This article was first published on 28 September 2022 and has been updated on 22 December 2022 with an ex-post analysis of the coal situation during 2022 post-monsoon season.

In 2021, India was left with less than four days worth of coal stock (on average across the country) by mid-October. But 2022 is different. As the south-west monsoon, influencing large parts of peninsular India and the Indo-Gangetic Plain, begins its withdrawal, coal stocks at power plants have peaked and begun their customary decline (Figure 1). How will India’s coal stocks fare in 2022 post-monsoon season?

Cooler temperatures and a significant uptick in the contribution of wind mean that coal stocks also get a chance to build up during the monsoons. Further, with support from a range of government interventions, coal stocks for the 2022 post-monsoon season are significantly higher [26.5 million tonnes (MT) as on 21 September 2022] than at the same time last year [9.3 MT]. However, due to an increase in electricity demand — attributed to a growing economy — the demand for coal is also expected to be higher this year.

In our analysis, we find that if the year-on-year increase in electricity demand, during September and October 2022, is within the mean scenario estimates (~ 15 per cent), then the power system is likely to fare better than last year and have stock in the range of 4-8 days through the period. However, to cater to contingency situations — a spike in electricity demand attributed to economic activity, meteorological conditions, or outages of key assets — a plan to conserve resources through efficient dispatch and augmenting supplies on a daily basis to keep pace with requirements is important.

Every year during monsoons, production from mines is lower, which consequently affects the dispatch to power plants. Last post-monsoon season, this resulted in a significant spike in prices on the power exchange (Figure 2) and power outages (planned and unplanned) across the country. Earlier this summer, India again witnessed a similar situation; poor planning of stocks by generators, a sharp increase in temperature, and logistical challenges in getting supply to power plants were the major contributing factors.

The recurring issue of falling coal stocks is a combination of the following challenges (among other things) — high outstanding dues of distribution companies (discoms) to generation companies (gencos), resulting in the inability of gencos to pay for coal procurement and maintaining adequate stocks, even during the pre-monsoon period; high capacity outages in power plants for reasons other than fuel availability; unanticipated increase in electricity demand on account of higher temperatures (post-monsoon); high international coal prices and low level of coal import; and coal transportation related issues.

However, in anticipation of a similar crisis this post-monsoon season (2022), the Government of India has taken several steps:

1. Rise in domestic production and dispatch — Cumulative coal production from Coal India Limited (CIL) and Singareni Collieries Company Limited (SCCL) for April-July 2022 increased 21 per cent on a year-on-year basis. Simultaneously, dispatch to the power sector increased by 19 per cent (Figure 3). This follows a seven-year high production and dispatch to the power sector last year.

2. Readying imports — The Ministry of Power (MoP) maintained a dynamic policy on the import of coal for thermal-based power generation. In May 2022, it mandated all gencos to maintain a 10 per cent blending rate (with imported coal), given its higher calorific value. Further, gencos were allowed a pass-through of high imported coal prices to end consumers. However, the mandate was later withdrawn due to muted demand for imported coal from state gencos and Independent Power Producers (IPPs). Based on data from Central Electricity Authority (CEA), coal imports from the power sector almost doubled from 15.2 MT in 2021 to 29.3 MT in 2022 (April-August period).

3. Improvement in (financial) liquidity of discoms — MoP also brought in a scheme in May 2022 to liquidate the past dues of discoms. Discoms were given a one-time relaxation in Late Payment Surcharge (LPSC) and flexibility to pay the outstanding amount (principal and LPSC) in up to 48 instalments to the gencos. As a result, generation companies are expected to benefit from assured monthly payments which otherwise were not forthcoming to them, which in turn would allow for timely sourcing of coal1.

Coal demand in the power sector is ultimately a function of two key parameters — the total demand for electricity and the expected generation from non-coal based sources2.

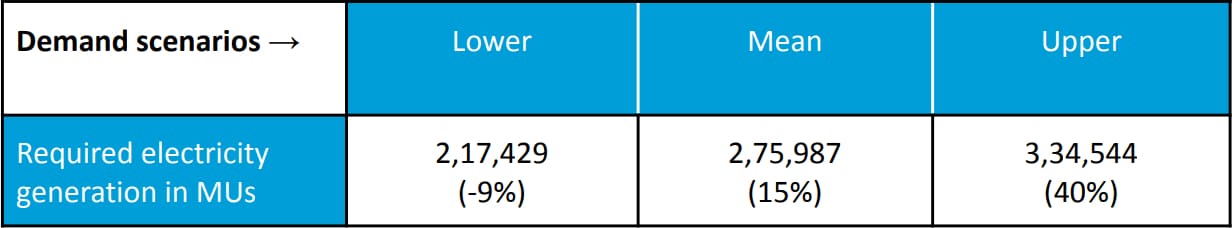

We assess the expected electricity demand for September and October (2022) based on the trend and seasonality assessment of demand data, from 2013 onwards (Table 1). We also capture uncertainty in estimates using confidence intervals, to reflect on a conservative assessment of coal stocks and preparations needed should they materialise.

