Suggested citation: Rao, Harsha V., and Disha Agarwal. 2021. How India’s Solar and Wind Policies Enabled its Energy Transition – A Decade in Review. New Delhi: Council on Energy, Environment and Water.

The report provides a detailed overview of India's solar and wind policies over the last decade, both at the Central and state level. It assesses renewable energy (RE) policies of eight RE-rich states and three RE-deficit states. The RE-rich states covered are Andhra Pradesh, Gujarat, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, and Telangana. The RE-deficit states include Bihar, Punjab, and Uttar Pradesh. The study analyses the achievements, challenges faced, and the policy outcomes that led India to demonstrate a functional RE transition pathway to the world successfully. It also evaluates where India stands today and draws lessons for shaping the next generation policies needed for the country to champion the global energy transition.

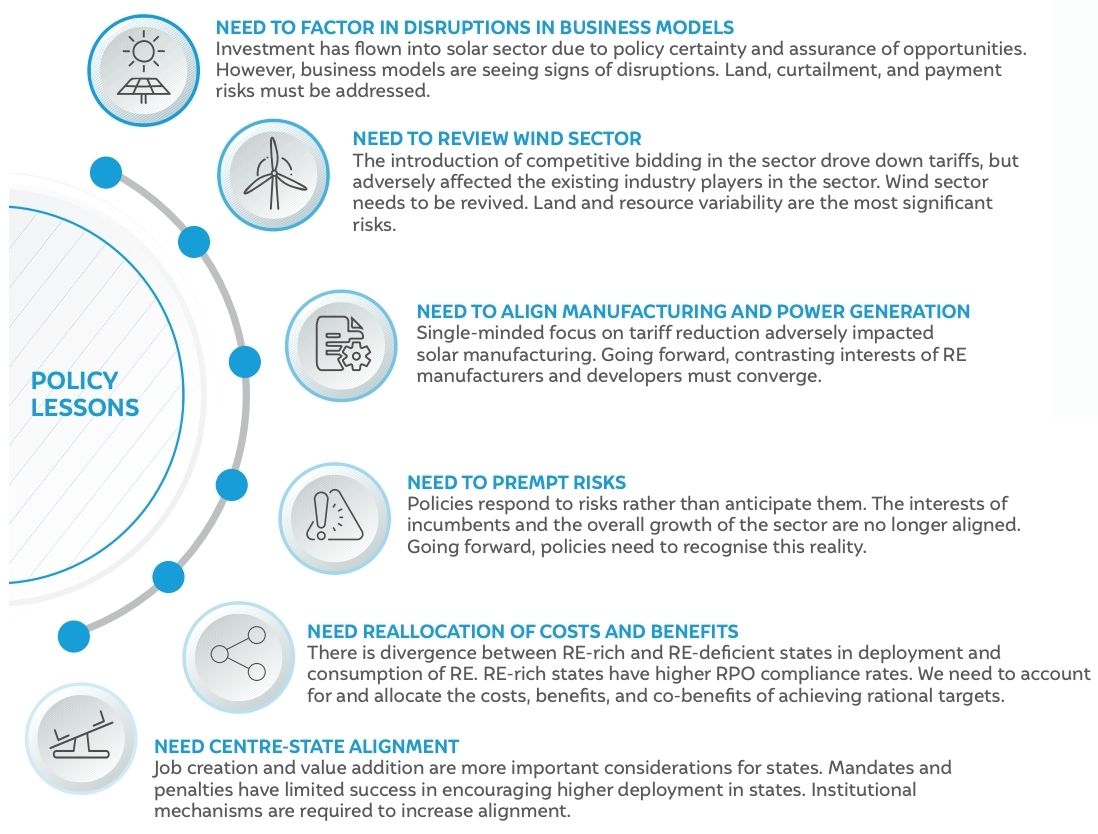

The lessons from the policy journey so far

Source: Author’s analysis

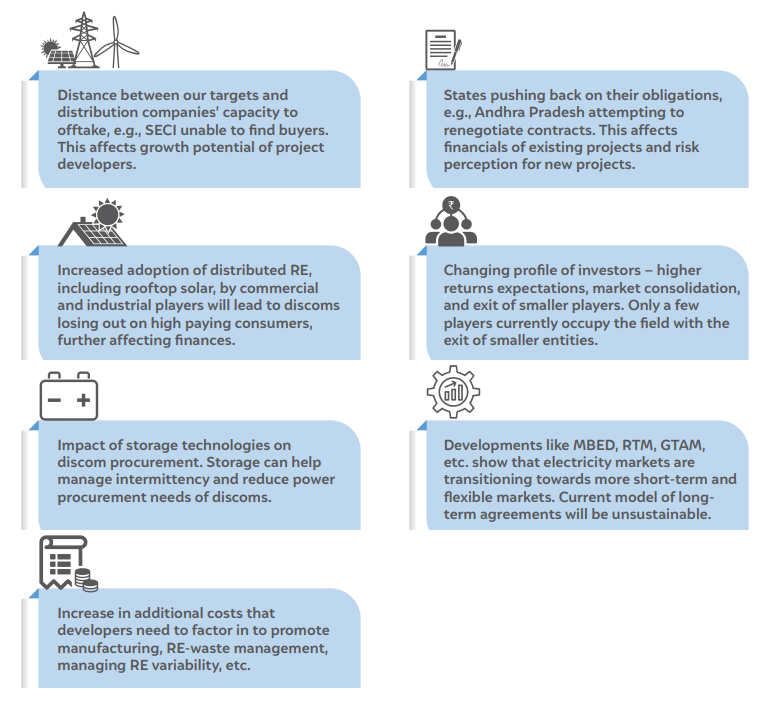

The sector is faced with imminent market disruptions

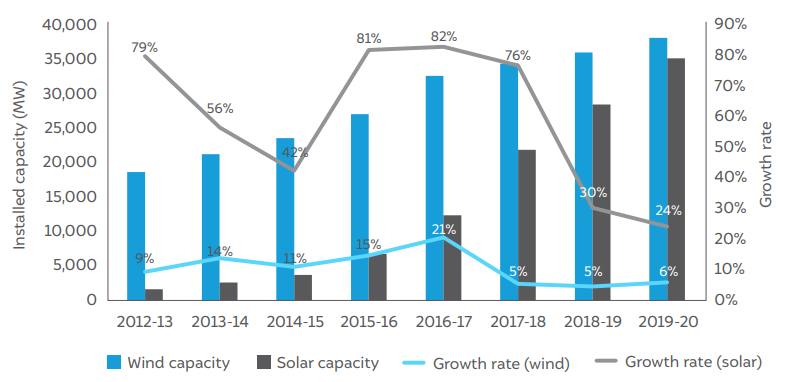

In 2015, India announced ambitious targets for renewable energy—175 GW by 2022—one of the largest expansion initiatives in the world. Just four years later, at the United Nations Climate Action Summit 2019, the Prime Minister of India pledged to increase India’s renewable energy (RE) capacity to 450 GW by 2030 (PIB 2019). India’s journey to reaching these targets is at a critical juncture. The pace of capacity addition in utility-scale wind and solar power, which saw a rapid increase during 2014–2017, has since slowed down (Figure ES1).

Figure ES1 Pace of capacity addition in wind and solar projects has slowed down

