It is becoming increasingly clear in one climate negotiation after another that just focusing on emission mitigation is not going to help the world limit global warming to the 1.5°C threshold. Developing countries, especially, need to step up climate adaptation measures. One of the foremost strategies for it is Nature-based Solutions (NbS), such as mangrove protection.

The Mangrove Ministerial hosted at COP28 in Dubai saw the establishment of a formal partnership between the Mangrove Alliance for Climate (MAC) and the Mangrove Breakthrough. The Breakthrough aims to secure 15 million hectares of mangroves globally by 2030 by restoring half of the recent mangrove losses that occurred during the past decade, doubling the protection of mangroves and ensuring sustainable long-term finance for all existing mangroves by achieving an investment of USD 4 billion by 2030.

For centuries, mangroves have been known for their invaluable benefits as resilient guardian ecosystems. Mangroves provide multifaceted benefits such as carbon sequestration and enhance resilience against extreme climate events such as floods and cyclones. For instance, mangroves present in the Kutch and Saurashtra regions reduced the impacts of Cyclone Biparjoy which made landfall during June 2023. In fact, mangroves prevent more than USD 65 billion in property damage and reduce flood risk for 15 million people annually. Additionally, mangroves have the ability to store up to 10 times more carbon per hectare than terrestrial forests. However, the finance – both public and private – flowing into the conservation and protection of mangroves is currently limited.

How India plans to strengthen mangrove ecosystems

According to the Indian Forest Survey Report 2021, India has a mangrove cover of 4,975 sq km and has witnessed an increase of 336 sq km in mangrove area over the last decade. Since India became a member of the MAC in 2022, it has bolstered its efforts in mangrove plantation and conservation through a series of initiatives.

In its 2023-24 Budget, India announced the Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) Scheme, which aims to develop 540 sq km of mangroves across the country and promote the sharing of best practices on plantation techniques, conservation measures, management practices and resource mobilisation through Public-Private Partnerships. According to estimates by the Indian government, MISHTI will provide indirect economic benefits worth INR 51.78 billion per year and provide an additional carbon sink of 4.5 million tonnes over a 10-year period. The Government also launched the Green Credit Programme, which incentivises environmentally positive actions through market-based mechanisms and generates green credit, with the aim to encourage industries, private companies and other entities to meet their existing targets related to environment conservation and protection.

As India aims to harness the potential of mangroves to achieve the target of creating an additional carbon sink of 2.5-3 billion tonnes of CO2 equivalent through additional forest and tree cover by 2030, it must create a strategy to generate investments in mangrove conservation and restoration. The government must also diversify the sources of investments flowing into mangroves by incentivising private investments.

Mangroves need money – both public and private

Mangroves are identified as NbS that contribute towards achieving both emission mitigation and adaptation-related goals. An increase in investments towards mangroves could provide both the public as well as the private sector with multiple benefits and opportunities.

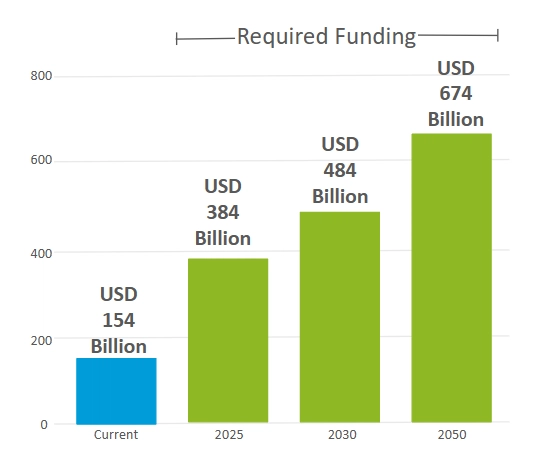

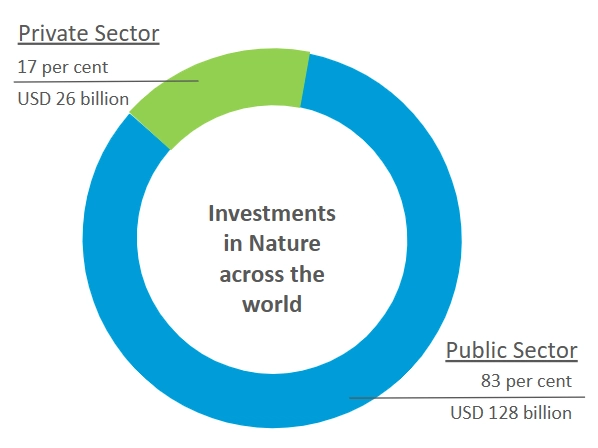

The State of Finance for Nature 2022 by the United Nations Environment Programme (UNEP) highlights a massive funding gap of USD 230 billion in investments in nature required to achieve mitigation, biodiversity and degradation-related targets (Figure 1). According to a report by the Global Mangrove Alliance, approximately USD 11.1 billion will be needed over the next two decades to reinstate restorable mangroves worldwide. However, the current scale of investments is significantly insufficient to meet this requirement. A report by Systemiq, developed for the Mangrove Breakthrough, suggests that a majority of the investment in mangrove protection and restoration has been delivered by the public and philanthropic sectors. But the financial flows from the private sector remain a challenge. The UNEP report supplements this by highlighting that the private sector contributes only 17 per cent of the current investments flowing into NbS (Figure 2).

