As of November 2023, over 200 businesses across various sectors in India, including giants like Godrej, Birla, Bajaj and Airtel, have committed to reducing their greenhouse gas (GHG) emissions. Many multinational corporations with a significant presence in India have also announced their intention to reduce emissions and enforce net-zero targets. Yet, an all-pervasive challenge for companies is electricity consumption—a key source of emissions. In a country where the commercial and industrial (C&I) sectors together consume 50 per cent of the total electricity generated, it is vital for companies to address this. Instruments enabling consumers to specifically procure green power could be the answer. These instruments would not only facilitate Indian firms to achieve their sustainability targets but also attract climate-conscious firms from around the world to invest in India.

Green tariffs could be the way forward

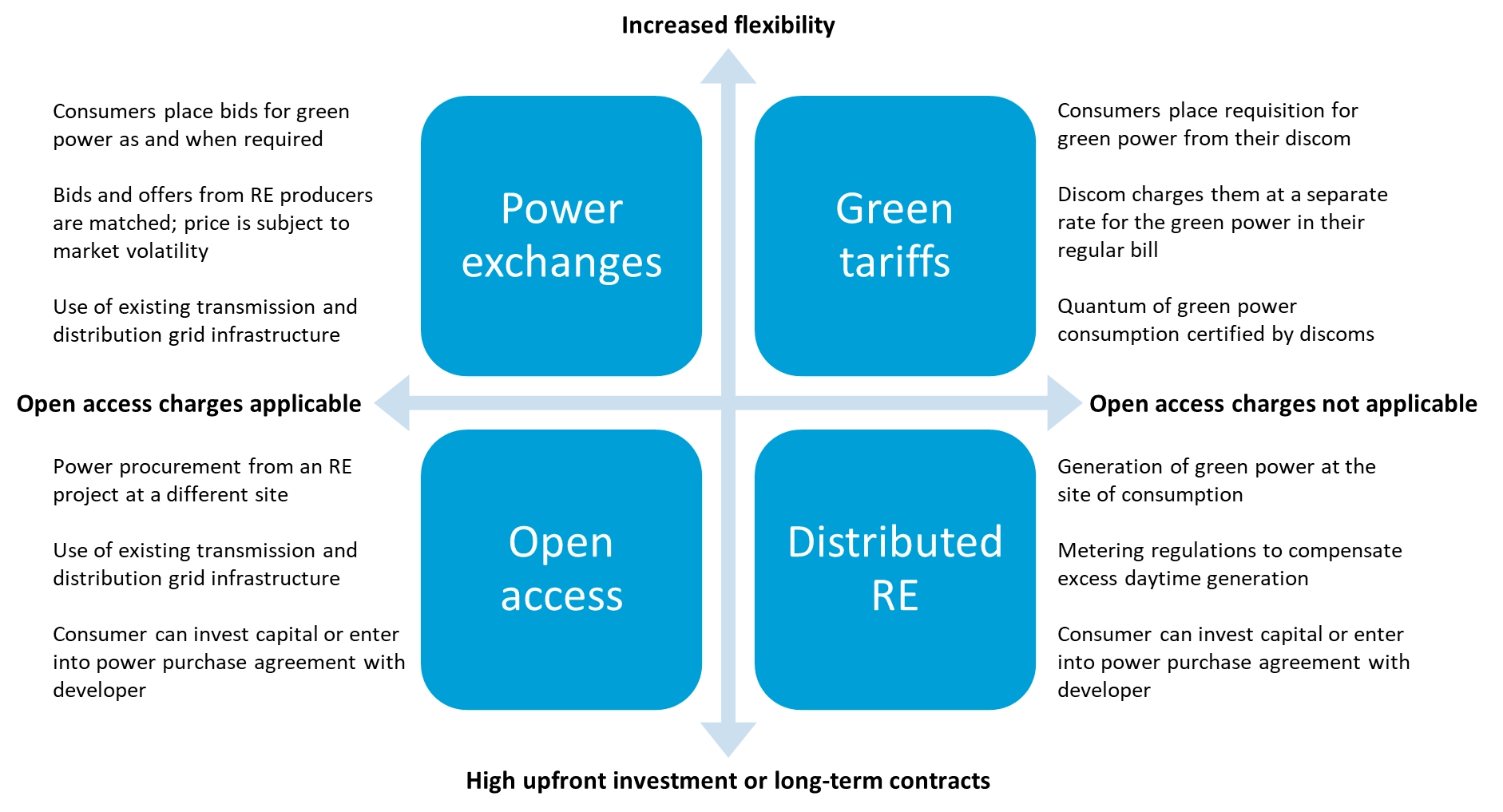

Green power procurement instruments can be categorised under four buckets – power exchanges, green tariffs, open access and distributed renewable energy (RE).

