Suggested Citation: Elango, Sabarish, Kartheek Nitturu, Deepak Yadav, Pratheek Sripathy, Rishabh Patidar, and Hemant Mallya. 2023. Evaluating Net-zero for the Indian Steel Industry: Marginal Abatement Cost Curves of Carbon Mitigation Technologies. New Delhi: Council on Energy, Environment and Water.

This report evaluates emission mitigation options to achieve net-zero carbon emissions through marginal abatement cost (MAC) curves for the existing plants in the steel industry. MAC curves were developed for the four pillars for the four major steelmaking routes – blast furnace-basic oxygen furnace (BF-BOF) route, coal-based direct reduction of iron-electric arc furnace (coal DRI-EAF) route, coal-based direct reduction of iron-induction furnace (coal DRI-IF) route, and gas-based direct reduction of iron-electric arc furnace (gas DRI-EAF) route. Data was collected at various levels – plant, state and country – along with some overarching assumptions and key inputs obtained from literature and conversations with industry experts.

The Indian steel industry is the second largest producer of crude steel in the world, with a production capacity of 154 million tonnes per annum (Mtpa) in 2021–22. The industry emitted nearly 297 million tonnes of CO₂ for the 120 million tonnes of crude steel (and 6.3 million tonnes of pig iron) produced in the same year, equating to an emission intensity of 2.36 tCO₂/tcs. This study evaluates emission mitigation measures to achieve net-zero carbon emissions under four pillars: energy efficiency, renewable power, alternative fuels and carbon management.

Read the explainer: What Will It Take for India’s Steel and Cement Industry To Go Net Zero

Read more: Evaluating Net-zero for the Indian Cement Industry

The Indian steel industry is currently the second largest in the world and has immense growth potential. India’s steel capacity is projected to double from 154 Mtpa in 2021–22 to 300 Mtpa by 2030 (JPC 2022a, Ministry of Steel 2017). In 2018–19, the steel industry accounted for 12 per cent of India’s total CO₂ emissions (GHG Platform India, n.d.) – a sizable share that necessitates the use of comprehensive decarbonisation measures if India is to achieve its 2070 net-zero emissions goal. Considering that the steel industry employs several manufacturing technologies and routes, there is a need for a consolidated estimate of the emissions from each route, the decarbonisation measures available for each route, their abatement potential, and the abatement costs. Our study aims to provide options for the steel industry to effectively work towards achieving net-zero targets. The study considers four major steelmaking pathways:

For each pathway, we estimated the baseline emissions for the year 2021–22. We then calculated the costs and emission reductions possible with various technologies under four categories:

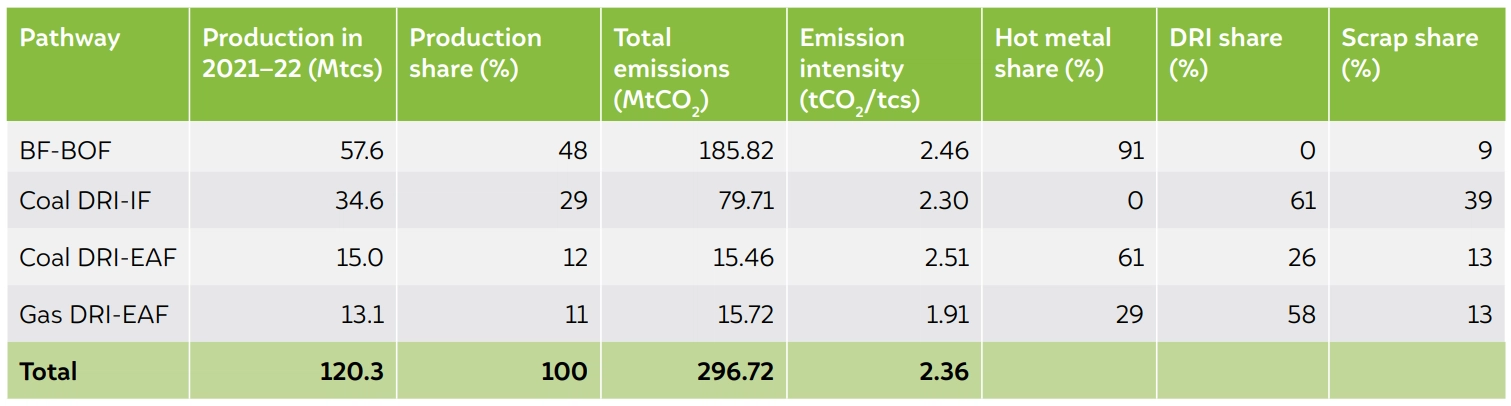

Our assessment indicates that the Indian steel industry emitted 297 million tonnes of CO₂ (MtCO₂) in 2021–22 while producing 120.3 million tonnes of crude steel. Table ES1 shows the emission estimates for various steelmaking routes along with the respective shares of the inputs. The BF-BOF route accounted for the highest cumulative emissions, not only because it holds the largest share in steelmaking but also because of its emission-intensive process. Although the coal DRI-IF route exhibits a relatively low emission intensity of 2.30 tonnes of CO₂/tcs due to the higher usage of scrap (39 per cent, including primarily scrap-based, standalone IF plants), it ranks second in terms of emissions due to its substantial steel production volume. In comparison, the coal DRI-EAF and gas DRI-EAF routes have lower absolute emissions, primarily because their shares in the overall production are relatively smaller. Our assessment indicates that the average emission intensity of steel in India amounts to approximately 2.36 tCO₂/tcs.

Table ES1 Baseline emissions from the Indian steel industry totalled ~297 MtCO2 in 2021–22

Source: JPC (2022a); JPC (2022b); Authors’ analysis

Note 1: Figures may not tally due to rounding.

Note 2: The emission intensity of a given route was calculated by considering both the iron produced by plants employing that route and the allocated emissions of iron from other plants.

*includes emissions from pig iron sold directly.

Note 3: The emission intensity of coal DRI-IF is lower than that of BF-BOF and coal DRI-EAF because we have grouped integrated plants, which consume only about 15 per cent scrap, and standalone IF plants, which can consume as much as 80 per cent scrap, under the same overall route. With 15 per cent scrap, the emission intensity of integrated DRI-IF plants can be higher than 3 tCO₂/tcs.