Note: Figures for 2019-20 are only up to December 2019.

Source: CEA. 2019. Growth of Electricity Sector in India From 1947-2019. New Delhi: CEA, MoP; CEA. 2020. All India Installed Capacity as on 31 December 2019. New Delhi: CEA.

Private investment has shaped deployment trajectories so far. Today, solar and wind technologies have advanced, supply chains have strengthened, and expertise has developed. Despite the highs and lows, investor confidence in India’s RE sector continues to remain robust. Further, many factors favour investments in RE. It has proved itself to be resilient in times of crisis, including the COVID-19 induced shocks in 2020. There are strong signals that RE is a preferred choice, not just because of its green attributes, but because of its favourable cost economics for all stakeholders.

Evolving policies at the Central and state level have played a significant role in building investor confidence. From our study of the evolution of the sector, we learn that the initial policies were instrumental in propelling RE growth. Every time a roadblock emerged, India has been successful in testing and identifying alternate approaches and solutions. Some of these innovative approaches include tariff bundling; encouraging solar parks to benefit from economies of scale; creating payment security mechanisms to address counterparty risks; encouraging solar–wind hybrid parks to improve utilisation factors; testing and introducing protocols and mechanisms such as security constrained economic dispatch (SCED), a real-time market (RTM), market based economic dispatch (MBED), and a green term-ahead market (GTAM) to optimise grid integration costs, etc. However, a mixture of legacy issues and recent developments threaten the current business models and existing policies may no longer be sufficient to ensure continued growth of the sector.

