Suggested Citation: Sripathy, Pratheek, Kartheek Nitturu, Deepak Yadav, and Hemant Mallya. 2024. Evaluating Net-zeroTrajectories for the Indian Aluminium Industries: Marginal Abatement Cost Curves of CarbonMitigation Technologies. New Delhi: Council on Energy, Environment and Water.

This report evaluates emission mitigation options to achieve net-zero carbon emissions through marginal abatement cost (MAC) curves for the existing plants in the aluminium industry. In terms of overall metal consumption, aluminium ranks second, next only to steel. However, India’s per capita aluminium consumption is low, at 2.5 kilograms (kg), compared to the world average of 11 kg, and has potential for growth. Data was collected at various levels – state and country – along with some overarching assumptions, such as the uniform energy consumption across all aluminium plants in the country, and key inputs obtained from literature and conversations with industry experts.

The installed capacity and production of aluminium for the year 2019–20 were 4.1 million tonnes per annum (MTPA) and 3.6 MTPA, respectively, with cumulative emissions of 77 million tonnes of CO2 (MtCO2). Electricity consumption accounted for 80 per cent of the total, while process emissions and fuel consumption accounted for the rest. Given the highly energy-intensive production process and the expected growth in demand, decarbonising the energy supply, particularly in the smelting process, will have a substantial impact on India’s cumulative industrial emissions.

In terms of overall metal consumption, aluminium ranks second, next only to steel (NITI 2017). However, India’s per capita aluminium consumption is low, at 2.5 kg, compared to the world average of 11 kg (NITI 2017), and has potential for growth. The installed capacity and production of aluminium for the year 2019–20 were 4.1 million tonnes per annum (MTPA) and 3.6 MTPA, respectively (IBM 2022). Given the highly energyintensive production process and the expected growth in demand, decarbonising the energy supply, particularly in the smelting process, will have a substantial impact on India’s cumulative industrial emissions. Our study aims to provide various decarbonising options to the aluminium industry that can help it strategically achieve net-zero targets.

As per our estimates, the total baseline emissions in the production of aluminium in India is 20.88 tonnes of CO2 (tCO2 ) per tonne of aluminium. This includes the emissions due to direct fuel use, emissions associated with the electricity consumed in the process, and the emissions generated due to the nature of the process itself, also termed ‘process emissions’. The industry emitted nearly 77 million tonnes of CO2 (MtCO2 ) in the year 2019–20, and electricity consumption accounted for 80 per cent of the total, while process emissions and fuel consumption accounted for the rest. Our study considers only scope 1 and 2 emissions, and all interventions analysed are limited to the plant boundary.

