Suggested Citation: Warrior, Dhruv, Akanksha Tyagi, and Rishabh Jain. 2023. How Can India Indigenise Lithium-ion Battery Manufacturing? Formulating Strategies across the Value Chain. New Delhi: Council on Energy, Environment and Water.

Scaling and stabilising lithium-ion battery cell manufacturing in India is critical to India realising its decarbonisation goals. This issue brief deconstructs the lithium-ion battery cell manufacturing process, estimates the material and finance requirements, and offers a blueprint for a possible indigenisation strategy. A significant portion of the rapidly growing battery demand projected between 2021-2022 and 2029-30 from India’s power and mobility sector can be met by domestic battery manufacturing. This study finds that enabling such a large-scale buildout will require mobilisation of significant capital and securing of battery components and electrode materials to supply the industry.

Developing indigenous upstream and midstream capacity in lithium-ion battery supply chains were identified as avenues for significant additional value capture. The study concludes that India will need to focus on innovation, ecosystem building and securing cathode mineral supplies to secure this nascent industry.

Energy storage technologies are expected to play a critical role in the decarbonisation of the electricity and transport sectors, which account for 49 per cent of India’s total greenhouse gas emissions (CO2 equivalent) as of 2016 (MoEFCC 2021). Among the several technologies available for energy storage, lithium-ion-based batteries are expected to dominate the sector in this decade (IEA 2021). With nearly non-existent infrastructure across the supply chain and limited deployment experience, it is crucial for India to gain more control over the supply chain of lithium-ion batteries. Given the complexity of the global supply chain, scaling up and stabilising battery cell manufacturing is critical to India realising its decarbonisation goals. In this issue brief, we deconstruct the lithium-ion battery cell manufacturing process, estimate the material and finance requirements, and offer a blueprint for a possible indigenisation strategy.

The cumulative storage demand will vary significantly based on the trajectory of the country’s transport and power sectors. For this study, we estimate the demand for utility-scale storage based on the recently announced energy storage obligation by the Ministry of Power (MoP 2022). The notification recommends stored renewable energy comprise 4 per cent of total consumption by 2030. Our analysis suggests that this would translate to approximately 327 GWh of storage capacity by 2030 (CEA 2022).

The remaining demand (576 GWh) from electric vehicles (EVs) is estimated based on a 2020 study by the Council on Energy, Environment and Water (CEEW), which estimates the stock of EVs in India in 2030 under the EV30@30 scenario (Soman, et al. 2020).

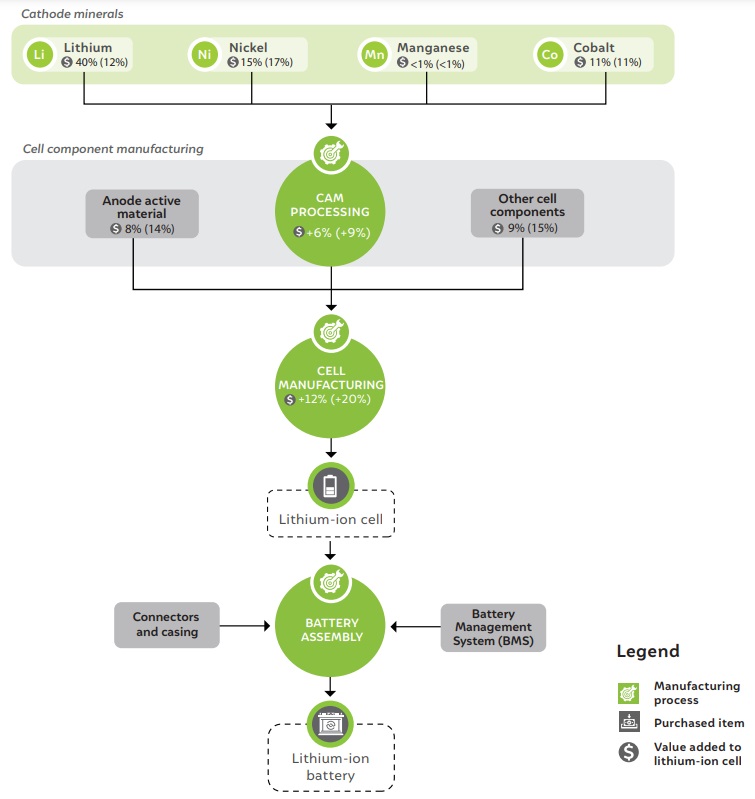

Figure ES1 shows the various stages and value addition possible in the value chain for lithium nickel manganese cobalt (Li-NMC) batteries. Although the current focus of Indian companies is on battery cell manufacturing, the upstream process will likely be the next focus area as more cell manufacturing plants are commissioned in India. These industries include graphite anode production and cathode active material production as well as electrolyte, separator, and current collector manufacturing.

Among these, active cathode material production is most critical. The market prices of the minerals that go into the battery cathode are highly volatile. As commodity prices fluctuate, so will the actual cost of batteries based on their chemistry. Further, securing reliable access to minerals is a new challenge. Given India’s low natural endowment of most lithium-ion battery minerals, between 12–60 per cent of the value chain is subject to imports.