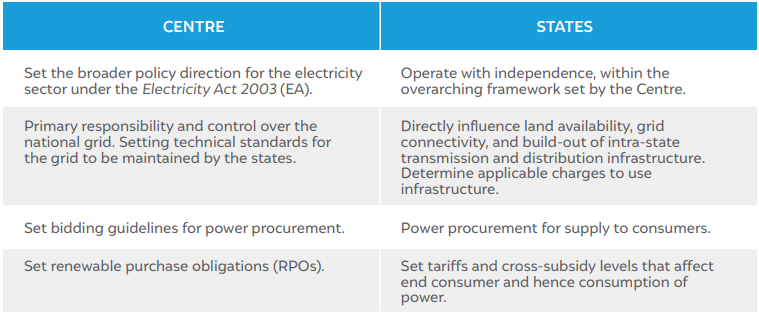

Both the Central government and the state governments have different spheres of influence (Table ES1) affecting the power sector. Hence, both Central and state policies need to be studied to understand the functioning and evolution of the sector.

Table ES1 Spheres of influence of the Centre and states

Source: Authors’ analysis

The initial drivers for RE capacity addition were fiscal, financial, and tax incentives, like accelerated depreciation, generation-based incentives, and feed-in tariffs (FiTs) determined by state commissions. Wind turbine manufacturers were the first movers. The de-licensing of generation under the Electricity Act 2003 (EA) set the stage for private investments in RE.

However, the introduction of the National Solar Mission (NSM) in 2010 brought about a massive jump in solar capacity addition and turned the spotlight to utility-scale RE projects. The NSM addressed offtake and payment risks, with creditworthy trading intermediaries signing long-term power purchase agreements (PPAs) with project proponents. The payment and offtake risks arose from the higher costs of solar power as opposed to prevailing conventional power tariffs and poor financial health of distribution companies or discoms (primary bulk procurers of power). The NSM progressed from a FiT regime to competitive bidding and was successful in increasing solar capacity deployment in the country from just 2 MW in 2007–08 to 3,744 MW in 2014–15 (CEA 2019).

Competitive bidding also became mandatory for wind power from 2017. However, it did not see the same level of success as solar. While tariffs did come down, the rate of growth of wind capacity also reduced (see Figure ES1) because the low tariffs disrupted the business model of existing players who were also equipment manufacturers. The future trajectory of wind deployment remains to be seen, with solar tariffs continuously falling and the evolution of the models adopted by independent RE power producers.

Critical requirements that Central policies have not fully tackled are those of timely procurement of suitable land, timely construction of evacuation and transmission facilities, and minimising curtailment. These are also the areas in which states have significant roles and authority. The Ministry of New and Renewable Energy (MNRE) introduced the Solar Park Scheme in 2017 to address land-related issues and fast-track deployment through land aggregation and access to the Central transmission network. However, the scheme’s target of setting up at least 50 solar parks by 2022, is still distant (MNRE 2020). It has been unable to solve coordination issues, and the ability of the Centre in developing schemes to address land issues is limited.

Initially, in the absence of cost-competitive tariffs, large buyers of power were mandated to purchase RE through renewable purchase obligations (RPO) under the National Tariff Policy, 2006, in a bid to create demand for RE. The EA authorises state regulators to set their own targets and regulations on RPOs. In subsequent years, the Ministry of Power (MoP) and the MNRE made multiple attempts to nudge states to set higher RPO targets and ensure strict compliance. However, our analysis shows that there have been considerable lags in both.