Of all the options, green tariffs are one of the most flexible and low-upfront investment options that allow eligible consumers to procure a specific quantum of power at a premium tariff from their power distribution company (discom), which, in turn, certifies that this power has come from RE sources. This is a more stable alternative than power exchanges, as the green tariff rates are notified by the respective State Electricity Regulatory Commissions (SERCs) from time to time.

With green tariffs, green power can be procured from discoms without paying separate open access charges or planning for the intermittency of RE. It also eliminates the need to finance capital-intensive projects or sign long-term agreements with project developers. Green tariffs provide a low-investment and low-risk alternative for consumers to procure green power.

For discoms, green tariffs provide an opportunity to not just retain high-paying C&I consumers committed to increasing RE adoption but also earn additional revenue from them.

Deconstructing green tariffs across states

Green tariffs were first introduced for high tension (HT) consumers (consumers connected at voltages of 11 kV or above) in Andhra Pradesh in 2008, followed by Karnataka in 2010, Maharashtra in 2021, and Odisha in 2022. Although green tariffs have existed for nearly 15 years, adoption by consumers has been limited. In FY 2021-22, power procured via green tariffs in Andhra Pradesh and Karnataka was less than 0.3 per cent of the total HT C&I electricity consumption. The limited adoption can be attributed to the high premium, especially in Andhra Pradesh, and low clarity on the rules and procedures of procurement.