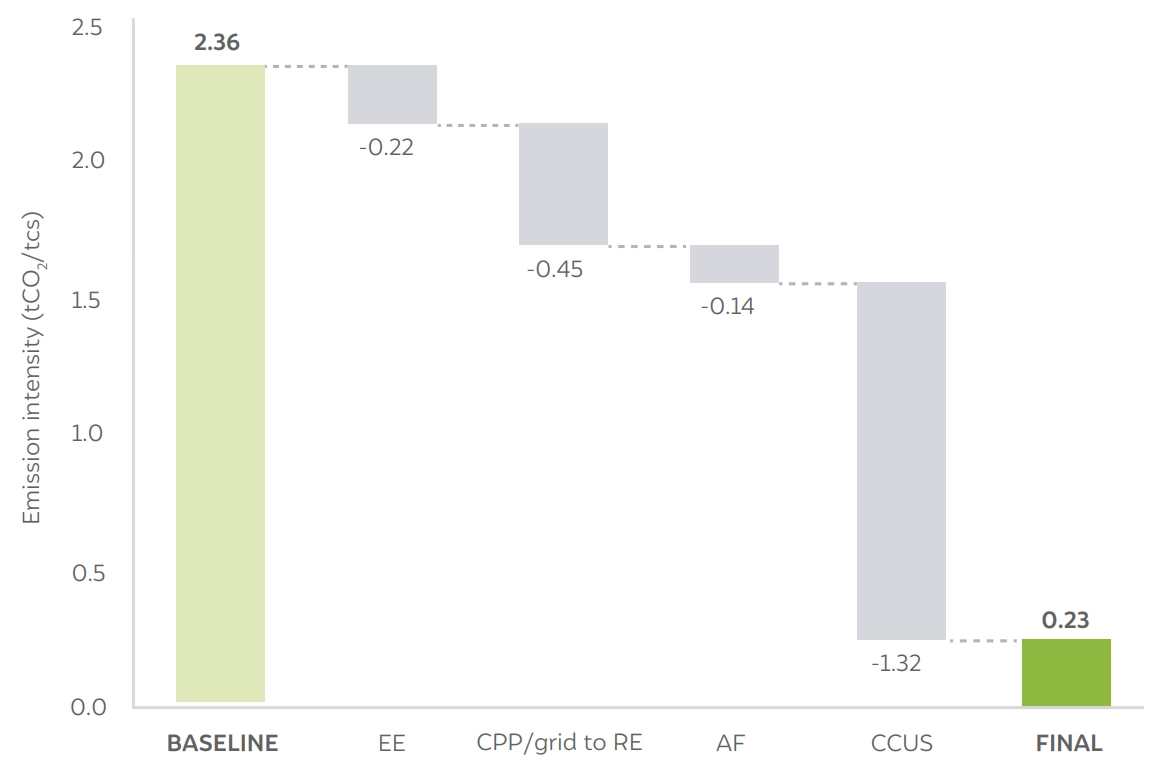

Due to process- and technology-specific constraints and operating conditions, the decarbonisation trajectory of each steelmaking pathway will be unique. The role of EE, RE, AF, and carbon management for decarbonising the Indian steel industry is shown in Figure ES1.

Assuming an initial weighted average emission intensity for steel produced across processes, we estimate that EE contributes to 9 per cent of the total reduction, followed by a nearly 19 per cent reduction through round-the-clock (RTC) renewable energy. The use of alternative fuels, such as natural gas and biomass pellets, has a limited effect on the overall reduction of emissions (at 6 per cent). In contrast, carbon capture, utilisation, and storage (CCUS) have the potential to abate 56 per cent of the emissions generated from the steel sector.

Figure ES1 CCUS will play a significant role in the decarbonisation of the Indian steel industry

Source: Authors’ analysis

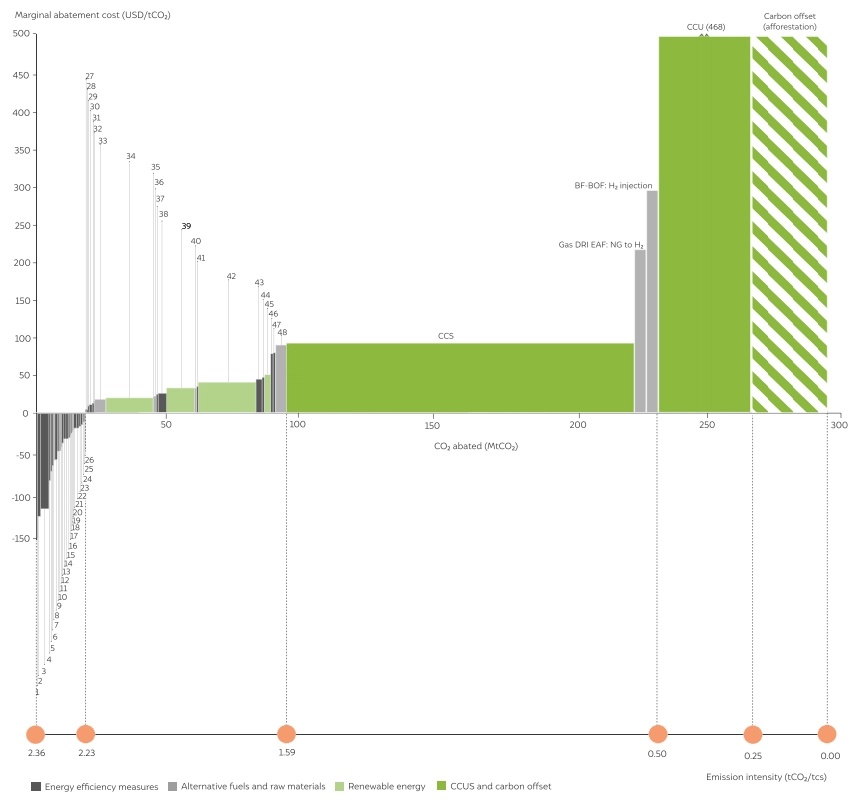

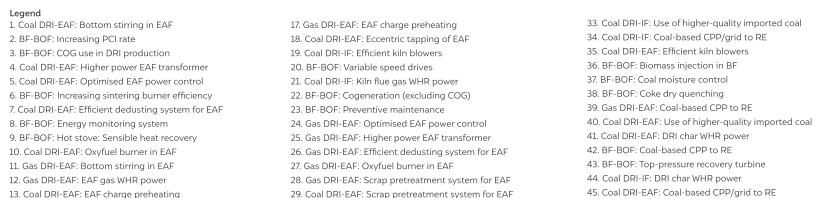

Figure ES2 shows the consolidated marginal abatement cost (MAC) curve for the Indian steel industry. The X-axis represents the total emissions of the steel industry in 2021–22, which was 297 MtCO₂. Approximately 7 per cent of the average emissions per tonne of crude steel (tcs) can be reduced through mitigation measures that have a net negative annualised mitigation cost. However, the remaining emissions can only be reduced by employing technologies that have a positive annualised mitigation cost, suggesting that manufacturers who adopt these measures will face an increase in their steel production cost.

