– India is the second-largest producer of steel and cement in the world

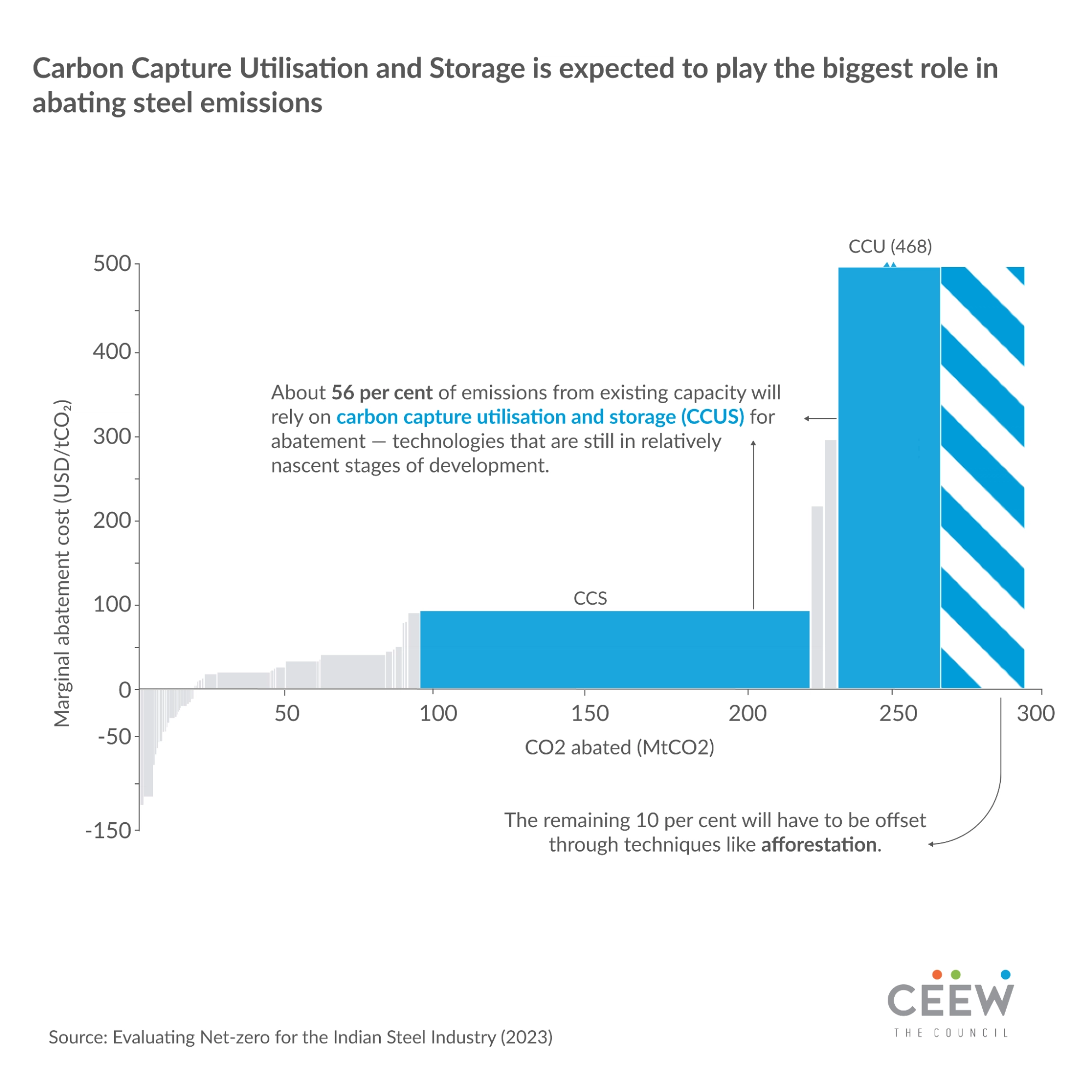

– Carbon capture and storage, if successfully scaled up, could abate 56% of emissions from the steel industry

