Suggested Citation: Tyagi, Akanksha and Neeraj Kuldeep. 2021. How India can Manage Solar Photovoltaic Module Waste Better: Learnings from Global Best Practices. New Delhi: Council on Energy, Environment and Water.

This policy brief captures the Indian and international policy landscape of PV module waste management to outline some immediate interventions needed in India to prepare for this issue. The recommendations are guided by a thorough review of the recycling processes and globally implemented regulatory and voluntary mechanisms to manage PV module waste.

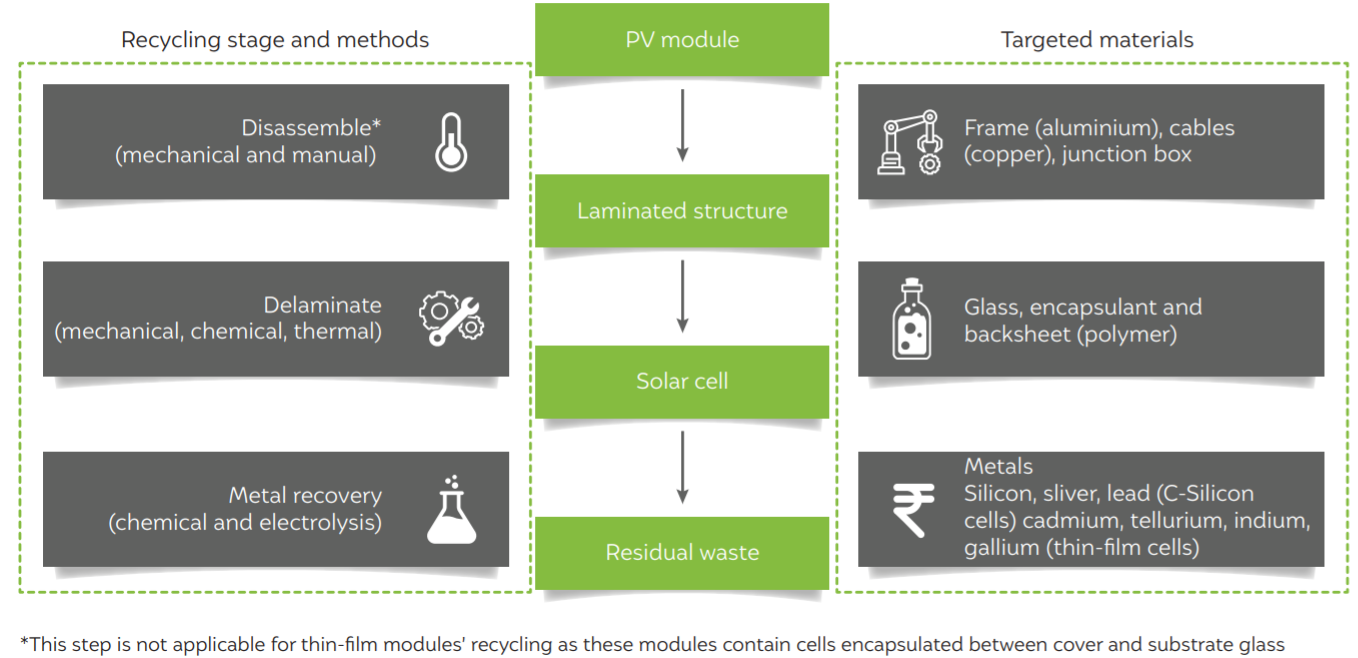

PV module recycling is a multistep process

Source: Authors’ analysis

Solar photovoltaic (PV) technology will play a critical role in India’s clean energy transition. The phenomenal rise in annual deployments over the past five years has powered solar to reach a cumulative capacity of 40 GW. However, with rapid deployments arises the issue of waste management of the PV modules. The International Renewable Energy Agency (IRENA) estimates the global PV waste will touch 78 million tonnes by 2050, with India being one of the top five PV waste creators.

