As global economies move towards their net-zero goals, trade has a critical role to play in the entire process. Trade openness is a driver of economic growth. India witnessed a prominent change in its economic trajectory post the 1991 economic liberalisation – the average annual growth rates have been around 6.2 per cent since then, as against 4.2 per cent for the three decades prior to the reforms. Now, the key is to formulate policies to foster trade in relevant goods and facilitate investments in green technologies as India moves towards its net-zero-by-2070 target.

This blog argues for adopting short-term import tariff liberalisation of key inputs that are fundamental for green energy manufacturing like renewable energy, green hydrogen and electric mobility. While the Indian domestic industry gears for its net-zero journey, this trade policy tool can be used to build initial momentum. The economic Budget for FY 2023-24 has shown some welcome steps in this direction by announcing customs duty exemptions for capital goods used to manufacture lithium-ion batteries. This would ensure the country’s self-reliance in manufacturing in the long run. The importance of trade in an economy has also been well demonstrated by key global economies such as China, South Korea, Taiwan, and Japan.

Over the decades, different forms of trade have dominated the global economy. When economies are at the initial stages of development, comparative advantage theory has greater relevance. Countries produce and export goods in which they possessed a comparative advantage – for instance, in the year 2000, India primarily exported agricultural commodities and largely imported mineral and chemical products. As countries move up the economic ladder, there is a transition to intra-industry trade. Here we see countries innovate, due to which the trade within similar industries gets strengthened. For instance, India exports as well as imports mineral and chemical products for which it once largely relied on imports only. Currently, Global Value Chains (GVCs) are the form dominating global trade. In this phenomenon, tasks and activities under a production process are distributed across different countries along the supply chain. This concept strengthens the trade in intermediate goods that form an integral part of the supply chain – for instance, parts like circuit boards and microphones that go into mobile phone manufacturing. Trade-driven GVCs can be a critical economic driver for respective trading partners.

Under its trade and climate change initiative, CEEW aims to build on different ways by which India can use the trade policy route to achieve its net zero targets.

While many major economic players have been continuously increasing their engagement in global supply chains, India has been lagging behind. For instance, its Foreign Value Added (FVA) of exports, which signifies the foreign content share of gross exports, is much lower compared to other countries (Figure 1). Most of the economies that currently dominate the manufacturing exports – ASEAN countries (specifically Vietnam) and key European economies – have higher FVA. China appears to have a lower FVA, indicating the creation of surplus domestic manufacturing capacity over the years.

As FVA of exports is a function of a country’s imports, India’s FVA trend can be largely attributed to the relatively high rate of tariffs that the country places on its imports. Despite a significant degree of liberalisation over the years, India has high protective barriers compared to other economies like the US, China, EU, and ASEAN countries (Figure 2).

While high import tariffs are meant to provide protection to domestic producers from foreign competition, this approach has failed to expand the scale of operations in India. There are other important factors like complex business regulations, taxation policies, land, and labour laws that act as constraints to increasing the manufacturing base. An important point overlooked here is the consideration of the global economy as a potential supplier of cheaper inputs.

The trend pertaining to India’s limited role in global value chains can be consistently seen in some of the sunrise sectors in the renewable energy space. Under its net zero commitments, India has to meet 50 per cent of its energy requirement from renewable energy (RE) sources by 2030, and the RE industries are proactively working to serve this demand.

Since it is a relatively newer area for research and development activities, it is imperative that countries come together and create a global market for green energy production. Relying on cheaper inputs from countries that specialise in manufacturing key components is crucial for this development process. And India can show leadership here.

