Suggested Citation: Soman, Abhinav, Harsimran Kaur, Himani Jain, and Karthik Ganesan. 2020. India’s Electric Vehicle Transition: Can Electric Mobility Support India’s Sustainable Economic Recovery Post COVID-19? New Delhi: Council on Energy, Environment and Water.

This report, supported by Shakti Sustainable Energy Foundation, explores the impact of India’s electric vehicle transition on India’s economic recovery. It examines the impact of a 30 per cent EV sales share in 2030 on domestic value-addition, jobs, crude oil imports, revenue generated from taxes, local pollution and greenhouse gas (GHG) emissions. In addition, the study quantifies these impacts in different mode-share scenarios - (i) high public transport scenario, (ii) high private vehicle scenario, and (iii) shared mobility scenario.

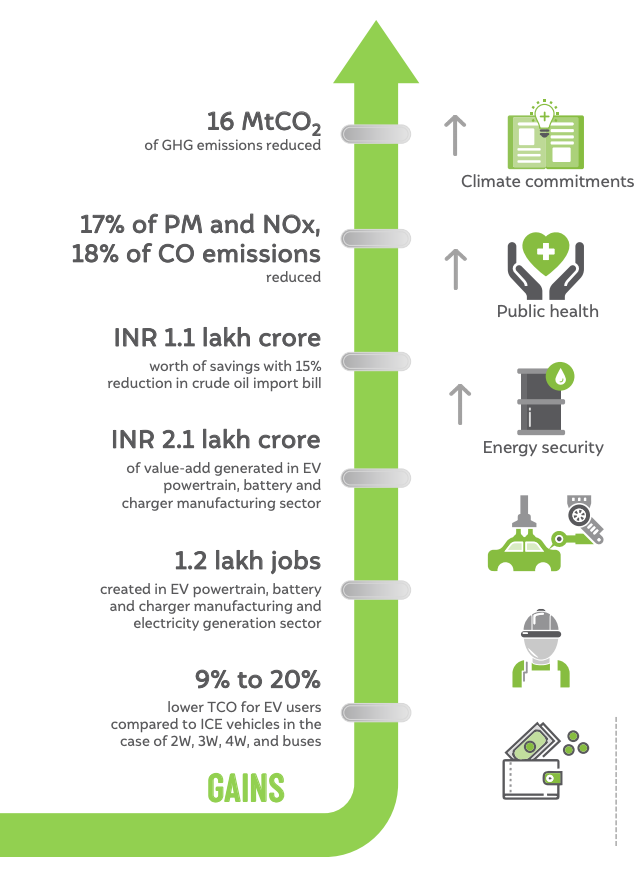

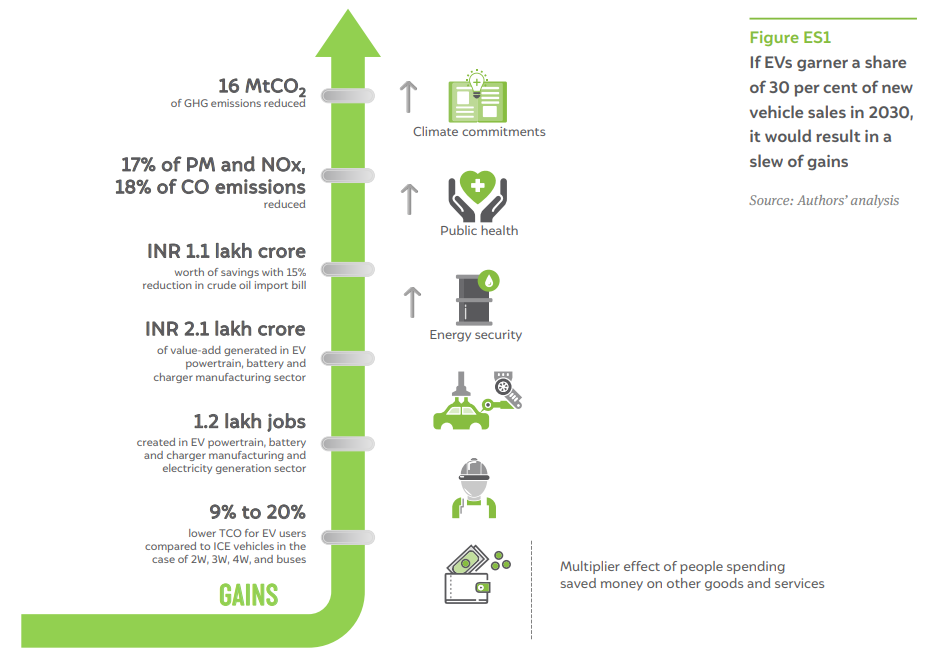

A 30% EV transition in 2030 will result in a slew of gains as well as trade-offs, the impacts of which can be staved off through prescient planning

Source: Authors' Analysis

Among the avenues for economic recovery and sustained growth after the COVID-19 pandemic dies down, paving the path with a transition to electric vehicles (EV) has immense potential for investment and rapid market growth. The 30 per cent EV transition in 2030 is likely to have a wide-ranging impact on the economy and we focus specifically on changes in oil import, value-addition, employment, impact on public finances, market size for EV components, and environmental gains from reduced local air pollutants and greenhouse gas (GHG) emissions.

We attempt at unpacking these issues by projecting the vehicle stock in 2030 in business-asusual (BAU) and a scenario with 30 per cent EV penetration. In addition, we explore three different mobility paradigms – (i) high public transport, (ii) high private vehicle and (iii) high shared mobility to gauge the range of impact of mode-share coupled with 30 per cent EV sales in 2030 on the industry, economy and environment. Our key findings and recommendations are summarised as follows.