Table 1: Electricity generation required for September and October 2022 is expected to show 15 per cent y-o-y growth

Source: CEEW analysis using ARIMA model and data from daily POSOCO reports.

Note 1: Values in brackets indicate y-o-y growth under various scenarios.

Note 2: Based on data from 2021, we take a 5 per cent markup on electricity supplied at the state periphery, to account for auxiliary consumption and calculate the electricity generation required to meet that demand.

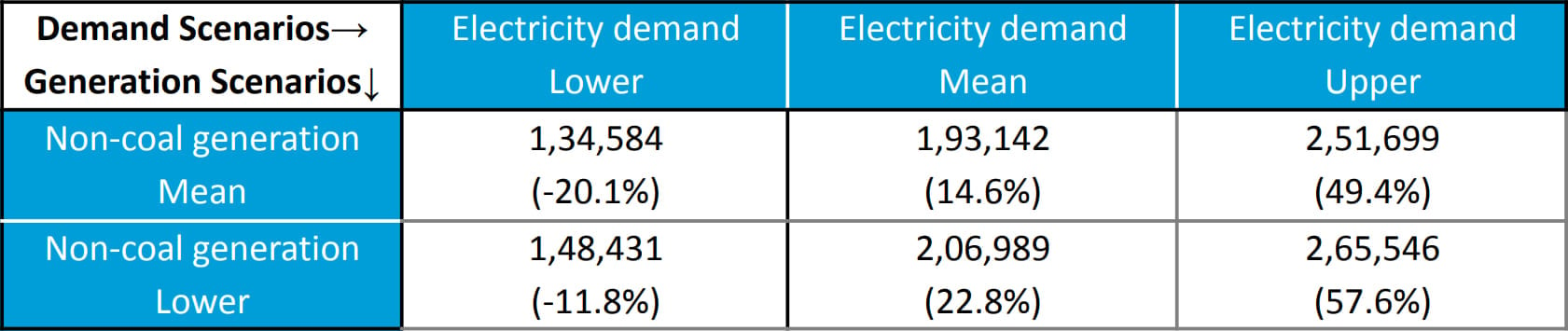

Similarly, using past trends of the capacity utilisation factor (CUF)/ plant load factor (PLF) and the latest numbers on their installed capacity, we estimate expected generation from solar, large hydro, and wind power. Generation from other sources (nuclear, biomass, others) is calculated based on their average generation during September and October in the last three years. In order to capture conservative scenarios of coal stocks, we consider the mean as well as lower bound estimates of non-coal generation.

Table 2: Coal generation (in MUs) required for September and October 2022 is expected to show y-o-y increase of 14-23 per cent

Source: CEEW analysis from POSOCO daily reports and CEA daily conventional power generation report.

Note 1: Values in brackets indicate y-o-y growth under various scenarios.

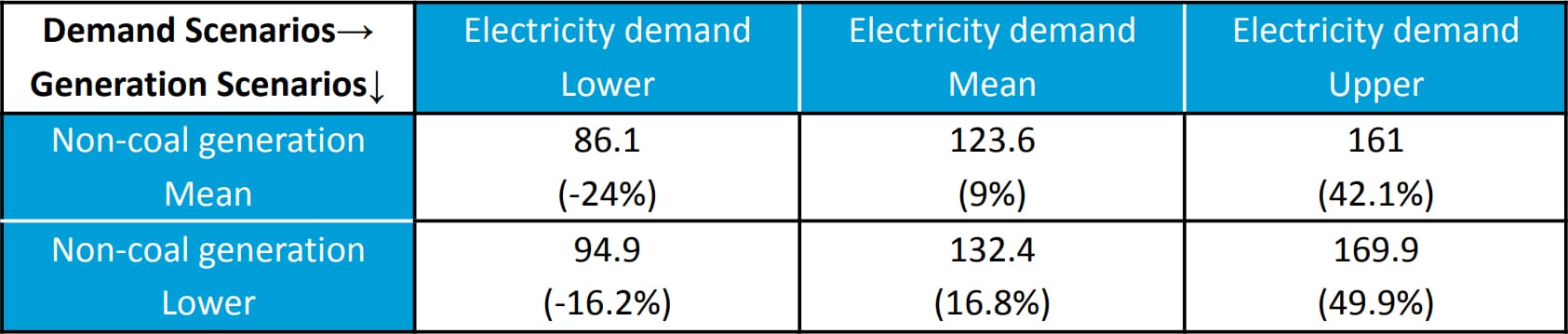

Coal demand, corresponding to this requirement from thermal generation sources, is estimated using the average specific coal consumption of the past two years (FY2021-FY2022), i.e., 0.64 kg/kWh.