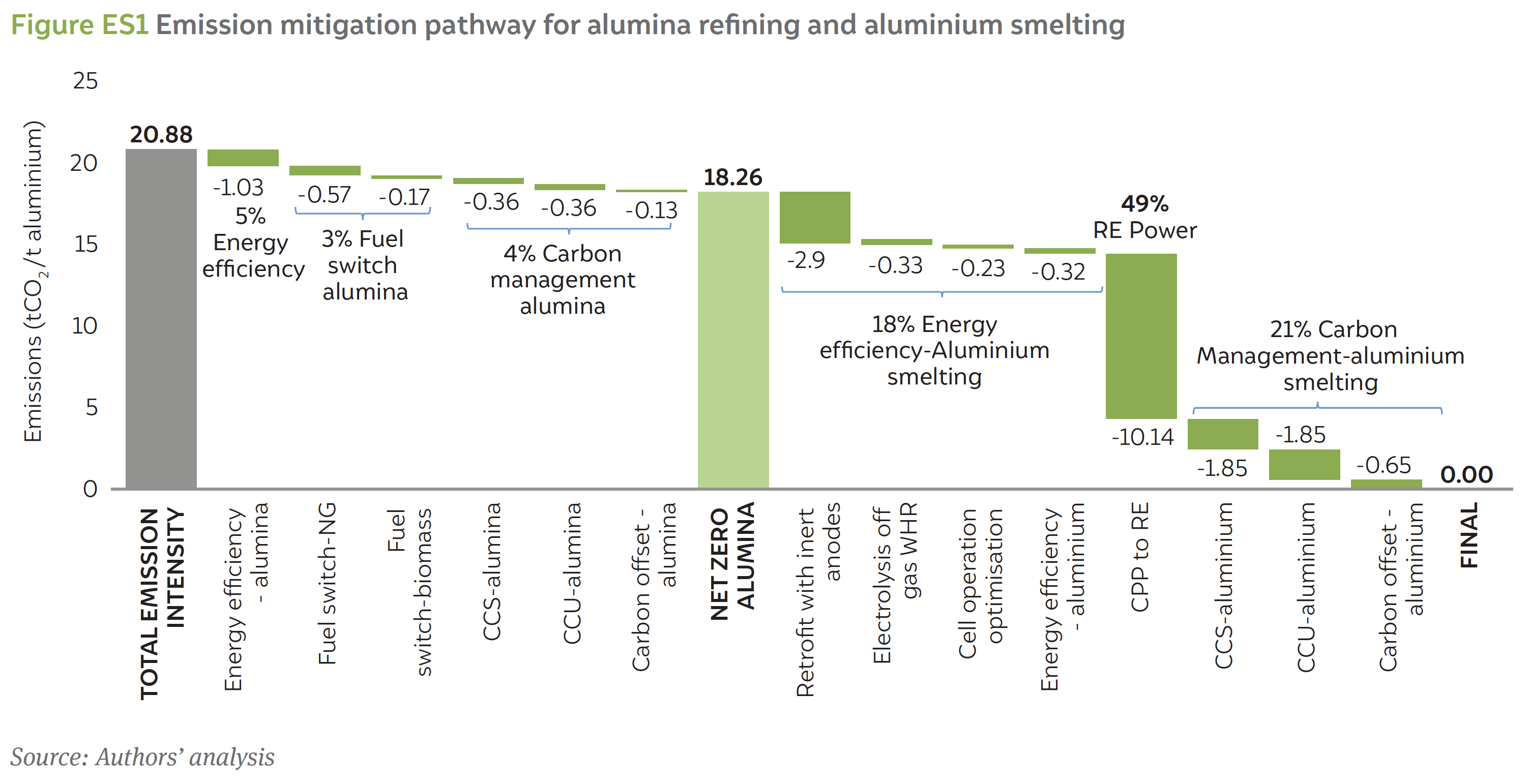

Our study shows that the use of power sourced from renewable energy (RE) abates 49 per cent of emissions, corresponding to 38 MtCO2 of total emissions from the industry. Since aluminium production requires large amounts of reliable supply of electricity, it is unlikely that the entire electricity demand can be met through RE, and we, therefore, consider that 30 per cent of the demand would still be supplied by the captive power plant (CPP). Consequently, the emissions due to coal combustion need to be mitigated through carbon management, which would contribute to 21 per cent of the total emissions abatement. In addition, a large number of alumina refineries lie in close proximity to natural gas (NG) pipelines, and therefore, a large proportion of their thermal energy needs are met by NG. The emissions from NG combustion are also abated through carbon capture, utilisation, and storage (CCUS). Similar to the decarbonisation trajectory of the cement and steel industries (Elango et al. 2023; Nitturu et al. 2023), energy efficiency expected to play a significant role, while fuel switching will play a limited role in aluminium decarbonisation. This is summarised in Figure ES1.