By implementing other EE measures (that have a positive cost of mitigation), switching to renewable power, and using alternative fuel options, we can reduce emissions by 28 per cent, which is equivalent to 92 MtCO₂. For abating the remaining emissions, carbon management techniques or expensive alternative fuels, such as green hydrogen injection, need to be considered to achieve net-zero emissions. We expect the cost of hydrogen-based steel to decline more aggressively than the cost of measures such as CCUS. In such a scenario, hydrogen-based steelmaking would become a predominant production pathway, specifically for new capacity deployment. It should, however, be noted that in accordance with plant-specific conditions, location, and the availability of alternative fuels, the order of adopting various carbon mitigation technologies might vary.

Figure ES1 CCUS will play a significant role in the decarbonisation of the Indian steel industry

Source: Authors’ illustration

Our analysis indicates that the present capacity of the steel industry will need a total capital expenditure (CAPEX) of more than USD 283 billion (INR 21.2 lakh crore) (in 2022 value), of which the BF-BOF route alone has a 61 per cent share. The annual operational expenditure (OPEX) for these measures will amount to USD 8.8 billion (INR 66,715 crore) per annum to achieve net-zero emissions. However, if the cost of green hydrogen decreases to USD 1/ kg, then the total CAPEX requirement for achieving net zero in the steel industry decreases to USD 182 billion (INR 13.6 lakh crore) due to a significant decrease in the cost of CCU Deploying EE measures alone will cost around USD 9.5 billion (INR 76,317 crore), of which the BF-BOF route holds a share of more than 87 per cent.