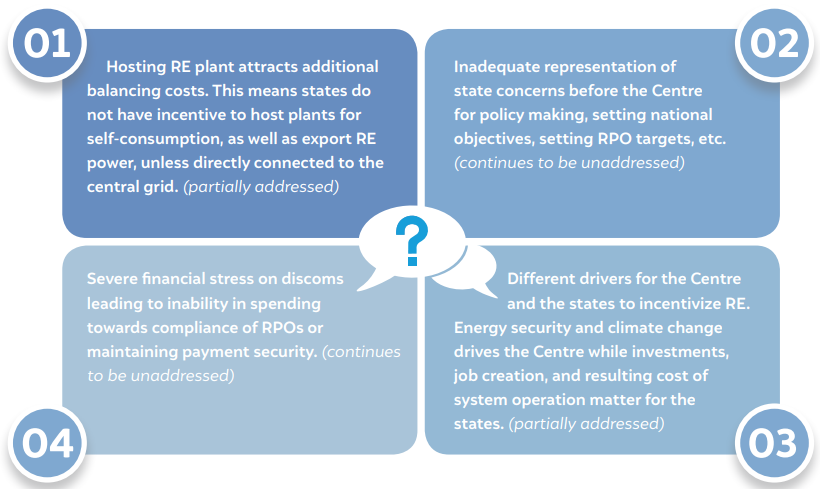

We find that the reasons for middling compliance with RPO targets are:

Currently, apart from setting up inter-state projects, there are no other mechanisms to equitably share the costs of hosting RE projects to supply power to other states. Further, despite RE tariffs attaining grid parity, investors continue to rely on RPOs for demand creation, indicating deeper causes obstructing further RE penetration in markets. Inadequate compliance of Central policies by states also point to certain legitimate state concerns that may not have been addressed (Figure ES2).

Figure ES2 State concerns that remain unaddressed in Central policies till 2014 and beyond

Source: Authors’ analysi

We also note that the main drivers for promoting RE are slightly different for the Centre and the states. While the Centre initially emphasised energy security and climate change mitigation, the states were keen to obtain the benefits of private investment and job creation. It is only lately that the Centre has also emphasised the job creation and domestic manufacturing potential in RE.

Most RE-deficit states are inclined to meet their RPO targets mostly through local deployment, even if the local deployment is inadequate to meet the targets. This is particularly true for solar, which is a more abundant and widespread resource throughout the country. State-level RPO regulations, compliance provisions, participation in REC markets, and achievement levels demonstrate this. However, with stricter enforcement measures and falling tariffs, the inter-state transmission system (ISTS) procurement of wind and solar power has seen a rise

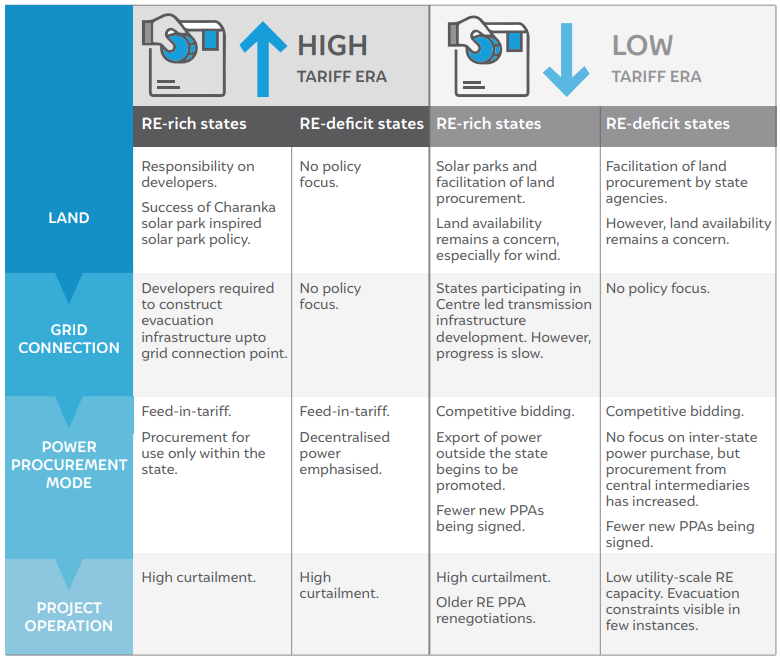

State-level institutions have the power and responsibility to ease land procurement for projects, facilitate connectivity to the grid, enable the construction of transmission infrastructure, and ensure offtake of the power generated from the plants. From our analysis of the RE policies of eight RE-rich states and three RE-deficit states, we find that policies vary widely on these fronts (Figure ES3).*