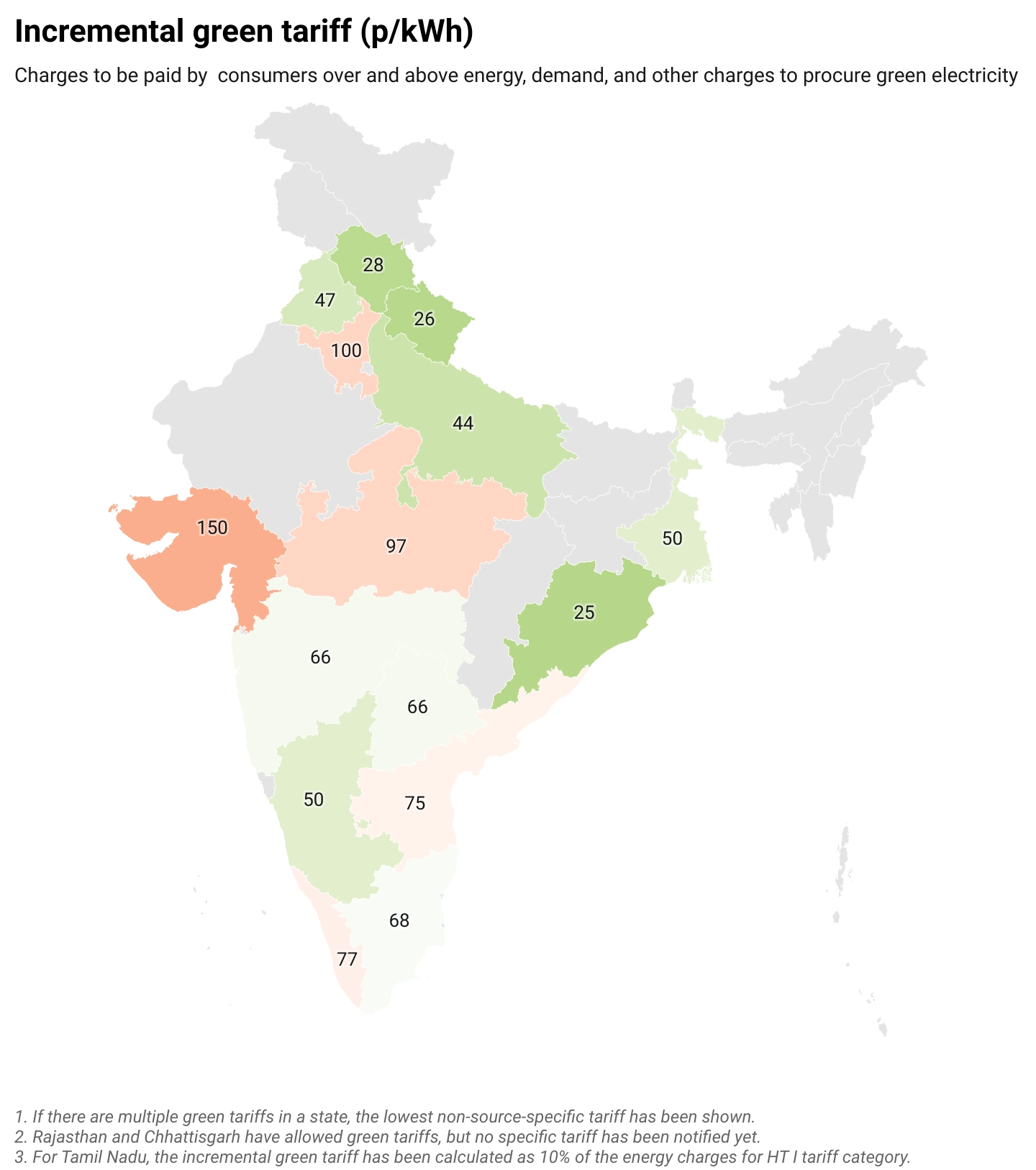

The Ministry of Power sought to standardise the green tariff regime in the Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2022 (GEOA Rules). And following a push from the Ministry this year, SERCs in 15 states have notified green tariffs. In September 2023, Rajasthan and Chhattisgarh amended the regulations to allow green tariffs; however, the tariff is yet to be defined. These 17 states together represent over 90 per cent of India’s total electricity consumption.

Only 10 of these states allow all consumers to access green tariffs, with the others excluding domestic, agricultural, or low-voltage connections. Further, SERCs depart from the GEOA Rules on key aspects of green tariffs, such as determination methodology, their use for statutory compliance, and procurement flexibility.

