Suggested citation: Yadav, Deepak, Ashish Guhan, and Tirtha Biswas. 2021. Greening Steel: Moving to Clean Steelmaking Using Hydrogen and Renewable Energy. New Delhi: Council on Energy, Environment and Water.

This study evaluates the feasibility of green hydrogen-based steelmaking [hydrogen-based direct reduced iron (H-DRI) & electric arc furnace (EAF)] in India by providing insights into the techno-economics and associated environmental benefits. It considers four-time horizons: 2020 (current), 2030 (medium-term), and 2040 to 2050 (long-term).

Expanding India’s production capacity with the existing set of technology options in the iron and steel industry will significantly affect its future greenhouse gas (GHG) emissions. Hydrogen has the potential to decarbonise steel manufacturing which currently accounts for 35 per cent of GHG emissions from India’s manufacturing sector.

Hydrogen has the potential to decarbonise steel manufacturing—a process that currently occupies the lion’s share (35 per cent) of the greenhouse gas (GHG) emissions from India’s manufacturing sector. Hydrogen-based steel has received global attention across several industry collaborations and partnerships. A joint venture founded by Swedish companies SSAB, Luossavaara-Kiirunavaara Aktiebolag (LKAB), and Vattenfall initiated the Hydrogen Breakthrough Ironmaking Technology (HYBRIT) project to achieve 100 per cent fossil-free steelmaking by 2035 (HYBRIT 2017). At the same time, Voestalpine, an Austrian steel company, in partnership with Siemens and VERBUND, has installed a 6 MW electrolyser in their steelmaking plant at Linz (H2Future 2019a).

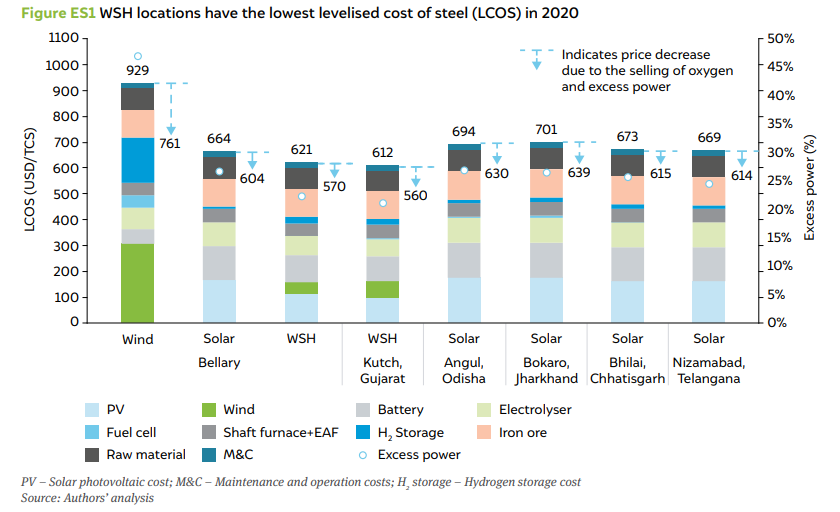

Here, we evaluate the feasibility of green hydrogen-based steelmaking (hydrogen-based direct reduced iron (H-DRI) + electric arc furnace (EAF)) in India by providing insights into the techno-economics and associated environmental benefits. Figure ES1 shows the cost break-up of an optimised green steel plant configuration at various locations in India. Depending on the renewable energy (RE) mix, the levelised cost of steel (LCOS) in 2020 varies between 612 and 929 USD/TCS – currently 50-127 per cent higher than the average cost of the conventional blast furnace-basic oxygen furnace (BF-BOF) process. The variation in cost is primarily due to renewable intermittency, which increases as the renewable profiles shift away from a wind-solar hybrid (WSH) towards either solar- or wind-only profiles. The wind profiles in Bellary exhibit strong seasonal variability. Hence, a larger buffer of hydrogen storage is required to ensure continuous operation during the low generation months.

Figure ES1 WSH locations have the lowest levelised cost of steel (LCOS) in 2020

PV – Solar photovoltaic cost; M&C – Maintenance and operation costs; H2 storage – Hydrogen storage cost

Source: Authors’ analysis

Similar oversizing of the system is observed in other locations. However, the magnitude is several times lower when compared to a wind-only operation. The oversized system also produces excess electricity. Figure ES1 indicates that the excess electricity is approximately 45 per cent of the total electricity produced for wind-only operation, whereas for other locations, the excess electricity ranges between 21 to 26 per cent. If additional revenues from the sale of electricity (at levelised cost of electricity (LCOE) prices) and oxygen are considered, LCOS ranges between 560-7611 USD/TCS. However, a challenge with selling the excess power is that the excess solar and wind electricity are available only during peak solar and wind availability periods. The excess power is significantly higher for the solar plant during the daytime, with reduced generation during early afternoon or evening hours. Similarly, for the wind plant, we see very high availability during the months of peak wind. During the lean months, the excess power from the wind plant decreases significantly. Therefore, it is important to ensure that the power evacuation infrastructure is ready and flexible enough to support the large-scale deployment of hydrogen-based steelmaking.

