Suggested citation: Dixit, Himanshu and Shikha Bhasin. 2022. Technology Gaps in India’s Air-conditioning Supply Chain: Enhancing Jobs, Growth and Sustainability. New Delhi: Council on Energy, Environment and Water.

This report seeks to explore the challenges and technological bottlenecks faced by the heating, ventilation and air-conditioning (HVAC) sector in India. By analysing the sectoral supply chain and issues pertaining to research and development in firms, the report looks at the areas of technology adoption in small and big manufacturers to achieve global competitiveness. Further, the report recommends ways to improve the knowledge flows between suppliers while increasing access to critical R&D, performance testing and certification infrastructure.

The conversation about manufacturing, particularly in countries where it is low, is salient today as fundamental changes are afoot in the world. The energy transition is not going to be about energy alone; it will bring along with it big economic transformations. Industrial development remains a critical marker of the progress of a nation. As a fait accompli, the COVID-19 pandemic-induced economic disruption has brought into focus India’s manufacturing industries and the need to build back the economy better. India, therefore, needs a new social contract that is able to deliver on the trifecta of jobs, growth, and sustainability (CEEW 2020).

The HVAC industry in India is one such sunrise sector that has the potential to contribute to India’s manufacturing story. In an economic sense, it is one of those boats that rise with the rising tide. Economic prosperity creates better and bigger growth opportunities for the HVAC sector, which further fuel economic growth. With its climate footprint, it is indeed a crucial sector. It is also certain that the HVAC value chains will get reconfigured. Unsurprisingly, the India Cooling Action Plan (ICAP) has predicted eight times growth in cooling by 2037 based on the present penetration of around 5-6 per cent households, i.e. households with an air-conditioner. Further, the average growth will be 12 per cent up to 2027 and 10 per cent thereafter for the next 10 years (ICAP 2019).

India needs to meet the Kigali Amendment1 commitments with the freeze starting in 2028 (Press Information Bureau 2016) and voluntary commitments to be achieved by 2030. The multiple transitions necessitated by these commitments will warrant investment in adoption of new technologies by large manufacturers in system design and by MSMEs who supply the subsystems and components for the sector. Given its potential for growth, it will in the process.

a. create many skilled and semi-skilled jobs

b. have transformational impact on productivity and the economy as a whole

c. offer opportunities to decarbonise India by reducing emissions embedded in its manufacturing supply chain and secondary emissions by reducing electricity usage

d. imbibe and absorb technology across the supply chain

e. create an ecosystem to become self-reliant

Thus, embedded in the larger discourses about the Indian economy, levels of industrialisation, and the need to become self-sufficient (aatmanirbhar), this report seeks to explore the challenges faced by the heating, ventilation and air-conditioning sector in India. By analysing the sectoral supply chain and issues pertaining to research and development in firms, the report looks at the areas of technology adoption in small and big manufacturers to achieve global competitiveness. In this sense, the report provides the argument and basis to set the agenda for working on technology bottlenecks in India to improve and develop the domestic value chain in the cooling sector.

The report explores and answers the following research questions:

The peculiar challenges of the HVAC sector, non-availability of quantitative R&D data of firms and certain theoretical issues with measures of technological upgrading are some unavoidable aspects of this research. It, thus, leads us to choose a qualitative research method to collect insights from key persons of the HVAC sector.

The interviewees were shortlisted keeping in mind the following points:

