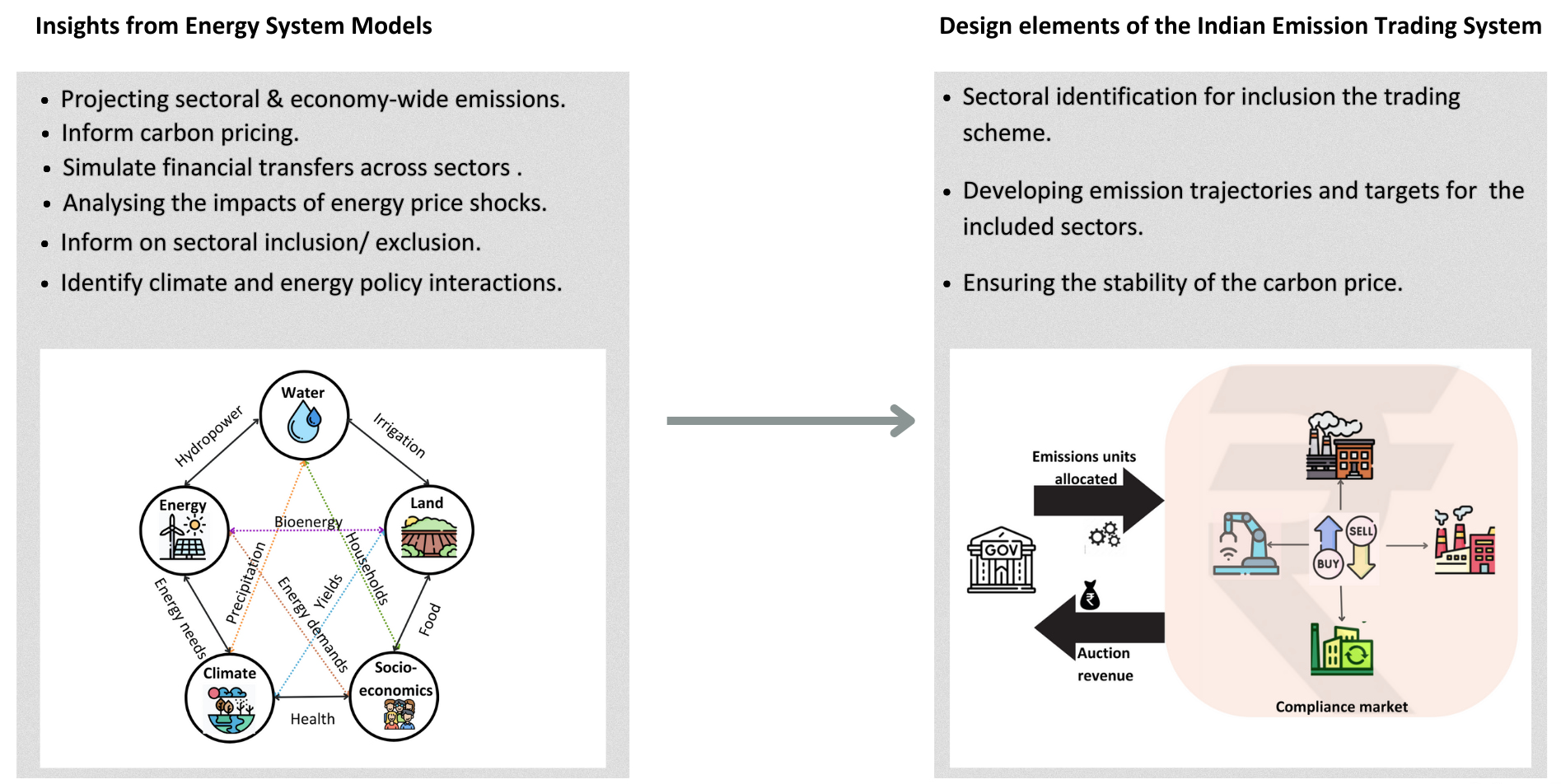

India will likely roll out the framework of its domestic carbon market in a fortnight, said Union power minister RK Singh recently. Covering approximately 72 per cent of India’s total CO2 emissions1, the domestic emission trading scheme will have far-reaching implications on the country’s journey to net-zero carbon emissions by 2070. It will, however, enter into full force by 2026 and the main design elements of this policy instrument are still being discussed. As mentioned in the recent gazette notification on Carbon Credit Trading Scheme (CCTS), these include - i) identifying which sectors to be included in the trading scheme, ii) developing emission trajectories and targets for the sectors to be included, and iii) developing mechanisms to ensure the stability of the carbon price. We explain how energy system models can inform the design of India’s carbon emission trading scheme, both in the initial phase and for years to come.

Energy system models (ESM) are modelling tools used to simulate and analyse the behaviour of energy systems and their interaction with global land, water, and climate systems. By taking into account energy demand and supply, costs of technologies, and environmental constraints, they can help researchers and policymakers understand how different energy sources, technologies, and policies interact. These models are useful for long-term energy planning, optimising energy systems, and exploring the transition to renewable energy sources. ESMs have been around for more than 40 years and have been heavily used in Intergovernmental Panel on Climate Change (IPCC) reports, although their structured use in India has been more recent, for example through the India Climate and Energy Modelling Forum (ICEMF)2.

