Report

Reenergising India’s Solar Energy Market through Financing

Arunabha Ghosh, Rajeev Palakshappa, Rishabh Jain, Shalu Agrawal, Poulami Choudhury

August 2014 |

Suggested Citation: Ghosh, Arunabha, Rajeev Palakshappa, Poulami Choudhury, Rishabh Jain, and Shalu Aggarwal. 2014. Reenergizing India’s Solar Energy Market through Financing. New Delhi; New York: Council on Energy, Environment and Water and Natural Resources Defense Council.

Overview

This report, in collaboration with the Natural Resources Defense Council, analyses financial mechanisms and instruments used to stimulate solar power market growth in India and internationally. It discusses their impact on capacity addition, risk mitigation, and reduction in the cost of finance while leveraging existing policies. In addition, it provides recommendations to reenergize India’s solar market growth through financing. The framework presents policymakers and industry leaders a set of tools to use while addressing a range of barriers to industry growth.

Successful state policies coupled with the National Solar Mission (NSM) demonstrated that strong government policies with active financial mechanisms can create a robust ecosystem for solar energy and give shape to a new clean energy market. However, financing remains the largest barrier to the expansion of solar energy market in India.

This report is a part of the India Clean Energy Finance series which also includes A Second Wind for India’s Energy Market: Financing Mechanisms to Support India’s National Wind Energy Mission, Greening India’s Financial Market: How Green Bonds Can Drive Clean Energy Deployment, Greening India’s Financial Market: Opportunities for a Green Bank in India.

Key Highlights

Financing during Phase 1 of the National Solar Mission

- State programmes supported two-thirds of India’s solar installation during Phase 1 (2010–2013). The NSM provided a foundation for the nascent solar market by driving down solar power prices through reverse auctioning.

- India must send clear demand signals to the market to allow solar companies to create pipelines of projects.

- Multilateral financing and self-financing provided for majority of financing. However, domestic banks were reluctant to lend because of higher levels of perceived risk associated with solar investment.

- The burden on domestic banks increased due to decline in international financing. Hence, policies that aimed at increasing domestic lending (Indian Green Bank) became critical.

- Key financial mechanisms used were Feed-in Tariffs, Long-Term Power Purchase Agreements, Renewable Energy Certificates, Renewable Purchase Obligations, and Power Bundling.

Phase 2 of the National Solar Mission

- Delays in government programmes and frequent changes in proposed incentives complicated policy environment in phase 2 (2017), which increased uncertainty and perceived solar market risk.

- Top priorities to boost Indian solar market were: to deploy Viability Gap Funding (VGF) for Phase 2, disburse subsidies through lending agencies or banks, include renewable energy within priority sector lending, etc.

- Implementation of financial instruments such as VGF, refinancing, and securitisation prompted a positive response from investors. Phase 2 guidelines increased minimum project size from 5 MW to 10 MW to ensure that serious and experienced developers bid for projects, a concern raised by financiers during Phase 1.

Innovative Finance Programs and Best Practices

- Several mechanisms, such as green bonds, are effectively used in international markets to stimulate solar market growth.

- International financial mechanisms range from debt and tariff instruments to tax exemptions and direct financial transfers, which offer practices for funding India’s solar market.

- Green banks offer low-cost capital for clean energy development which help in significant savings in delivering clean energy.

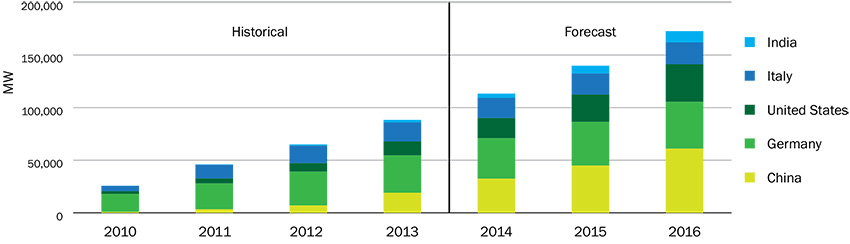

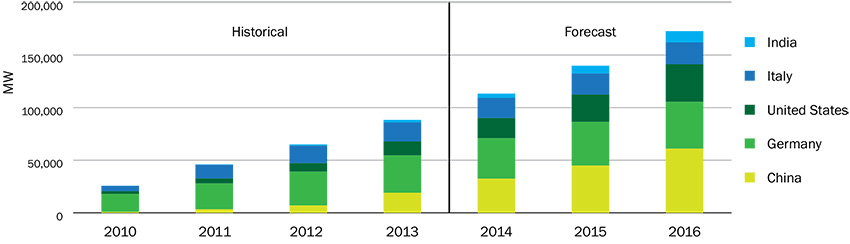

Historic and Forecast Installed Solar Capacity (MW) in Four Leading Countries and India

Source: “H1 2014 India Market outlook,” Bloomberg New Energy Finance, January 16, 2014

Key Recommendations

- Create an environment for institutions to conduct workshops, which allows stakeholders across the solar ecosystem to exchange knowledge and experiences about solar investments.

- Ensure timely programme implementation of solar policies with timelines for guidance, auctions, and payments.

- Increase transparency of solar market information and provide information on the progress of solar projects. This will boost investors’ confidence and reduce perceived risk in solar investment.

- Pilot a system of green bonds and establish green banks to inject new liquidity and reduce capital cost. This will allow greater clean energy access and development.

Stronger policies and mechanisms to finance solar energy are needed to achieve the goal of the National Solar Mission’s second phase.