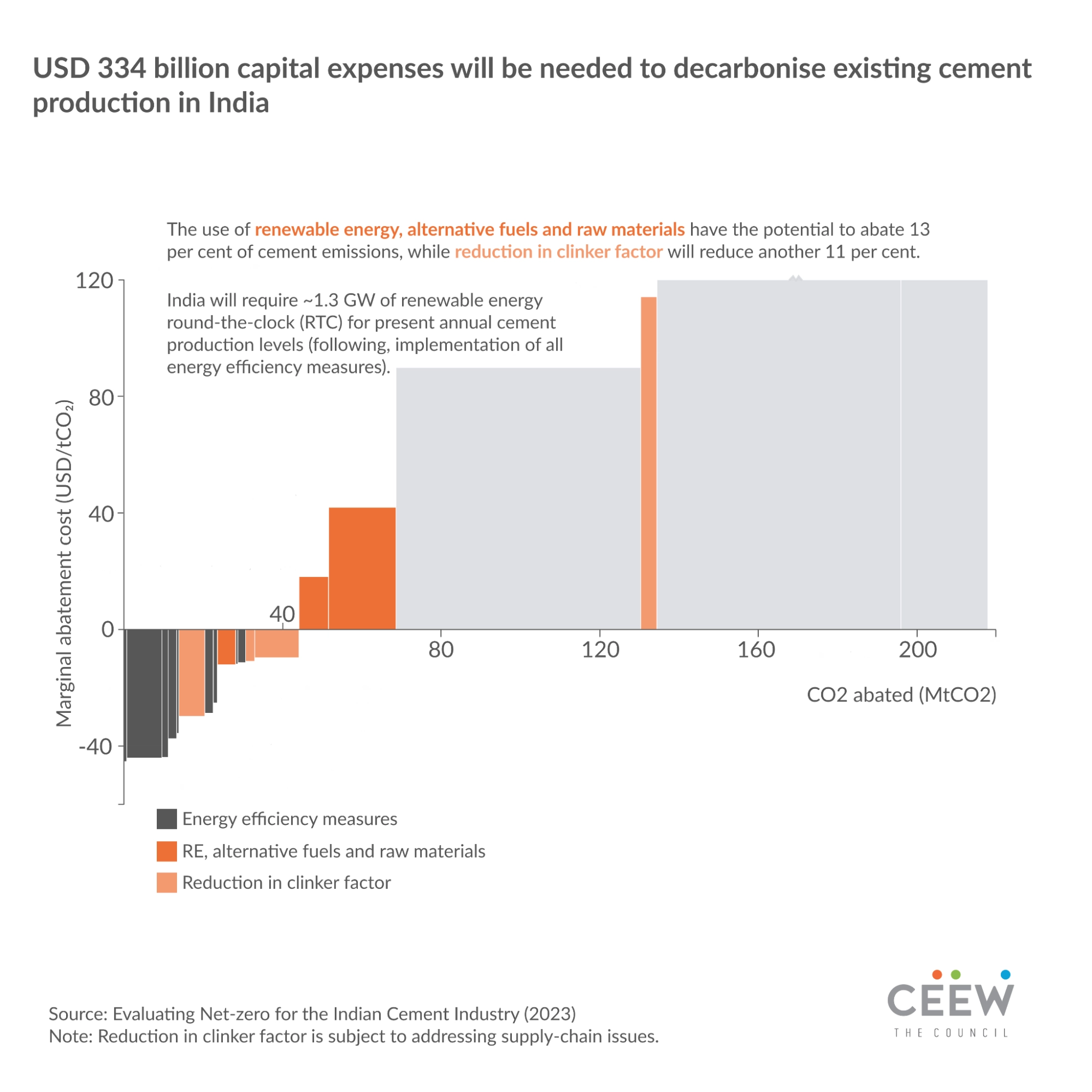

– For cement industry, 32% of emissions can be reduced without increasing current production costs

New Delhi, 12 October 2023: India’s existing steel and cement plants, which play a vital role in the country’s economic development, will require INR 47 lakh crore (USD 627 billion) in additional capital expenditure (CAPEX) to achieve net-zero carbon emissions, according to independent studies (read here and here) by the Council on Energy, Environment and Water (CEEW) released today. India is the second-largest producer of steel and cement in the world but both are emission-intensive processes making these hard-to-abate industries. The studies–which are the first-of-its-kind calculation of the cost of decarbonising these industries–also pointed out these two sectors will need INR 1 lakh crore each year in additional operational expenditure (OPEX) to go net-zero.