This policy brief captures the Indian and international policy landscape of PV module waste management. First, we delve deep into the multidimensional impacts of the PV module waste. It is followed by a review of the technology landscape of recycling processes and a listing of some commercialised programmes. Then we review the globally implemented regulatory and voluntary mechanisms to manage PV module waste. Lastly, we outline some immediate interventions for India to prepare for the systematic and responsible management of PV module waste.

A responsible management of PV module waste and efficient recovery of different components would prevent the leaching of various toxic elements into the environment and render them available for the manufacturing industry. PV module recycling is a multistep process involving dismantling, delamination, and metal recovery. Several techniques are available to recover the intrinsic components in the PV modules. Some of these, like chemical delamination, yield undamaged solar cells, which could be reused directly or with little refurbishing. Mechanical and combustion delamination, on the contrary, yields damaged solar cells that are treated electrochemically or metallurgically to recover the metals.

Globally, only a few regulations cover PV modules in any waste category. The European Union (EU) is the first to revise its Waste Electrical and Electronic Equipment (WEEE) legislation and bring PV modules under its ambit. It also provides some financing mechanisms to cover the waste management costs. The solar industry is also gradually focusing on waste management. PV Cycle and First Solar are the two renowned PV module recycling initiatives, promising more than 90 per cent of the recycling yield. PV Cycle is a not-for-profit organisation of module manufacturers providing regional compliance services to its members. First Solar, a US-based PV module manufacturer, runs an in-house thin-film recycling programme.

These international developments provide many learnings for India. Our research outlines the following priority areas for policymakers and industry to tackle the issue of PV module waste.

Policymakers should:

1. introduce a ban on dumping of waste modules by different entities in the landfills;

2. formulate a dedicated PV module waste management regulation; and

3. introduce incentives like green certificates to provide a level-playing field and encourage recycling and mineral recovery by the industry.

The industry needs to do the following:

1. improve the PV module design to minimise the waste at the disposal stage. This can include sustainable design with reduced use of toxic minerals or adopting a ‘design to disassemble’ approach

2. invest in the second-life use of sub-standard modules to delay the waste creation

3. collaborate with research institutes to develop recycling techniques and support pilot demonstrations

4. conceptualise new business models to manage and finance the waste disposal

“As distributed renewable energy sources such as solar PV and energy storage penetrate deep into the Indian electricity sector it is necessary to prepare for managing the waste generated from these technologies. In addition to being environmentally benign, the ‘reduce, reuse, and recover’ approach offers multiple socio-economic co-benefits” (A. Tyagi 2020). The recovery of the precious minerals present in the modules can support the domestic manufacturing industry and improve its self-sufficiency. The informal sector, if institutionalised and roped into PV module waste management, could be effectively deployed for waste collection and recycling activities and derive various social benefits so that the informal workers can lead a better quality life. Inclusion and recognition of the informal sector would improve the efficiency of the entire waste management process.

Several recycling techniques are available with varying material efficiencies, energy consumption, and environmental impact. Solar companies can customise their recycling processes by choosing a combination as per their strengths and capabilities. They can also learn from the globally prevalent financing models to arrange to fund the waste management activities. The solar industry is capable of minimising or delaying their waste by focusing on the second-life use of the substandard modules. For instance, they can target nonmonetary applications for refurbished modules such as solar lamps and solar pumps.

The government must introduce a holistic policy framework for handling the waste from clean energy technologies. The policy should highlight the responsibility of different stakeholders across the supply chain, set annual targets for each stage of waste management (collection, recycling, and recovery), introduce innovative business models and incentive mechanisms, and provide guidelines for the handling and safe disposal of different waste categories. India is now in the midst of a clean energy transition and should not lose out on PV module waste management.

Enabling Circular Economy in Used Water Management in India

Toolkit for "Preparing City Action Plans for Reuse of Treated Used Water"

Activating Circular Economy for Sustainable Cooling

Activating Circular Economy for Sustainable Cooling

Activating Circular Economy for Sustainable Cooling