India’s policy commitment to its energy transition has been both mammoth and sustained. However, policy signals alone will not unlock the scale of capital required for realising the 2022 target of 175 GW of installed renewable capacity, or the 450 GW target for 2030. Despite the advances made in the clean energy sector in recent years, the consistently poor financial health of electricity utilities poses a sizeable risk to the sector. The proposed amendments to the Electricity Act 2003 could be an important lever in determining the pace and efficiency of India’s clean energy transition.

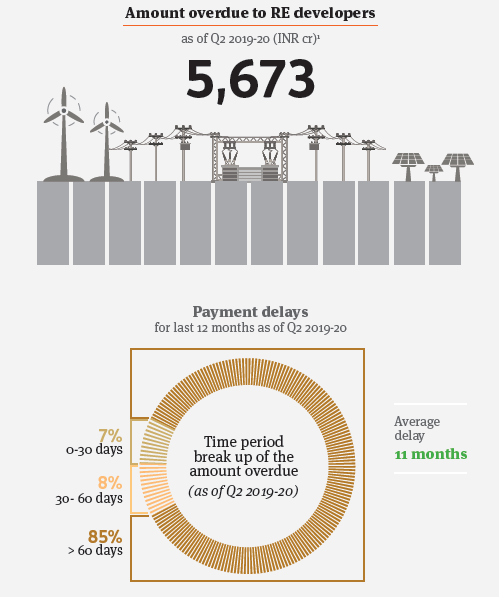

Discoms have repeatedly not met their obligations to renewable energy generators as enshrined in the power purchase agreement (PPA) between them. These PPA violations include delays in payment to generators, curtailment of renewable power, and threats of renegotiation of contracts. These risks are bundled together under the catch-all counterparty risk and form the largest impediment for private capital to flow into the renewable energy (RE) sector.

India needs an estimated USD 80 billion to realise its 2022 targets, and manifold more for the 2030 targets and the associated system upgrades. For India to attract such quantum of capital at affordable prices, it is critical to address the risk that currently inhibits the flow of capital. This is in direct contradiction to the worsening condition of discoms as a result of COVID-19, which heightens this risk.

However, the amendment proposed to the Electricity Act of 2003 offers an opportunity to make structural changes to the statutes governing the sector, and resolve some of these deep-rooted and systemic challenges. Proposed amendments to Electricity Act 2003 do signal an intent to mitigate these counterparty risks. We review and propose additions below.

- As per the proposed amendments, grid operators can withhold the supply of electricity to discoms in the absence of payment security as agreed upon by parties to the contract. System operators in India perform the function of scheduling/dispatching electricity from generators based on daily requisition from the discoms. This is a welcome move to ensure timely payments from discoms, however, the applicable clauses should be strengthened to prevent discoms from obtaining waivers to maintain adequate payment security. Waivers are a common practice as the long-term wholesale electricity sector is a buyer’s market. Further, another clause that prevents a discom’s access to short term markets in case of inadequate payment security may be added to ensure the right balance of bargaining power between the generator and discom in their transactions.

- Timely and efficient resolution of contractual disputes would be a huge boost for attracting investment in RE. To this end the proposed Electricity Contract Enforcement Authority (ECEA), an apex body equivalent to a civil court to decide over contractual disputes in the sector, is highly encouraging. In the current framework, State Electricity Regulatory Commissions (SERC) carry out these functions, but now the ECEA would have exclusive powers and jurisdiction to adjudicate on the performance of obligations under all contracts relating to sale, purchase, or transmission of electricity. The ECEA however will not have any jurisdiction over any matters related to regulation or determination of tariff, or disputes involving tariff. Without any definition of ‘disputes involving tariff,’ the proposed amendment creates room for disputes between the jurisdiction of the ECEA or an ERC. The effectiveness of the ECEA hinges on its role being clearly defined, and its authority and independence maintained as sacrosanct. Further, the body is expected to dispose of cases within 120 days. We recommend that this be lowered to 90 days, considering an authority like the National Company Law Tribunal (under the Insolvency and Bankruptcy Code 2016) disposes of power sector stressed asset resolution cases within such timeframe.

- The amendments, although progressive in nature, fall short in addressing the risk of curtailment of RE power. Lack of project-level data transparency and accountability by discoms are the leading causes for poor enforcement of must-run or speedy dispute resolution in case of violations. This can be addressed by empowering the Central Electricity Authority (CEA) to disseminate RE project level forecasting, scheduling, and curtailment data in collaboration with the National, Regional, and State Load Dispatch Centres. ERCs can then use this information to monitor compliance levels and make necessary changes to the regulatory framework and market structure. CEA in its current operations already monitors such granular plant level details for conventional fuel projects and should, therefore, extend its purview to RE projects as well. Such information shall thereby paint a clear picture of curtailment risk in India and create robust evidence for enforcing must-run status, an absolute essential for RE project viability.

India is in the midst of a rapid and dynamic energy transition in its electricity sector. Despite the adverse impact of COVID-19, the renewable energy sector continues to grow and offers an opportunity for India’s economic recovery. India’s electricity distribution sector has long needed structural reforms and policy and legislative direction for the creation of appropriate market mechanisms to attract sustainable capital at scale. Amending the Electricity Act to enable this, could, therefore, be a defining moment in India’s sustainable future.

Nikhil Sharma is an Associate and Kanika Chawla is the Director of the CEEW Centre for Energy Finance. Send your comments to [email protected] and [email protected]

Read Part 1: Separating Regulation and Adjudication Through a Proposed New Judicial Arm

Read Part 2: What Works and What Does Not in the Proposed Electricity Act Amendments

Read Part 4: Centre-State Alignment is Key to Accelerating Renewable Energy Deployment in India

Read Part 5: Rethinking the Role of Institutions for Effective Policy Implementation in Power Sector

Add new comment