Suggested Citation: Khanna, Krishna, Satyajit Ganguly, Faraz Ahmed, Shivanshu Singh, Kanica Gola, Sivasubramaniam Jayaraman, Sandeep Gandhi and Himani Jain. 2024. The Road Ahead for Private Electric Buses in India: Case of Non-urban Routes. New Delhi: SGArchitects; Council on Energy Environment and Water; and Institute for Transportation and Development Policy, India.

Private stage carriage bus operators across the country ferry 150 million people daily! With a majority of them operating in the non-urban sector, these operators provide critical and affordable public transport linkages across the regions. However, the rising fuel (diesel/ CNG) prices significantly threaten their current business.

This issue brief finds that non-urban e-bus operations are more profitable than diesel bus operations over the duration of the life of the bus. It highlights that the high cost of finance remains a major deterrent to e-bus adoption. Additionally, other concerns like limited e-bus designs, its robustness and longevity, lack of charging infrastructure, and poor know-how of the maintenance ecosystem are highlighted by operators.

In India, non-urban bus operations comprise 88% of all stage carriage bus services, catering to over 150 million daily passenger trips. Currently, there are 0.4 million such buses, but the demand will rise to 0.7 million buses by 2030 (MoRTH, 2019; Gandhi et al., 2021). Private operators cater tor 60% of these operations under stage carriage permits. However, we estimate that rising fossil fuel prices are pushing many operators out of business, all of whom currently ply CNG/ diesel buses.

As India looks at its 2070 net-zero targets, balancing economic growth with affordable and clean mobility is key. Here, electrification of the stage-carriage buses can present an opportunity. However, India has a negligible number of e-buses currently plying in non-urban areas, and will need 390,000 e-buses by 2030, to be on track to meet 100% electrification by 2050 (Gandhi et al., 2021). This would lead to significant reduction in emissions and catapult the decarbonisation of the sector. Our study tests the viability of e-buses in non-urban settings and documents various challenges to the transition.

