Suggested citation: Dutt, Arjun, and Akanksha Tyagi. 2022. Building Resilient Mineral Supply Chains for Energy Security. New Delhi: Council on Energy, Environment and Water.

This issue brief outlines the contours of a sourcing strategy for India to secure access to critical non-fuel minerals for either sectoral or economy-wide requirements, using the case study of the indigenisation of battery energy storage manufacturing to illustrate various facets.

Amid a complicated global geopolitical landscape typified by conflict, dwindling multilateralism and rising trade barriers, building robust domestic clean energy supply chains has emerged as a key policy imperative. The indigenisation of these supply chains can help India advance two objectives. First, it can help further its energy transition and thereby reduce dependence on fossil fuel imports. Second, through a focus on domestic clean energy equipment manufacturing, India can also reduce its dependence on global supply chains and further its pursuit of atmanirbharta or self-reliance in both energy and manufacturing. Access to critical minerals, which are inputs in the manufacturing process, is fundamental to building a vibrant indigenous clean energy manufacturing industry.

India’s clean energy ambitions envision the decarbonisation of the economy alongside realising improvements in energy security, enabled by the domestic manufacturing of clean energy equipment. The need for greater indigenisation of manufacturing to ensure India’s energy security is evident if one considers its import dependence for clean energy equipment. India imported 75 per cent of its installed solar photovoltaic (PV) modules over 2017-2022 (IEA 2022). Domestic lithium-ion battery manufacturing is largely limited to the assembly of battery packs, while the entire ecosystem for low-carbon hydrogen production in India, including domestic manufacturing of equipment, is still nascent. To become more self-reliant, the clean energy manufacturing sector in India will require access to a consistent supply of critical minerals, which are inputs in the manufacturing process. However, these minerals are often concentrated in geographies characterised by unfavourable commercial regimes or political instability; their production is often controlled by a few firms, often from countries that are geostrategic competitors; and future production is often tied up in supply contracts to cater to upcoming demand, restricting manufacturing companies’ ability to rapidly scale up production due to the limited supply of inputs not bound by prior contracts.

The ongoing supply chain crisis caused by the war in Ukraine and the COVID-19 pandemic highlights the challenges associated with sourcing critical non-fuel mineral resources. Thus, India requires a concerted strategy to secure these minerals to further its energy security. This issue brief outlines the contours of a sourcing strategy to secure minerals for indigenising the manufacturing of battery energy storage systems. We use the case study of energy storage manufacturing to illustrate the fundamental principles underpinning the sourcing of non-fuel minerals, either for sectoral or economy-wide requirements

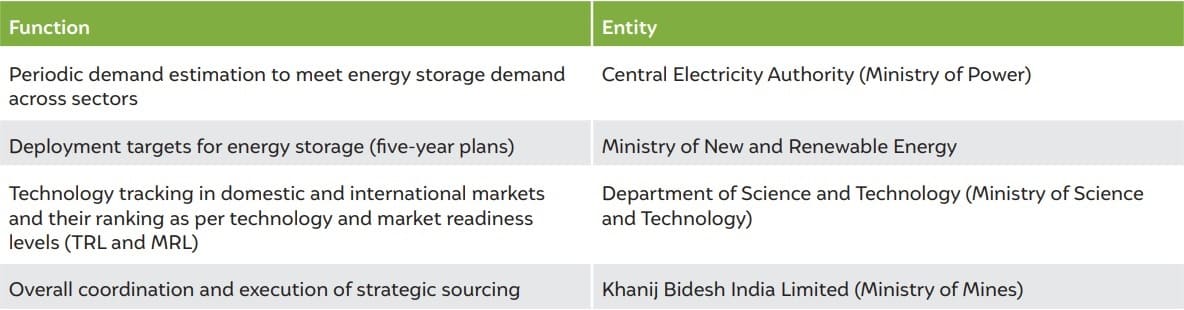

A key prerequisite before undertaking sourcing is estimating the type and quantity of minerals required for the domestic industry. This, in turn, depends on several policy choices, including deployment targets, the desired level of indigenous production to support the targets, the underlying technology mix, and the planning horizon for the sourcing strategy. This issue brief proposes setting up a multi-stakeholder group that coordinates and facilitates making these policy choices for India’s storage requirements (Table ES1).

Source: Authors’ analysis

This issue brief recommends that Khanij Bidesh India Limited (KABIL), which was set up with the objective of ensuring a consistent supply of critical minerals to cater to the requirements of domestic industries, undertake the overall coordination of strategic sourcing for India’s domestic storage manufacturing industry. To effectively perform this role, KABIL needs to bolster its existing capabilities in research, coordination, and partnerships.

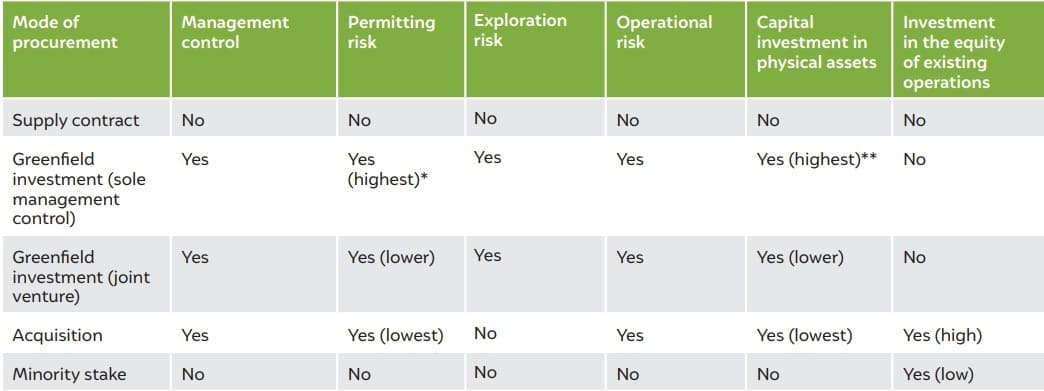

To successfully secure supplies of critical minerals, KABIL must consider the following aspects while designing sourcing strategies.

Source: Authors’ analysis

*Note 1: Permitting risk is higher relative to joint ventures, in which the risk is shared with and potentially reduced by the in-country expertise of the joint venture partner, and acquisitions, in which case ongoing operations have low permitting risk.

**Note 2: Relative to capital expenditure for operations of the same capacity through the acquisition or joint venture routes.

Addressing Technology Gaps through Collaboration on Advanced Cell Chemistry Batteries

Addressing Vulnerabilities in the Supply Chain of Critical Minerals

How Can India Indigenise Lithium-Ion Battery Manufacturing?

Solar Geoengineering and the Montreal Protocol