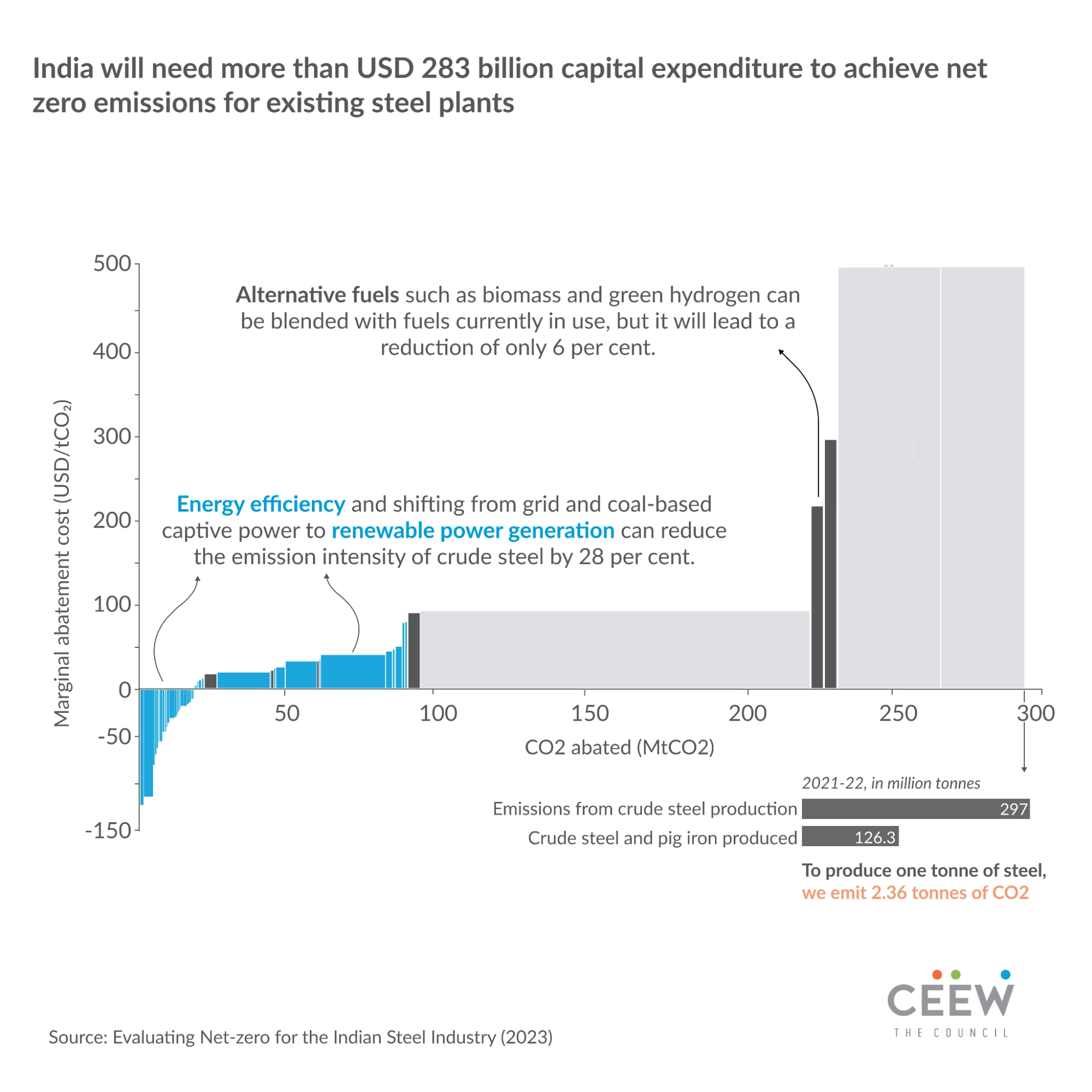

The CEEW analyses, funded by ‘bp’, an integrated energy company, also found that an 8–25 per cent reduction in steel emissions and 32 per cent reduction in cement emissions is possible without any price increase by adopting efficient technologies such as waste-heat recovery and energy efficient drives and controls. Moreover, a 33 per cent reduction in the combined carbon emissions of the steel and cement industries could be achieved with just 8.5 per cent of the total additional CAPEX and 30 per cent of the additional annual OPEX. This reduction can be done without considering the need for carbon capture and with the requisite supply of alternative fuels and raw materials.