So, how can these energy models help in informing the design of carbon markets?

Source: Authors' analysis

Calculate future emissions from different sectors and the whole economy. The first step in designing an ETS is assessing the future carbon emissions for the participating sectors in a country. Energy system models clearly and coherently represent the drivers of energy services (such as heating, cooling, and transport) and material services (such as steel, cement, and fertiliser) for the economy. This demand is then met through specific industries using inputs – energy fuels, electricity, and raw materials, based on specific technologies. By calibrating the models to the current fuel and technology used, and the associated emissions, and then fulfilling future demand, energy models can show how emissions for each sector and the whole economy will evolve over time.

Inform carbon price dynamics. One of the important indicators of the effectiveness of an ETS is the carbon price. A low carbon price often implies a weak emissions target, which may not provide an incentive for the industry to invest in more expensive decarbonisation technologies. As ESMs have information on the capital cost, lifetime, energy costs, and emissions intensity of the technologies used in various industrial sectors, they can compare abatement costs across sectors, and find a carbon price at which the emissions cap/constraint is met cost-effectively.

Simulate financial transfers across sectors. Although the auctioning of emission allowances is the most efficient method of operating an ETS, jurisdictions often provide free allowances or set sector-specific targets in the initial phase of the ETS. This is done to ease the transition to a carbon-constrained economy but also protect industries with high emission intensities from higher production costs, which in turn could affect their competitiveness. Since energy systems models by default choose the lowest cost of reaching a particular emissions cap, the ESM can provide information on the direction and quantity of emission permits that can be traded across sectors.

Show the impact of energy price shocks on emissions reduction and carbon price. ESMs also account for the international trade in energy fuels (coal, oil, gas, and biomass) between nations or world regions, and can thus simulate how (real or experimental) economic and energy price shocks to an economy can affect its energy demand, which in turn would affect the emissions and the carbon price.

Help decide which sectors to include in the emissions trading system. Countries usually choose to start their ETS with only one or a few sectors. As domestic experience grows, more sectors are brought under the regulation. Both the type and the size of a sector can influence the carbon price. For example, adding a sector with a lower marginal abatement cost and with a large potential such as electricity can reduce the carbon price as it makes overall mitigation cheaper. Thus, ESMs can inform the effect on overall mitigation costs and carbon price through the addition or exclusion of sectors into an ETS.

Identify interactions between climate and energy policies such as energy efficiency targets, taxes on fossil fuels, and renewable energy purchase obligations. ESMs are capable of simulating and implementing a number of high-level climate and energy policies and targets thereby allowing us to understand their interactions and outcomes on emissions, energy use, and energy prices. Moreover, countries, including India regularly use a mix of energy and climate policies to achieve climate-related and development objectives. ESMs can also be used to understand the impact of other policies on carbon prices in the ETS, thereby aiding in ETS design.

Limitations of ESMs

Although ESMs can be useful in designing an ETS, as with all models, there are limitations to their use. First, ESMs represent technologies and sectors in a simplified form. This entails that the marginal abatement cost for, say, the iron and steel sector, can differ compared to bottom-up estimates that look at all possible decarbonisation options. Second, ESMs generally function using time intervals of 5 or 10 years, focussing mainly on broader, long-term dynamics. Consequently, factors like short-term oil price changes carry less relevance within a 5-year timeframe. This also means, for example, that ESMs cannot be used as a forecasting tool for financial traders, who are often interested in developments over 1-2 years. Third, ESMs differ in their capability to represent policies. Policies especially on the demand side, such as behavioural changes or energy efficiency measures, can only be represented in a stylised manner, without understanding how these policies drive emission reduction. Lastly, models are only as good as the assumptions they use. Models utilise a number of assumptions relating to future socioeconomic conditions, especially GDP and population, but also the cost of technologies and policies. Therefore, an uncertainty analysis is essential to assess the robustness of the results.

The process of developing and operationalising an effective carbon market is a complex one. Although, both domestic as well as international experience from countries with a longer history of running a carbon market can aid in designing an ETS, energy system models can additionally serve as useful tools to generate insights on ETS design. They are, however, not intended to forecast any variable, be it price or quantities, and therefore care must be taken to interpret their results. The Indian government, particularly the Bureau of Energy Efficiency, which is the main regulator of the Carbon Credit Trading Scheme, should consider using their capabilities to explore insights on ETS.

Aman Malik is a Programme Lead and Nikita Shukla is a Research Analyst at the Council on Energy, Environment and Water (CEEW). Send your comments to [email protected].

1Number based on emissions in 2016 and includes total emissions from all entities in these sectors. In reality, an ETS is often limited to large entities, i.e., small and medium-size industries are excluded.

2https://icemf.niti.gov.in/about-us

Add new comment