Table 3: Demand for coal (in MT) during September and October 2022 is expected to increase y-o-y by 9-17 per cent

Source: CEEW analysis.

Note 1: Values in brackets indicate y-o-y growth under various scenarios.

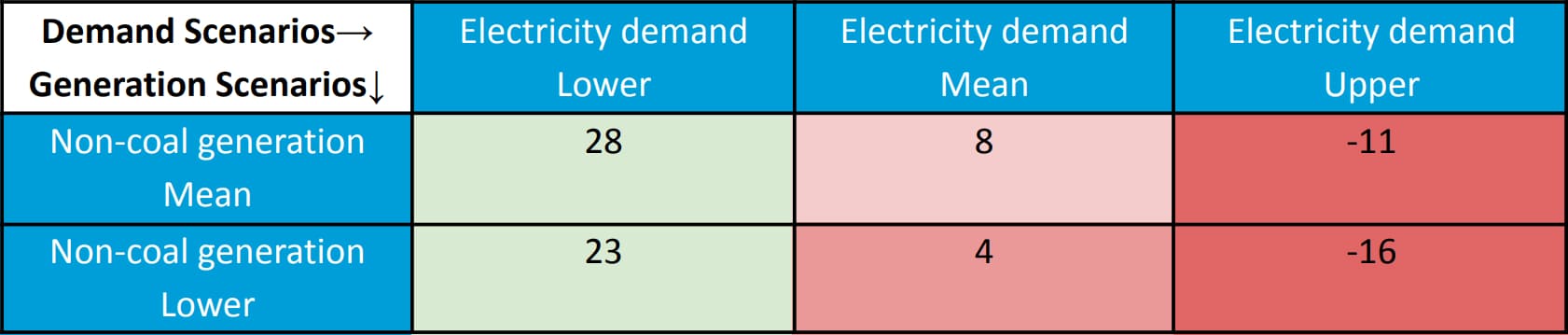

On the supply side, we consider the opening coal stock as of 1 September and add to it, the expected coal receipts during the months of September and October 2022 — assumed to be the same level as 2021, to arrive at the total coal availability at the power plants — 139.8 MT.

As shown in Table 4, by the time the monsoon retreats and coal supply dwindles, the coal stock situation does deteriorate, except under the low demand scenario. On average, we expect electricity demand for September and October 2022 to be 15 per cent higher. If demand materialises at this level or is lower, we envision the power system to meander through the post-monsoon season with 4-8 days worth of coal stocks still left in the plants. This is marginally better than last year. However, the system stays in a delicate balance and any unanticipated increase in demand or underperformance of non-coal sources can undermine our preparations this year.

Table 4: In the mean scenario, coal stocks in early November, are likely to be higher than last year

Source: CEEW analysis. Calculated as (Coal supply - Coal demand)/Expected daily coal consumption in November 2022.

Note 1: Based on ARIMA estimates, the daily coal consumption in November 2022 is expected to be at 1.91 MT.

Note 2: Negative values indicate that coal stocks would be depleted before November 1, 2022.

Our analysis suggests that a 10 per cent increase in coal supply — either through imports or increased production and dispatch — can augment coal stock by (approx) six days. Thus far, through the monsoon season, the dispatch to the power sector has been higher than last year (between 11 per cent and 30 per cent). This has come at the cost of supply to other sectors and is a clear indication that the government is prioritising supply to power generation stations across the country.

Through October, as the monsoon continues to wane in Northern and Central India, it will be important to increase the coal supply to power plants on a daily basis, so as to ensure the logistics network holds up towards the end of October. It will also be prudent to pre-empt the shortages by monitoring energy demand and non-coal generation share. State gencos and IPPs should continue to avail the flexible import policy and increase blending rates as required to keep stocks from reaching critical levels.

Equally, an opportunity that presents itself even in the short-term is to assess the efficiency of generation and incentivise more efficient generation stations to supply a larger share of the power demand. This can reduce the need for imports and decrease the stress on the supply lines. A CEEW study from 2021 estimates that up to seven per cent reduction in coal demand could be achieved by deploying efficient generation assets that are already a part of the current fleet. While this may entail higher costs, given the contractual structure, the benefits of ensuring supply security will outweigh these costs.