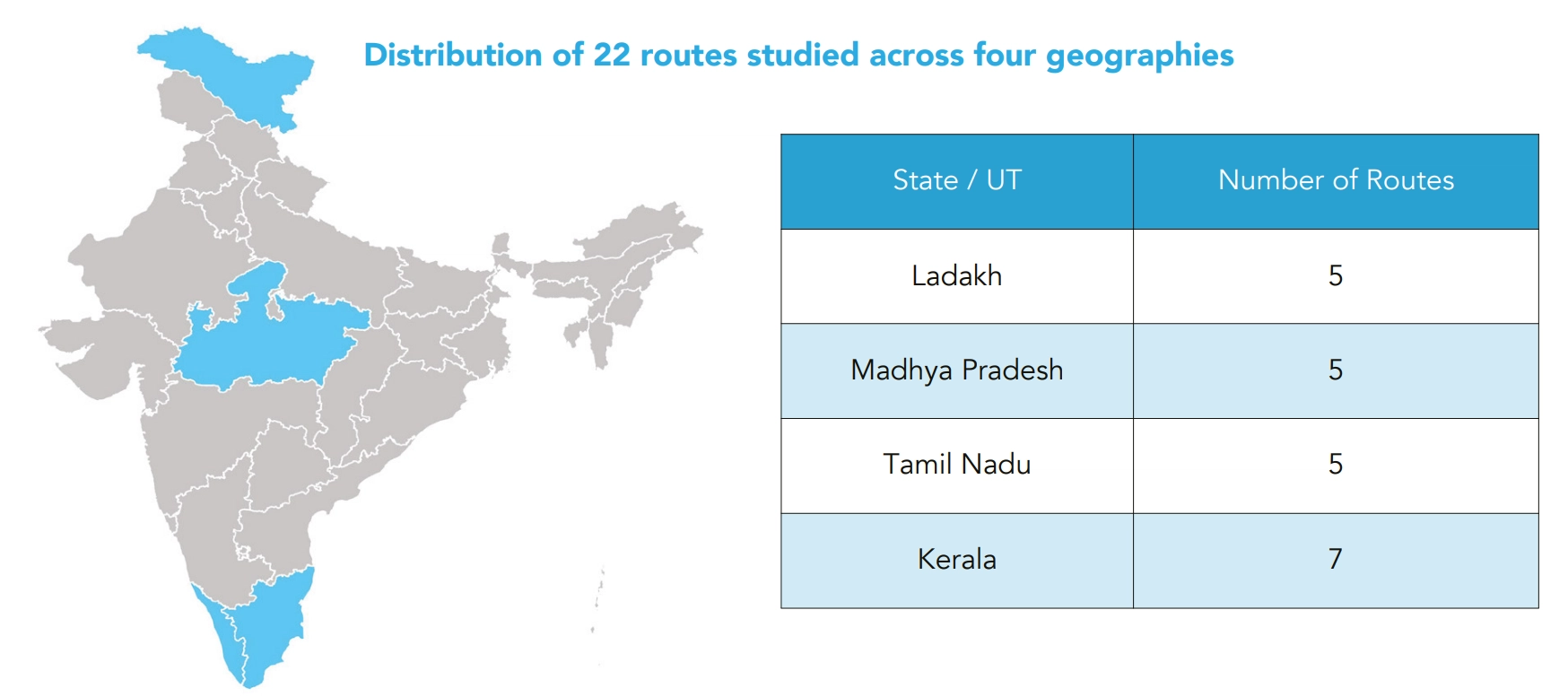

We studied 22 private-operator-run intercity and mofussil routes across four states to test the viability of e-buses. We gathered e-bus-related performance and technical specifications on 16 e-bus models from three Original Equipment Manufacturers (OEMs). These OEMs have a 70% market share and this data was used to build our ‘e-bus viability tool'. We make assumptions in the model for charging tariffs; while permit fees, and parking fees are substituted as per the prevailing diesel bus operation conditions.

E-buses are more viable than diesel buses, due to lower cost per km (CPK) across 17 of the 22 studied routes, especially for the OEM whose upfront cost is the lowest and have the highest stated fuel efficiency (FE). We find high variation in the upfront costs and operational efficacies between different OEM models. The 9 meter (9m) e-bus models show higher profitability when replacing their commensurate diesel version (same seating capacity). 12 meter (12m) e-buses offer lower profit margins than 9m e-bus owing to 20% higher bus costs and lower FE.

Battery capacity optimisation is highly sensitive to vehicle utilisation impacting the total cost of ownership (TCO) of an e-bus. However, battery capacity optimisation by route length helps save time in charging and allows operators to schedule more trips. We find the following nuances in the route length categories:

Non-urban e-bus operations are more profitable than diesel bus operations over the duration of the life of the bus. However, the high cost of finance remains a major deterrent to e-bus adoption. We estimate that under prevailing loan conditions, majority (>50%) of e-bus owners will face significantly more losses than diesel bus owners during the loan repayment period of 4-7 years.

Eight state EV policies provide up-front incentives for procurement of e-buses. Our analysis shows that either a 10- 15% subsidy on e-bus costs or an INR 10,000-12,500 per kWh on battery sizes can reduce the burden faced during loan repayment tenure, however it has no impact on the high down-payment cost. Thus, we find that leasing e-buses remain the most promising option. However, we also find that the limitations of the regulatory structure for permits, concerns around charging infrastructure, customised products and skills are barriers to exploring e-bus technology.

We recommend four levers to usher e-bus adoption in the non-urban sector:

Our findings provide e-bus financial planning for non-urban mofussil and long routes based on the ‘e-bus viability tool’. It includes product insight into required bus models and battery sizing for OEMs. Financing institutions can use these findings for developing e-bus lending portfolios and leasing contracts. These findings can support governments in establishing effective incentives, regulatory mechanisms and policy provisions to help accelerate e-bus adoption amongst private operators.

A Feasibility Study of Electric Bicycles

How Does Intermediate Public Transport (IPT) System Operate in Lucknow?

Decarbonising Shipping Vessels in Indian Waterways Through Clean Fuel

How Solar-Assisted Electric Boats Can Empower Fishing Livelihoods