Maintaining the security of any power system is non-negotiable. World over, and in India too, power system operators do so by applying strict controls over the grid frequency, which requires ensuring a near-perfect balance between electricity supply and demand. We deconstruct the Deviation Settlement Mechanism (DSM) – a regulatory mechanism to maintain grid frequency in India.

Source: Authors' illustration of the concept of demand-generation balance in a power system.

We take Uttar Pradesh (UP) as a case for analysis. UP incurred INR 374 crore1 during the first half of FY232 (H1 FY23) as DSM charges, one of the highest in the northern region. Could the state have saved on these costs? And, what changes does the new DSM regulation, effective 5 December 2022, bring forth?

Any demand-supply imbalance of electricity leads to a fluctuation in the grid frequency from the standard value, which is set at 50 Hertz (Hz) in India. A significant drop or rise in frequency could lead to a power system blackout. Therefore, the Indian Electricity Grid Code (IEGC) 2010 restricts the operational frequency between 49.90 to 50.05 Hz. To maintain the frequency within the band, the power distribution companies must predict demand accurately and schedule supply accordingly.

Grid operators use ancillary services to maintain grid frequency and ensure system security at all instances and restore system security in real time. Therefore, ancillary services are naturally more expensive than the energy scheduled to flow otherwise.

Uncertainties in a large electricity system, such as that of UP, are inevitable. In 2021-22, UP had the second-highest electricity requirement in the country, and contributed to 12.3 per cent of the national peak demand3. In such a large-scale system, consumer behaviour or tripping of a transmission line can be hard to predict. Therefore, the use of ancillary services cannot be avoided. However, it can be minimised if (i) demand and generation is forecast as accurately as possible and (ii) all suppliers or generators stick to their given schedules. The DSM instils discipline on these two fronts through penalties and incentives. Hence, the Central Electricity Regulatory Commission (CERC) notified DSM regulations in 2014 (referred to as DSM 2014). The charges, payable to or receivable by states, are managed through a common DSM pool. This pool of money is used to procure the ancillary services needed to balance the system.

The CERC has now updated the DSM regulations (DSM 2022). Based on the Council on Energy, Environment and Water (CEEW)’s ongoing research on power system dispatch, we explain the existing and the upcoming regulations below.

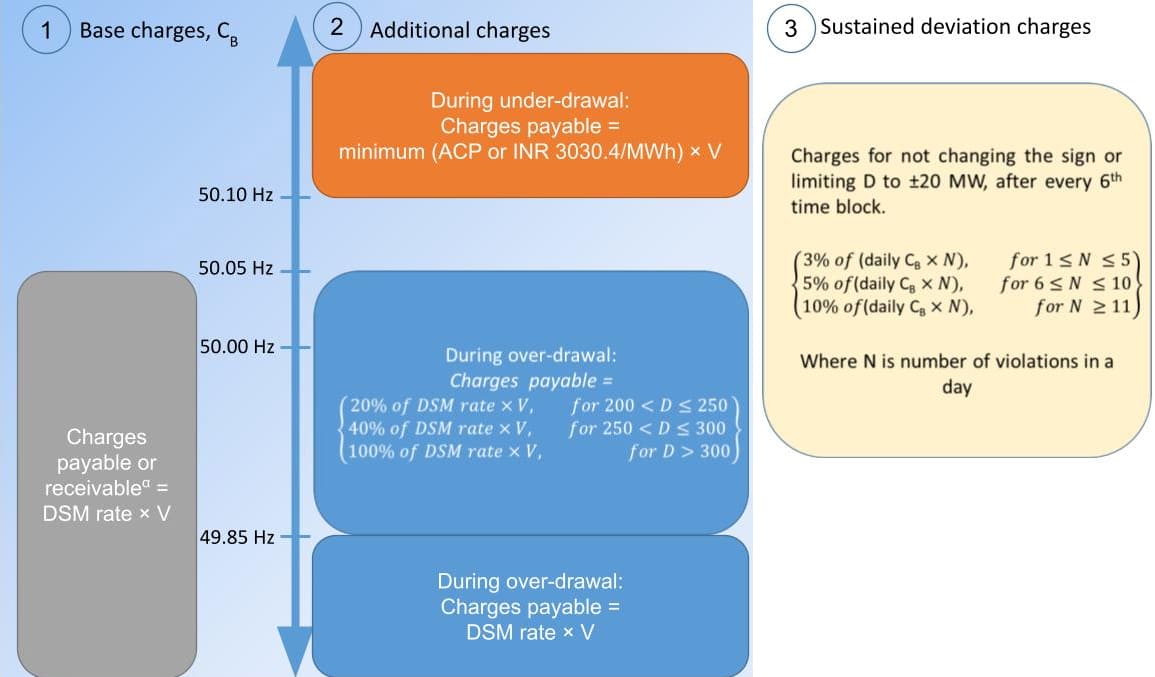

The DSM 2014 regulation is designed to have three cost components:

These cost components are illustrated in Figure 1, indicating the limits defined for UP.