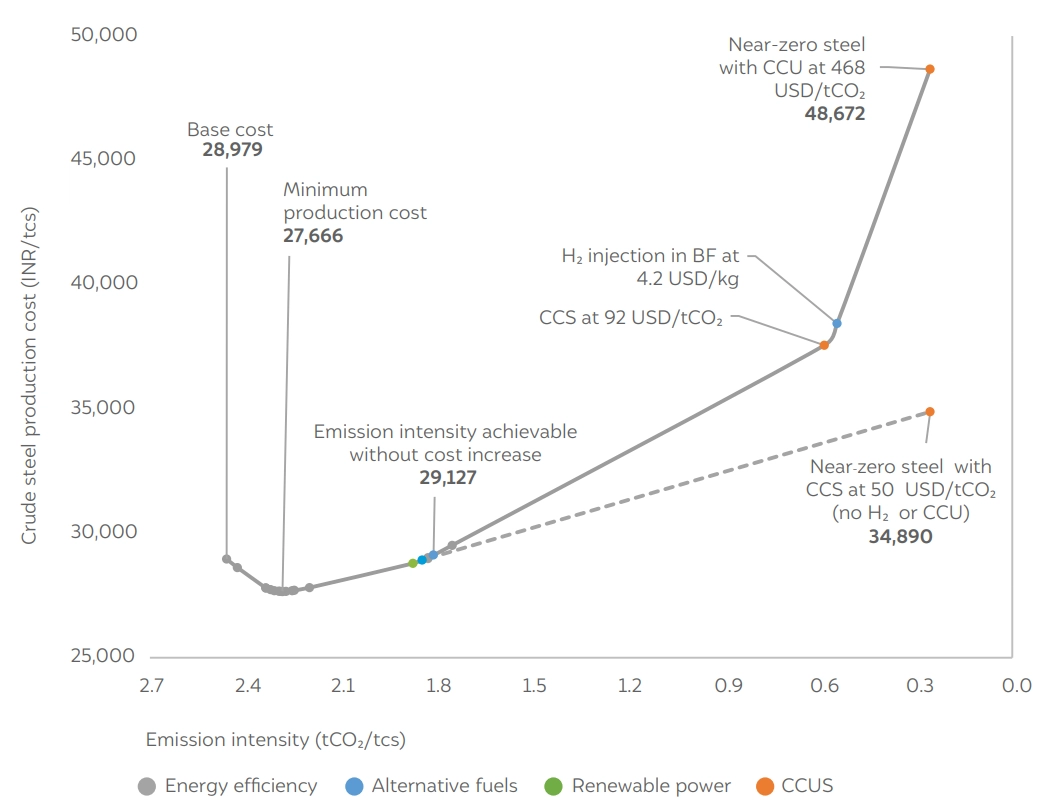

The cost of producing steel will increase with the tightening of emission intensity limits. For the BF-BOF process, Figure ES3 shows that the cost of producing steel can be reduced by 5 per cent while achieving a 7 per cent reduction in emission intensity, primarily due to the deployment of EE measures. At the lowest production cost, the emission intensity of steel is 2.28 tCO₂/tcs. If the emission intensity of steel has to be reduced below this, then the cost of producing steel will increase. However, our analysis shows that the BF-BOF process could achieve an emission intensity of 1.84 tCO₂/tcs without any increase in the production cost. If COG is not used for producing DRI but is used in reheating furnaces and captive power plants, then the production cost breaks even at 1.94 tCO₂/tcs. The monetary gains obtained due to the adoption of EE measures partially offset the cost increase due to the uptake of renewable energy and alternative fuels. However, if the emission intensity needs to be reduced below 1.84–1.94 tCO₂/tcs, there will be a steep increase in the cost of production due to the high cost of CO₂ abatement associated with CCS, green hydrogen, and CCU.

In an alternative scenario (shown in green on the graph), if the cost of abatement for CCS reduces to USD 50/tCO₂, then CCS will be preferred over technologies such as slag heat recovery and top-pressure recovery turbines. In such a scenario, the near-zero steel would have only a 20 per cent premium. Therefore, the government must focus on creating a CCS ecosystem in the country to achieve its long-term decarbonisation targets.

Figure ES3 A 25% reduction in emissions is possible without any price increase for BF-BOF