Source: Authors' analysis

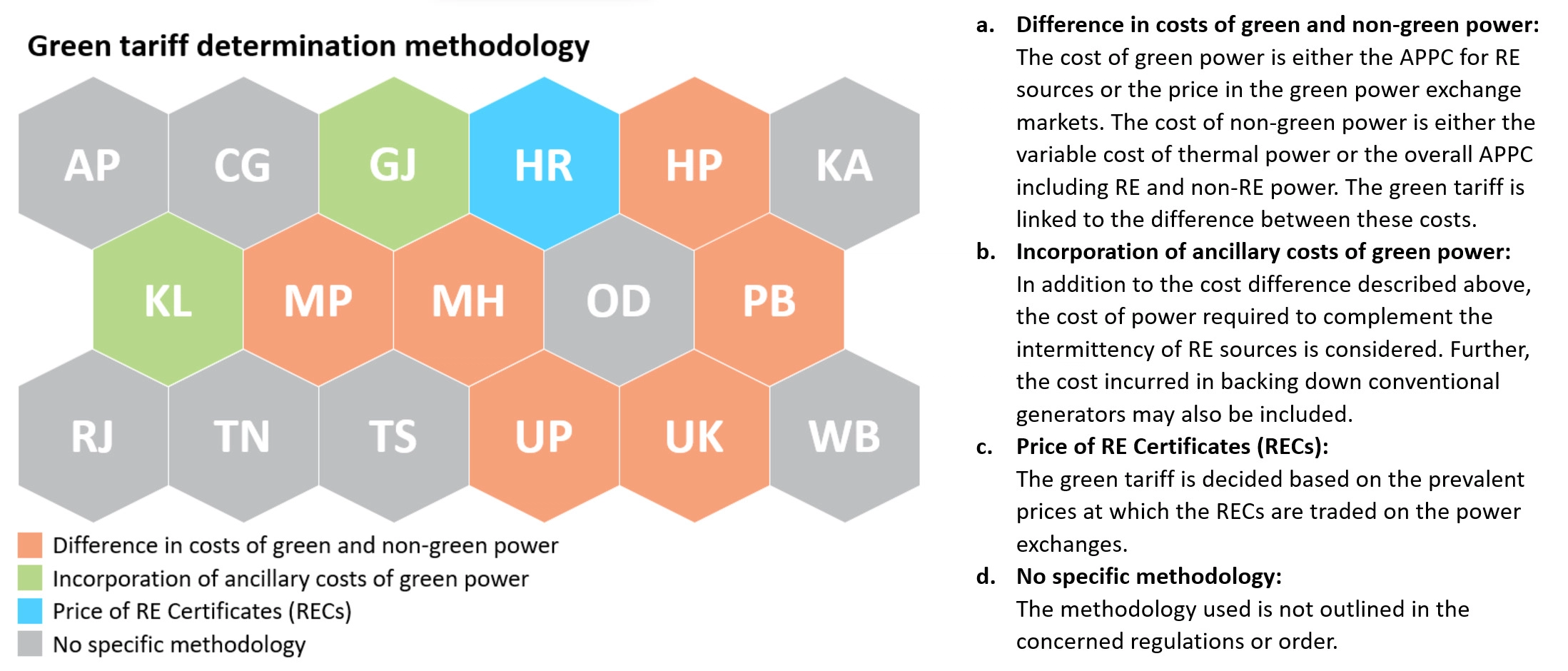

Green tariff determination methodology

According to the GEOA Rules, the green tariff will be the sum of the average pooled power purchase cost (APPC) of RE, applicable cross-subsidy charges, and prudent service charges. Thus, while the Rules imply green tariffs as a separate tariff category, states have adopted them as incremental tariffs – a per-unit charge to be paid by the consumer over and above the regular charges as per their consumer category. In determining these charges, the varying methodologies followed by SERCs can be broadly categorised as shown below.

Source: Authors' analysis

Note: The labels are the two-letter ISO codes for states

Green tariffs, RPO accounting, and flexibility in procurement

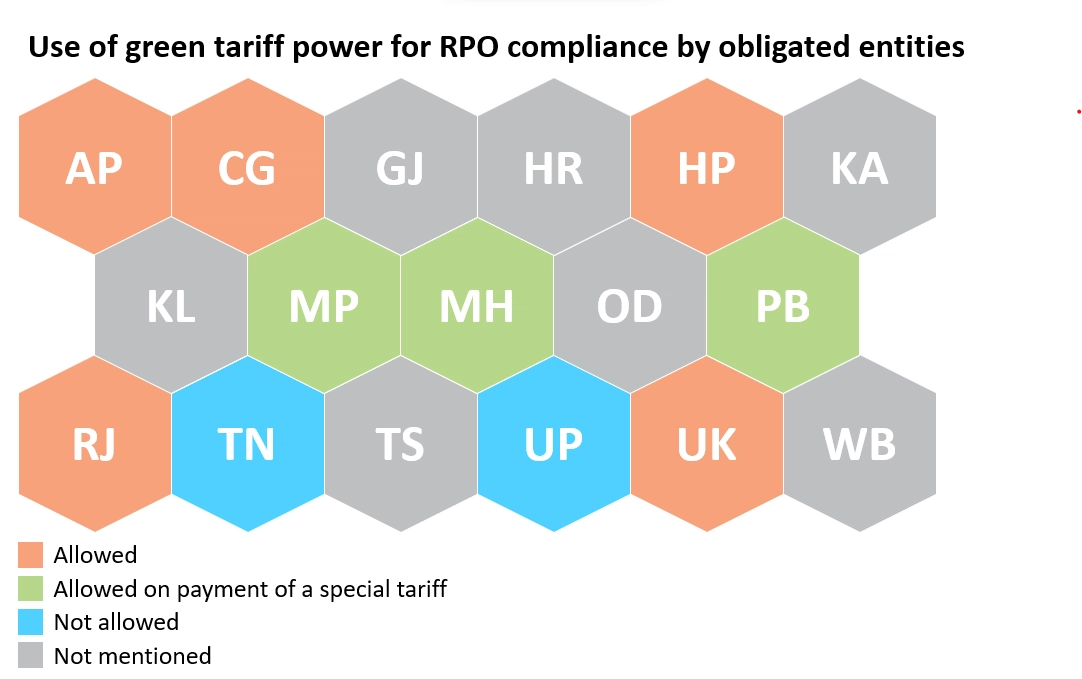

As per the GEOA Rules, power procured under green tariffs can be used to meet the consumer’s Renewable Purchase Obligation (RPO) targets, with the excess counting towards the discom’s RPO targets. However, SERCs have adopted different stances on the same.

Source: Authors' analysis

Note: The labels are the two-letter ISO codes for states

Prohibiting consumers from using green tariff power for RPO compliance particularly disincentivises industries that constitute most of the non-discom obligated entities. On the other hand, Madhya Pradesh, Punjab, and Haryana also have source-specific green tariffs, enabling obligated entities to meet the respective RPO sub-targets easily.