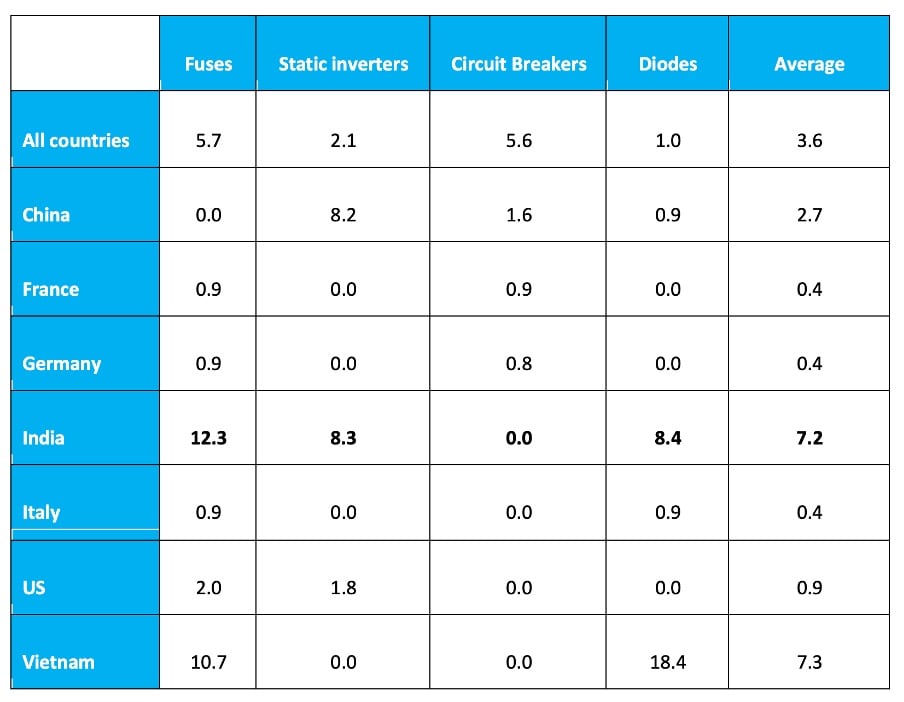

For instance, our discussions with Indian solar panel dealers, manufacturers, and solar plant installers underscored the fact that India does not have enough manufacturing capacity for key Power Electronic (PE) parts such as inverters, fuses and circuit breakers. They reported that the reliance on imports in the manufacturing process was an overwhelming 90 to 95 per cent. Despite the huge dependence of India’s solar power industry on imports, the tariff levels for some of these items are quite high when compared to other solar power leaders like the US, Germany, and Italy1(Table 1).

Table 1: Applied tariffs for selected power electronic items (2020)

Source: WTO TRAINS database

For solar modules2 exports, then, the top exporters include the countries that are also large importers of PE components – like Germany, China, and Hong Kong. With a mere 0.2 per cent share in the world’s export of solar modules, India remains stuck in a classic chicken-and-egg situation of its own making when it comes to increasing the country’s share in green GVCs.

As the trade architecture is going to see a gradual shift in the coming years, it is important that India be ready to be an active player in this new variant of trade – global value chains. In this respect, intermediate goods for green energy equipment should be identified by conducting industry-specific stakeholder discussions. Then, there should be an effort to reduce the tariffs specifically on intermediate goods.

An emerging economy like India should take the lead in this deliberation at the global level and be the pioneer in creating the necessary ecosystem for greener manufacturing. The G20 Presidency can be a platform for it.

Dr Prerna Prabhakar is a Programme Associate at the Council on Energy, Environment and Water (CEEW),an independent not-for-profit policy research institution. Send your comments to [email protected]

Notes

1 As the import tariff data is for 2020, the values for Vietnam seem higher. Vietnam has been actively reducing its tariff levels and according to the sector-wise data for 2021, the average applied tariff for the electrical machinery sector is 7.8 per cent.

2 Solar modules are defined by combining 3 different HS codes - 8541.29 (Electrical apparatus; transistors, (other than photosensitive), with a dissipation rate of 1W or more); 8541.40 (Electrical apparatus; photosensitive, including photovoltaic cells, whether or not assembled in modules or made up into panels, light-emitting diodes); 8541.90 (Electrical apparatus; parts for diodes, transistors and similar semiconductor devices and photosensitive semiconductor devices); based on

Bridle and Bellman. 2021 “How Can Trade Policy Maximise Benefits From Clean Energy Investment?”, International Institute for Sustainable Development.

Add new comment