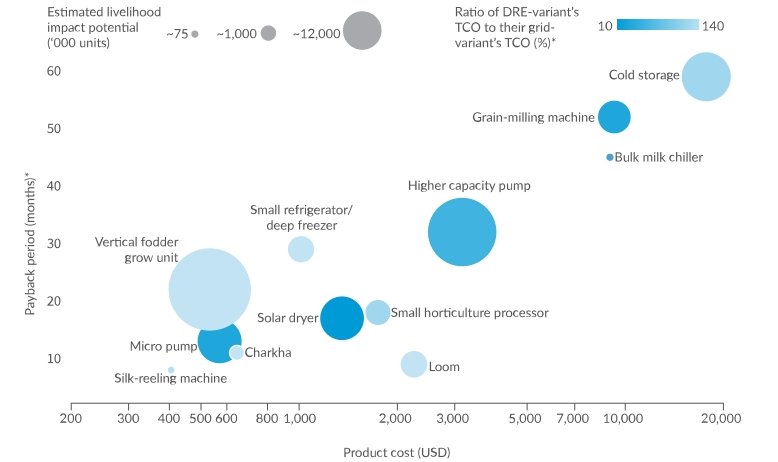

Next, we add another feasibility dimension to the same plot: the TCO for ten years of operations compared to grid alternative2 , represented by the colour of the bubbles in Figure ES5. The darker the bubble’s shade, the lower the long-term cost of the DRE variant compared to the grid alternative. It indicates that DRE livelihood technologies such as solar dryers, and solar-powered looms are highly attractive economically, even in areas with reliable grid supply. By contrast, for technologies such as small solar refrigerators, solar-powered horticulture processors, or solarpowered cold storages, their DRE variant saves costs only marginally over a 10-year period as compared to their grid alternative. However, over a 15-year investment horizon, the DRE variants of such technologies become much more attractive than their grid alternatives. So, if an end user is considering a business horizon of 10+ years, the DRE livelihood technologies could be economically more attractive, even if the grid is reliable.

Figure ES5 Solar dryers, fodder-growing units, and looms are highly economically attractive than their grid variants

Source: Authors’ compilation

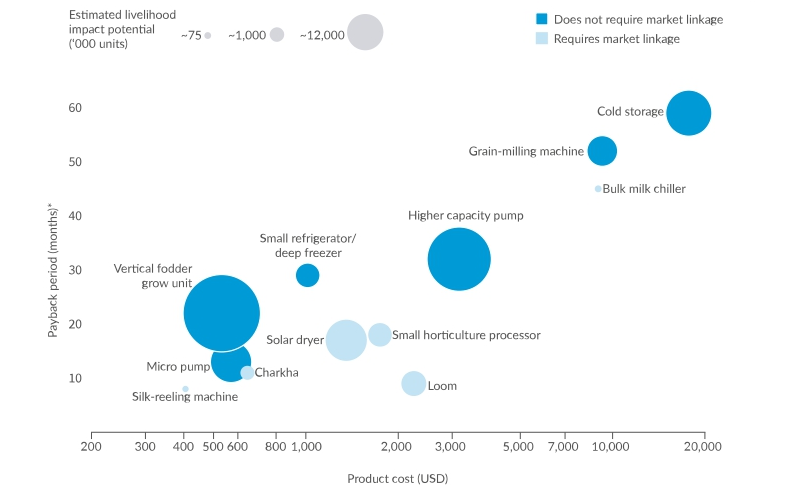

Finally, instead of colouring the bubbles with the comparative costs of the grid alternatives, we colour the bubbles based on whether the DRE livelihood technologies need an explicit market linkage to be viable. As shown in Figure ES6, the products with the darker shade (i.e., which do not need a market linkage) would have lower barriers to adoption, ceteris paribus.

Figure ES6 DRE livelihood technologies for local demands may experience better adoption

Source: Authors’ compilation

Image: CEEW/Emotive Lens

Kuni Dehury from Keonjhar, Odisha has enhanced here monthly income from INR 1,500 to 6,000 using solar-powered silk reeling machines. Additionally, she has trained more than 500 women on using solar-powered silk reeling machines.

Figure ES7 The product cost and payback period can help guide ownership models, source of financing, and loan tenures

Source: Authors’ compilation

Apart from identifying technologies with high impact potential and feasibility, the impactfeasibility framework also helps to strategise the business, financing, and stakeholderengagement models for these DRE livelihood technologies. For instance, as shown in Figure ES7, as the value of the products increases, the ownership model for these technologies would likely shift from individual users to community/farmer groups. Similarly, the financiers for such technologies would change from Microfinance institutions (MFIs) and Small Finance Banks (SFBs) on the left end of the spectrum to larger Non-Banking Financial Companies (NBFCs) and banks on the right. Similarly, the location of these bubbles on the Y-axis (i.e., the typical discounted-payback periods) can help financiers devise relevant financial products with appropriate loan tenures to match the typical payback periods, as the technologies move up the Y-axis, longer tenure loans are needed to make the financing viable.

The analysis and key findings that emerge would generally help sector stakeholders make more informed decisions about which products to support in different contexts. They would also help the stakeholders appreciate the relative impact potential and the feasibility of the various DRE livelihood technologies. However, it is important to reiterate that this broad sector-wide analysis does not conclude the viability of each individual installation in its particular context. The factors that would play an important role in determining the contextspecific viability of these technologies are:

The results of the scenario/sensitivity analysis around these factors for each of the twelve mature DRE livelihood technologies are discussed in the section below. It may help stakeholders make more informed choices based on the specific contexts in which they plan to support the deployment of DRE livelihood technologies.

DRE livelihood technologies provide a significant opportunity to impact tens of millions of livelihoods across the country. Sector stakeholders – policymakers, financiers, investors, technology distributors, and manufacturers – must extend context-specific support to mainstream DRE livelihoods while appreciating the relative impact potential and the factors guiding the financing, business, and stakeholder-engagement models.

Enabling a Circular Economy in India’s Solar Industry

Mapping India’s Residential Rooftop Solar PotentialA bottom-up assessment using primary data

Community Solar for Advancing Power Sector Reforms and the Net-Zero Goals

Promoting the Use of LPG for Household Cooking in Developing Countries