Figure ES3 Developments across project deployment and operations

Source: Authors’ analysis

Pre-2014, when RE tariffs were still quite high, the policies of even the RE-rich states did not provide a lot of support to private investors in the sector. The responsibility of obtaining land was placed on the developers themselves. Even though the states notified their own RE policies, they did not meet their targets. States like Gujarat and Rajasthan saw considerable capacity deployment under the NSM in this period, owing to the easy availability of land and high wind and solar potential. Charanka Solar Park in Gujarat, set up in 2012, was successful in attracting investors. This inspired the push towards establishing more solar parks in the country. Because evacuation infrastructure was inadequate, state policies required developers to finance and construct the required infrastructure, at least till the interconnection point.

*The RE-rich states covered are Andhra Pradesh, Gujarat, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, and Telangana and the RE-deficit states covered are Bihar, Punjab, and Uttar Pradesh.

However, beyond the interconnection point, transmission infrastructure continues to remain a challenge. This, coupled with the financial difficulties of the distribution utilities, led to the severe curtailment of RE power. The state policies only incentivised RE project development that supplies power to their own state discoms. Some states, like Maharashtra, Karnataka, and Andhra Pradesh, even made it mandatory to sell electricity only to discoms within their borders and obligated entities within the state.

Lowering tariffs corresponded with increased state promotion of RE, but legacy issues came in the way. The year 2014 marked the beginning of a significant departure from the past. Many developments favoured the RE sector, and Central and state policies found greater synergy. As RE tariffs fell steeply, states moved to incentivise large-scale projects, including solar parks. They sought to capitalise on investor interest in this sector, and states like Andhra Pradesh extended the incentives available to other industry, like land allotment, facilitation of clearances, tax incentives, etc., to RE power plants. There was a shift in focus from setting up projects for self-consumption to supporting projects for the export of power to other states. Rajasthan, Maharashtra, and Andhra Pradesh provided developers with incentives, such as time bound open access approval, facilitating land procurement, exemption on charges, etc., for setting up inter-state projects. States also turned their attention to facilitating deployment, and many policies tasked their state agencies with facilitating revenue land procurement for the planned and systematic development of projects.

However, the PPAs signed in the high-tariff era have become a sore thumb for RErich states. These agreements, which were signed for 20–25 years, must be honoured by discoms even though cheaper power is available. States attempted to push back against these obligations as early as 2014, when Gujarat moved to renegotiate tariffs. Andhra Pradesh made the most recent attempt in 2019. These moves by states have added to the set of risks to be mitigated. In all these cases, the states were ultimately unsuccessful in renegotiating tariffs as their actions were struck down in courts or due to interventions by the Central Government. However, states continue to employ other means, like curtailment, to reduce their obligations under expensive contracts. Considering that the state bears these costs at the end, we need a more equitable solution that can ensure a fair transition for all players, without creating uncertainty for investors.

In RE-deficit states, state policies emphasised decentralised power as opposed to utility-scale projects. Their primary drivers were the RPO targets and the potential for private investment. For example, Punjab and Bihar focused on ensuring payment security and ease of doing business in their states. The existing policies of RE-deficit states do not exhibit intention to increase their inter-state purchase of RE, for example, they do not lay out any roadmap or explicit commitment of procuring power from any of the trading intermediaries like Solar Energy Corporation of India Limited (SECI) or from other states to meet their RPOs. Any purchase made is unplanned and this prevents RE-rich states and intermediaries from accurately forecasting demand.

