CEEW: Akanksha Tyagi, Dhruv Warrior, Karthik Ganesan, Rishabh Jain, Vibhuti Chandhok

IEA: Amrita Dasgupta, Swati Dsouza, Tae-Yoon Kim

UC-DAVIS: Aditya Ramji

WRI India: Deepak Krishnan, Geetika Gupta, Niharika Tagotra, Parveen Kumar, Tirthankar Mandal

Suggested citation: CEEW, IEA, UC-DAVIS and WRII. 2023. Addressing Vulnerabilities in the Supply Chain of Critical Minerals. New Delhi: Council on Energy, Environment and Water.

The global move towards achieving net zero emissions will increase demand for low-carbon and clean technologies such as wind turbines, solar photovoltaics, electric vehicles and energy storage. However, the production of these technologies depends heavily on a few geographically concentrated minerals with limited availability. This report highlights the vulnerabilities in the supply chain of seven minerals: lithium, cobalt, nickel, copper, manganese, graphite and rare earths. It examines mineral criticality assessment frameworks and the global concentration of reserves and mineral processing facilities. The report also explores technologies that could reduce global dependence on these critical minerals. Further, it recommends specific actions to improve supply and reduce demand, tracking the critical mineral value chain and co-development of technologies to explore, mine and process minerals. It also talks about the need to develop mineral stockpiles. The report also emphasises circularity and scaling up alternative technologies to reduce mineral demand.

The report has been commissioned by the Ministry of Mines, Government of India to inform the G20 Energy Transition Working Group (ETWG) negotiations.

Also read: Developing Resilient Renewable Energy Supply Chains for Global Clean Energy Transition

The theme of India’s G20 presidency in 2023 – “Vasudhaiva Kutumbakam” – affirms the value of all life – humans, animals, plants, and microorganisms– and their interconnectedness. Energy in all its forms is the central driver for this interconnectedness. Our energy usage across centuries is a key cause of human-induced climate change. While mitigation and adaptation efforts have reduced vulnerability, there is still a lot more to be achieved. Though the current energy use is a significant contributor to the problem, sustainable energy transitions are the key to the solution.

Within this framing, it is also instructive to note that the G20 countries are responsible for more than 75 per cent of the total greenhouse gas (GHG) emissions in the world and 78 per cent of global CO2 emissions – the key contributor to global warming. Concerted efforts by this group towards realising sustainable and clean energy transitions will widen and increase the demand for minerals. This means that the traditional paradigm of energy security, which so far has been limited to fossil fuel supply disruptions and price spikes, will need to be reassessed, and the vulnerabilities associated with mining minerals will have to be considered.

Our paper analyses the framework for establishing criticality of minerals. It found that there is no set list of critical minerals across different geographies, and each country identifies critical minerals based on their level of economic development, nationally available resources, and technology choice. Despite this, certain minerals are more commonly considered critical across different geographies. With respect to technologies in the energy sector, the paper found that certain minerals are commonly used across different applications and uses. These include lithium, cobalt, nickel, copper, manganese, graphite and rare earths.

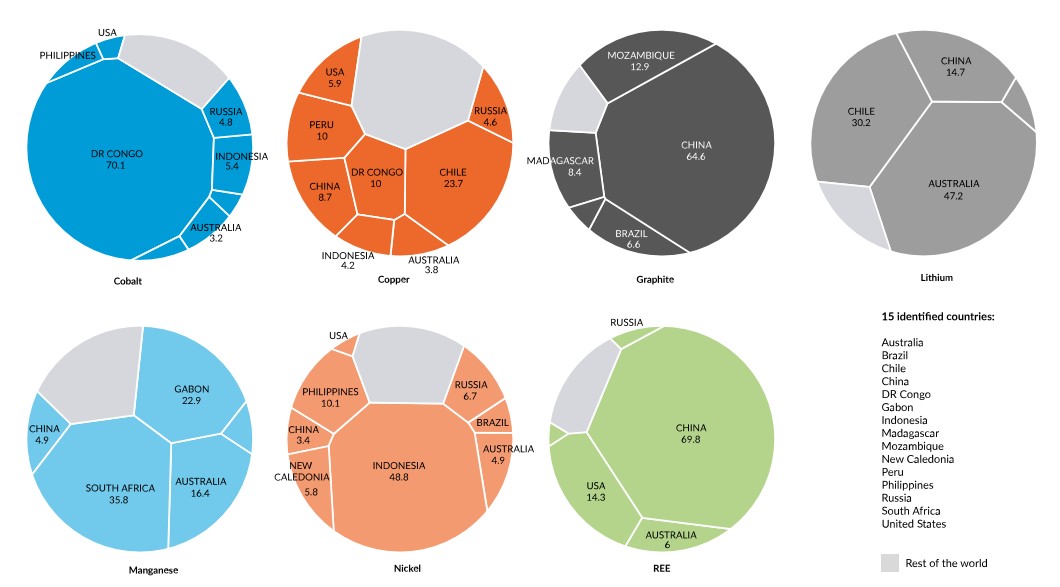

The paper shows that resources and reserves, and therefore production, for most minerals were geographically concentrated. For example, Bolivia has the world’s largest deposits of lithium (despite not mining it), while 46 per cent of the world’s cobalt reserves is found in the Democratic Republic of Congo. China accounts for ~79 per cent of natural graphite production while nearly 50 per cent of the world’s lithium is mined in Australia. Further, investment needs are not being adequately met to keep pace with the increasing demand and longer lead times of mining project development. Regulatory changes are further affecting investment outlooks for companies. A handful of countries, such as Australia, Indonesia and Mozambique have driven the increase in the production of these minerals in recent years. For some minerals such as copper, cobalt and nickel, current mining production is over two per cent of identified reserves. As the mining of these and other minerals grows in the coming years, inefficiencies in existing mining technologies could lead to an increase in the emissions intensity of mineral mining, especially since issues related to intellectual property rights limit the sharing of more efficient technologies. Delays in implementing recycling practices and regulations also have the potential to impact the demand and supply balance over the next few decades.

