Prateek Aggarwal, Tarun Mehta, Chanmeet Singh Syal and Vaibhav Pratap Singh

October 2022 | Power Markets

Suggested Citation: Aggarwal, Prateek, Tarun Mehta, Chanmeet Singh Syal, Vaibhav Pratap Singh. 2022. Approach for the regulatory treatment of the UDAY debt takeover. New Delhi: Council on Energy, Environment and Water.

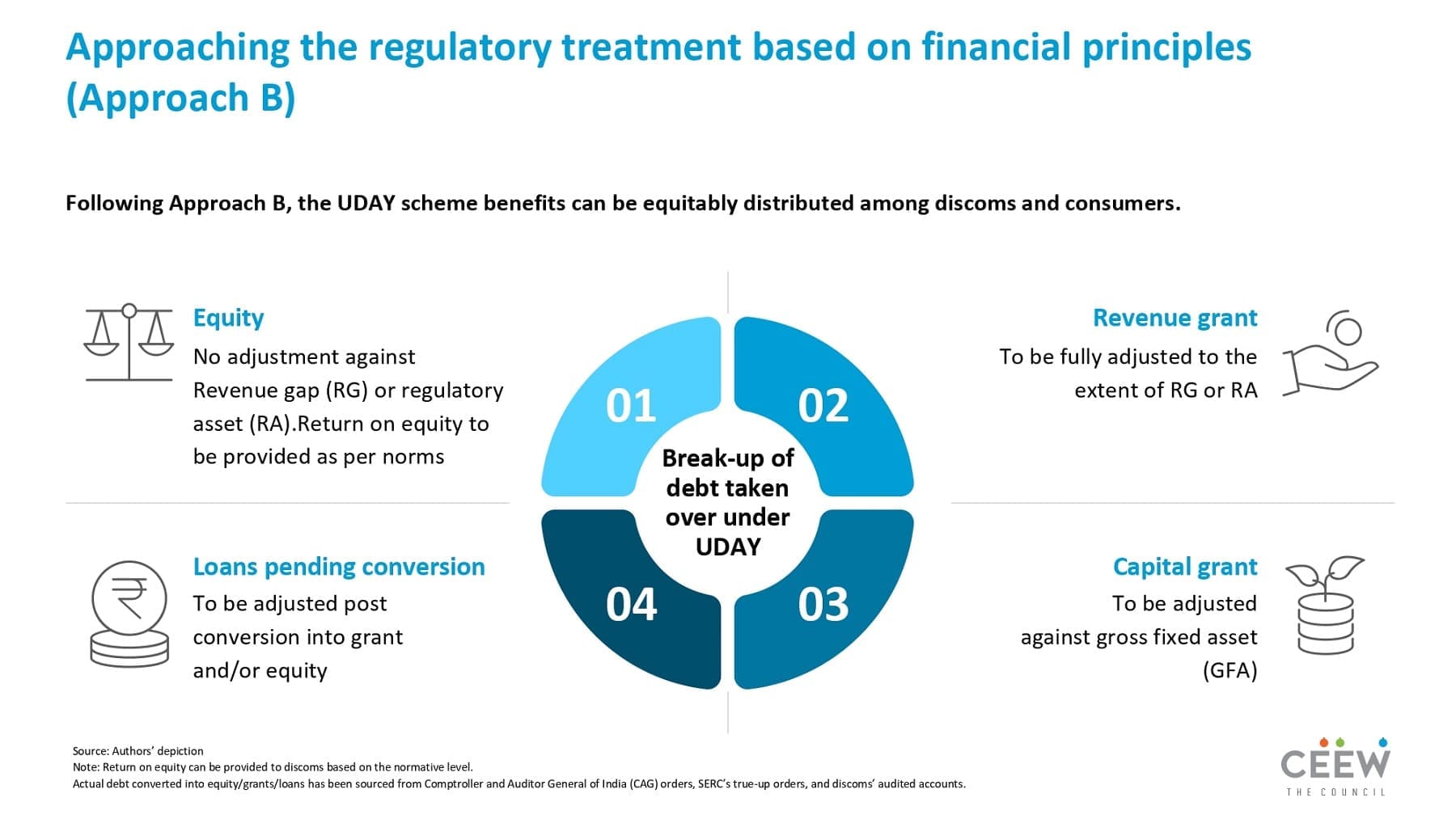

This study is a first of its kind and it reviews and analyses the impact of the regulatory treatment of the Ujwal DISCOM Assurance Yojana (UDAY) debt takeover on distribution companies (discoms) and consumers under two approaches: Approach A examines the regulatory treatment by state electricity regulatory commissions (SERCs) and Approach B looks at treatment based on financial principles.

Discoms from 16 states participated in the Ujwal Discom Assurance Yojana (UDAY) scheme for their financial turnaround and operational efficiency improvement1. As of 30 September 2015 (the launch date for the UDAY scheme), the total debt of the discoms of 15 states stood at INR 3.7 lakh crore, i.e.~93 per cent of the total debt of discoms in India2. Under the UDAY scheme, state governments were to take on over INR 2.3 lakh crore of discoms’ debt (~75 per cent of the INR 3.7 lakh crore debt).

The two approaches for regulatory adjustment provides insights for the Ministry of Power (MoP), Forum of Regulators (FoR), Appellate Tribunal for Electricity (APTEL), distribution companies (discoms), state electricity regulatory commissions (SERCs), state governments, and sectoral experts.

Notes

1 Overall, 32 states participated in the UDAY scheme. While 16 states participated to improve discoms’ financial and operational efficiency, the other 16 states participated to improve operational efficiency only.

2 Authors’ analysis based on the UDAY MoU for the 15 states that are covered in the study. Jammu and Kashmir has been excluded from our study due to a lack of data in the public domain.

3 Authors’ analysis based on the five states with reliable data

How can India Scale Up Electricity Demand-side Management?

Dhruvak Aggarwal, Muskaan Malhotra, Shalu Agrawal

Improving Discoms’ Financial Viability

Bharat Sharma, Kanika Balani, Shalu Agrawal, Paras Bhattarai, Rashi Singh

Assessing the Value of Offshore Wind for India’s Power System in 2030

Ashwani Arora, Disha Agarwal

Making India’s Advanced Metering Infrastructure Resilient

Dhruvak Aggarwal, Simran Kalra, Shalu Agrawal

Enabling a Consumer-centric Smart Metering Transition in India

Shalu Agrawal, Sunil Mani, Simran Kalra, Bharat Sharma, Kanika Balani