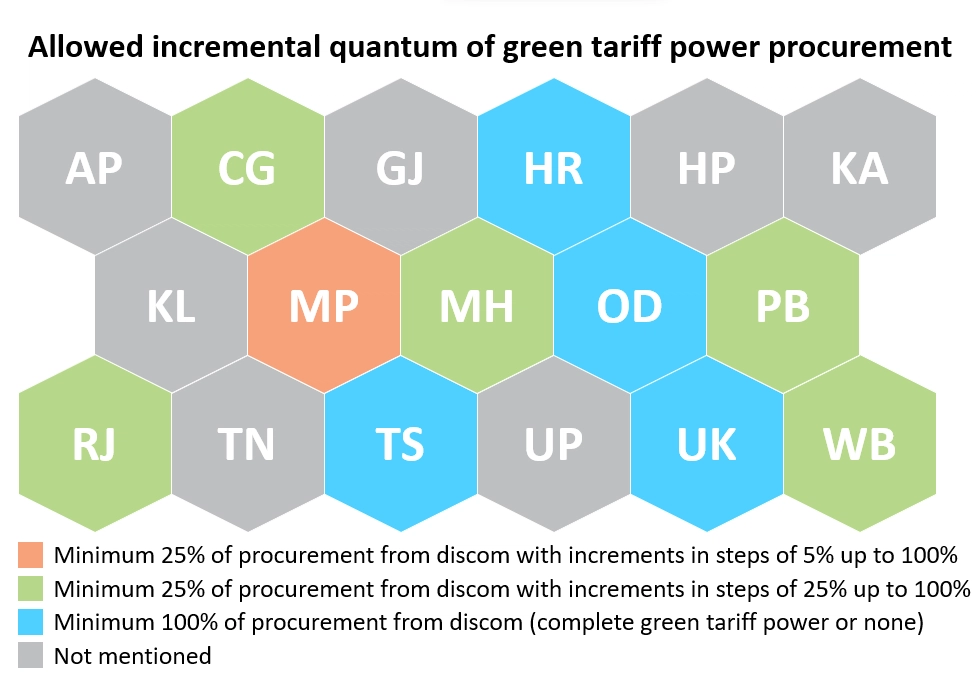

SERCs also differ on the allowed quantum of procurement under green tariffs. The GEOA Rules permit consumers to procure green electricity equal in steps of 25 per cent of their total procurement.

Source: Authors' analysis

Note: The labels are the two-letter ISO codes for states

Requiring consumers to procure their entire requirement under green tariffs limits consumers who may want to gradually increase their RE consumption or strike a balance between higher costs and lower emissions.

Strengthening the green tariff ecosystem

Marginal adoption by very few consumers would largely result only in a changed accounting of energy allocation by discoms rather than signalling an increased demand for RE power. Truly leveraging green tariffs as a mutually beneficial solution for consumers and discoms to help decarbonise the power sector requires active participation from regulators and discoms, particularly on four key aspects – accessibility, standardisation, flexibility, and recognition.

Accessibility: Discoms must create awareness of the current rules for green tariffs and make the application procedure seamless for consumers. All consumers, including those with captive generating plants, irrespective of voltage level or end-use, should be allowed to procure green electricity.

Standardisation: The Forum of Regulators can float a consultative paper on methodology seeking comments from different stakeholders, following which the respective SERCs can notify a common framework. The green tariff should be structured as an incremental charge, reflective of the difference between APPC for RE and non-RE sources. At higher levels of RE penetration, the cost of banking or storage may also be considered.

Flexibility: Consumers should be allowed to procure a minimum of 25 per cent, and up to 100 per cent, of their monthly total consumption in steps of five per cent. They can be required to submit the monthly procurement percentage in the preceding financial year to allow discoms to estimate their total requirements and plan accordingly.

Recognition: Obligated entities should be allowed to count the power procured via green tariffs towards their RPO targets. They should be able to requisition power separately from sources as per the targets. Green certification should be provided by the discom to the consumer as per the actual procurement, even if it is less than 100 per cent. The government should also ensure that the green certificate is internationally accepted by as many regulators, financiers, and other key stakeholders as possible.

The green tariff regime represents a promising experiment that allows an unprecedentedly large consumer base to meet their climate commitments and participate in India’s energy transition while providing a new revenue stream to discoms. Realising this potential requires an enabling regulatory framework that offers consumers flexibility and a policy and financing environment that recognises and rewards climate-conscious consumers. Early adopters successfully leveraging green tariffs can then help trigger a virtuous cycle of several more businesses achieving ambitious emission reductions through this mutually beneficial arrangement with discoms.

Kumaresh Ramesh is a Research Analyst at the Council on Energy, Environment and Water (CEEW), an independent policy research institution. Send your comments to [email protected].

Add new comment