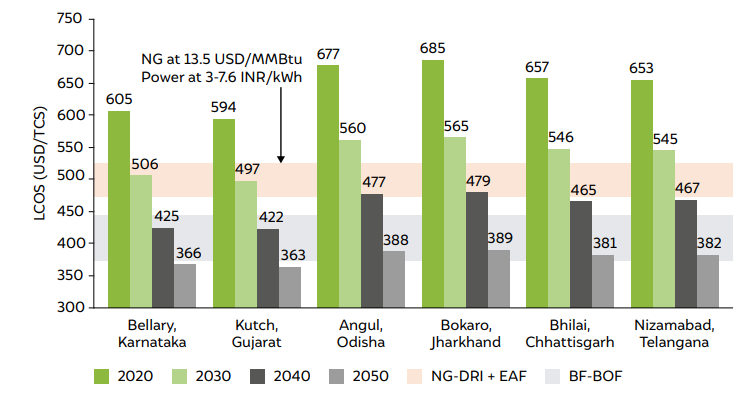

Figure ES2 illustrates the mid- and long-term production costs estimates for all RE mixes. The estimates only consider revenues from selling oxygen. The results indicate that the green hydrogen-based process requires a favourable RE mix to break even with the conventional production process. Availability of wind and solar resources is a prerequisite to minimise the renewable intermittency cost and reduce the production cost by 8 to 13 per cent in the near to medium term. In 2050, with an aggressive decline in electrolyser and storage costs, the intermittency costs also reduce. Hence, the cost differential between these locations further reduces to 4 to 7 per cent.

In 2040, only the WSH locations (Bellary and Kutch) become competitive with the blast furnace production costs. However, our estimates indicate that the solar-only locations can break even with natural gas (NG)–based DRI costs (with NG price of $13.5/MMBtu) by 2040, and with blast furnace costs, only in 2050.

Figure ES2 WSH locations break even with NG-DRI by 2030, and with blast furnace costs by 2040

Source: Authors’ analysis

A 0.5 million tonnes per annum (MTPA) production capacity in Bellary will require 1157 MW of solar photovoltaic (PV) and 207 MW of wind capacity. Further, the oversized system will also generate 580 GWh of excess electricity. The magnitude of excess electricity in a year is equivalent to annual power generation from 277 MW PV and 35 MW wind plants. However, the fact that the excess generation is available only during the peak hours of renewable generation increases the challenge of absorbing this power in the grid. For the solar plant, excess electricity is generated during the afternoon. Similarly, we see very high excess generation for the wind plant during the months of peak wind generation. Therefore, as green steel production scales up, it is important to ensure that the grid infrastructure is flexible enough to maintain the future electricity demand-supply balance.

An overnight transition to fossil-free steelmaking will be highly expensive. In 2030, the lowest cost of producing green steel is still 22 per cent higher than the blast furnace process. Renewable intermittency contributes to a significant share of the costs of fossil-free steel production. Hence, the overall cost of production can be reduced by blending grey hydrogen (flexibly produced from NG during periods of low renewables generation) with green hydrogen and grid electricity with renewable power (for auxiliary electricity demand).