Source: Authors’ illustration

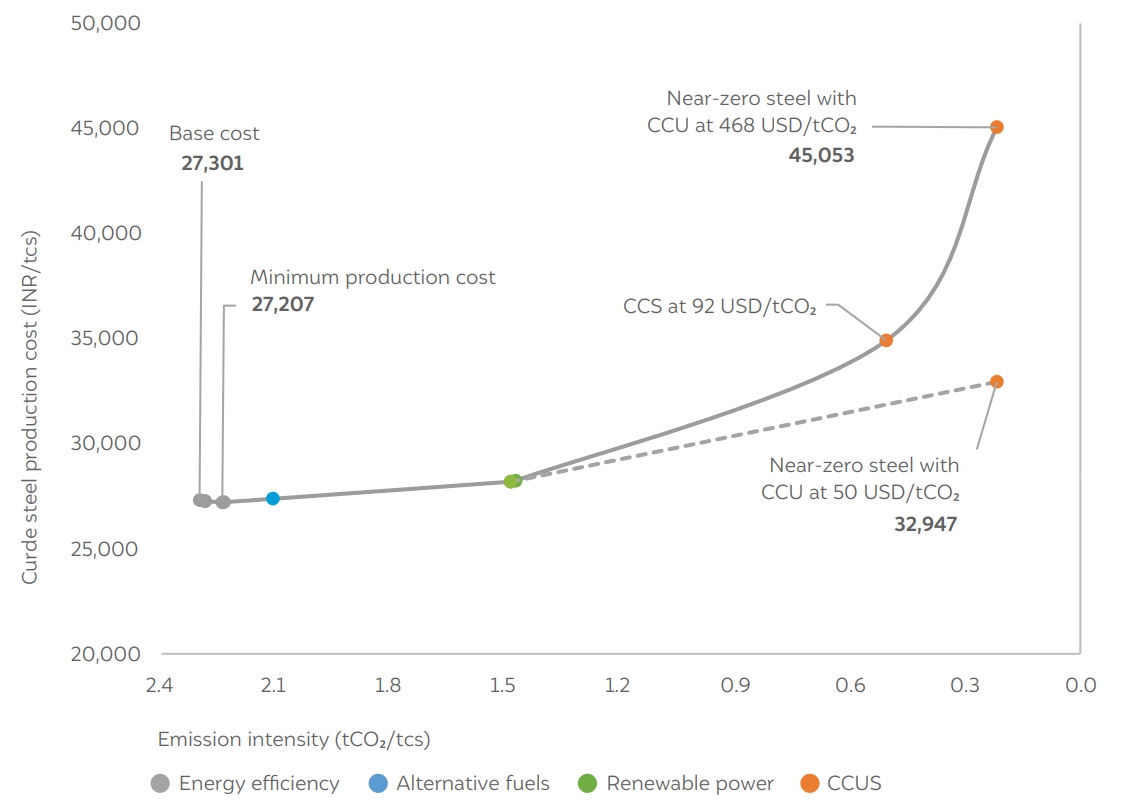

Figure ES4 shows the change in the cost of producing crude steel vis-à-vis emission intensity for the coal DRI-IF route. Similar to the BF-BOF pathway, there is initially no significant decrease in the cost of steel as the emission intensity decreases, as very few energy efficiency technologies are available for the process. Beyond EE, the cost of steel increases steeply with a decrease in emission intensity due to the higher mitigation costs associated with renewable energy, CCS, and CCU. In the base case, achieving near-zero emissions is 65 per cent more expensive compared to a scenario where steel has an emission intensity of 2.3 tCO₂/tcs. If the CCS cost reduces to USD 50/tCO₂, and right-of-way is not an issue, then the cost increases by only 21 per cent, compared to the base case.

The emission intensity of coal DRI-EAF steel can be reduced by 6 per cent while achieving a 3 per cent reduction in production cost through the deployment of energy efficiency technologies in BFs (this route has a 62 per cent share of hot metal in the EAF) and EAF units. Although the steel cost starts increasing quickly beyond this, a 30 per cent reduction in emission intensity can be achieved without any net change in the cost. In the base case, near-zero steel will cost 64 per cent more. However, with the deployment of CCS at USD 50/ tCO₂, the increase will only be 21 per cent.

The cost of producing gas DRI-EAF steel is reduced by 1.6 per cent after the adoption of all EE measures. A 17 per cent reduction in emission intensity can be achieved without any cost increase, mainly due to the use of RE. In the base case, the near-zero emissions steel is expected to cost 41 per cent more than conventional steel. However, if CCS can be deployed at USD 50/tCO₂ across all steel plants, then the cost of steel will increase by only 15 per cent over the current production costs.

Figure ES4 An 8 per cent reduction in emissions is possible without any price increase for coal DRI-IF

Source: Authors’ analysis

We recommend the following measures to achieve net-zero in the steel industry:

For India to achieve its net-zero carbon emissions goal by 2070, actions taken by the steel industry will have an important role to play. While a substantial amount of new capacity will be deployed in the coming decade, the fact remains that the existing capacity is sizeable and relatively young. Therefore, several decarbonisation measures need to be taken by the industry collectively, not only to achieve our climate ambitions, but also to ensure the sustainable growth and development of Indian industry.

Crude steel production in India emitted nearly 297 million tonnes of CO₂ in the financial year 2021–22, equating to an emission intensity of 2.36 tonnes of CO₂ per tonne of crude steel.

Steel manufacturing leads to significant particulate matter (airborne dust) emissions. There is a large number of medium- and small-scale plants operating in India that may not have in place the necessary measures to effectively control dust emissions. Steel plants also rely on continuous supplies of iron ore and coal, thus leading to expanding mining operations in potentially sensitive areas and an increasing number of trucks plying between the mines and the plants.

More than 80 per cent of India’s steelmaking capacity relies on coal-based technologies. This capacity cannot fully switch to alternative fuels, as the inherent designs of the plants are tuned towards using coal. Therefore, decarbonising these plants will depend heavily on carbon capture technologies.

For the existing steel industry to decarbonise, 56 per cent of emissions will rely on carbon capture and utilisation/storage (CCUS) systems for abatement. India needs to invest significantly in the development of a CCUS ecosystem. This includes affordable technologies for capture, pipeline networks for CO₂ transportation, identification and development of reservoirs for storage, and supporting the expansion of markets for CCU products. Several mitigation technologies considered in our study have a positive marginal abatement cost, indicating that they are not economically feasible at present. The Government of India has recently announced the impending introduction of the National Carbon Market (NCM). The NCM will enable the trading of carbon emission certificates between those industries who exceed set decarbonisation targets and those who do not. These targets must be set based on the marginal abatement costs of different decarbonisation technologies such that their adoption is gradually incentivised.

Assessing Effectiveness of India’s Industrial Emission Monitoring Systems

Evaluating Net-zero for the Indian Cement Industry

Accelerating the Implementation of India's National Green Hydrogen Mission

Best Practices in CEM (Continuous Emission Monitoring)

Assessing India’s CO₂ Storage Potential