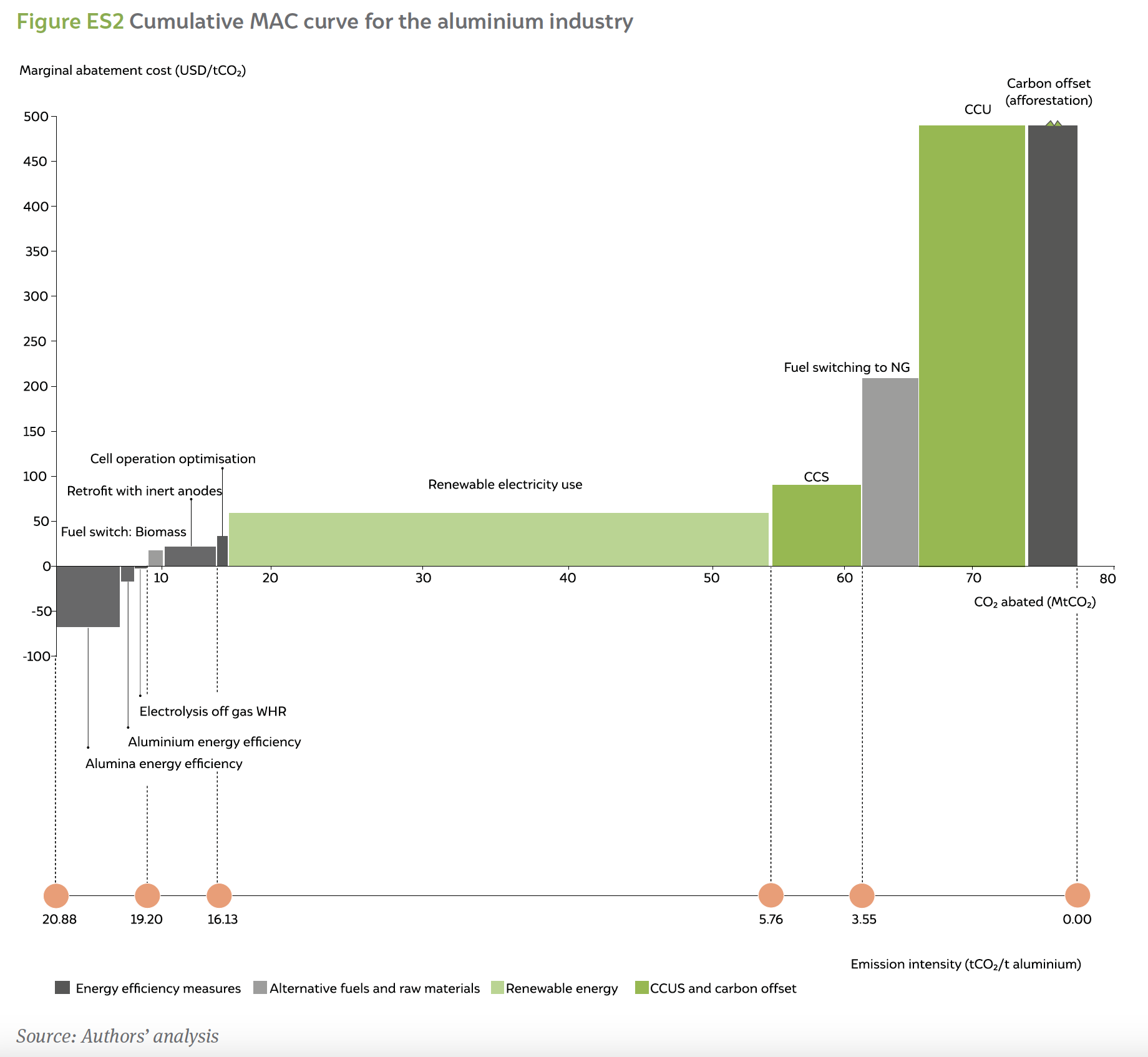

The marginal abatement cost curve for the aluminium industry is shown in Figure ES2. It can be seen that energy efficiency in alumina refining and aluminium smelting and waste heat recovery (WHR) through electrolysis off-gas are the most impactful, with negative marginal abatement costs (MACs). However, these technologies represent only 8 per cent of the total emission that needs to be abated. All the remaining carbon abatement measures have a positive MAC, meaning that there is a net cost incurred for facilities deploying these measures. The shift from coal-based CPPs to renewable power has the highest potential for carbon mitigation – at 38 MtCO2 – but also involves substantial costs.