Figure 1: Summary of DSM cost components for Uttar Pradesh

Source: Authors’ compilation based on DSM 2014.

Notes -

1. D is deviation quantum in MW (difference between the actual and scheduled drawal)

2. V is volume in MWh corresponding to D in MW

3. ACP is the daily weighted average Area Clearing Price (ACP) of the Day-ahead market (DAM).

4. αReceivable base charges are capped at volumes corresponding to under-drawal of up to 200 MW less than the schedule

As illustrated in Figure 1, base charges and additional charges are determined according to the DSM rate. The sustained deviation charges are calculated as a proportion of the sum of total base charges applicable for a day, based on the number of violations observed during that day.

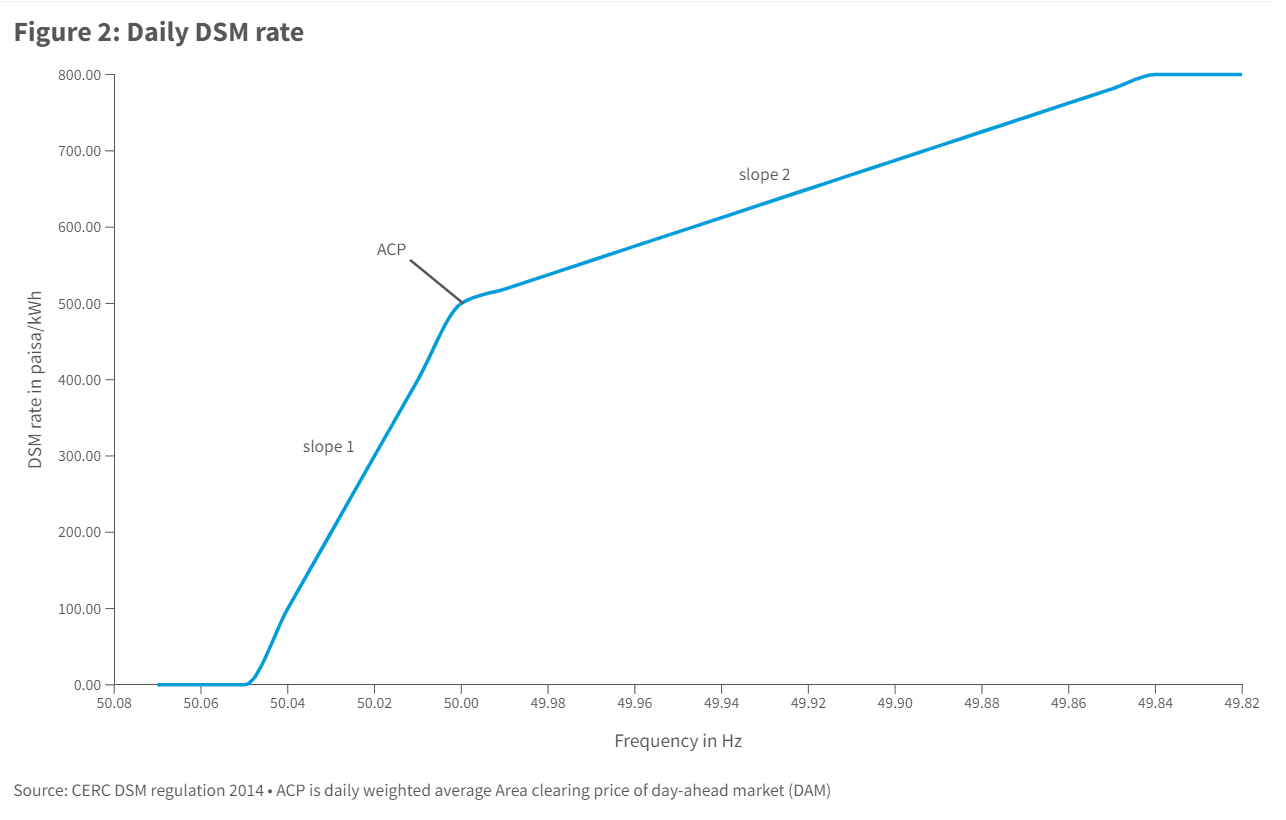

The DSM rate is determined on a daily basis. It is linked to (i) the grid frequency and (ii) the weighted average Area Clearing Price (ACP) of Day-ahead market (DAM), as illustrated in Figure 2. ACP is an indication of congestion and demand-supply position in the area. Higher the ACP, higher will be the DSM rate at low-frequency levels (< 50 Hz).