Figure 1: Current investments in nature and required funding

Source: State of Finance for Nature 2022, UNEP

Figure 2: Contribution of the public and private sector in investments in nature

Source: State of Finance for Nature 2022, UNEP

Bringing in funds for mangroves

We propose three recommendations aimed at fostering private investments in mangroves. These can yield positive outcomes for both investors and the preservation of mangrove ecosystems.

Proposing a blended finance vehicle to mobilise investments from Multilateral Development Banks (MDBs): A high percentage of private climate finance, for projects under both adaptation and mitigation, is mobilised by Multilateral Development Banks (MDBs). According to a report by the OECD, MDBs mobilised private climate finance worth USD 33.8 billion per year between 2018 and 2020. However, MDBs face several risks and challenges, especially in developing countries such as credit risk, lack of data on the benefits of projects and potential barriers, and non-availability of efficient monitoring, reporting and valuation tools that deter investments.

A new blended finance vehicle named ‘Global Fund for Mangroves’ proposed by the Mangrove Breakthrough could be used to mobilise private finance from MDBs to scale mangrove-related nature-based solutions in India. The tool will address the multiple risks faced by MDBs and other private investors such as credit and offtake risk by ensuring multiple streams of funding and project development, thus, bridging the funding gap and encouraging private investments.

Incentivising the private sector to invest in mangroves: Investing in nature-based solutions as grants or direct investors could provide companies with multiple benefits in the form of profit, resilience, compliance or mission. Some of the most common barriers faced by the private sector in providing finance for nature include the uncertainty in assessing risks and estimating the value of investments. In order to reduce these uncertainties, the government should take two steps.

First, create a data repository with nature-related data such as data on ecosystem services, risk of climate change on different ecosystems and data on biodiversity, which includes the number of endangered and vulnerable species in an ecologically sensitive area, and observed change in habitat. This would help companies conduct risk assessments and help them understand the impact of their activities on natural ecosystems such as mangroves. Further, this would strengthen disclosures that are necessary under the Business Responsibility and Sustainability Reporting set by the Securities and Exchange Board of India (SEBI).

Second, the government must provide a framework to measure the effectiveness of nature-based solutions, which helps companies identify benefits achieved from existing projects, economically quantify ecosystem services such as avoided costs due to disasters, value of carbon sequestered, and livelihoods generated. This would also deter greenwashing. A framework to map and estimate the costs and benefits of nature-based solutions will provide much-needed guidelines to companies and thus encourage investments by reducing uncertainties. These measures will aid companies in finding relevant projects for investment under Corporate Social Responsibility (CSR) as well as support them in understanding their impact on ecosystems and biodiversity.

Several companies have already invested in mangroves as part of their CSR efforts. Reliance Industries Ltd (RIL) entered into an MoU with the Government of Gujarat to develop a 3,500-acre area of mangrove forest within the Marine National Park, as part of the Central Government's MISHTI scheme. The mangrove conservation project by Godrej in Maharashtra, which includes training and building capacity of the community, conserving species of both flora and fauna, increasing livelihood opportunities for local communities over a 3,000-acre area, has been functional since the 1940s.

Encouraging social entrepreneurship in mangrove conservation: Nature-positive businesses, which protect the environment and conserve natural resources while providing local livelihood opportunities, could lead to the establishment of a new revenue stream of climate finance in India. There is a growth of green entrepreneurship for nature and biodiversity conservation in India. The government could promote the establishment and sustenance of small enterprises that depend on the resources available in the mangrove ecosystem and thus conserve mangroves. This could include providing special incentives such as micro-loans to scale the positive impact of such businesses on both livelihoods and mangroves.

Ultimately, a push to increase private finance will go a long way in helping India achieve its target of increasing the mangrove cover to more than 5,500 sq km by 2030. India, as a member of MAC and Mangrove Breakthrough, should aim to improve its restoration efforts significantly as it aims to host COP33 in 2028 towards the end of the Decade of Ecosystem Restoration. The scaling up of mangrove-positive actions would highlight India as a globally prominent conservation leader and help the country achieve both its mitigation- and adaptation-related targets.

Aryan Bajpai is a Research Analyst at the Council on Energy, Environment and Water (CEEW). Send your comments to [email protected].

Add new comment