By our estimates, we project the vehicle stock (passenger + freight) to increase by nearly 2.7 times between the base year 2016 and the projected year 2030. We explored the consequences of 30 per cent EV sales (35 per cent in e-two-wheelers [e-2Ws] and e-three-wheelers [e-3Ws]; 30 per cent in electric buses [e-buses]; 25 per cent in electric taxis [e-taxis]; and 13 per cent in electric cars [e-cars]) in in contrast to a business-as-usual (BAU) scenario.

Figure ES1: If EVs garner a share of 30 per cent of new vehicles sales in 2030, it would result in a slew of gains

Source: Author's Analysis

In contrast to a BAU, the gains from 30 per cent electric vehicle (EV) sales in 2030 are hard to miss. With the reduction in oil demand from the passenger road transport sector, India will save on crude oil imports worth INR 1,07,566 crore (USD 14.1 billion). Further, a 17 per cent decrease in particulate matter and NOx emissions, 18 per cent reduction in CO emissions, and 4 per cent reduction in GHG emissions relative to BAU can be expected. In addition to aligning with India’s goals to reduce its oil imports and strengthening its forex reserves, the EV ecosystem presents a market size of INR 2,12,456 crore (USD 27.8 billion) for batteries, powertrains, and charging infrastructure in 2030. Under the right policy environment, supply-chain for EV manufacturing presents an attractive opportunity for future investments providing a much-needed stimulus to the economy. However, any major technological transition is fraught with losses and trade-offs. Figure ES2 highlights some of the major tradeoffs from an EV transition.