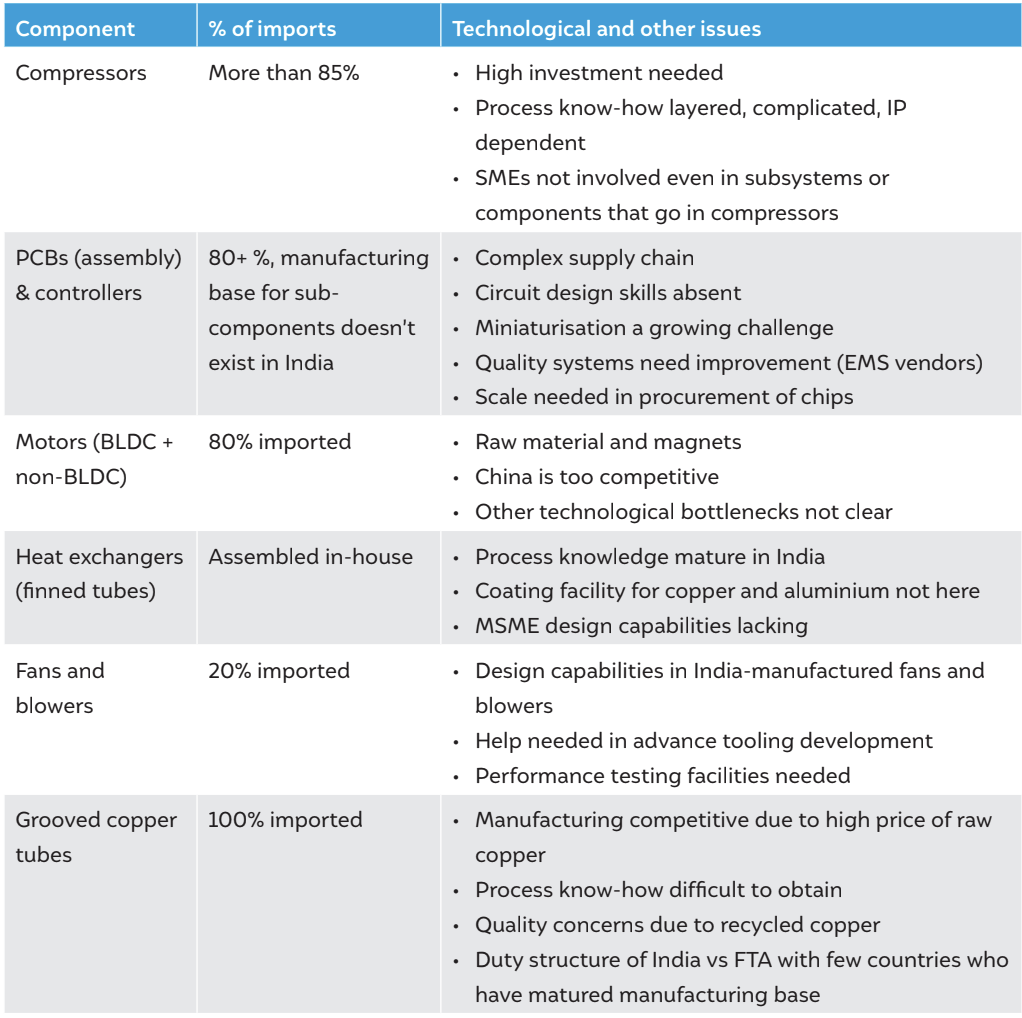

The manufacturing in HVAC sector is often described as following an import-assembly model. Some of the major components are sourced from countries that manufacture them at very competitive prices. These components are then assembled here by different manufacturers. Completely built units (CBUs) of ACs are also imported, although it has stopped due to India imposing a ban on this practice. At a granular level, significant variations are seen in the share of domestically manufactured and imported AC components. The noteworthy point here is that the import share is higher in case of technology-intensive components like compressors and drives, while components which are relatively easy to manufacture are sourced from domestic market. Some of these nuances have been captured in Figure ES1.

Figure ES1: Share of imports and domestically manufactured AC components

Source: Market research commissioned by CEEW

An interesting paradox of the Indian HVAC sector is that, despite the size and growth potential of the Indian market, not having scale is often cited as a major barrier to countering the dominance of imports. This is explained, in large part, by the fragmented manufacturing base in India. There are too many small and medium enterprises (SMEs), and even the large firms are not large enough when compared with their Chinese counterparts. These structural constraints of the sector cause a number of technology handicaps.

An important facet of this technology challenge is that it is not the cutting-edge, state-of-theart technologies, which are difficult to access and not available in India. Compressors and drives are examples of that. However, in a big measure, the challenges in many segments are of a type that can be characterised as ‘small-tech’ needs which helps manufacturers improve the overall quality and performance of their products. These include quality enhancement tools, new machinery, testing labs, etc. Access to these technologies and research infrastructure enhances the marketability of products and creates scope for further product innovation. This is particularly relevant for SMEs. Another part of the technology challenge is the lack of ability in firms to deploy new technologies to add new competencies to make their processes optimal.

In addition to these general challenges, we also identify specific technology challenges with the manufacturing of major air-conditioning components.

Table ES1: Technology issues identified for different components

Source: Authors’ analysis

Quite a lot of technology challenges identified above require: a) better coordination and knowledge transfers across the supply chain; b) collaboration between industry and academia; c) access to critical infrastructure for R&D and quality improvement such as testing and accreditation labs. In addition, SMEs need to be given special focus to ensure the robustness of supply chains.

With the technology issues identified in the sector, it’s clear that we need to take measures at different levels to improve the competitiveness and attractiveness of Indian air-conditioning enterprises and develop local options in the supply chain. These key issues and possible interventions have been mapped as follows:

Activating Circular Economy for Sustainable Cooling

Activating Circular Economy for Sustainable Cooling

Activating Circular Economy for Sustainable Cooling

Activating Circular Economy for Sustainable Cooling