Suggested citation: Harikumar, Aravind, Himani Jain, and Abhinav Soman. 2022. India’s EV Transition: Managing Fuel Tax Revenue Loss. New Delhi: Council on Energy, Environment and Water.

This issue brief explores solutions for managing the fuel tax revenue loss from the electric vehicle (EV) transition in India, without impeding the EV transition. It estimates fuel tax revenue losses and evaluates alternative taxation options for governments to recover these losses.

The brief recommends a distance tax regime mileage-based user fees (MBUF) or road user charges (RUCs); distance taxes are per kilometre rates, charged according to utilisation. Brief analyses the impact of the distance pricing on road user costs. It also evaluates alternative technology options for measuring and charging distance tax to suggest global navigation satellite system (GNSS)-based distance tax as the sustainable alternative to fuel tax. Finally, the brief make recommendations to pilot GNSS technology and road pricing regimes in urban areas; and prepare policy to guide pricing and build public acceptability.

In the financial year (FY) 2021, electric vehicle (EV) sales exceeded one per cent of the total vehicle sales in India for the first time. With the recent spate of union and state policies in favour of EVs and rising fuel prices, there has been a rapid uptick in EV sales across passenger vehicle categories. Overall, this is excellent news, but the exponential growth of EVs in the vehicle stock will create a new challenge for the exchequer – revenue lost in fuel taxes on petroleum products.

Most governments around the world are fiscally dependent on fuel tax revenues (FTR). According to the Petroleum Planning and Analysis Cell (PPAC), almost 13 per cent of the Government of India’s revenue in 2019–20 came from the excise duty and cess on motor spirit and high-speed diesel (PPAC 2022). Moreover, 15per cent of the revenue from all the states and union territories (UTs) came from the value-added tax (VAT) on petroleum products.

Due to the EV transition, the Government of the National Capital Territory of Delhi (GNCTD) will have INR 1,457 crore or 10.2 per cent lesser FTR than the business-asusual scenario (B-a-U) in 2030. This loss in revenue is almost equal to the funds allotted in the GNCTD’s transport budget for viability gap funding for cluster buses in 2020–21. Similarly, the Government of India will lose 10 per cent or INR 1,896 crore of revenue from fuel taxes due to EV penetration in Delhi.

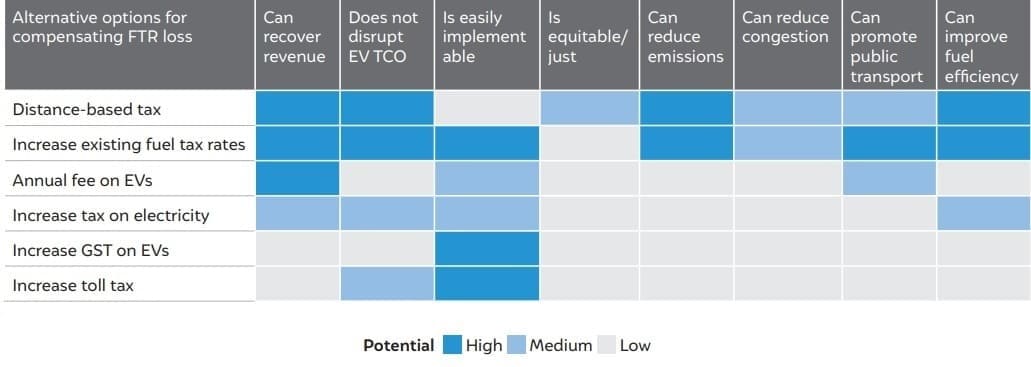

Many provincial and federal governments worldwide have experienced FTR loss due to high EV uptake. We study six global government interventions to identify a feasible and scalable alternative tax regime to replace fuel taxes without impeding the EV transition. We evaluate these options across eight parameters: revenue recovery potential, impact on EV costs, ease of implementation, equity, and potential to reduce emissions and congestion, improve fuel efficiency, and promote public transport. Increasing the already high fuel taxes, although attractive, will be grossly unjust for many groups and is not recommended.

Introducing annual flat taxes for EVs or increasing their GST will be highly disruptive to the EV transition. Alternatives that do not adhere to the ‘user pays principle’ have a low potential to reduce congestion or emissions. Based on the parameters considered, a distance-based tax is the best alternative to compensate for the revenue loss from fuel taxes. Taking Delhi as a case study, we estimate the FTR lost by state and central governments in two EV penetration scenarios for Delhi’s vehicle stock. We conclude that a distance-based tax (DT) regime is the best option for recovering revenue without impeding the EV transition. We demonstrate that an intelligent DT regime can reduce the impact on EV costs and simultaneously send policy signals for technology shifts and modal shifts, thus adhering to equity and sustainable mobility principles. We use the effect on the total cost of ownership (TCO) to show the impact of the distance tax on users.

Distance taxation is the best option for recovering FTR loss

Source: Authors’ analysis

Locating and tracking a vehicle in space and time is fundamental to charging users based on distance fairly. We list and compare six technologies considered for distance-based taxes. We compare the options based on four parameters – ease for users, interoperability, ease of setting up infrastructure, and enforcement. Within each parameter, each technology is rated high, medium, or low based on the ease of implementation.

Our analysis suggests that a global navigation satellite system (GNSS) is best suited for a long-term transition to a DT regime in India. The most accepted GNSS is a popular US technology known as the global positioning system (GPS). In India, GNSS technology is already being used for tracking commercial passenger vehicles and is being piloted to replace ‘fast tags’ in national highway tolling. The scope of this technology can be expanded to a DT regime on all roads.

We recommend four steps to transition from fuel taxes to a DT regime using the GNSS technology.

The Road Ahead for Private Electric Buses in India

A Feasibility Study of Electric Bicycles

How Does Intermediate Public Transport (IPT) System Operate in Lucknow?

Decarbonising Shipping Vessels in Indian Waterways Through Clean Fuel