In subsequent years, power plants must plan for stock-piling of coal in the pre-monsoon period to avoid undue stress on the value chain during the monsoon and post-monsoon season. This should be supported by continued efforts to improve the liquidity of the discoms and ensure timely payment of power purchase dues, so that they are able to off-take as much coal as possible before the monsoons.

Finally, in the medium to long-term, with the increase in the penetration of renewables, it is expected that coal producers would get a breather. Progress in the installation of smart meters, together with the implementation of demand-side management measures, would also help shave off some of the peak demand. However, structural reforms must accompany these developments within the overall power value chain. The government should review the way coal is allocated, reduce distortions introduced by coal freight, and enable our most efficient assets to generate and dispatch power.

Data from the CEA suggests that starting mid-October 2022 coal stocks, as in other years, began showing an increase, without dipping to the levels observed last year. During the 2022 post-monsoon season, India had a minimum coal stock of 11 days, and on average, coal stocks were three times higher than last year (Figure 1). Consequently, we did not experience a coal-shortage induced power crisis this year.

Key factors explaining the improved situation include:

1. No unanticipated increase in electricity demand — Our ex-ante analysis predicted a y-o-y increase of 15 per cent in energy demand in the mean scenario for September and October 2022. However, the actual increase was 7 per cent. Lower than anticipated electricity demand implied lower thermal power generation, and therefore a truncated demand for coal.

2. Increased generation from solar and wind — Our mean forecasts for solar and wind generation were based on their installed capacities as of August 2022. However, during September and October 2022, the installed capacity for solar and wind generation increased by 2.3 GW and 0.6 GW, respectively. This resulted in their higher than anticipated contribution to meeting the electricity demand.

3. Planned shoring up of coal stocks — At the onset of September, cumulative coal stock at power plants stood at 29 MT – more than twice the last year. Record production and priority dispatch of coal to the power sector over non-regulated sectors ensured a significant build-up of coal stocks in the months leading up to September (Figure 1, Figure 3 and Figure 5). Further, supply to the power sector during September and October 2022 was 8 MT higher than last year.

Figure 5 illustrates the priority supply of coal to the power sector over non-regulated sectors. CIL’s and SCCL’s aggregate coal supply to the power sector for the April to August period has recovered by over 50 per cent from 172 MT in 2020 (which partially coincided with phase-1 of the Covid-induced lockdown) to 264 MT in 2022. However, during the same period, coal supply to the non-regulated sectors shrunk from 51 MT to 44 MT, despite increased economic activity that industries would have witnessed, given the waning influence of Covid on demand.

While the preferential supply to the power sector has averted the coal crisis this year, it created inflationary pressure for industries in the non-regulated sector. As CIL and SCCL reduced the supply under the fuel supply agreements, industries were compelled to purchase coal from domestic spot auction markets or rely on expensive imports. Since January 2022, coal has been auctioned in the domestic spot market at a markup of 232 to 425 per cent over the notified price. Global coal prices witnessed a similar increase. Additionally, Captive Power Plant (CPP) integrated industries were forced to shift to power exchanges for their electricity demand. Figure 2 further illustrates the surge in market price due to an increase in electricity demand at the power exchanges.

Endeavours to augment domestic coal supplies should aim at maintaining adequate coal stocks at the power plants without causing a supply shock to other sectors. This requires a scientific approach to production and dispatch planning through demand forecasting. Our blog presents the first step towards conducting this analysis. However, it was exclusively based on a time series assessment of the respective variables. This made our forecasts susceptible to large stochastic variation, particularly in the case of electricity demand and non-thermal generation. Therefore, a critical next step would be to strengthen these forecasts by taking into consideration variations in temperature and economic activity and their associated impact on demand for thermal power generation in India.

Notes

1 CEEW could not verify the impact of the scheme on discom dues to the generators because PRAAPTI portal is under upgradation.

2 Non-coal sources include both conventional (nuclear, gas, diesel, large hydro) and non-conventional (small hydro, bio power, solar, wind) sources.

3 These include cement, aluminium, sponge iron, textile, tea, paper, etc and Captive Power Plant (CPP) integrated industries.

Tarun Mehta is a Research Analyst and Karthik Ganesan is a Fellow and Director - Research Coordination at the Council on Energy, Environment and Water (CEEW), an independent not-for-profit policy research institution. The blog has been written with inputs from Mohammad Rafiuddin , a Programme Associate at CEEW. Send your comments to [email protected].

Add new comment