In our analysis, we assume that new battery manufacturing facilities have a minimum capacity of 5 GWh. The total cost, including land acquisition, factory floor space, warehousing, and connecting utilities, could lie between USD 325–450 million (INR 2437–3375 crore1 ) for each 5 GWh facility. Furthermore, these factories will be energy intensive, with a 5 GWh production facility consuming about 250 GWh (250 MU) annually.

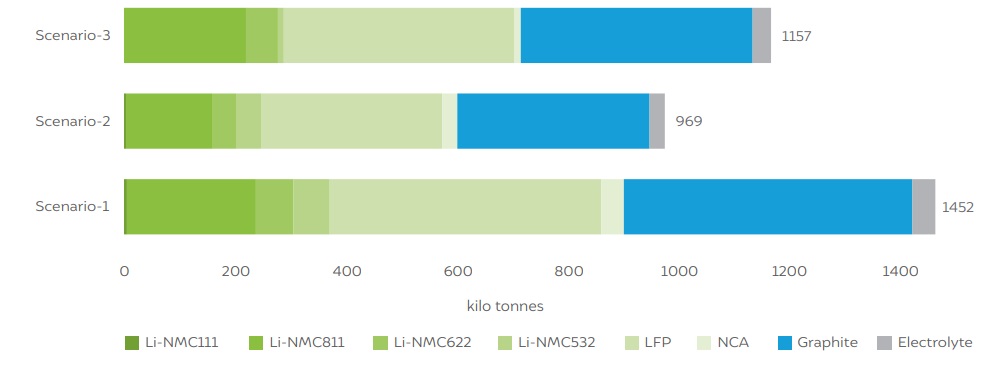

We use three scenarios with varying degrees of indigenisation and technology mixes to estimate India’s active electrode (cathode and anode) and electrolyte requirement to meet the energy storage demand of 903 GWh by batteries (Table ES1).

Figure ES 1 Lithium nickel manganese cobalt (Li-NMC-622) chemistry value chain

Source: Author’s analysis, Argonne National Laboratory 2020, Shanghai Metals Market (SMM n.d.), CellEst 2019

Note: The value added to the finished LIB cell at each stage of the value chain is provided for June 2022 and June 2021 (in brackets). CAM processing value add includes value added during precursor CAM processing. For components other than CAM, the value of the consumable to the manufacturer have been provided as their value share. Other cell components refer to: separator [VA - 3%(6%)], aluminium current collector [VA - <1%(<1%)], copper current collector [VA - 2%(4%)], electrolyte [VA - 2%(4%)]; cell casing value not considered in analysis. Values may not add up to 100% due to rounding. CAM: cathode active material.

Table ES 1 The scenarios developed for active electrode material and electrolyte demand estimation

As Figure ES2 shows, demand is highest in Scenario 1 (1452 kt); it is characterised by high indigenisation (60 per cent of the cumulative demand) and the market is largely dominated by lithium-ion-based chemistries.

Meanwhile, Scenario 3 – with the same level of indigenisation but other emerging technologies, like redox flow and solid-state batteries – features less demand for active materials and electrolytes (1157 kt).

Figure ES 2 Cumulative active material requirement (kilo tonnes, kt) for India’s storage ambitions under different scenarios (2022-2030)

Note: Li-NMC — Lithium nickel manganese cobalt; LFP— lithium ferro phosphate; NCA—nickel cobalt aluminium

Source: Author’s analysis

Multiple interventions are required to ensure that investors are interested in funding battery manufacturing. Broadly, these interventions can be categorised into three types:

Taking a strategic view on the sector will ensure that India is a trend-setter, and not a follower, in the battery manufacturing ecosystem. In the absence of such a concerted strategy, the government would need to intervene periodically through artificial support measures.

Energy storage systems are slated to play a critical role in the global decarbonisation process, leading to an exponential increase in their demand. Trends suggest that batteries based on lithium-ion technology will have the largest market share in the foreseeable future. India should strive to not only meet the demand via domestic manufacturing but also aim to become an export powerhouse. This would require the government to think strategically about different aspects of the value chain – procurement, manufacturing, deployment, and recycling. The progress on each of these aspects is currently limited and would require a mix of stakeholders – from government, industry, research, and academia – to work together. The accessibility of minerals at favourable prices will be a critical aspect for global competitiveness. India’s foreign policy must align with new trends and target strategic interventions in key geographies.

Designing a long-term roadmap is the most urgent intervention that the government needs to undertake. This will help stakeholders across the value chain align with the country’s long-term vision. A specific focus on R&D, process improvements, and recycling can reduce the need to source cell components from other countries. Academia must immediately start designing courses and curricula to meet the increasing demands of the workforce. Through multiple interventions, India can indigenise a large part of the lithium-ion battery manufacturing ecosystem.

Addressing Technology Gaps through Collaboration on Advanced Cell Chemistry Batteries

Addressing Vulnerabilities in the Supply Chain of Critical Minerals

Building Resilient Mineral Supply Chains for Energy Security

Solar Geoengineering and the Montreal Protocol