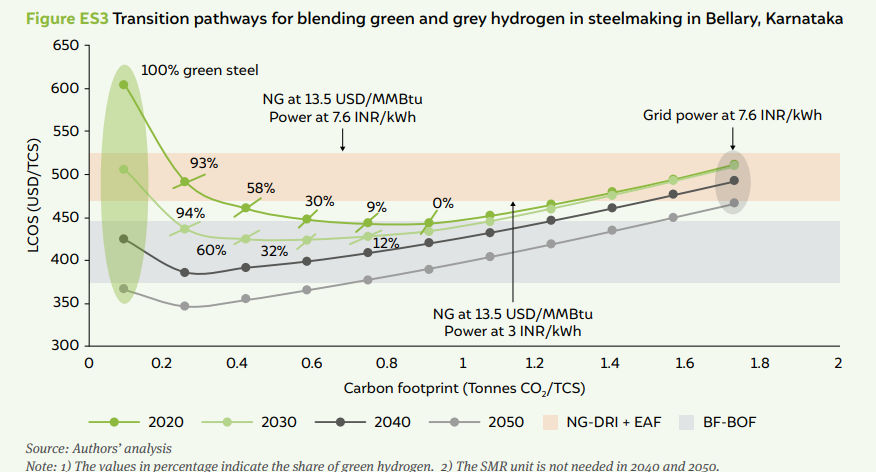

Figure ES3 illustrates the optimal blend configuration for WSH operation and the associated production cost for various CO2 emissions targets. The figure also shows the high marginal abatement cost of carbon emissions, especially when moving towards a 100 per cent green hydrogen operation. We consider an NG price of 13.5 USD/MMBtu. We also consider a grid power cost of 7.6 INR/kWh and the time-of-day tariff currently imposed in Bellary, Karnataka.

Figure ES3 Transition pathways for blending green and grey hydrogen in steelmaking in Bellary, Karnataka

Source: Authors’ analysis

Note: 1) The values in percentage indicate the share of green hydrogen. 2) The SMR unit is not needed in 2040 and 2050.

