Paper

Analysing the Falling Solar and Wind Tariffs

Evidence from India

Kanika Chawla, Manu Aggarwal, Arjun Dutt

December 2019 |

Suggested citation: Chawla, Kanika, Manu Aggarwal, and Arjun Dutt. 2019. "Analysing the Falling Solar and Wind Tariffs: Evidence from India." Journal of Sustainable Finance & Investment, DOI: 10.1080/20430795.2019.1706313

Overview

The paper focuses on two major constituents of renewable energy (RE) tariffs - (i) equipment related factors and (ii) financing costs. Further, by dissecting specific examples of competitively-determined Indian solar and wind tariffs into their respective constituents, it illustrates their relative contributions to overall RE tariffs. Lastly, the paper highlights areas that represent opportunities for increasing the competitiveness of RE tariffs in the years to come, and discusses policy measures for accelerating future tariff reduction.

Key Highlights

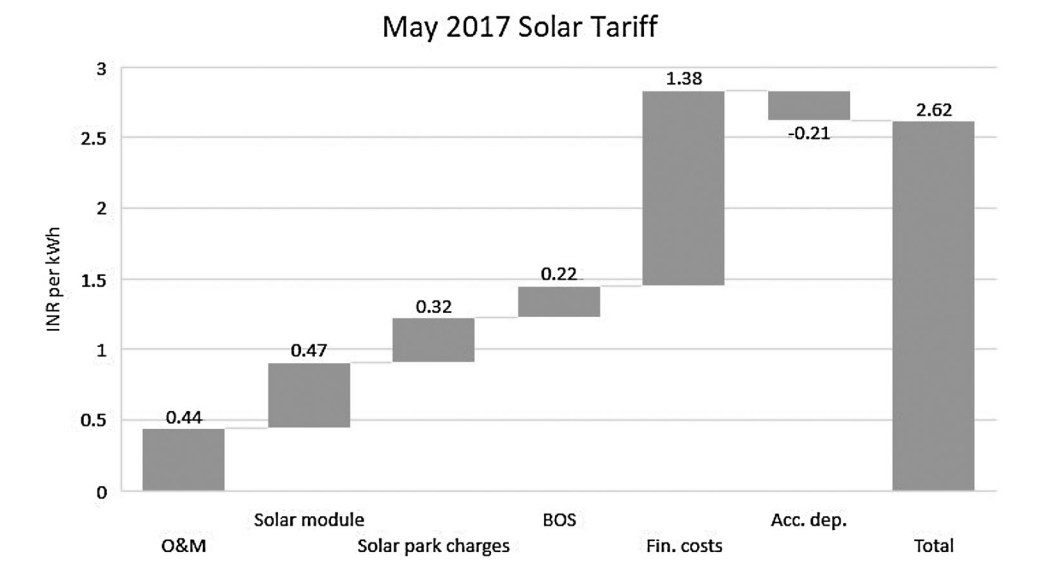

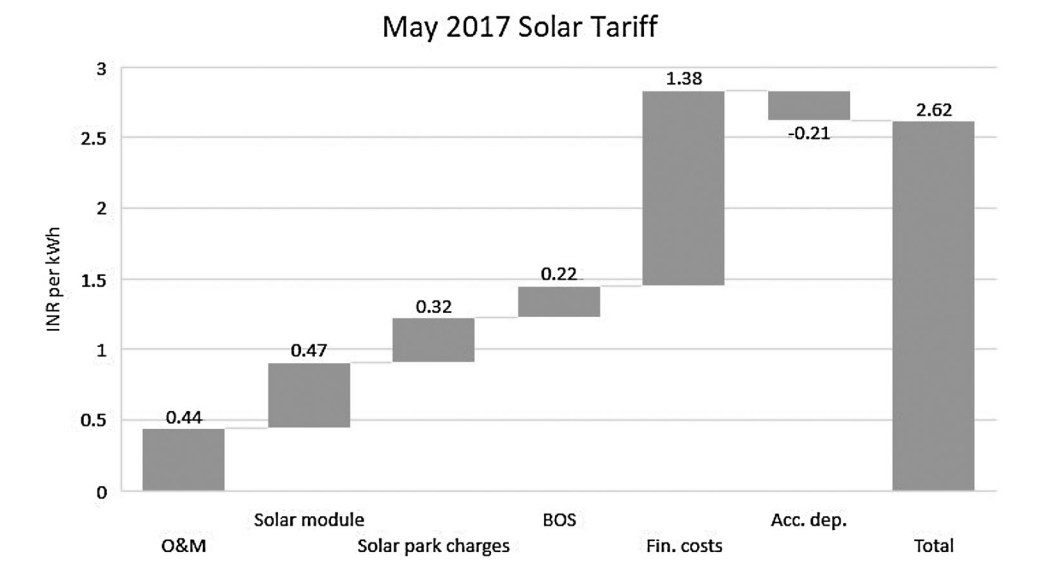

- Solar PV module costs and wind turbine costs account for only around 20 per cent of the respective solar and wind tariffs. Thus, financing costs account for the largest component – over 50 per cent of RE tariffs.

- In 2017, the tariffs dropped to a record-low of INR 2.44 per kWh (USD 0.04) for utility-scale solar and INR 2.43 per kWh (USD 0.04) for wind energy generation.

- Historically, equipment related factors have been the major drivers of tariff reduction, accounting for 73 per cent of the solar tariff reduction between January 2016 and May 2017.

- The decline in financing costs accounting for the remaining roughly 27 per cent of the tariff decline.

- However, there could be a role reversal – changes in financing costs could drive future declines in both solar and wind tariffs.

- Improvements in the financing costs for RE projects can partly be explained bydeclining commercial bank benchmark lending rates, growing familiarity with RE technologies, favourable policy ecosystem resulting in lowered risk perceptions among debt financiers, and intense competition at RE auctions

- The impact of equipment-related factors is likely to be less significant in wind tariff decline in the years ahead./li>

Source: Author's analysis

Key Recommendations

- De-risk the RE sector through explicit subsidies or measures translating into lower return expectations for investors.

- Enforce contractual provisions to minimise instances of payment delays or power purchase agreement (PPA) renegotiation.

- Safeguard RE developers against long payment delays with payment security mechanisms.

- Facilitate timely land acquisition to streamline the process of solar park development.

- Ensure contractual provisions that safeguard against curtailment risk by guaranteeing a minimum level of offtake of RE generation.

- Design financial instruments such as guarantees that mitigate curtailment risks for developers.

Changes in financing costs are likely to be much more important in tariff reduction going forward than equipment-related costs.