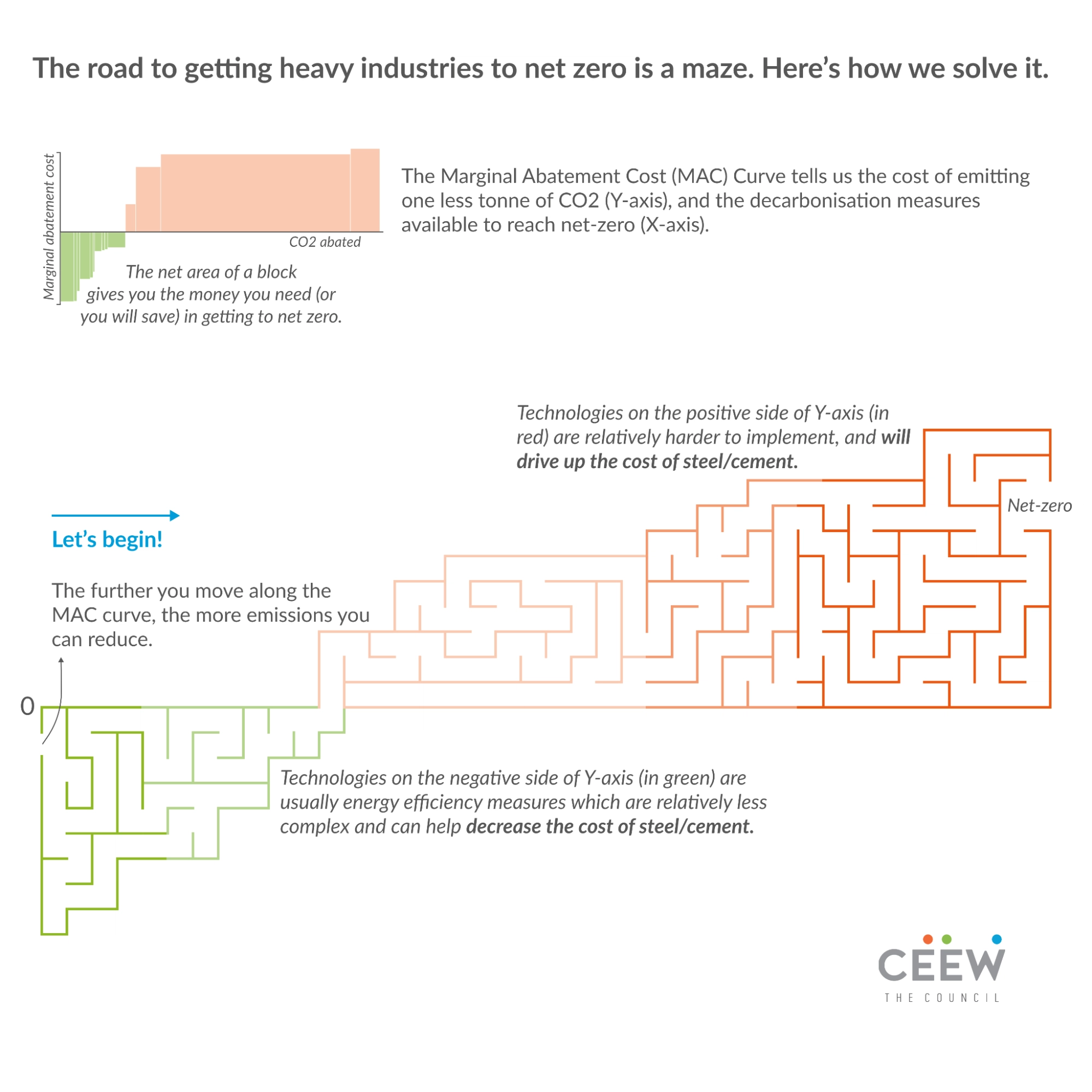

Dr Arunabha Ghosh, CEO, CEEW, said, “Decarbonising India’s steel and cement industries will not only help it meet its climate ambitions but also make its industries market competitive and future-ready in a world with increasingly sustainability-driven regulations. CEEW’s pioneering work with these marginal abatement cost (MAC) curves provide the necessary foundation to quantify the potential for emissions mitigation from these heavy industries and the associated costs. Such analysis is necessary to help inform policies and systematically pursue India’s net-zero targets in pursuit of decarbonisation without deindustrialisation.”

CEEW’s assessment indicates that the Indian steel industry emitted 297 million tonnes of CO₂ in 2021-22 in crude steel production. That translates to an average emission intensity of 2.36 tCO₂/tcs (compared to the world average of 1.89 tCO₂/tcs). The cost of producing this steel would increase with the tightening of emission intensity limits. The study found that depending on the production route taken, technology chosen, and the prevailing costs of carbon capture, utilisation, and storage (CCUS), near net-zero steel could be 40–70 per cent more expensive than current costs. Here, CCUS will be critical for decarbonising the steel industry with the potential to abate as much as 56 per cent of the emissions generated from the sector. But CCUS is still in its nascent stages and will need to be tested at scale before implementation.