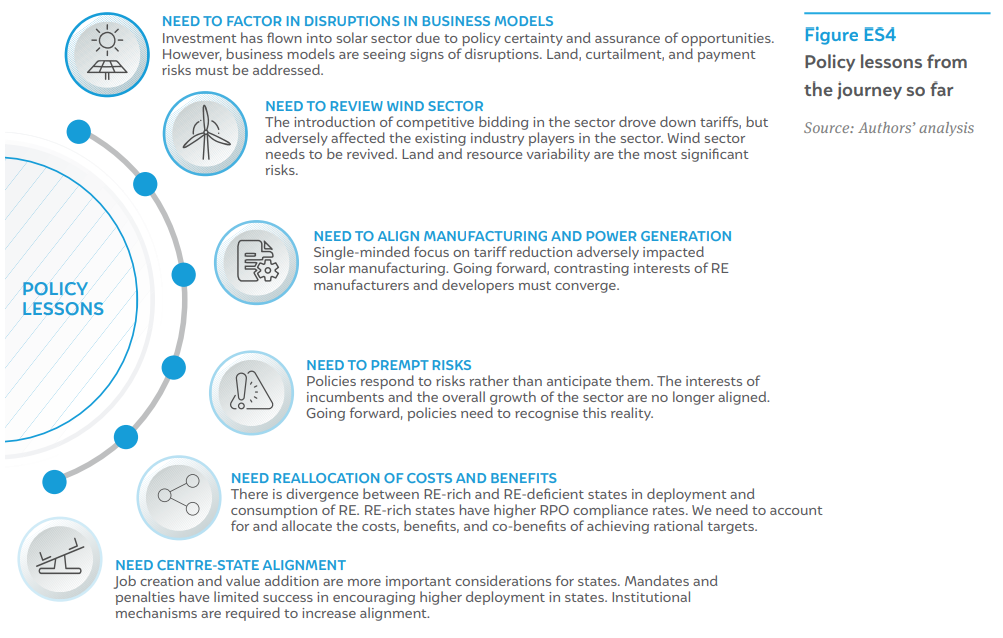

Varied and evolving challenges have to be tackled to achieve 450 GW RE target by 2030. The existing policies have resulted in tremendous outcomes, though short of the targets we set for ourselves. As we advance in our energy transition journey, it is apt that we incorporate the policy lessons from the journey so far (Figure ES4).

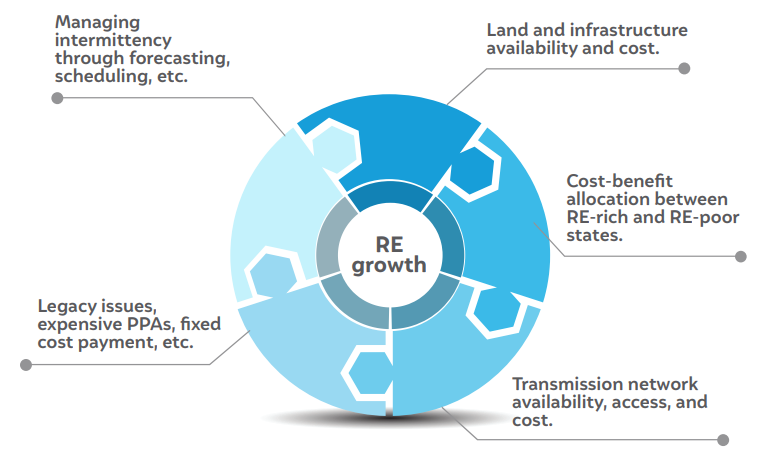

India’s electricity sector is grappling with issues, both legacy and novel. Legacy issues, affecting discom financial health, is an obstacle to further growth of the RE sector. Further, new market and technological advancements like storage and new trading platforms at the doorstep have the potential to bring economy and choice in power procurement and support the energy transition. Growth pathways must, hence, emphasise market-based choices for generation technologies and market-driven procurement and dispatch of electricity.

