Kanika Balani, Bharat Sharma, Shalu Agrawal

November 2020 |

Suggested Citation: Balani, Kanika, Bharat Sharma, and Shalu Agrawal. 2020. Addressing Discoms’ Revenue Recovery Concerns During and After the Pandemic: A Case Study of MVVNL Discom in Uttar Pradesh. New Delhi: Council on Energy, Environment and Water.

This study discusses the systemic gaps in billing and collection operations of Madhyanchal Vidyut Vitran Nigam Ltd. (MVVNL), one of the power distribution companies (discoms) in Uttar Pradesh. It analyses how the COVID-19 lockdown aggravated these gaps. The study is based on findings from a telephonic survey of 300 randomly selected domestic consumers of MVVNL. Further, the study suggests measures to enhance billing and collection efficiency and discusses innovative revenue collection initiatives implemented by discoms in other states.

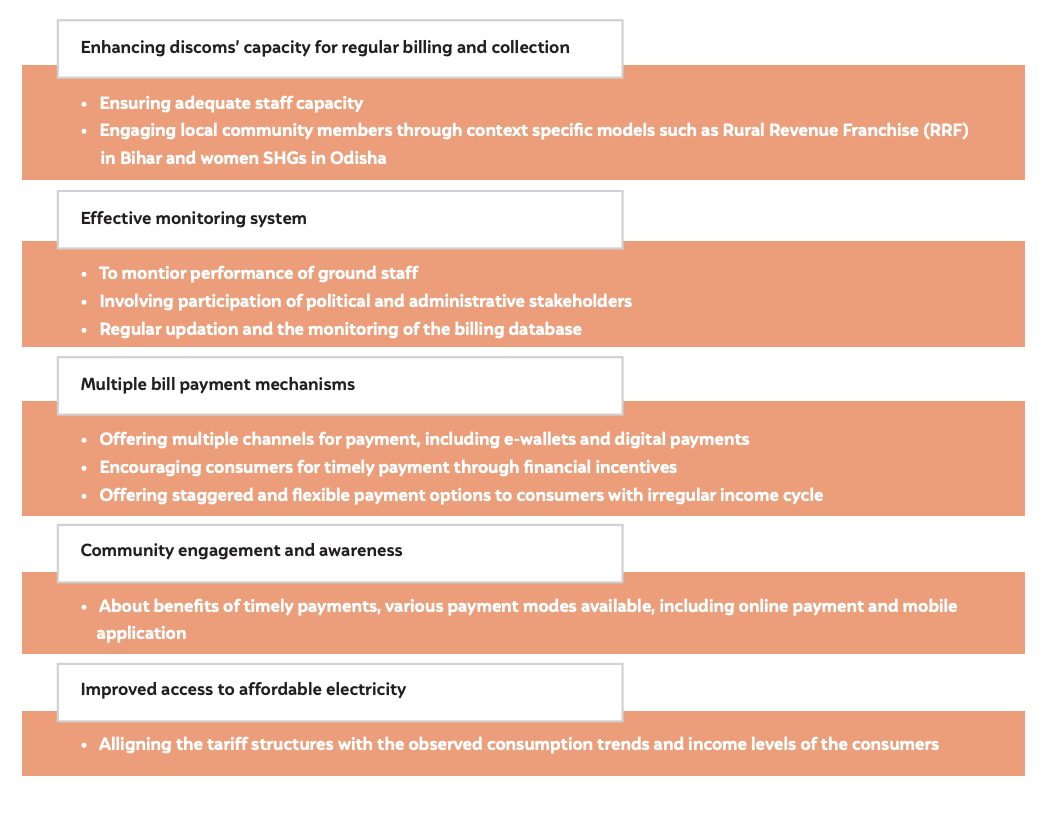

Key factors contributing to billing inefficiencies in MVVNL

Source: Authors’ analysis based on consumer survey and interaction with discom officials

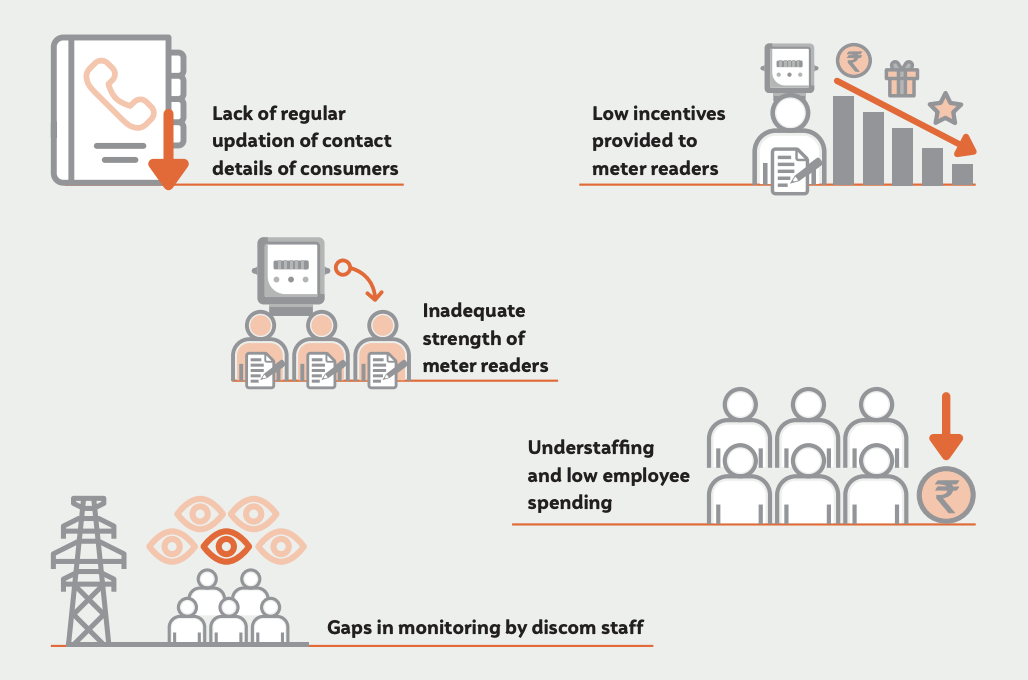

Factors contributing to low receipt of bill payments

Source: Authors’ analysis based on consumer survey and interaction with discom officials