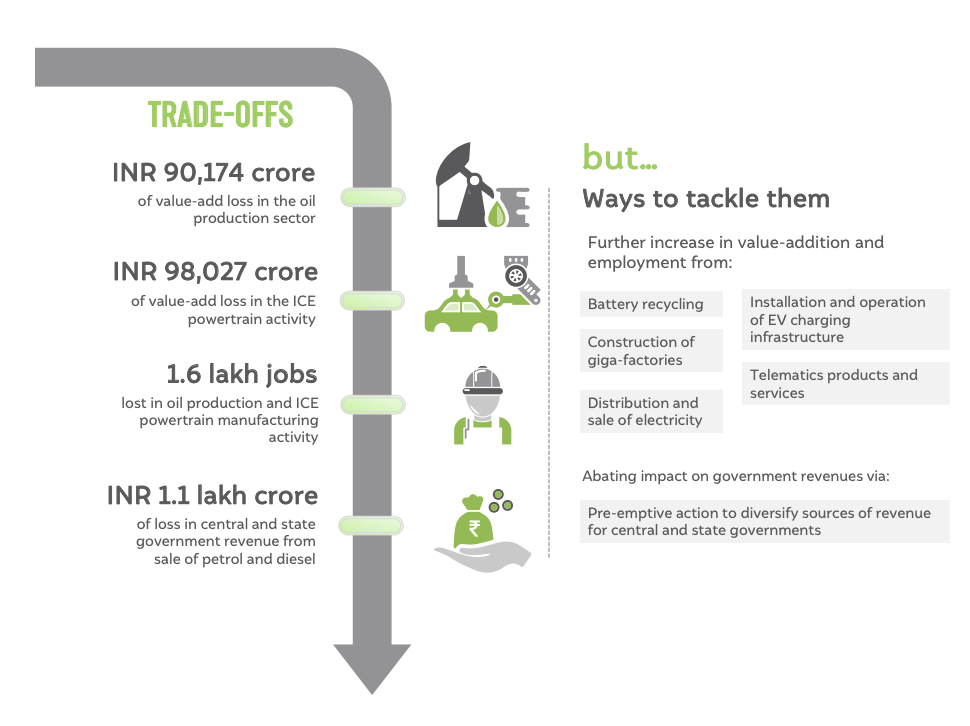

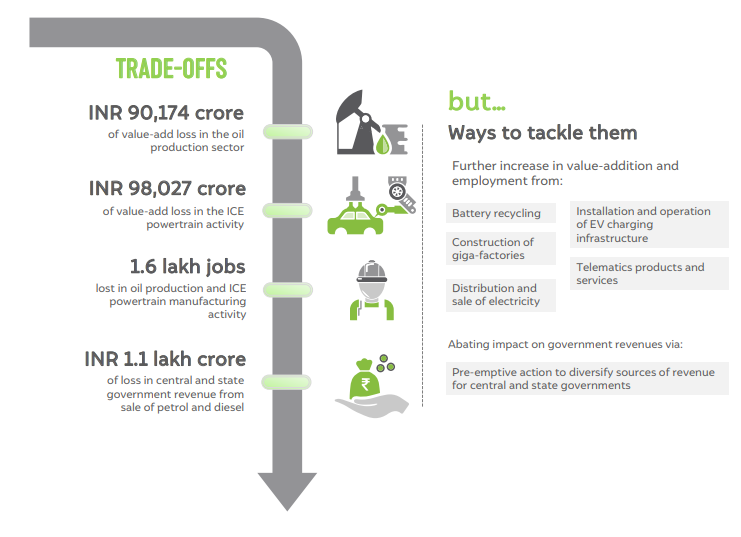

Figure ES2 EV transition includes trade-offs, the impacts of which can be staved off through prescient planning

Source: Authors’ analysis

When comparing direct jobs created in manufacturing and energy production activities in the EV sector, we find there are fewer jobs in a scenario with EVs – a reduction of 19 per cent jobs in the oil sector and ICE vehicle manufacturing combined. An EV transition plan must lay equal emphasis on new economic activities such as battery recycling (urban mining) and other services associated with electric mobility, for job creation. The central and state governments must wean away from their dependence on revenues linked to petroleum consumption, in order to limit perverse incentives that sustain policy support for ICE vehicles, and help accelerating EV adoption in India. As is evident form Figure ES1 and ES2, the gains from the transition to electric mobility overshadow potential losses.

Policy interventions and behavioural changes can drive changes in passenger transport mode-share and this in turn can impact energy consumption, air quality, congestion, and road safety. Therefore, we further explored EV penetration under various mobility paradigms. Our projections show that a 30 per cent EV sales in future combined with a higher share of public transport would lead to a 31 per cent reduction in oil imports (worth INR 2,16,043 crore (USD 28.3 billion) relative to a BAU scenario. This would result in a concomitant reduction of 36 per cent in carbon monoxide (CO) emissions, 28 per cent in nitrogen oxide (NOx) emissions, 29 per cent in particulate matter (PM) emissions, and 20 per cent in GHG emissions, in the same scenario. On the flip side, the purported benefits of electrifying passenger transport are overturned in case of high private vehicle ownership, which would lead to an overall increase of 5 per cent in energy consumption compared to the BAU scenario. Therefore, to realise the benefits of an EV transition, policymakers must focus on shaping the evolution of passenger transport mode-share. A majority of trips and passenger travel demand must be met by public transport and non-motorised transport options such as walking and cycling.