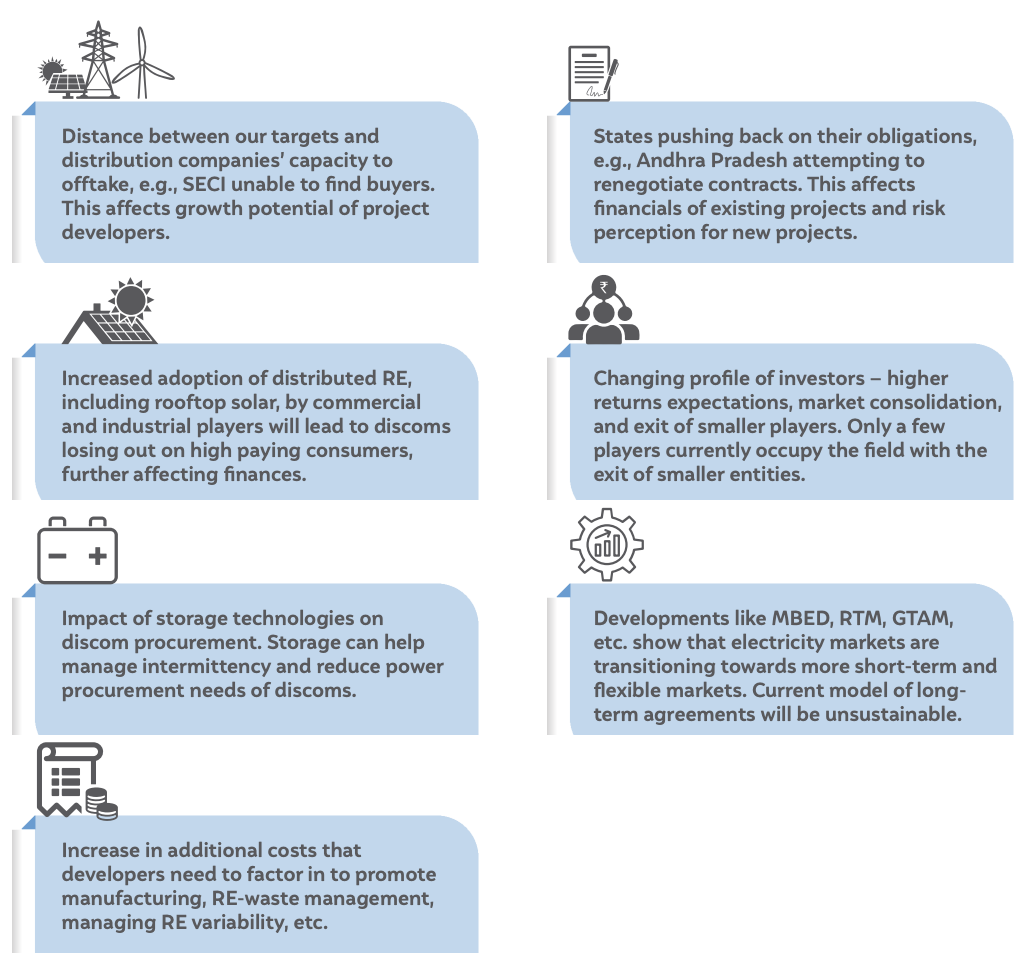

The inhibitions and counterproductive steps of the state governments, like renegotiations of PPAs, rolling back incentives, etc., are reflective of genuine operational and financial implications (Figure ES5). State actions show the evolving nature of challenges in RE deployment. High tariffs were the initial roadblock, which were then followed by infrastructural and operational challenges, such as land availability, transmission, and grid integration issues, and other legacy issues that soon became starkly visible.

With an increasing share of RE in their energy mix, RE-rich states have improved their capabilities to manage RE variability, harness system flexibility, and forecast and schedule demand and supply. However, grid integration continues to be a challenge. There has been some push-and-pull between state regulators, system operators, and generators around bearing additional costs relating to forecasting, scheduling, and deviation settlement. The contentions relate to the availability of forecasting methods, formulae for penalties, the status of aggregation, error bands, and permissible revisions. Forecasting and scheduling add to the costs borne by host states.

Figure ES5 Operational and financial challenges in increasing RE’s share in the energy mix

Source: Authors’ analysis

Policies must pre-empt risks and support transition to a market-driven sector. Going forward, policy decisions must enable the overall growth of the sector rather than target scale through incumbent models. The incumbent business models and market mechanisms are at the cusp of disruptions caused due to natural market progression, technological advancement, and discoms’ responses in meeting their challenges (Figure ES6).

Figure ES6 Signals of disruption to the existing business models of investors

Source: Authors’ analysis

Unlocking the demand for RE and capitalising on the immense opportunity that it presents requires innovative solutions that account for legacy issues and yet are forward looking. The policies must anticipate these changes and prepare for them while investors need to hedge their bets and modify ways of doing business to continue to lead the energy transition.

We recommend the following changes to the policy framework. These are based on policy lessons from the study of the sector’s evolution and anticipate the power sector transition that is upon us.

Enabling a Circular Economy in India’s Solar Industry

Community Solar for Advancing Power Sector Reforms and the Net-Zero Goals

Mapping India’s Residential Rooftop Solar PotentialA bottom-up assessment using primary data

Promoting the Use of LPG for Household Cooking in Developing Countries