Issue Brief

Grid Integration Guarantee

A financial buffer to address renewable energy curtailment

Manu Aggarwal, Kanika Chawla

July 2019 | Energy Transitions, Sustainable Finance

Suggested Citation: Aggarwal, Manu, and Kanika Chawla. 2019. Grid Integration Guarantee: A financial buffer to address renewable energy curtailment. New Delhi: Council on Energy, Environment and Water.

Overview

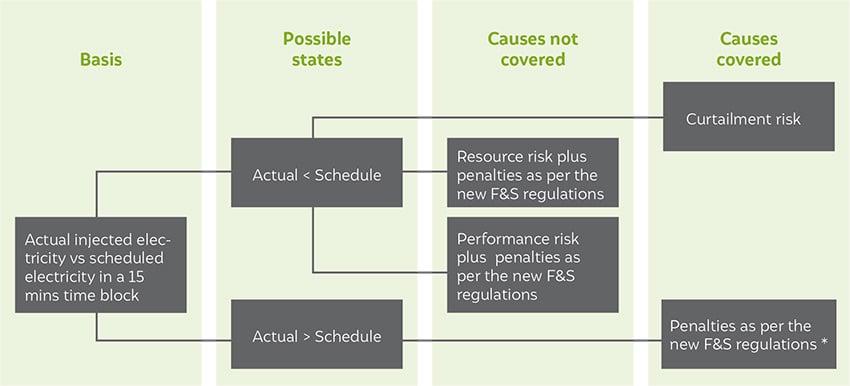

The grid guarantee (GIG) only covers the curtailment risk

Source: CEEW-CEF Analysis

Key Findings

This study presents a proposed solution to the risk of renewable energy (RE) curtailment – a grid integration guarantee (GIG), which offers cover against tail-end curtailment risk with market-reflective pricing. It showcases the design, feasibility, and applications of the proposed GIG and delves into its aspects such as risk coverage, governance, capitalisation, and product features. It highlights the drivers that would support the successful deployment of the GIG and the barriers to its uptake.

The curtailment of RE generation results in the inefficient utilisation of installed RE capacity and lower than expected returns for developers and investors. The declining viability of projects with the backdown could potentially result in stressed assets for banks and equity investors. In this study, the use case has been designed for the state of Gujarat using data for solar and wind generation spanning January 2015 to July 2017.

Key highlights

- There is considerable variation in the quantum of curtailment across months, states, and even districts in a state.

- Distribution companies (discoms) have to pay the fixed component of conventional power tariffs in case these sources are curtailed. However, this is not applicable for RE sources. This constitutes a perverse incentive for state transmission utilities (STUs) to back down RE generation.

- The mitigation of curtailment risk lowers the cost of capital, ensures that RE tariffs are sustainable, and reapportions risks in the power system more robustly. This ensures that RE capacity addition continues apace in a sustainable manner.

- Even the newer power purchase agreements (PPAs), with the exception of a few, do not address tail-end curtailment risk, thus making the case for an instrument like the GIG.

- The GIG is built on the intersection of two major disciplines and technologies – big data techniques and actuarial science. Its foundational structure has many data limitations and assumptions to derive proxies, but its logic is robust.

- The GIG can help in quantifying the cost of grid integration since higher premiums will signal increasing congestion or backdown in certain parts of the grid to the government.

Drivers for the uptake of a grid integration guarantee

- Since transmission utilities (transcos) or governments on their behalf will capitalise the initial fund of the GIG, it will kick-start a virtuous cycle where transcos will start accounting for their commissioning timelines before they grant connectivity to the RE generator.

- A gradual withdrawal of the must-run status for RE as the market matures can pave way for developers opting for the GIG.

- Better quality of scheduling and forecasting regulations for RE plants would improve the workings of the GIG as timely scheduling and accurate forecasts are its foundational bedrock.

Barriers to the uptake of a grid integration guarantee

- Paucity of granular data is a big barrier to the optimal design and structuring of the GIG.

- Interest from RE investors and developers to opt for an instrument such as the GIG would depend on the proportional duration of their skin in the well-functioning of these RE projects during the course of their life.

- Older developers who signed RE capacities at higher tariffs might not find value in opting for GIG.

In this first version of the GIG, risk premiums are calculated on the basis of forecasting the past data. However, the grid could change profoundly after an inflection point as more RE capacity comes online. Instead of relying on past data, there is a need to model the grid in its future state.