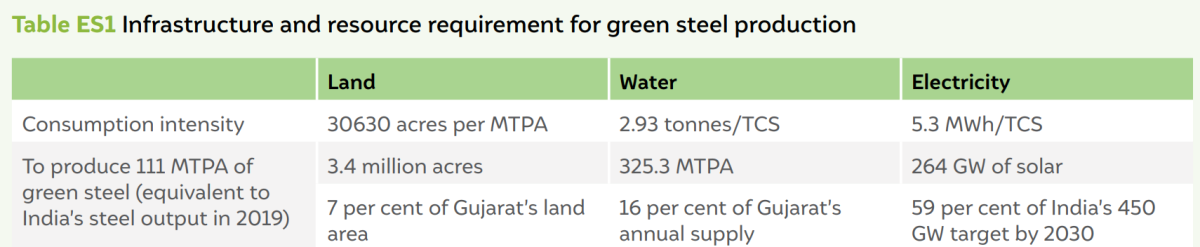

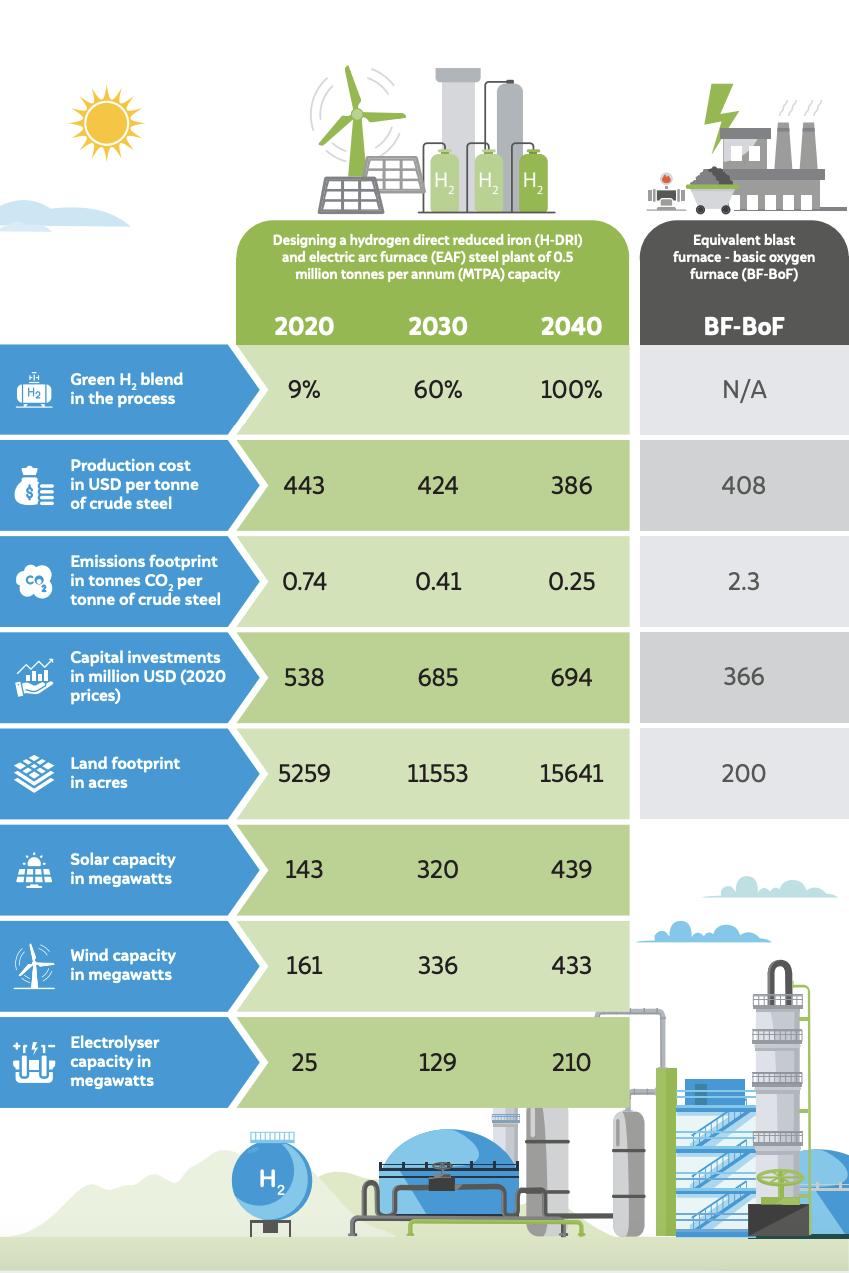

Table ES1 shows a summary of infrastructure and energy required for green steel production.

Source: Authors’ analysis

In 2020, the emission footprint of steel can be reduced from 1.75 tonnes CO2 /TCS to 0.91 tonnes CO2 /TCS just by co-locating the steel plant with a location having access to captive wind and solar energy. In this scenario, RE is used to meet only the plant auxiliary demand without producing any green hydrogen. The emission footprint of coal and natural gas-based processes are 2.3-2.4 tonnes CO2 /TCS and 1.3 tonnes CO2 /TCS. We see that in 2020, hydrogenbased steelmaking just about breaks even with the upper range (442 USD/TCS) of blast furnace cost for an emission footprint of 0.75 tonnes CO2 /TCS using 9 per cent green hydrogen (on an annual basis) in the plant. The cost of steel obtained from the coal DRI + EAF process is 300-451 USD/TCS. By 2030, hydrogen-based steelmaking becomes competitive (with an LCOS of 424 USD/TCS), with an average blast furnace cost for an emission footprint of 0.41 tonnes CO2 /TCS by using 60 per cent green hydrogen. Subsequently, when the costs across the hydrogen value chain decrease to the 2040 and 2050 levels, the steel units can reduce emissions without the need of a steam methane reforming (SMR) unit. In this scenario, the emission constraint at minimum cost value (0.25 tonnes CO2 /TCS) is met by using a blend of grid electricity and RE to power the electrolyser.

The majority of the existing steel plants are currently located close to iron ore and coal mines. However, most of these locations do not have access to favourable renewable resources. Our analysis indicates that the three states in the east (Odisha, Chhattisgarh, and Jharkhand) have no wind installations and only 1.8 per cent of India’s total solar installed capacity but caters to 45% of national steel demand (PIB, 2019). For green hydrogen-based production, these plants have the following options: a) transporting hydrogen and wheeling RE power for meeting auxiliary load, b) wheel power from RE-rich areas (to produce hydrogen locally and meet auxiliary power demand), and c) shift their production base to RE-rich areas and transport iron ore instead.

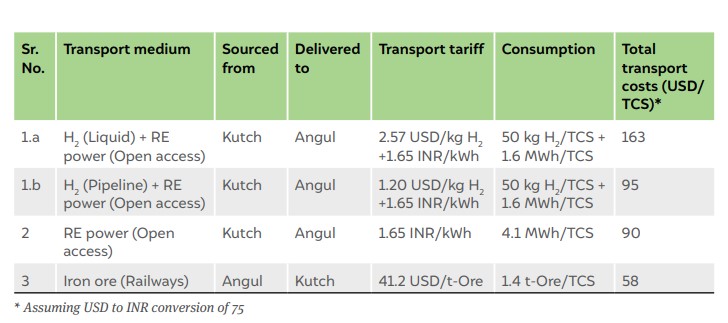

Table ES2 shows the various transport cost scenarios for a steel plant located in Angul, Odisha. The source of hydrogen or renewable power is Kutch, Gujarat. Across these scenarios, the increase in steel production cost is the highest for liquid hydrogen transport. The transportation costs for hydrogen using large-scale pipelines (~500 TPD) while wheeling RE power to meet auxiliary load or wheeling electricity alone to meet the entire plant power requirement using open access are comparable. However, we find out that transporting iron ore through railways is the cheapest option.