Figure ES 1 The production of minerals needed for low-carbon technologies is concenterated in a handful of countries

Source: USGS 2023

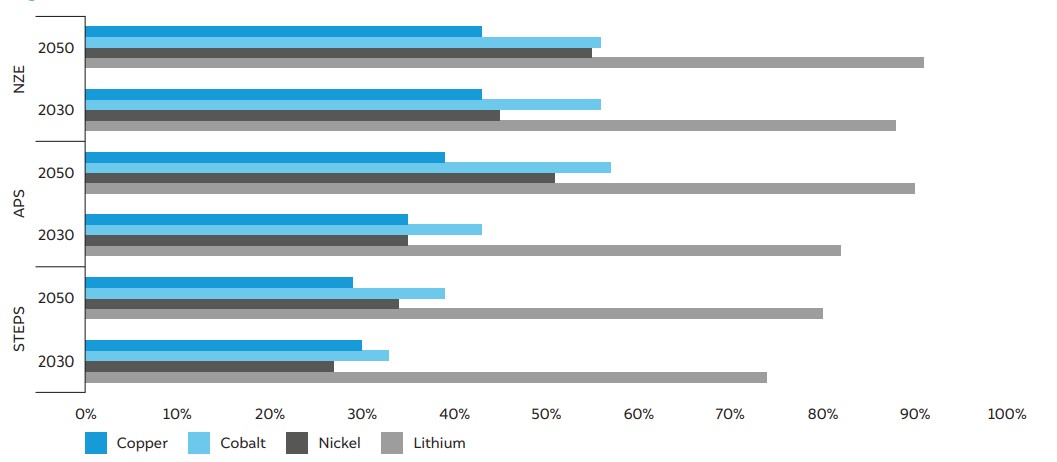

The paper finds that the demand for critical minerals, based on their use in batteries (electric vehicles [EVs] and grid storage), solar photovoltaics (PV), wind turbines, and transmission wires, will rise significantly in the future. The analyses show that the focus on clean technologies (solar, wind, batteries for EV and grid storage, and grid infrastructure) will account for the majority of the lithium demand (80–91 per cent) by 2050. Nickel demand from clean technologies is estimated to between 34-55 per cent of the total demand by 2050, while copper demand is estimated to range 29–43 per cent by 2050. Cobalt demand from the clean energy sector is expected to cross 55 per cent of the total demand in 2050. This provides a strong indication of the dependence of key technologies on these minerals.

Figure ES 2 Focus clean technologies make up a significant share of total demand for certain minerals

Source: IEA analysis

To meet the future demand, the paper examines new developments on exploration, mining, and processing of critical minerals. This includes new technologies to detect mineral deposits and improving current mining practices to increase production. It also discusses investing in technologies that avoid over-dependence or reduce mineral demand. It details examples such as replacing cobalt with other minerals in battery cathode materials, replacing graphite with silicon for battery anodes, developing rare earth–free EV motors and wind turbines and reducing the silver content in passive emitter rear contact (PERC) cells for solar PVs. Additionally the paper talks about extending product use (second-life application for batteries for instance) and mandating repairs and services provision for extending the life of various consumer goods along with increasing recycling and recovery from discarded products. Based on this in-depth assessment, the paper identifies two key priorities for G20 countries to address vulnerability with respect to critical mineral demand for clean energy technologies. These are as follows:

First, develop a shared vision on critical minerals for increasing the supply of minerals: We recommend specific action points to increase mineral supply. There is an urgent need to institutionalise periodic assessments of the critical mineral value chain. The G20 should also support investments in, and the development of, new exploration and mining technologies. Finally, the group must examine the creation of a strategic stockpile of critical minerals.

Second, enhance global mineral security by scaling up reduce and reuse efforts: The G20 must lead the charge in investing in focused R&D efforts to improve existing technologies from a resource-efficiency perspective and must support the development of alternative technologies that reduce dependence on critical minerals. The G20 must also provide an enabling ecosystem that nurtures these alternatives through dedicated public procurement plans, standardisation regimes, and a harmonising approach to these technologies from a trade perspective. Lastly, the G20 must increase focus on recycling of products and recovery of minerals by co-developing mineral recovery technologies which are currently concentrated. Enabling regional and local ecosystems to recover through global mandates that encourage local recovery would pave the way for equitable access to recovered minerals.

Addressing Technology Gaps through Collaboration on Advanced Cell Chemistry Batteries

How Can India Indigenise Lithium-Ion Battery Manufacturing?

Building Resilient Mineral Supply Chains for Energy Security

Solar Geoengineering and the Montreal Protocol