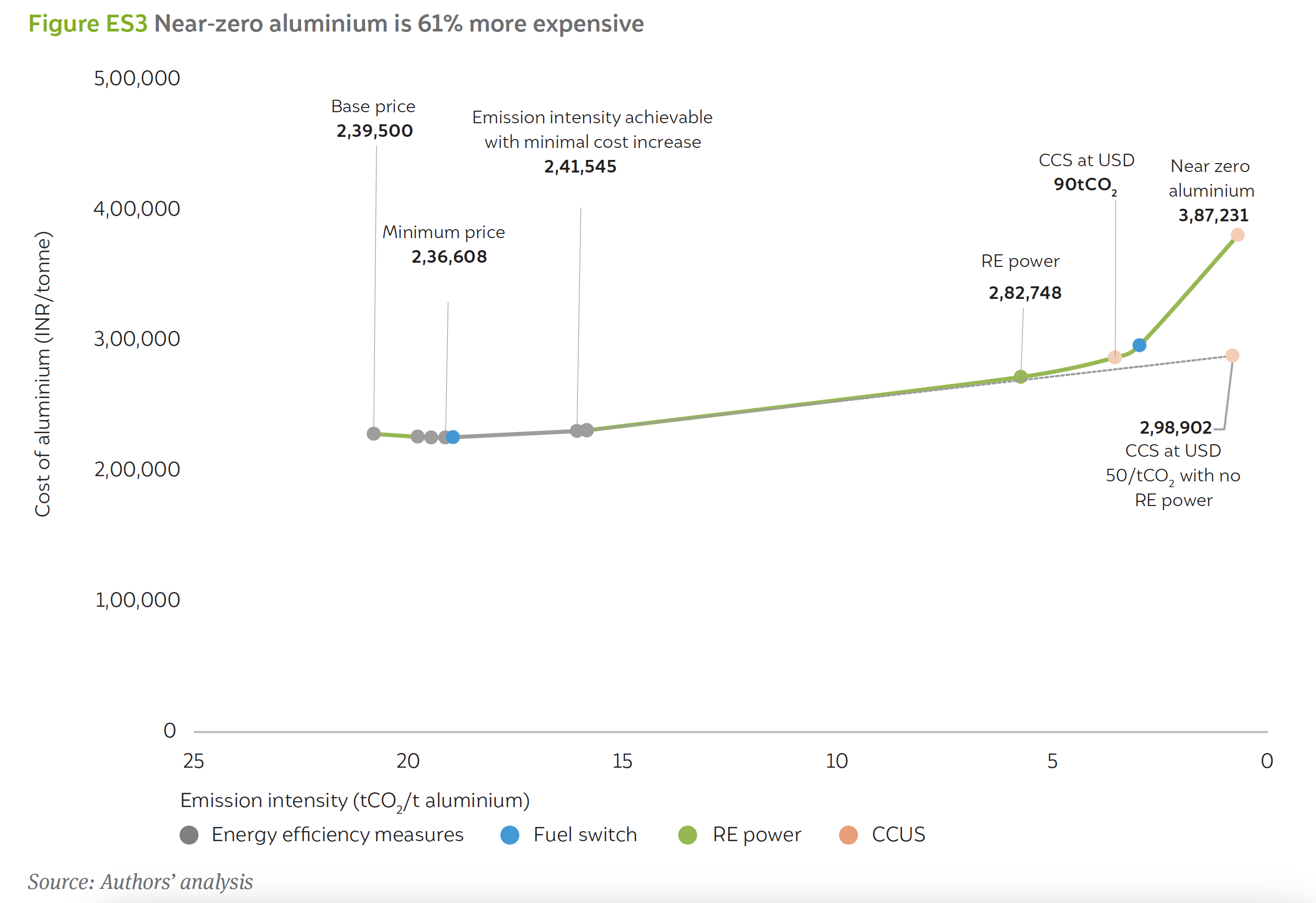

The adoption of carbon mitigation technologies directly affects the cost of producing aluminium due to the requirement of additional capital expenditure (CAPEX) and operating expenditure (OPEX). In a net zero scenario, the industry would require a CAPEX of INR 2,18,241 lakh crore (USD 29 billion), and there would be a yearly increase in OPEX by 26,049 crore (USD 3.5 billion). Consequently, net-zero aluminium is 61 per cent more expensive. Figure ES3 shows the price increase trajectory for net-zero aluminium. According to our analysis, net-zero aluminium is nearly 61 per cent more expensive than conventional aluminium. However, a 1.2 per cent decrease in production costs can be achieved by adopting alumina EE, aluminium EE and electrolysis off-gas WHR. An emission intensity of 16.13 tCO2 per tonne (23 per cent reduction) can be achieved by further using alternative fuels like biomass in alumina refining and retrofitting with inert anodes in aluminium smelting resulting in a cost increase of less than one per cent. However, for further decarbonisation, adopting RE power would result in a cost increase of 18 per cent and net zero aluminium would cost 61 per cent more than the base price. Alternatively, in a scenario where the switch to RE power does not happen and CCS is available at USD 50 per tCO2 , then net-zero aluminium would cost 21 per cent higher than the base price (represented as a dotted line).

The carbon footprint of aluminium production in India is 20.88 tonnes of CO2 (tCO2) per tonne of aluminium. This includes the emissions due to direct fuel use, emissions associated with the electricity consumed in the process and the emissions generated due to the nature of the process itself, also termed ‘process emissions’.

Aluminium and its alloys are used extensively for aircraft manufacturing, building materials, consumer goods like refrigerators and air conditioners, electrical conductors, and chemical and food-processing equipment.

Aluminium production is particularly hard to decarbonise since the process requires large amounts of uninterrupted power supply, which are currently being met through coal-based capacities. In addition, levers such as energy efficiency and fuel switch have a limited role in decarbonising aluminium production.

Our study shows that the use of power sourced from renewable energy (RE) abates 49 per cent of emissions, corresponding to 38 MtCO2 of total emissions from the industry. Since aluminium production requires a reliable supply of electricity, we consider that 30 per cent of the demand would still be supplied by the captive power plant (CPP). Consequently, the emissions due to coal combustion need to be mitigated through carbon management, which would contribute to 21 per cent of the total emissions abatement. The remaining emissions can be abated using levers such as energy efficiency and fuel switch.

Evaluating Net-zero for the Indian Fertiliser Industry

Assessing Effectiveness of India’s Industrial Emission Monitoring Systems

Evaluating Net-zero for the Indian Steel Industry

Evaluating Net-zero for the Indian Cement Industry

Accelerating the Implementation of India's National Green Hydrogen Mission