Over the years, the DSM 2014 regulation has evolved to accommodate variability in the state schedules due to the increasing installation of renewable energy and transmission congestions. The regulations have continuously aimed to narrow the permissible frequency band and ensure randomness in deviation patterns of states.

DSM 2022 de-links the determination of charges from frequency, and instead, links them to the prices observed on market platforms.

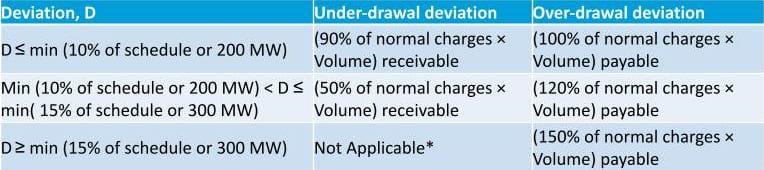

Table 1: New DSM charges for Uttar Pradesh

Source: CERC DSM regulation 2022

*Per the regulation, the state will not receive any amount if it under draws beyond 300 MW in a time block

For the first year, the ‘normal charges’ for each time block will be either (i) the weighted average ACP of DAM across all power exchanges or (ii) the weighted average ACP of RTM across all power exchanges or (iii) the weighted average ancillary services charge across all regions, whichever is the highest of the three. The charges in table 1 indicate the penalties and incentives to manage grid frequency. However, DSM 2022 does not include any provisions for penalising continuous over- or under- drawals.

We now take a deep dive to understand the implications of DSM 2014 on Uttar Pradesh.

Figure 3 shows the break-up of the charges incurred. Of the INR 374 crore, base charges and additional charges constituted 62 per cent and 31 per cent, respectively. The state incurred penalties worth INR 459 crore for over-drawing electricity, which was four times the payments that accrued for under-drawing.

Figure 4 indicates that 54 per cent of the time in June, the actual drawal deviated by more than the specified volume limit. Of this, 40 per cent of the time, the state overdrew beyond the permissible volume limit of 200 MW, for which it incurred penalties. For the remaining 14 per cent of the time, the state underdrew by a quantum higher than 200 MW, for which it did not receive any incentive. June was also the month that saw the highest additional charges (INR 28 crore). This was majorly because of the violation of volume limits.

