Issue Brief

Financing Clean Energy Innovation

Case for an Indian Business Demonstration Facility

Kanika Chawla, Manu Aggarwal

July 2019 | Sustainable Finance

Citation: Chawla, Kanika, and Manu Aggarwal. 2019. Scaling Clean Energy Innovation: Case for an Indian Business Demonstration Facility. New Delhi: Council on Energy, Environment and Water.

Overview

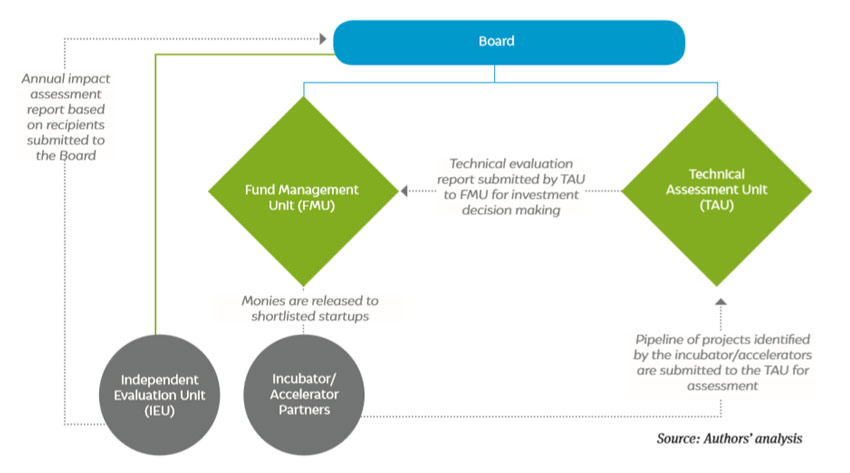

This feasibility study presents the structure and legal framework of a business design facility (the Facility) for clean energy projects in India. It addresses the urgent need for increasing the flow and affordability of private capital into clean energy markets in emerging economies.

For this study, the CEEW Centre for Energy Finance evaluated 32 existing initiatives that foster an environment that can help clean energy innovation projects to reach commercial scale. The facility design proposed in this study focuses on piloting and commercialising technical innovations in renewable energy (RE), energy efficiency, electric vehicles and grid dispatch. In addition, this study explores the various legal structures allowed under the Indian regulations and provides an overview of the governance involved to leverage financing clean energy innovations.

Key Highlights

- Emerging technologies have a business life cycle: research and development (R&D), demonstration, and eventual commercialisation. Clean energy projects have long timelines, large upfront capital costs, low returns, and high risk. This is especially true for innovations in their nascent stages that have not yet achieved a state of guaranteed returns.

- Grants tend to favour technical R&D and smaller demonstration projects; private funds are invested once large-scale profitability is achieved. Traditional finance outlets are usually too risk-averse to provide the patient capital required.

- Public money funds more than 70 per cent of the analysed initiatives (23 out of 32). Private sector entities fund two, and four are partnerships between government and private sector players (industries or philanthropies).

- Despite recent advances in the solar and wind sectors in India, annual investment in its clean energy market has stagnated at about USD ten billion for several years. Although this inflow is the second highest in a developing country, it is significantly short of the investment in China (USD 126.6 billion in 2017), and a very small proportion of global flows (USD 333 billion in 2017).

- Market evidence suggests that clean energy start-ups struggle in raising capital in what is identified as the ‘second valley of death’ – the prototype-to-market stage. This vacuum can be filled by the proposed Indian business development facility (the Facility).

- The Facility will aid in India’s energy transition by creating market depth in its underserved and new clean energy sectors. It will do so by leveraging patient, low-cost, risk-friendly capital, raised predominantly from philanthropic sources and by using market principles and mechanisms, to scale business and technological innovations.

Schematic design of the Facility

Source: Authors’ analysis

Major features of the proposed Facility

- Estimated Size: The Facility will need to meet the regulatory requirements of a Social Venture Fund (SVF).

- Source of capital: Domestic and international philanthropic organisations, private impact capital, international and domestic public monies, and even the private sector can capitalise the Facility.

- Mode of investment: Facility will predominantly take equity positions in technically proven technologies in the energy transition–related sectors. It will do so on preferential terms so as to crowd-in additional private capital.

- Sectoral Focus: The Facility will invest in sectors related to the energy transition: renewable energy, energy efficiency, electric vehicles, grid dispatch, and distributed renewable energy (DRE).

- Jurisdiction: It will be incorporated in India to meet the requirements of the social venture category.

- Business Model: It will be a self-sustaining, non-profit, non-loss entity. All returns will be ploughed back into the capital pool for redeployment.

Key Recommendations

- Align the areas of innovation with domestic priorities as many such priorities impact climate action. The proposed Facility will focus on innovations (both Indian and foreign start-ups) that support the energy transition in India.

- Focus on piloting and commercialising technical innovations in renewable energy, energy efficiency, electric vehicles, and grid dispatch. Also, identify gaps and specify its mandate through three-year and five-year strategy plans that reflect the market and respond to it.

- Focus on equity and grant investments at preferential terms. Also, focus on the modes of investing available to the selected legal investment vehicle.

The flow of investment into India’s clean energy market has plateaued at about USD 10 billion for several years. An Indian business development facility could address the urgent need for increasing the flow and affordability of private capital into clean energy markets in emerging economies.