Issue Brief

Petcoke Use in India’s Iron and Steel Industry

Recommendations to the Environmental Pollution (Prevention and Control) Authority

Tirtha Biswas, Karthik Ganesan

January 2020 | Industrial Sustainability

Suggested citation: Biswas, Tirtha, and Karthik Ganesan. 2020. Petcoke Use in India’s Iron and Steel Industry: Recommendations to the Environmental Pollution (Prevention and Control) Authority. New Delhi: Council on Energy, Environment and Water.

Overview

The use of petcoke in the industrial sector has been a longstanding debate. This analysis of petcoke use in the steel sector provides more nuance to the previous deliberations involving the Supreme Court, Environment Pollution (Prevention & Control) Authority (EPCA), and the Ministry of Environment, Forest and Climate Change (MoEFCC). In order to address the EPCA’s concerns regarding petcoke use in the steel industry, this brief makes several recommendations.

The iron and steel sector is the single-largest consumer of energy (approximately 36 per cent) and contributor to greenhouse gas (GHG) emissions (approximately 37 per cent) within the Indian manufacturing sector. Typical coke consumption in Indian plants ranges between 344 and 400 kg/thm compared to the global best available technology (BAT) of 280 kg/thm. While there are multiple ways to reduce coke consumption, some Indian steelmakers have resorted to petcoke, as it provides both economic and environmental benefits – reduced transport emissions, ash generation, and production emissions.

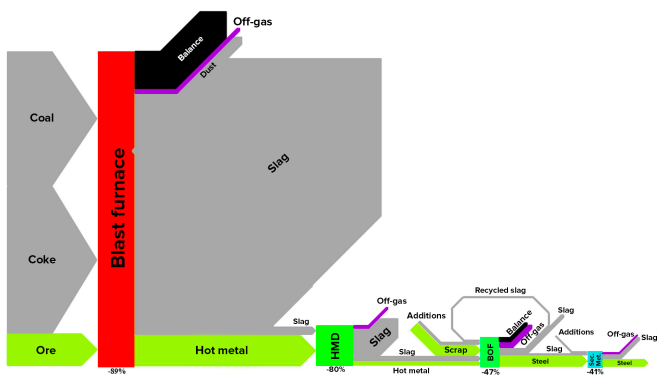

Sulphur flow distribution in a typical blast furnace process

Source: Schrama, Frank Nicolaas Hermanus, Elisabeth Maria Beunder, Bart Van den Berg, Yongxiang Yang, and Rob Boom. 2017. "Sulphur Removal in Ironmaking and Oxygen Steelmaking." Ironmaking & Steelmaking - Processes, Products and Applications 44: 333–343.

Key highlights

- The iron and steel industry uses petcoke as a feedstock – blending with coking coal during the coke making process.

- The industry only uses low-sulphur (<2.5 per cent) imported petcoke with a blending limit of 15 per cent as the presence of sulphur is detrimental to steel quality.

- Increase in the sulphur content would require additional volumes of limestone to remove the sulphur as slag. It will further increase the coke requirement per tonne of crude steel.

- A Central Pollution Control Board (CPCB) study of an iron and steel plant indicated that slag, tar, and sludge absorbs ~ 95 per cent of the sulphur.

- The use of petcoke leads to a reduction in coking coal consumption by around 16 per cent and a net reduction in energy intensity by a little over 1 per cent.

Key recommendations

- Allow the use of low-sulphur petcoke in production facilities with only recovery-type coke ovens

- All performance data related to the desulphurisation plant—input H2S concentration, sulphur recovered, etc.—be submitted to the Central Pollution Control Board (CPCB) quarterly.

- The CPCB should conduct a detailed assessment of the manufacturing sector (with other stakeholders like the Bureau of Energy Efficiency) to revise/develop standards for all processes that have associated emissions.

- The steel industry should develop a concrete and ambitious decarbonisation roadmap, with specific emission reduction targets every five years, leading up to net zero emissions by 2050.

While there are multiple ways to reduce coke consumption, some Indian steelmakers have resorted to petcoke, as it provides both economic and environmental benefits – reduced

transport emissions, ash generation, and production emissions.