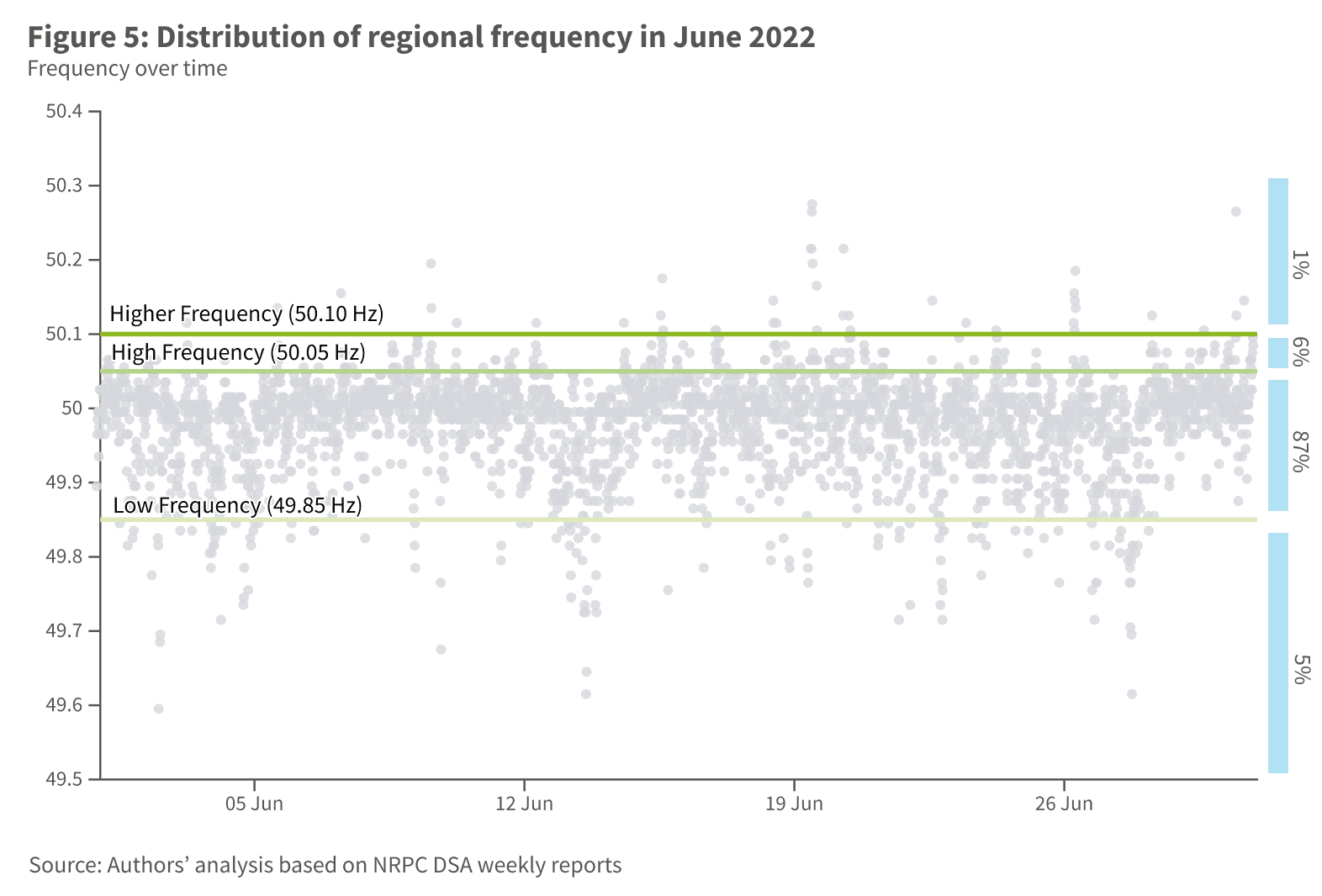

Alongside the observed volume limit violations, 13 per cent of the time in June, the northern region’s frequency was reported to be out of the permissible range, as Figure 5 illustrates. 8 per cent of the time, the regional frequency rose above 50.05 Hz, during which the regulations do not impose any penalties/charges for drawing more electricity than scheduled. We find that the state overdrew 11 million units (MUs) of electricity during these high-frequency instances, for which the regulation imposes no charges. Also, when the grid frequency was between 50.05 Hz and 50.10 Hz, UP drew about 6 MUs of electricity less than their schedule. This could have increased the grid frequency further, putting the grid at risk.

However, the regulations do not impose any penalties for such occurrences.

Based on the above analysis, we conclude that Uttar Pradesh could have avoided incurring the majority of the DSM charges if the deviations were restricted within the specified limit. One way to achieve this is to forecast the electricity demand with higher accuracy.

We quantify the potential savings if UP forecast its schedules with 95 per cent accuracy and also trading the quantum corresponding to the balance ±5 per cent at the real-time market (RTM)4. The purpose of utilising RTM would be to stay within the deviation limits, i.e. sell instead of underdrawing and buy instead of overdrawing. We find that by doing so, UP could have saved INR 58 crore during H15.

The analysis indicates that it is cheaper for the state to increase the forecasting accuracy that in turn enables them to use markets for deviation management, than to violate limits and pay penalties.

The upcoming regulations are linked to the electricity market segments, making the optimisation opportunity clearly visible. We attempt to examine if these regulations ensure the desired behaviour from states to support the grid. We do so by applying the new regulations in hindsight and assessing the outcome for possible scenarios.

We observed that when the grid frequency was low, indicating demand is higher than the available generation, the regulations penalise the over-drawal and incentivise the under-drawal, thus improving the frequency. However, concerns arise during high-frequency instances when there is no incentive or penalty for overdrawing or underdrawing, respectively. This can potentially put the grid at risk. There could also be a possibility of high-frequency incidents coinciding with renewable energy generation kicking-in. Therefore, it becomes even more important for DSM 2022 to prevent such occurrences.

Rapidly increasing the share of renewables while ensuring grid security is a challenge that confronts us today. DSM regulations 2022 hold promise to empower system operators to ensure grid discipline and security cost-effectively. Time will tell how the regulations will perform.

Notes

1 Northern regional power committee (NRPC) weekly deviation settlement accounts (DSA) reports retrieved on 10 November 2022.

2 April to September 2022

3 20th Electric Power Survey of India, Central Electricity Authority.

4 The analysis considers the RTM segment of the Indian Energy Exchange (IEX) only. Assuming the quantum to be traded at the IEX RTM is limited based on actual volumes cleared vis-a-vis the sell and buy bids in the respective time block

5 Assuming the bids are cleared at the actual marginal prices observed at RTM segment of the Indian Energy Exchange (IEX).

Arushi Relan is a Research Analyst and Disha Agarwal is a Senior Programme Lead at the Council on Energy, Environment and Water (CEEW), an independent not-for-profit policy research institution. Send your comments to [email protected]

Add new comment