The world is currently reeling under the adverse impact of the COVID-19 pandemic, which has put brakes on economic growth as well. When India emerges out of the pandemic, the priority for policymakers would be reviving economic growth and creating jobs. We strongly feel that stoking the development of domestic EV manufacturing and creating a market for electric mobility in road passenger transport are promising interventions that foster economic growth and ensure sustainability. We therefore call upon policymakers and industry to collaborate on a transition plan for electric mobility that capitalises on the opportunities created in the form of improvement in balance of payments, new markets, and jobs generated at the same time taking adequate counter-measures to offset the impact on government’s revenues, oil sector, and ICE vehicle manufacturing.

We estimate an 165 per cent increase in vehicular population in the country between 2016 and 2030 to meet India’s growing travel demand. In an EV30 scenario, up to 12 per cent of reduction of oil consumption from passenger transport can be achieved. This strategy corroborates with India’s targeted goals of reducing oil import to improve trade balance and energy security. However, due to reduced fossil fuel consumption, as a result of dwindling share of ICE vehicles in the vehicular population in the country, central and state governments together are likely to incur a loss of revenue of about INR 1.1 lakh crore. This situation requires the government to come up with suitable strategies to wean away from dependence of petroleum tax revenues, which should be pursued in parallel to the promotion of electric mobility.

Importantly, EV penetration presents a tremendous market growth opportunity. The market for high value-add components in a scenario with the projected 30 per cent EV penetration amounts to about INR 2.1 lakh crore (USD 27.8 billion) in 2030 for batteries, electric powertrain, and charging infrastructure. These activities represent parts of the EV supply chain that can generate a significant stimulus for new investments in a favourable policy environment. The new manufacturing activities and increase in electricity consumption are expected to further generate close to 1.2 lakh jobs in 2030. A 30 per cent EV sales scenario is certainly not ambitious given that it can be met via sales of just e-2Ws and e-3Ws, which will have achieved cost competitiveness, both in terms of upfront cost and total cost of ownership by 2030. So, we strongly recommend that the EV roadmap for India should target a significantly higher share of EV penetration.

Merely catalysing electric mobility through policy and financial stimulus (subsidies) is not sufficient. For sustainable mobility, decongesting roads and improving road safety also should form part of plans chalked by policymakers. We recommend shaping and shifting mode-choice of citizens towards public and shared mobility to reduce traffic congestion and enhance road safety. For achieving the mode-share of choice, the central and state governments need to focus on decreasing motorisation through several strategies including incentivising public and shared modes of transport. Apart from widespread EV adoption, scenario in which public transport takes precedence over others has the potential to reduce oil imports by up to 31 per cent (compared to a BAU scenario). If citizens favour public transport and shared mobility, when combined with their shift to electric mobility, it can drastically bring down the level of PM, CO and NOx emissions, thereby having a positive impact on public health in India. Another positive externality in an EV-driven mobility, supplemented by public and shared mobility modes, whose economic costs have not been assessed in this study, is reduced congestion.

Future studies assessing the impact of EV transition on jobs could consider installation and operations jobs associated with charging infrastructure and differentiate between point charging and battery swapping. Further, indirect jobs and job creation in activities beyond vehicle manufacturing such as battery recycling and other services in the EV ecosystem were not assessed in the current study, which can be explored in future work.

The Road Ahead for Private Electric Buses in India

A Feasibility Study of Electric Bicycles

How Does Intermediate Public Transport (IPT) System Operate in Lucknow?

Decarbonising Shipping Vessels in Indian Waterways Through Clean Fuel