Is your fan energy efficient? It’s time to check. Almost a year ago, India’s Bureau of Energy Efficiency (BEE), the national appliance energy performance regulator, made the Standard and Labelling (S&L) programme mandatory for ceiling fans. Fans were one of the first appliances for which the voluntary S&L programme was introduced in 2009 and is one of the latest appliances to be added to the mandatory list. The change marks a crucial milestone since it enacts a minimum energy performance standard for ceiling fans. Hence, the hype around energy-efficient ceiling fans, as brands rush to highlight the energy performance of their products.

Figure 1: Manufacturers are increasingly highlighting the energy performance of their products

Source: Polycab ad from Times of India webpage dated 13 May 2022

But why should consumers care? How will it affect them and the larger ceiling fan market? We answer these questions.

What does the different number of stars on a label mean?

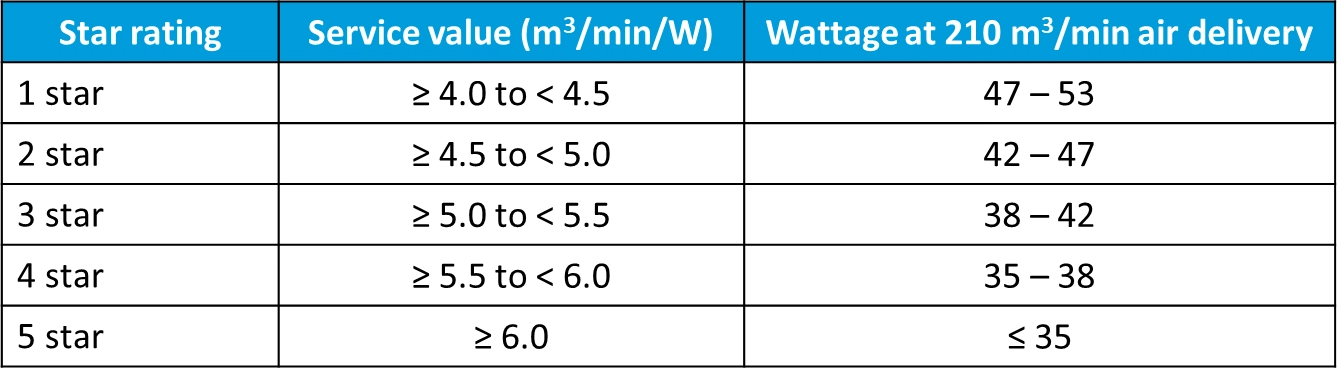

Energy efficiency is the measure of desired output derived from each unit of input energy. For ceiling fans, the desired output is airflow. Thus, the energy efficiency of ceiling fans is measured as the rate of air delivery achieved for each Watt of energy that it consumes. This metric is known as the fan’s service value, measured in cubic metres per minute per Watt (m3/min/W). The higher the service value, the more energy-efficient the fan is, and the higher the number of stars on its label (Table 1).

Table 1: The baseline energy performance for 1200mm ceiling fans has improved with the mandatory star rating programme

Source: BEE’s Schedule 8 for ceiling fans

Note: The above table is as per the schedule applicable from 1 July 2022 to 31 December 2024.

How energy-efficient fans work

Energy-efficient fans use improved blade and motor designs that allow them to deliver the same amount of air with lower electricity consumption. While the shape and finish of the blades can help fans cut through the air more efficiently and silently, the energy performance is largely governed by the motor. While a typical induction motor fan is likely to consume ~75W at top speed, improved induction motor designs can reduce the power consumption to the minimum 53W now mandated by regulations. Most 5-star models that are currently available use brushless direct current (BLDC) motors, which are based on permanent magnets instead of induced magnetic fields.

How the mandatory S&L programme has affected fan market so far

About 40 million ceiling fans are sold in India every year. However, due to the S&L programme’s voluntary nature, star-rated models were hardly being sold before 2023. A CEEW survey found that only three per cent of fan-owning households had star-rated models in 2020. With mandatory star ratings in place, the market can now be expected to transform as brands begin to comply with the new regulation. We compare snapshots of the fan market before and after the regulation change to track this transformation1.