Each of the three scenarios has several limitations associated with them. Setting up hydrogen pipelines is highly capital intensive and will require off-take guarantees well before the project’s construction. Similarly, several policy barriers and price uncertainties are limiting the open-access volumes in the current electricity sector. While transporting iron ore is the cheapest option, the rail infrastructure in the country can constrain the annual capacity that can be transported. Setting up steel plants within the RE-rich areas in the western part of the country can also lead to a future increase in iron ore imports. Nevertheless, we expect the price of green steel to roughly increase by 10-15 per cent due to the logistical challenges in moving iron ore and renewable power/hydrogen.

Table ES2 Green steel plants located near the favourable RE locations will have the lowest logistics cost

Source: Authors’ analysis

Our study finds that hydrogen can be a promising candidate to decarbonise the growing domestic steel industry. However, we see that a 100 per cent green hydrogen operation will only become viable in the next two decades. We also find that access to favourable renewable resources is critical towards achieving an early break-even. Producing green steel using only solar resources (which is true for most locations in the country) will push back the breakeven period to 2050. We propose a faster way to incentivise the transition: blending green hydrogen with conventional grey hydrogen (produced from SMR) and RE power with grid power. The high renewables intermittency costs of 100 per cent fossil-free operation can be significantly reduced by blending 7 per cent grey hydrogen while marginally increasing the emissions footprint of the process. At today’s prices, blending ~9 per cent of green hydrogen (with grey hydrogen) is competitive with the upper range of BF-BOF costs.

We also highlight the major challenges in transitioning to green hydrogen-based steel production. A green steel plant will need investments to the tune of USD 3 Billion per MTPA – more than three times the conventional BF-BOF route. With the thin research and development (R&D), and innovations investments by steelmakers (less than 1 per cent of their annual turnover), the transition may be extremely challenging. Further, converting the current steelmaking capacity to green hydrogen-based production will require 264 GW of solar capacity and annual water consumption representing ~16 per cent of the annual water supply in the state of Gujarat. A detailed evaluation of raw-material and energy (including hydrogen) delivery infrastructure will help identify the optimal locations of future investments and evaluate the potential impact on jobs and revenues from shifting existing supply chains. The recommendations of this study are aimed at strengthening the National Hydrogen Energy Mission and National Steel Policy, 2017 to support a transition to green hydrogen and make our steel industry Aatmanirbhar.

Transition pathways for blending green and grey hydrogen in steelmaking

Source: Authors’ analysis

Expanding production capacity with the existing set of technology options in the iron and steel industry will significantly affect the country’s future greenhouse gas emissions. The findings from our report will help strengthen both the National Hydrogen Energy Mission and National Steel Policy 2017 in supporting the transition to green hydrogen-based steel production. We find that a 100 per cent green hydrogen operation only becomes viable in the next two decades. Our results comparing the production costs across various locations indicate that access to wind and solar resources is critical towards an early break-even with the conventional production processes. Producing green steel using only solar resources (which is true for most locations in the country) will push back the break-even period to 2050.

A faster way to incentivise the transition is by blending green hydrogen with conventional grey hydrogen (produced from SMR). The high renewables intermittency costs of 100 per cent fossil-free operation can be significantly reduced by blending 7 per cent grey hydrogen while marginally increasing the emissions footprint of the process. At today’s prices, blending ~9 per cent of green hydrogen (with grey hydrogen) is competitive with the upper range of BFBOF costs. Nevertheless, our findings indicate that green hydrogen is a promising technology to decarbonise the sector.

We also highlight the major challenges in transitioning to green hydrogen-based steel production. A green steel plant needs an investment of USD 3 Billion per MTPA, more than three times the conventional BF-BOF route. Considering the current situation of thin R&D and innovations investments by steelmakers (less than 1 per cent of their annual turnover), the transition will be extremely challenging. Further, converting the current steelmaking capacity to green hydrogen-based production will require 264 GW of solar capacity and annual water consumption representing approximately 16 per cent of Gujarat’s annual water supply.

We recommend that the current policy framework should incentivise increased R&D investments to evaluate the performance and production costs across the various transition pathways. Further, a detailed evaluation of raw-material and energy (including hydrogen) delivery infrastructure will help identify the optimal locations of future investments and evaluate the potential impact on jobs and revenues due to a potential shift in existing supply chains. Our recommendations are aimed at strengthening the existing policy framework to support a green hydrogen transition in the steel industry.

Assessing Effectiveness of India’s Industrial Emission Monitoring Systems

Evaluating Net-zero for the Indian Cement Industry

Evaluating Net-zero for the Indian Steel Industry

Accelerating the Implementation of India's National Green Hydrogen Mission

Best Practices in CEM (Continuous Emission Monitoring)