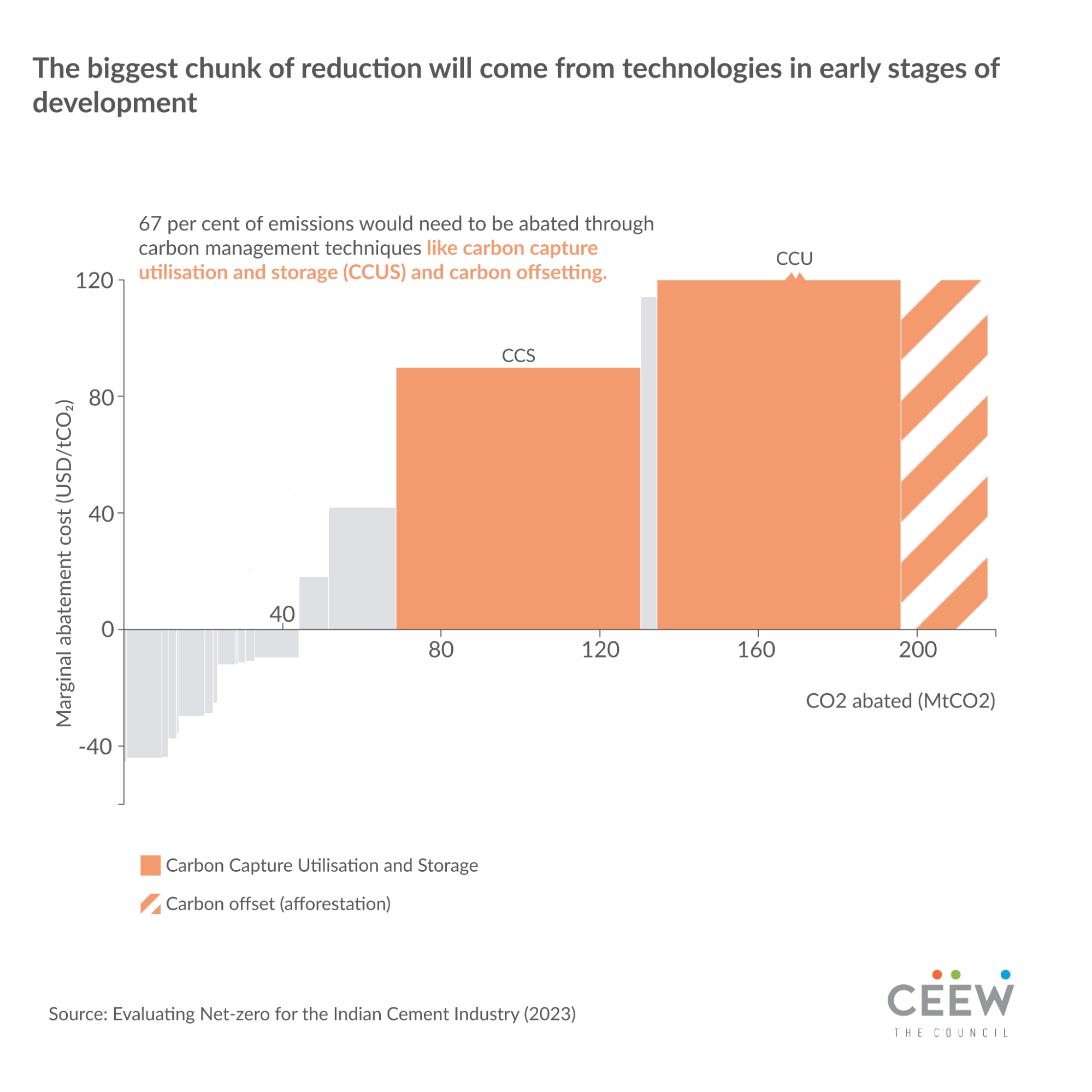

The Indian cement industry is among the most energy-efficient in the world. However, apart from the use of fossil fuels, carbon emissions are inherent to the production process due to limestone processing. CEEW assessment indicates that the industry emitted 218 million tonnes of CO2 while producing 337 million tonnes of cement in 2018-19. Here too, carbon management mechanisms have the potential to abate a major share of emissions, but the cost is higher than other alternatives such as energy efficiency, use of alternative fuels and raw materials and reduction in clinker factor. The study shows that about 50 per cent of cement plants in India need access to CO2 pipelines for carbon capture and storage. These pipelines can be constructed using existing natural gas pipelines’ right-of-way. Without such pipelines, these plants cannot opt for CCS.

Sashi Mukundan, President, bp India and senior vice president, bp Group, said, “The Indian industry’s transition to net-zero is complex and requires technology advancements and policies that will give companies across the value chain the confidence to act. bp’s partnership with CEEW focuses on optimising pathways to net-zero for the hard-to-abate sectors in support of our strategy to help decarbonise carbon-intensive sectors.”

Hemant Mallya, Fellow, CEEW, said, “Achieving net-zero target for India’s steel and cement industry will require a concerted effort in developing pathways for carbon capture, utilisation and storage. Lowering of costs for carbon capture and green hydrogen production, and development of underground carbon dioxide storage sites are essential to achieving this objective.”

To achieve a net-zero steel and cement industry, the CEEW studies recommend the use of the best available energy-efficient technologies to reduce emissions at lower costs since all the energy efficiency measures are already commercially available. Further, incentivise renewable energy as it will play a pivotal role in decarbonisation through lower or no transmission charges at the central and state levels. The Government of India should develop a policy for and expedite the establishment of a CCUS ecosystem to abate more than half of the emissions from the existing steel and cement plants. Since hydrogen will play a key role in its implementation, the next phase of the National Green Hydrogen Mission should focus on this agenda.

For media queries contact: Tulshe Agnihotri – [email protected] | +91 9621119643 / +91 7905717812