Figure 2 shows that the number of star-rated fan models in the catalogues of select popular Indian brands has increased. While voluntary compliance with the S&L programme meant that only a few star-rated models were available across brands, this number has drastically improved with the enforcement of the mandatory regulation. The number of BLDC motor-based models has especially increased.

For example, Usha launched 27 new types of BLDC fans in February 2023, Crompton introduced the ActivBLDC range in April 2023, and Bajaj launched the Nex series in May 2023. Overall, the number of star-rated models available has increased from 87 in the months before July 2022 to 150 in 2023 post the regulation change. The large number of star-rated models available in the market even in 2022 suggests that the brands were already preparing for the transition to a mandatory star-rating regime.

Figure 2: The number of star-rated fan models on offer has gone up significantly across brands

Source: Authors’ analysis

Note: The figure shows the number of unique model series. The various colours and finishes within each model line are not considered.

Figure 3 shows that the number of 5-star models has increased from 37 to 59, an increase of about 60 per cent. While the number of 3-star models has remained the same, only Havells has introduced more 2-star models this year. Four-star models in the 1,200mm segment are largely absent from the market. Across all brands, the steepest increase is in the number of 1-star models, which has doubled from 35 models available during the recent voluntary S&L period to 69 in the summer of 2023. This indicates that the market is split between 1- and 5-star models, with 128 of 150 (~85 per cent share) star-rated models in these two categories.

Figure 3: The number of 1- and 5-star-rated fans has sharply increased

Source: Authors’ analysis

Note: The figure shows the number of unique model series. The various colours and finishes within each model line are not considered.

Since even 1-star models offer nearly a 30 per cent improvement in energy performance over the typical fans available earlier, the baseline energy performance of fans available in the market has improved. But how has this affected the price of fans?

Fans are getting costlier. Across the analysed brands, the maximum retail price (MRP) of the cheapest 1-star model has increased from INR 2,125 to almost INR 2,500. Interestingly, the cheapest 5-star model is available at a comparable MRP of INR 2,600.

The average MRP of 1-star fans across brands has increased from about INR 3,400 to almost INR 5,000 now, an increase of about 50 per cent. On the other hand, the average price of 5-star models has increased by merely four per cent (INR 7,335 to INR 7,600) despite the addition of a large number of new models to the catalogues. About a fourth of the 5-star models are priced under INR 5,000 but half of the 1-star models are priced under INR 4,700, which indicates that while most new 5-star models fall in the premium category, more affordable star-rated fans are also available. Fans with a basic design and colour (typically white and brown) tend to be cheaper, while models with features such as remote or IoT-enabled control, costlier finishes, and air purification capabilities tend to be costlier.

Based on these trends, we discuss four actions that can help achieve a more sustainable implementation of the mandatory star-rating programme for ceiling fans.

For example, our study shows that by replacing an unrated fan with a 5-star rated fan, an average Indian household can save up to INR 500 per year in electricity bills. Over its lifetime, the cost of ownership of an unrated fan is likely to be higher than a star-rated fan, implying that the latter is lighter on the pocket.

The experience of introducing mandatory S&L for other appliances shows that it has a massive potential to increase the efficiency of appliances. The dramatic expansion of the LED bulbs market in India due to the UJALA programme is one such example. Opting for higher efficiency for this modest appliance can help reduce your electricity bills and contribute to electricity savings at the national level. By making an environmentally conscious decision, you can become a valuable part of India’s energy transition.

1We used product catalogues, price lists and web page screenshots obtained from Wayback Machine, an archive of historical web page snapshots, to compare the number and prices of star-rated ceiling fans offered by Crompton, Havells, Orient, Usha and Atomberg between the years 2021-2022 and 2023. The selected brands are some of the largest appliance brands in India and possibly enjoy a 70-80 per cent2 share of the ceiling fans market. Therefore, changes in their offerings are likely to be indicative of the larger market trends.

Ritikaa Khanna was a Consultant and Dhruvak Aggarwal is a Programme Associate at CEEW. Send your comments to [email protected].

Add new comment